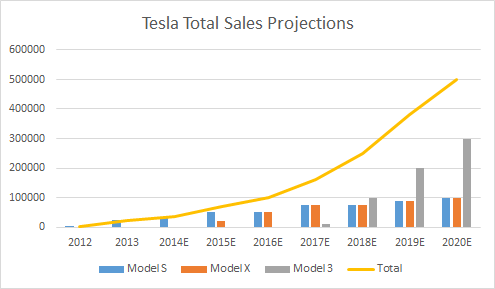

When Tesla announced its Gigafactory, it provided us with a fairly detailed picture of its growth going forward. And now that the Gigafactory deal is done with Nevada, that growth seems to be a low risk assumption. Tesla has also provided us with some color about 2015 and using all this information and filling in the blanks, I’ve come up with this chart for Tesla’s automotive growth going forward:

Tesla’s Gigafactory is expected to produce 50GWh of battery packs in 2020. If we assume that 85kWh is the average pack size – I expect the Model 3 pack to be smaller and Model X pack to be larger – Tesla will need 42.5GWh for automotive use. That leaves an excess of 7.5GWh for energy storage. By early next year, Tesla will be using as much or more than the rest of the global cylindrical cell output combined based on their stated Model S run rate goal of 50,000/year. So at 500,000 cars per year, Tesla would be using 10 times the current global output of cylindrical cells and more than the current total global output of batteries.

However, the Gigafactory should be maxed out by then and my personal prediction is that we will either see a major expansion of the Gigafactory go online shortly after 2020 or we will see more such factories go online in the coming years. Considering that the current Gigafactory that expects to start production in 2017 broke ground in 2014, factory 2 should break ground in 2018, just after the first one goes online. My expectation is also that during that time frame at the latest, Tesla will start considering auto factories on other continents.

Tesla has also stated that they are building superchargers at a rate greater than one per day. At that rate, by 2020, Tesla will have 2000 superchargers globally, enough to give them a major leg up over any other manufacturer. In fact, by 2017, which is the earliest that any long range EVs are expected, Tesla should already have 1000 supercharger stations in place. That would already put the Model 3 ahead of any potential competition in the space.

As far as storage batteries go, Tesla currently sells some storage batteries through SolarCity both for residential and commercial customers. Currently this is a very small limited availability offering. However, the Gigafactory will change all that making batteries more affordable and giving SolarCity the ability for bigger and more widespread deployments. As someone with solar panels, this excites me as much or more than automotive growth for Tesla. As solar system prices are dropping, over the next decade storage along with panels might become the norm. The market for this is potentially limitless.

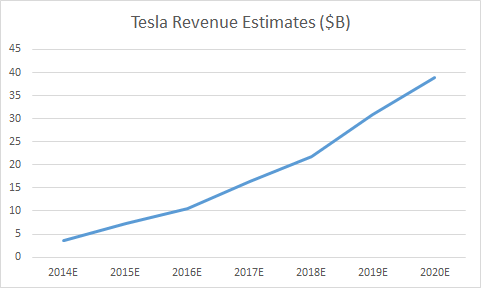

So if you think that you have missed out on Tesla’s growth, you are wrong. Major growth is still to come. If there is one company I see becoming bigger than Apple, it is Tesla. Here is what Tesla’s revenue growth would look like with Model S average price of 100,000$, Model X at 110,000$ and Model 3 at 60,000$ from cars alone.

At 500,000 cars, Tesla will have 0.5% of the global auto market still leaving significant growth potential ahead. Even though there has been a recent up tick in rumors of 200 mile EVs, I expect none of them to be competitive with Tesla until at least 2020 and that too only if the rest of the industry bothers with a charging network to enable long distance travel in an EV.

My personal estimate is that Tesla will produce 2 million cars by 2024. At that time, I estimate Tesla auto revenues of $160 billion – about equaling current GM revenues. However, none of this takes into account Tesla’s storage revenues. If by 2024, Tesla can sell 100GWh of storage batteries at 150$/kWh, that would bring in another $15 billion in revenue but at a higher margin than the auto business. At $175B in revenue and growing, with margins of 15% and a P/E of 20, Tesla would be worth more than $500 billion then. Tesla will still be a growth company with 4-6 available models and more coming soon.

Disclosure: I am long TSLA, SCTY.

Visit my personal finance blog or visit me at Seeking Alpha.