News

SpaceX Falcon 9 rocket sets reusability record, launches heaviest payload yet

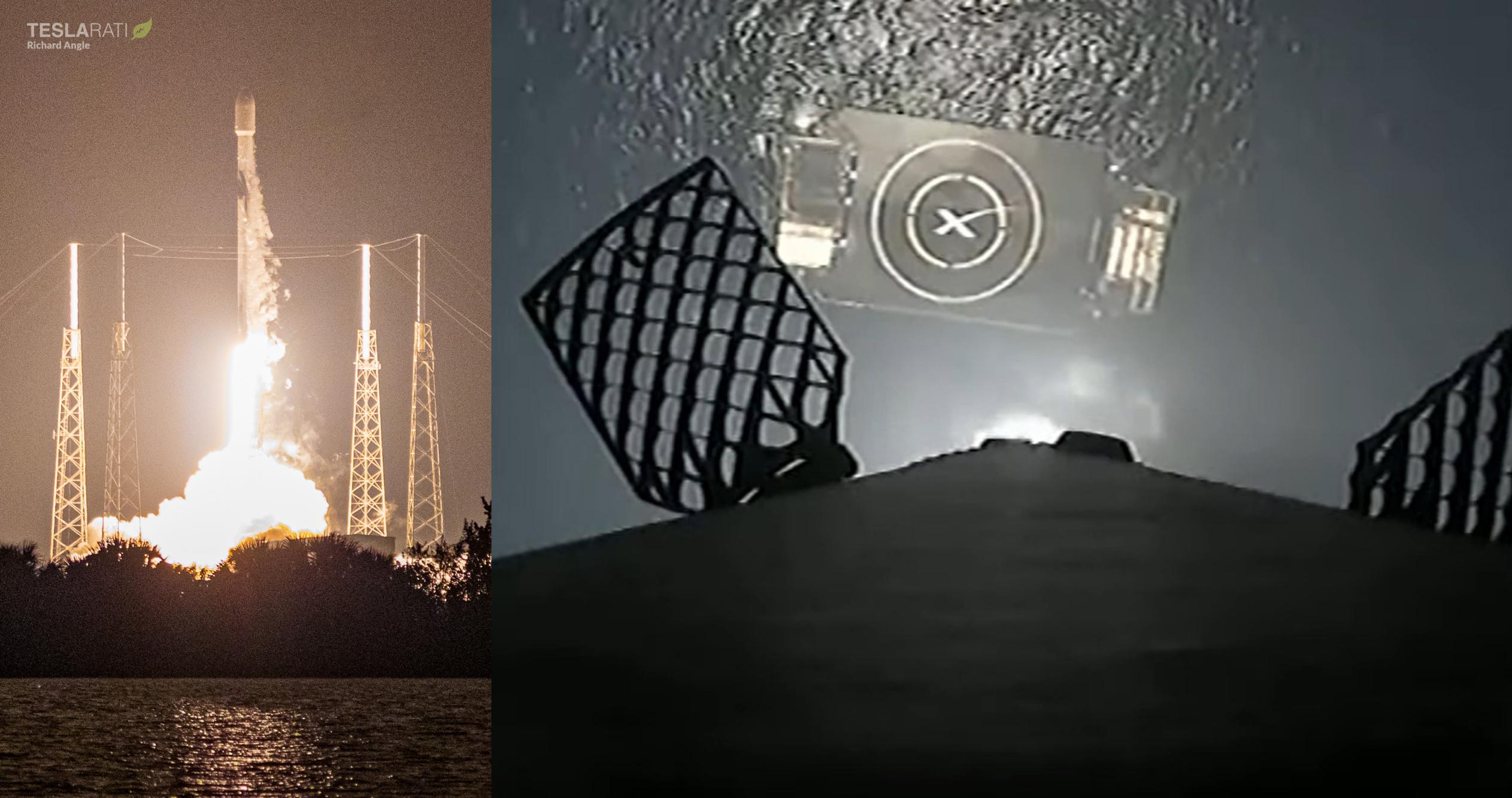

SpaceX Falcon 9 booster B1051 has become the company’s ‘fleet leader’ after acing its 12th orbital-class launch and landing – a new record for the rocket family.

After a roughly 90-minute weather delay, Falcon 9 lifted off without issue around 12:48 am EST on March 19th. Booster B1051 touched down on drone ship Just Read The Instructions (JRTI) about nine minutes later, followed by the successful deployment of 53 Starlink V1.5 satellites just over an hour after launch. Starlink 4-12 was SpaceX’s 11th successful launch in the first 11 weeks of 2022. SpaceX CEO Elon Musk says that Starlink 4-12 was also the heaviest payload ever launched by Falcon 9, weighing in at 16.25 metric tons or ~35,800 pounds.

It’s not entirely clear how SpaceX was able to expand Falcon 9’s performance envelope or how far the envelope was pushed. In May 2019, Musk actually claimed that the Starlink V0.9 payload would weigh “18.5 tons” and be SpaceX’s heaviest payload ever, whereas three years later he says Starlink 4-12 set a new record of 16.25 metric tons. Assuming Musk was referring to short tons in 2019 and that SpaceX’s Starlink payload adapter and the tensioning rods that hold the stack together are roughly the same weight (~3 mT) three years later, the true total mass of Starlink 4-12’s payload could be as high as 19-19.5 metric tons (~42,000 lb). Its 53 Starlink V1.5 satellites, meanwhile, would weigh about 307 kilograms (~675 lb) each.

In other words, Starlink 4-12’s record-breaking payload could be up to 2.5 metric tons – about 15% – heavier than the Starlink V0.9 payload that set SpaceX’s internal record in 2019.

SpaceX says a Falcon 9 rocket is on track to launch Starlink 4-12 – a new batch of 53 satellites – no earlier than (NET) 11:24 pm EST on Friday, March 18th (03:24 UTC 19 March).

While ‘just’ the latest in an increasingly routine line of Starlink launches, SpaceX has confirmed that the mission will also set a new record for Falcon 9 reusability. Setting minor records is practically just as common for the average SpaceX launch but this particular record is more significant: if all goes according to plan, booster B1051 will become the first Falcon 9 first stage to complete 12 orbital-class launches and landings, pushing the envelope that much further.

The second oldest Falcon 9 booster that’s still operational, B1051 debuted in a significant way on March 2nd, 2019 by supporting Demo-1, Crew Dragon’s first uncrewed test flight. The launch was a perfect success and simultaneously kicked off the prolific careers of Crew Dragon and Falcon 9 B1051, both of which continue to have an excellent track record. Since Demo-1, B1051 has also supported the launches of Canada’s RADARSAT constellation, SiriusXM’s SXM-7 radio satellite, and 469 Starlink spacecraft spread over eight separate missions.

Starlink 4-12 will be its 12th launch and is set to occur just over two weeks after the third anniversary of its launch debut, translating to an average of one launch every three months or ~93 days. As an older booster and a fleet leader for several reusability milestones, B1051’s average turnaround time between launches – ~100 days – isn’t exceptionally impressive, though the booster has still accomplished a great deal.

However, newer boosters like B1058 and B1060 – both of which have much faster average turnaround times – are tied with B1051 at eleven flights each. One of the two is almost guaranteed to supersede B1051 in the very near future and become SpaceX’s new fleet leader, meaning that either B1058 or B1060 is likely to be the first to set new reusability records after B1051’s 12th flight.

Falcon 9 B1060, for example, has flown 11 times in 611 days, averaging one launch every 55 days and 61 days per reuse. B1060’s last two turnarounds have been under 50 days. B1058 is very similar. In other words, both B1058 and B1060 could feasibly overtake B1051 as early as May or June 2022 and could both potentially complete their 15th, 16th, or even 17th launches before the end of the year.

As such, this could be Falcon 9 B1051’s last opportunity to lead SpaceX’s fleet of Falcon boosters. Tune into SpaceX’s official webcast to watch Starlink 4-11 live around 11:10 pm EST (03:10 UTC).

News

Tesla wins another award critics will absolutely despise

Tesla earned an overall score of 49 percent, up 6 percentage points from the previous year, widening its lead over second-place Ford (45 percent, up 2 points) to a commanding 4-percentage-point gap. The company also excelled in the Fossil Free & Environment category with a 50 percent score, reflecting strong progress in reducing emissions and decarbonizing operations.

Tesla just won another award that critics will absolutely despise, as it has been recognized once again as the company with the most sustainable supply chain.

Tesla has once again proven its critics wrong, securing the number one spot on the 2026 Lead the Charge Auto Supply Chain Leaderboard for the second consecutive year, Lead the Charge rankings show.

NEWS: Tesla ranked 1st on supply chain sustainability in the 2026 Lead the Charge auto/EV supply chain scorecard.

“@Tesla remains the top performing automaker of the Leaderboard for the second year running, and increased its overall score by 6 percentage points, while Ford only… pic.twitter.com/nAgGOIrGFS

— Sawyer Merritt (@SawyerMerritt) March 4, 2026

This independent ranking, produced by a coalition of environmental, human rights, and investor groups including the Sierra Club, Transport & Environment, and others, evaluates 18 major automakers on their efforts to build equitable, sustainable, and fossil-free supply chains for electric vehicles.

Tesla earned an overall score of 49 percent, up 6 percentage points from the previous year, widening its lead over second-place Ford (45 percent, up 2 points) to a commanding 4-percentage-point gap. The company also excelled in the Fossil Free & Environment category with a 50 percent score, reflecting strong progress in reducing emissions and decarbonizing operations.

Perhaps the most impressive achievement came in the batteries subsection, where Tesla posted a massive +20-point jump to reach 51 percent, becoming the first automaker ever to surpass 50 percent in this critical area.

Tesla achieved this milestone through transparency, fully disclosing Scope 3 emissions breakdowns for battery cell production and key materials like lithium, nickel, cobalt, and graphite.

The company also requires suppliers to conduct due diligence aligned with OECD guidelines on responsible sourcing, which it has mentioned in past Impact Reports.

While Tesla leads comfortably in climate and environmental performance, it scores 48 percent in human rights and responsible sourcing, slightly behind Ford’s 49 percent.

The company made notable gains in workers’ rights remedies, but has room to improve on issues like Indigenous Peoples’ rights.

Overall, the leaderboard highlights that a core group of leaders, Tesla, Ford, Volvo, Mercedes, and Volkswagen, are advancing twice as fast as their peers, proving that cleaner, more ethical EV supply chains are not just possible but already underway.

For Tesla detractors who claim EVs aren’t truly green or that the company cuts corners, this recognition from sustainability-focused NGOs delivers a powerful rebuttal.

Tesla’s vertical integration, direct supplier contracts, low-carbon material agreements (like its North American aluminum deal with emissions under 2kg CO₂e per kg), and raw materials reporting continue to set the industry standard.

As the world races toward electrification, Tesla isn’t just building cars; it’s building a more responsible future.

News

Tesla Full Self-Driving likely to expand to yet another Asian country

“We are aiming for implementation in 2026. [We are] doing everything in our power [to achieve this],” Richi Hashimoto, president of Tesla’s Japanese subsidiary, said.

Tesla Full Self-Driving is likely to expand to yet another Asian country, as one country seems primed for the suite to head to it for the first time.

The launch of Full Self-Driving in yet another country this year would be a major breakthrough for Tesla as it continues to expand the driver-assistance program across the world. Bureaucratic red tape has held up a lot of its efforts, but things are looking up in some regions.

Tesla is poised to transform Japan’s roads with Full Self-Driving (FSD) technology by 2026.

Richi Hashimoto, president of Tesla’s Japanese subsidiary, announced the ambitious timeline, building on successful employee test drives that began in 2025 and earned positive media reviews. Test drives, initially limited to the Model 3 since August 2025, expanded to the Model Y on March 5.

Once regulators approve, Over-the-Air (OTA) software updates could activate FSD across roughly 40,000 Teslas already on Japanese roads. Japan’s orderly traffic and strict safety culture make it an ideal testing ground for autonomous driving.

Hashimoto said:

“We are aiming for implementation in 2026. [We are] doing everything in our power [to achieve this].”

The push aligns with Hashimoto’s leadership, which has been credited for Tesla’s sales turnaround.

In 2025, Tesla delivered a record 10,600 vehicles in Japan — a nearly 90% jump from the prior year and the first time exceeding 10,000 units annually.

BREAKING 🇯🇵 FSD IS LIKELY LAUNCHING IN JAPAN IN 2026 🚨

Richi Hashimoto, President of Tesla’s Japanese subsidiary, stated: “We are aiming for implementation in 2026” and added that they are “doing everything in our power” to achieve this 🔥

Test drives in Japan began in August… pic.twitter.com/jkkrJLszXN

— Ming (@tslaming) March 5, 2026

The strategy shifted from online-only sales to adding 29 physical showrooms in high-traffic malls, plus staff training and attractive financing offers launched in January 2026. Tesla also plans to expand its Supercharger network to over 1,000 points by 2027, boosting accessibility.

This Japanese momentum reflects Tesla’s broader international expansion. In Europe, Giga Berlin produced more than 200,000 vehicles in 2025 despite a temporary halt, supplying over 30 markets with plans for sequential production growth in 2026 and battery cell manufacturing by 2027.

While regional EV sales faced headwinds, the factory remains a cornerstone for Model Y deliveries across the continent.

In Asia, Giga Shanghai continues to be recognized as Tesla’s powerhouse. China, the company’s largest market, saw January 2026 deliveries from the plant rise 9 percent year-over-year to 69,129 units, with affordable new models expected later this year.

FSD advancements, already progressing in the U.S. and South Korea, are slated for Europe and further Asian rollout, complementing plans to expand Cybercab and Optimus to new markets as well.

With OTA-enabled autonomy on the horizon and retail strategies paying dividends, Tesla is strengthening its footprint from Tokyo showrooms to Berlin assembly lines and Shanghai exports. As Hashimoto continues to push Tesla forward in Japan, the company’s global vision for sustainable, self-driving mobility gains traction across Europe and Asia.

News

Tesla ships out update that brings massive change to two big features

“This change only updates the name of certain features and text in your vehicle,” the company wrote in Release Notes for the update, “and does not change the way your features behave.”

Tesla has shipped out an update for its vehicles that was caused specifically by a California lawsuit that threatened the company’s ability to sell cars because of how it named its driver assistance suite.

Tesla shipped out Software Update 2026.2.9 starting last week; we received it already, and it only brings a few minor changes, mostly related to how things are referenced.

“This change only updates the name of certain features and text in your vehicle,” the company wrote in Release Notes for the update, “and does not change the way your features behave.”

The following changes came to Tesla vehicles in the update:

- Navigate on Autopilot has now been renamed to Navigate on Autosteer

- FSD Computer has been renamed to AI Computer

Tesla faced a 30-day sales suspension in California after the state’s Department of Motor Vehicles stated the company had to come into compliance regarding the marketing of its automated driving features.

The agency confirmed on February 18 that it had taken a “corrective action” to resolve the issue. That corrective action was renaming certain parts of its ADAS.

Tesla discontinued its standalone Autopilot offering in January and ramped up the marketing of Full Self-Driving Supervised. Tesla had said on X that the issue with naming “was a ‘consumer protection’ order about the use of the term ‘Autopilot’ in a case where not one single customer came forward to say there’s a problem.”

This was a “consumer protection” order about the use of the term “Autopilot” in a case where not one single customer came forward to say there’s a problem.

Sales in California will continue uninterrupted.

— Tesla North America (@tesla_na) December 17, 2025

It is now compliant with the wishes of the California DMV, and we’re all dealing with it now.

This was the first primary dispute over the terminology of Full Self-Driving, but it has undergone some scrutiny at the federal level, as some government officials have claimed the suite has “deceptive” names. Previous Transportation Secretary Pete Buttigieg was one of those federal-level employees who had an issue with the names “Autopilot” and “Full Self-Driving.”

Tesla sued the California DMV over the ruling last week.