News

Elon Musk Addresses Tesla Battery Fire

Elon Musk addresses safety concerns after the Tesla battery fire incident. Stock pairs losses with a late surge before the closing bell.

Transcript from Tesla Motors below.

Had a conventional gasoline car encountered the same object on the highway, the result could have been far worse. A typical gasoline car only has a thin metal sheet protecting the underbody, leaving it vulnerable to destruction of the fuel supply lines or fuel tank, which causes a pool of gasoline to form and often burn the entire car to the ground. In contrast, the combustion energy of our battery pack is only about 10% of the energy contained in a gasoline tank and is divided into 16 modules with firewalls in between. As a consequence, the effective combustion potential is only about 1% that of the fuel in a comparable gasoline sedan.

The nationwide driving statistics make this very clear: there are 150,000 car fires per year according to the National Fire Protection Association, and Americans drive about 3 trillion miles per year according to the Department of Transportation. That equates to 1 vehicle fire for every 20 million miles driven, compared to 1 fire in over 100 million miles for Tesla. This means you are 5 times more likely to experience a fire in a conventional gasoline car than a Tesla!

For consumers concerned about fire risk, there should be absolutely zero doubt that it is safer to power a car with a battery than a large tank of highly flammable liquid.

— Elon

Below is our email correspondence with the Model S owner that experienced the fire, reprinted with his permission:

From: robert Carlson

Sent: Thursday, October 03, 2013 12:53 PM

To: Jerome Guillen

Subject: carlson 0389

Mr. Guillen,

Thanks for the support. I completely agree with the assessment to date. I guess you can test for everything, but some other celestial bullet comes along and challenges your design. I agree that the car performed very well under such an extreme test. The batteries went through a controlled burn which the internet images really exaggerates. Anyway, I am still a big fan of your car and look forward to getting back into one. Justin offered a white loaner--thanks. I am also an investor and have to say that the response I am observing is really supportive of the future for electric vehicles. I was thinking this was bound to happen, just not to me. But now it is out there and probably gets a sigh of relief as a test and risk issue-this "doomsday" event has now been tested, and the design and engineering works.

rob carlson

On Oct 3, 2013, at 12:29 PM, Jerome Guillen wrote:

Dear Mr. Carlson:

I am the VP of sales and service for Tesla, reporting directly to Elon Musk, Tesla's CEO.

I am sorry to hear that you experienced a collision in your Model S 2 days ago. We are happy that the Model S performed in such a way that you were not injured in the accident and that nobody else was hurt.

I believe you have been in contact with Justin Samson, our service manager, since the accident. We are following this case extremely closely and we have sent a team of experts to review your vehicle. All indications are that your Model S drove over large, oddly-shaped metal object which impacted the leading edge of the vehicle's undercarriage and rotated into the underside of the vehicle ("pole vault" effect). This is a highly uncommon occurrence.

Based on our review thus far, we believe that the Model S performed as designed by limiting the resulting fire to the affected zones only. Given the significant intensity of the impact, which managed to pierce the 1/4 inch bottom plate (something that is extremely hard to do), the Model S energy containment functions operated correctly. In particular, the top cover of the battery provided a strong barrier and there was no apparent propagation of the fire into the cabin. This ensured cabin integrity and occupant safety, which remains our most important goal.

We very much appreciate your support, patience and understanding while we proceed with the investigation. Justin keeps me closely informed. Please feel free to contact me directly, if you have any question or concern.

Best regards,

Jerome Guillen I VP, WW sales and service

News

Tesla Cybercab spotted with interesting charging solution, stimulating discussion

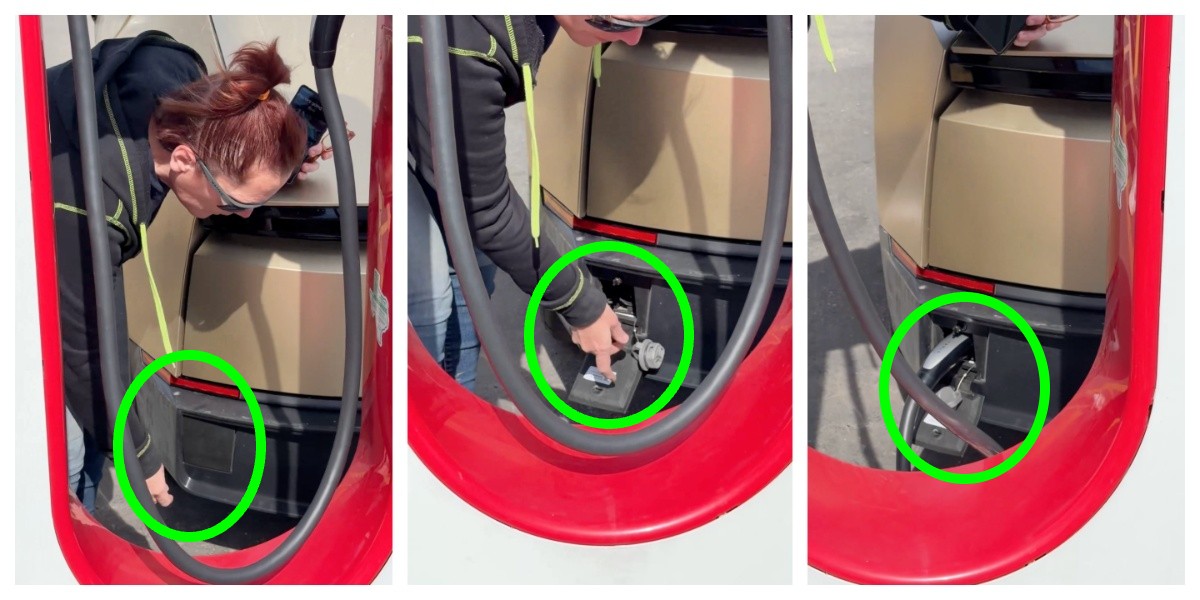

The port is located in the rear of the vehicle and features a manual door and latch for plug-in, and the video shows an employee connecting to a Tesla Supercharger.

Tesla Cybercab units are being tested publicly on roads throughout various areas of the United States, and a recent sighting of the vehicle’s charging port has certainly stimulated some discussions throughout the community.

The Cybercab is geared toward being a fully-autonomous vehicle, void of a steering wheel or pedals, only operating with the use of the Full Self-Driving suite. Everything from the driving itself to the charging to the cleaning is intended to be operated autonomously.

But a recent sighting of the vehicle has incited some speculation as to whether the vehicle might have some manual features, which would make sense, but let’s take a look:

🚨 Tesla Cybercab charging port is in the rear of the vehicle!

Here’s a great look at plugging it in!!

— TESLARATI (@Teslarati) January 29, 2026

The port is located in the rear of the vehicle and features a manual door and latch for plug-in, and the video shows an employee connecting to a Tesla Supercharger.

Now, it is important to remember these are prototype vehicles, and not the final product. Additionally, Tesla has said it plans to introduce wireless induction charging in the future, but it is not currently available, so these units need to have some ability to charge.

However, there are some arguments for a charging system like this, especially as the operation of the Cybercab begins after production starts, which is scheduled for April.

Wireless for Operation, Wired for Downtime

It seems ideal to use induction charging when the Cybercab is in operation. As it is for most Tesla owners taking roadtrips, Supercharging stops are only a few minutes long for the most part.

The Cybercab would benefit from more frequent Supercharging stops in between rides while it is operating a ride-sharing program.

Tesla wireless charging patent revealed ahead of Robotaxi unveiling event

However, when the vehicle rolls back to its hub for cleaning and maintenance, standard charging, where it is plugged into a charger of some kind, seems more ideal.

In the 45-minutes that the car is being cleaned and is having maintenance, it could be fully charged and ready for another full shift of rides, grabbing a few miles of range with induction charging when it’s out and about.

Induction Charging Challenges

Induction charging is still something that presents many challenges for companies that use it for anything, including things as trivial as charging cell phones.

While it is convenient, a lot of the charge is lost during heat transfer, which is something that is common with wireless charging solutions. Even in Teslas, the wireless charging mat present in its vehicles has been a common complaint among owners, so much so that the company recently included a feature to turn them off.

Production Timing and Potential Challenges

With Tesla planning to begin Cybercab production in April, the real challenge with the induction charging is whether the company can develop an effective wireless apparatus in that short time frame.

It has been in development for several years, but solving the issue with heat and energy loss is something that is not an easy task.

In the short-term, Tesla could utilize this port for normal Supercharging operation on the Cybercab. Eventually, it could be phased out as induction charging proves to be a more effective and convenient option.

News

Tesla confirms that it finally solved its 4680 battery’s dry cathode process

The suggests the company has finally resolved one of the most challenging aspects of its next-generation battery cells.

Tesla has confirmed that it is now producing both the anode and cathode of its 4680 battery cells using a dry-electrode process, marking a key breakthrough in a technology the company has been working to industrialize for years.

The update, disclosed in Tesla’s Q4 and FY 2025 update letter, suggests the company has finally resolved one of the most challenging aspects of its next-generation battery cells.

Dry cathode 4680 cells

In its Q4 and FY 2025 update letter, Tesla stated that it is now producing 4680 cells whose anode and cathode were produced during the dry electrode process. The confirmation addresses long-standing questions around whether Tesla could bring its dry cathode process into sustained production.

The disclosure was highlighted on X by Bonne Eggleston, Tesla’s Vice President of 4680 batteries, who wrote that “both electrodes use our dry process.”

Tesla first introduced the dry-electrode concept during its Battery Day presentation in 2020, pitching it as a way to simplify production, reduce factory footprint, lower costs, and improve energy density. While Tesla has been producing 4680 cells for some time, the company had previously relied on more conventional approaches for parts of the process, leading to questions about whether a full dry-electrode process could even be achieved.

4680 packs for Model Y

Tesla also revealed in its Q4 and FY 2025 Update Letter that it has begun producing battery packs for certain Model Y vehicles using its in-house 4680 cells. As per Tesla:

“We have begun to produce battery packs for certain Model Ys with our 4680 cells, unlocking an additional vector of supply to help navigate increasingly complex supply chain challenges caused by trade barriers and tariff risks.”

The timing is notable. With Tesla preparing to wind down Model S and Model X production, the Model Y and Model 3 are expected to account for an even larger share of the company’s vehicle output. Ensuring that the Model Y can be equipped with domestically produced 4680 battery packs gives Tesla greater flexibility to maintain production volumes in the United States, even as global battery supply chains face increasing complexity.

Elon Musk

Tesla Giga Texas to feature massive Optimus V4 production line

This suggests that while the first Optimus line will be set up in the Fremont Factory, the real ramp of Optimus’ production will happen in Giga Texas.

Tesla will build Optimus 4 in Giga Texas, and its production line will be massive. This was, at least, as per recent comments by CEO Elon Musk on social media platform X.

Optimus 4 production

In response to a post on X which expressed surprise that Optimus will be produced in California, Musk stated that “Optimus 4 will be built in Texas at much higher volume.” This suggests that while the first Optimus line will be set up in the Fremont Factory, and while the line itself will be capable of producing 1 million humanoid robots per year, the real ramp of Optimus’ production will happen in Giga Texas.

This was not the first time that Elon Musk shared his plans for Optimus’ production at Gigafactory Texas. During the 2025 Annual Shareholder Meeting, he stated that Giga Texas’ Optimus line will produce 10 million units of the humanoid robot per year. He did not, however, state at the time that Giga Texas would produce Optimus V4.

“So we’re going to launch on the fastest production ramp of any product of any large complex manufactured product ever, starting with building a one-million-unit production line in Fremont. And that’s Line one. And then a ten million unit per year production line here,” Musk stated.

How big Optimus could become

During Tesla’s Q4 and FY 2025 earnings call, Musk offered additional context on the potential of Optimus. While he stated that the ramp of Optimus’ production will be deliberate at first, the humanoid robot itself will have the potential to change the world.

“Optimus really will be a general-purpose robot that can learn by observing human behavior. You can demonstrate a task or verbally describe a task or show it a task. Even show it a video, it will be able to do that task. It’s going to be a very capable robot. I think long-term Optimus will have a very significant impact on the US GDP.

“It will actually move the needle on US GDP significantly. In conclusion, there are still many who doubt our ambitions for creating amazing abundance. We are confident it can be done, and we are making the right moves technologically to ensure that it does. Tesla, Inc. has never been a company to shy away from solving the hardest problems,” Musk stated.