Xpeng Motors is looking to rally around $300 million in funding prior to its United States’ initial public offering (IPO), sources said.

Of the companies and investors who are looking to get involved in the funding round, one of the most notable is the Qatar Investment Authority (QIA), which is the country’s sovereign wealth fund.

According to French media outlet Nouve L’obs, the QIA currently holds about a 17% stake in Volkswagen Auto Group, Porsche, and mining company Glencore, which holds a cobalt deal with Tesla for the Giga Shanghai and Giga Berlin production plants.

Xpeng is looking to raise $300 million. However, CNBC reported that the final number the Chinese automaker raises could be higher than that as some investors are still discussing the possibility of putting money into the company. The sources wished to remain anonymous, and Xpeng declined to provide a comment on the matter.

The company’s latest round of investments is apart of the same $500 million funding round it raised earlier in July. Firms such as Hong Kong-based Aspex, New York-located Coatue, Beijing’s Hillhouse Capital, and Sequoia Capital China took part in the fundraising round.

Xpeng also raised $400 million in November, led by Xiaomi, a Chinese smartphone manufacturer.

The company has officially filed for an IPO in the United States in a confidential manner, but it has not decided which exchange it will list on yet, the sources said to CNBC.

Xpeng has decided to enter the U.S. market at an interesting time. Not only did the U.S. Senate pass legislation that would increase the scrutiny of Chinese-based companies that trade on Wall Street, but a company employee also has an ongoing lawsuit with California’s Tesla, which is the outright leader in electric vehicle technology and development.

California Democratic Representative Brad Sherman spoke on the Chinese stock market restrictions. “As we continue to experience the economic fallout and volatility caused by the COVID-19 pandemic, the need to protect main street investors is all the more important,” he said. “For too long, Chinese companies have disregarded U.S. reporting standards, misleading our investors.”

Additionally, Tesla opened a lawsuit against Xpeng employee Cao Guangzhi earlier this year, accusing the engineer of stealing Autopilot’s source code. Tesla alleges that the former employee downloaded Autopilot source code to his personal computer and transferring it to Apple Airdrop before selling it to Xpeng for financial gain.

Despite the two ongoing issues, Xpeng plans to begin offering an IPO for potential investors shortly. The company also is delivering its P7 sedan in China, which will directly compete with the Tesla Model 3, which has been highly popular in the country since it started deliveries in January.

If Xpeng does go public on Wall Street, it will be the third Chinese electric car company to offer trading in the United States. Currently, NIO and Li Auto are active in the U.S. stock market.

News

Tesla Robotaxi ride-hailing without a Safety Monitor proves to be difficult

Tesla Robotaxi ride-hailing without a Safety Monitor is proving to be a difficult task, according to some riders who made the journey to Austin to attempt to ride in one of its vehicles that has zero supervision.

Last week, Tesla officially removed Safety Monitors from some — not all — of its Robotaxi vehicles in Austin, Texas, answering skeptics who said the vehicles still needed supervision to operate safely and efficiently.

BREAKING: Tesla launches public Robotaxi rides in Austin with no Safety Monitor

Tesla aimed to remove Safety Monitors before the end of 2025, and it did, but only to company employees. It made the move last week to open the rides to the public, just a couple of weeks late to its original goal, but the accomplishment was impressive, nonetheless.

However, the small number of Robotaxis that are operating without Safety Monitors has proven difficult to hail for a ride. David Moss, who has gained notoriety recently as the person who has traveled over 10,000 miles in his Tesla on Full Self-Driving v14 without any interventions, made it to Austin last week.

He has tried to get a ride in a Safety Monitor-less Robotaxi for the better part of four days, and after 38 attempts, he still has yet to grab one:

Wow just wow!

It’s 8:30PM, 29° out ice storm hailing & Tesla Robotaxi service has turned back on!

Waymo is offline & vast majority of humans are home in the storm

Ride 38 was still supervised but by far most impressive yet pic.twitter.com/1aUnJkcYm8

— David Moss (@DavidMoss) January 25, 2026

Tesla said last week that it was rolling out a controlled test of the Safety Monitor-less Robotaxis. Ashok Elluswamy, who heads the AI program at Tesla, confirmed that the company was “starting with a few unsupervised vehicles mixed in with the broader Robotaxi fleet with Safety Monitors,” and that “the ratio will increase over time.”

This is a good strategy that prioritizes safety and keeps the company’s controlled rollout at the forefront of the Robotaxi rollout.

However, it will be interesting to see how quickly the company can scale these completely monitor-less rides. It has proven to be extremely difficult to get one, but that is understandable considering only a handful of the cars in the entire Austin fleet are operating with no supervision within the vehicle.

News

Tesla gives its biggest hint that Full Self-Driving in Europe is imminent

Tesla has given its biggest hint that Full Self-Driving in Europe is imminent, as a new feature seems to show that the company is preparing for frequent border crossings.

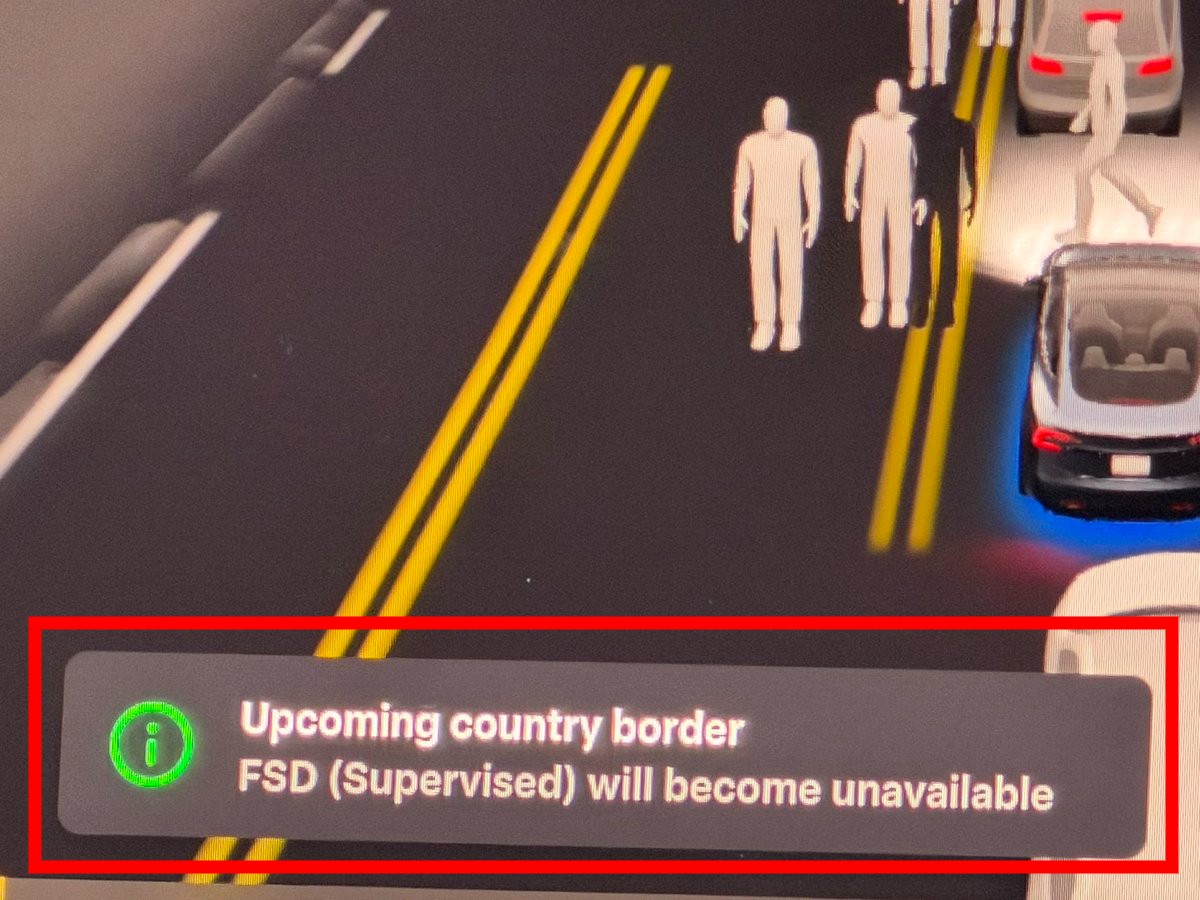

Tesla owner and influencer BLKMDL3, also known as Zack, recently took his Tesla to the border of California and Mexico at Tijuana, and at the international crossing, Full Self-Driving showed an interesting message: “Upcoming country border — FSD (Supervised) will become unavailable.”

FSD now shows a new message when approaching an international border crossing.

Stayed engaged the whole way as we crossed the border and worked great in Mexico! pic.twitter.com/bDzyLnyq0g

— Zack (@BLKMDL3) January 26, 2026

Due to regulatory approvals, once a Tesla operating on Full Self-Driving enters a new country, it is required to comply with the laws and regulations that are applicable to that territory. Even if legal, it seems Tesla will shut off FSD temporarily, confirming it is in a location where operation is approved.

This is something that will be extremely important in Europe, as crossing borders there is like crossing states in the U.S.; it’s pretty frequent compared to life in America, Canada, and Mexico.

Tesla has been working to get FSD approved in Europe for several years, and it has been getting close to being able to offer it to owners on the continent. However, it is still working through a lot of the red tape that is necessary for European regulators to approve use of the system on their continent.

This feature seems to be one that would be extremely useful in Europe, considering the fact that crossing borders into other countries is much more frequent than here in the U.S., and would cater to an area where approvals would differ.

Tesla has been testing FSD in Spain, France, England, and other European countries, and plans to continue expanding this effort. European owners have been fighting for a very long time to utilize the functionality, but the red tape has been the biggest bottleneck in the process.

Tesla Europe builds momentum with expanding FSD demos and regional launches

Tesla operates Full Self-Driving in the United States, China, Canada, Mexico, Puerto Rico, Australia, New Zealand, and South Korea.

Elon Musk

SpaceX Starship V3 gets launch date update from Elon Musk

The first flight of Starship Version 3 and its new Raptor V3 engines could happen as early as March.

Elon Musk has announced that SpaceX’s next Starship launch, Flight 12, is expected in about six weeks. This suggests that the first flight of Starship Version 3 and its new Raptor V3 engines could happen as early as March.

In a post on X, Elon Musk stated that the next Starship launch is in six weeks. He accompanied his announcement with a photo that seemed to have been taken when Starship’s upper stage was just about to separate from the Super Heavy Booster. Musk did not state whether SpaceX will attempt to catch the Super Heavy Booster during the upcoming flight.

The upcoming flight will mark the debut of Starship V3. The upgraded design includes the new Raptor V3 engine, which is expected to have nearly twice the thrust of the original Raptor 1, at a fraction of the cost and with significantly reduced weight. The Starship V3 platform is also expected to be optimized for manufacturability.

The Starship V3 Flight 12 launch timeline comes as SpaceX pursues an aggressive development cadence for the fully reusable launch system. Previous iterations of Starship have racked up a mixed but notable string of test flights, including multiple integrated flight tests in 2025.

Interestingly enough, SpaceX has teased an aggressive timeframe for Starship V3’s first flight. Way back in late November, SpaceX noted on X that it will be aiming to launch Starship V3’s maiden flight in the first quarter of 2026. This was despite setbacks like a structural anomaly on the first V3 booster during ground testing.

“Starship’s twelfth flight test remains targeted for the first quarter of 2026,” the company wrote in its post on X.