News

SpaceX on track with Crew Dragon program despite thin NASA budget

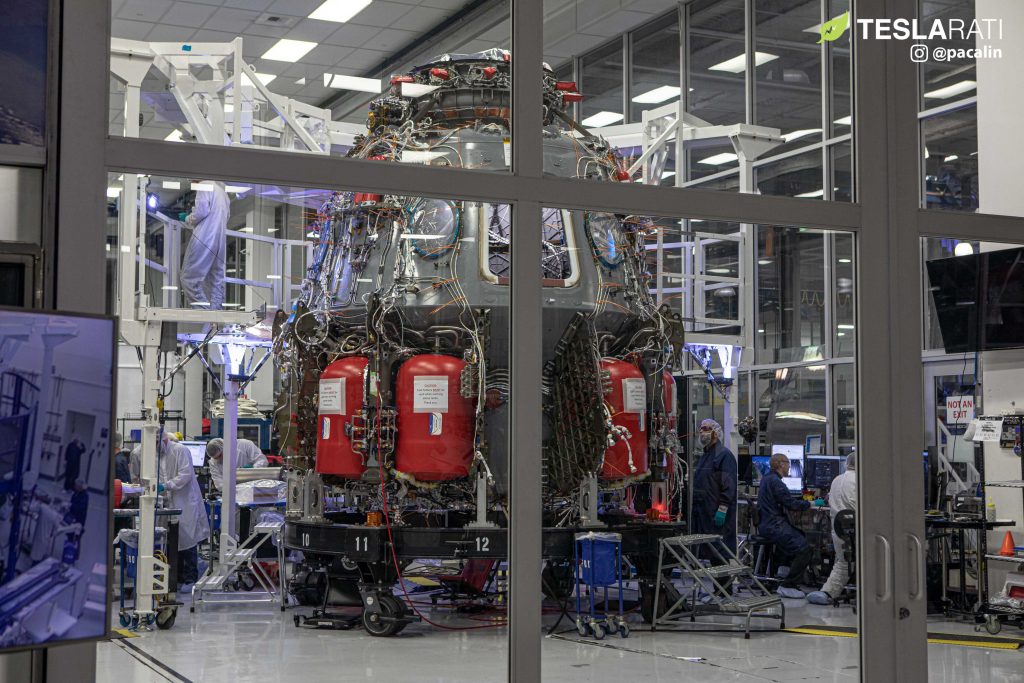

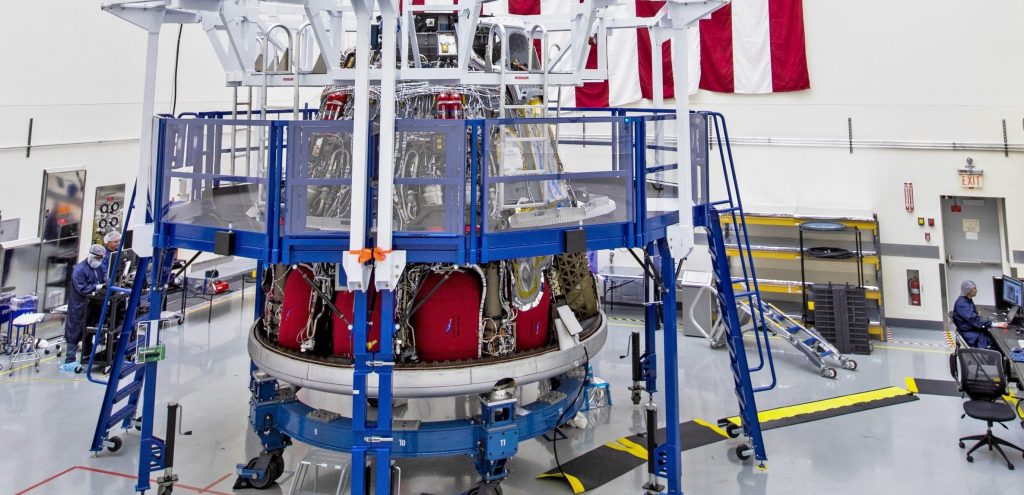

On Thursday (Oct. 10th) NASA Administrator Jim Bridenstine, SpaceX CEO Elon Musk, and NASA Demo-2 astronauts Bob Behnken and Doug Hurley spoke at the company’s Hawthorne, CA headquarters after the NASA and SpaceX heads toured the factory and spoke with company engineers.

While discussing NASA’s Commercial Crew Program (CCP) and SpaceX’s ongoing development, Musk revealed – among other things – one particularly impressive detail: the company’s Crew Dragon program is almost perfectly sticking to NASA’s budget.

During an audience Q&A session, Bridenstine touched on the impact federal funding has had on the NASA Commercial Crew Program, partially correctly stating that “the timelines never changed*, but the budget got cut. So, there are consequences when the budget doesn’t meet the vision.” The objective of returning to NASA the ability to launch its own astronauts to the International Space Station (ISS), however, was and still is a central priority.

*Bridenstine’s claim that “the timelines never changed” is explicitly false. In reality, Boeing and SpaceX launch schedules almost immediately changed as a direct result of systematic Congressional underfunding, slipping at least two years after egregious budget cuts from 2011-2014.

Musk further clarified that “the SpaceX Commercial Crew Program is within 1% of the (federal) budget”, meaning that Crew Dragon’s development costs have almost exactly matched the $2.6B NASA awarded SpaceX to build the spacecraft. He went on to reinforce that SpaceX has continuously operated within the confines of that overarching budget, while the three or so years of delays Crew Dragon has suffered can in many ways be traced directly back to the fact that “the NASA [budget] request for Commercial Crew for several years was substantially reduced by congress, I think in some cases by 50%.”

As Musk notes, in response to such a dramatic lack of funding, SpaceX impressively “didn’t spend more money, it just took longer”. He also politely hinted at his awareness of the political machinations that caused those shortfalls, stating that in “the same years that commercial crew was dramatically underfunded, some other unmentioned programs were overfunded.” The “unmentioned programs” that Musk alluded to are, of course, NASA’s own Space Launch System (SLS) and Orion spacecraft, both of which are infamously behind schedule and over budget

As previously reported on Teslarati:

“Former NASA deputy administrator Lori Garver noted that over the ~5 years Congress consistently withheld hundreds of millions of dollars of critical funds from Commercial Crew, NASA’s SLS rocket and Orion spacecraft were just as consistently overfunded above and beyond their budget requests. From 2011 to 2016 alone, SLS and Orion programs requested $11B and received an incredible $16.3B (148%) from Congress, while Commercial Crew requested $5.8B and received $2.4B (41%).”

Beyond the simple fact that there hasn’t been enough federal funding, Bridenstine also mentioned that CCP has suffered from misaligned – and completely unattainable – timelines given the underfunding. He continued to push his platform that, as the NASA Administrator, he has been focused on returning to “realism when it comes to terms of cost and schedule.” He stated that there needs to be more “realism built into the development timelines.”

In an effort to ensure that the safety of the NASA astronauts remains the top priority for Commercial Crew, Bridenstine clarified that the timeline is a “developmental timeline,” and one which may see further delays should something not go as planned or other safety issues arise. Musk assured that SpaceX is more than capable of supporting CCP and upholding its end of the bargain by stating that “we’re going to get this done. We’re going to get [this] done soon and we’re going to get [this] done right.”

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

Elon Musk

SpaceX weighs Nasdaq listing as company explores early index entry: report

The company is reportedly seeking early inclusion in the Nasdaq-100 index.

Elon Musk’s SpaceX is reportedly leaning toward listing its shares on the Nasdaq for a potential initial public offering (IPO) that could become the largest in history.

As per a recent report, the company is reportedly seeking early inclusion in the Nasdaq-100 index. The update was reported by Reuters, citing people familiar with the matter.

According to the publication, SpaceX is considering Nasdaq as the venue for its eventual IPO, though the New York Stock Exchange is also competing for the listing. Neither exchange has reportedly been informed of a final decision.

Reuters has previously reported that SpaceX could pursue an IPO as early as June, though the company’s plans could still change.

One of the publication’s sources also suggested that SpaceX is targeting a valuation of about $1.75 trillion for its IPO. At that level, the company would rank among the largest publicly traded firms in the United States by market capitalization.

Nasdaq has proposed a rule change that could accelerate the inclusion of newly listed megacap companies into the Nasdaq-100 index.

Under the proposed “Fast Entry” rule, a newly listed company could qualify for the index in less than a month if its market capitalization ranks among the top 40 companies already included in the Nasdaq-100.

If SpaceX is successful in achieving its target valuation of $1.75 trillion, it would become the sixth-largest company by market value in the United States, at least based on recent share prices.

Newly listed companies typically have to wait up to a year before becoming eligible for major indexes such as the Nasdaq-100 or S&P 500.

Inclusion in a major index can significantly broaden a company’s shareholder base because many institutional investors purchase shares through index-tracking funds.

According to Reuters, Nasdaq’s proposed fast-track rule is partly intended to attract highly valued private companies such as SpaceX, OpenAI, and Anthropic to list on the exchange.

Elon Musk

The Boring Company’s Prufrock-2 emerges after completing new Vegas Loop tunnel

The new tunnel measures 2.28 miles, making it the company’s longest single Vegas Loop tunnel to date.

The Boring Company announced that its Prufrock-2 tunnel boring machine (TBM) has completed another Vegas Loop tunnel in Las Vegas. The company shared the update in a post on social media platform X.

According to The Boring Company’s post, the new tunnel measures 2.28 miles, making it the company’s longest single Vegas Loop tunnel to date.

The new tunnel marks the fourth tunnel constructed near Westgate Las Vegas as the Vegas Loop network continues expanding across the city.

The Boring Company also noted that the new tunnel surpassed its previous internal record of 2.26 miles for a single Vegas Loop segment.

Construction of the tunnel involved moving roughly 68,000 cubic yards of dirt. The excavation process also used about 4.8 miles of continuous conveyor belt, powered by six motors totaling 825 horsepower.

The Boring Company’s Prufrock-series all-electric tunnel boring machines are designed to support the rapid expansion of company’s underground transportation projects, including the growing Vegas Loop network. Prufrock machines are designed for reusability, thanks in no small part to their capability to be deployed and retrieved easily through their “porposing” feature.

The Vegas Loop, specifically the Las Vegas Convention Center (LVCC) Loop segment, has already been used during major events. Most recently, the LVCC Loop supported the 2026 CONEXPO-CON/AGG construction trade show, which was held from March 3-7, 2026.

As per The Boring Company, the LVCC Loop transported roughly 82,000 passengers across the convention center campus during the event’s duration.

CONEXPO-CON/AGG is one of the largest construction trade shows in North America, drawing more than 140,000 construction professionals from 128 countries this year.

The LVCC Loop forms the initial segment of the broader Vegas Loop network, which remains under active development as The Boring Company continues building new tunnels throughout the city.

News

Tesla gathers Cybercab fleet in Gigafactory Texas

Images and video of the Cybercab fleet were shared by longtime Giga Texas observer Joe Tegtmeyer in posts on social media platform X.

Tesla appears to be assembling a growing number of Cybercabs at Gigafactory Texas as preparations continue for the vehicle’s mass production. Recent footage shared online has shown over 30 Cybercabs being transported by trucks or staged near testing areas at the facility.

The images and video were shared by longtime Giga Texas observer and drone operator Joe Tegtmeyer in posts on social media platform X.

Interestingly enough, Tegtmeyer noted that many of the Cybercabs being loaded onto transport trucks were still equipped with steering wheels. This suggests that the vehicles are likely testing units rather than the final driverless configuration expected for the company’s Robotaxi service.

The vehicles could potentially be headed to testing sites across the United States as Tesla prepares to expand its Robotaxi fleet.

Additional footage captured at Gigafactory Texas also showed the Cybercab’s side and rear camera washer system operating as vehicles were being loaded onto transport trucks.

The growing number of Cybercabs at Giga Texas comes amidst the company’s announcement that the first production Cybercab has been produced at the facility. Full Cybercab production is expected to begin in April.

The vehicle is expected to play a central role in Tesla’s Robotaxi ambitions as the company looks to expand autonomous ride-hailing operations beyond its early deployments using Model Y vehicles.

Tesla has also linked Cybercab production to its proposed Unboxed manufacturing process, which assembles large vehicle modules separately before integrating them. The approach is intended to reduce production costs and accelerate output.

Musk has also noted that the Cybercab’s ramp will likely begin slowly due to the number of new components and manufacturing steps involved. However, he stated that once the process matures, Cybercab production could scale quickly.