Tesla CEO Elon Musk promised a “giant contract” to a nickel supplier during the Q2 2020 Earnings Call. The problem is that the company will have trouble finding an efficient and environmentally-friendly nickel mine, and it could prove to be Tesla’s biggest challenge yet.

Nickel is a crucial metal in electric vehicle batteries because it can increase energy density and provide cars with more range. Musk stated during the Earnings Call that nickel-based cells are essential for the development of larger vehicles, like the Tesla Semi, for example. “Where every unit of mass that you add in battery pack, you have to subtract in cargo,” he said. “So it’s very important to have a mass efficient and long-range pack.”

Nickel-based cells would give Tesla an advantage in electric vehicle range, a category where the company already leads by a sizeable margin. However, with new vehicles on the way, cells have to be adjusted to work with specific workloads. The Semi is an excellent example of this.

Nickel could replace cobalt in Tesla’s current battery cells. Cobalt, a controversial element on its own, is responsible for stabilizing the cell and has been effective in increasing the safety of the high-energy batteries that Tesla has used. However, the mining process of cobalt is questionable, and mines which can obtain it likely are using child labor, which is highly illegal. It also is not environmentally-friendly to mine.

Tesla has taken extra steps to ensure that its cobalt suppliers are treating their workers humanely through a series of due diligence checks. Third-party companies complete random visits to these mines a few times a year to ensure that the cobalt Tesla is using in its batteries is humanely obtained.

The problem is: Nickel mining isn’t much different. Although it would be advantageous, safer, and provide more range for Tesla’s vehicles, it is tough to find nickel that is environmentally-friendly and responsibly mines. The largest nickel sources are in Indonesia, where millions of tonnes of waste are dumped into the sea, polluting coral reefs and damaging the homes of turtles.

Analysts believe that Indonesian miners will provide nearly all of the growth of nickel supplies over the next decade. With electric cars becoming more popular, batteries will be a large part of the surge in demand for the metal. Still, it is also used in everyday products, like stainless steel appliances, Financial Times says.

Other countries, like Canada and Australia, have nickel mines, but Indonesia is highly concentrated with it.

Steven Brown, a consultant and former employee at nickel mining company Vale, says that it could be challenging for customers who are environmentally-conscious to want products that contain the metal after hearing how some entities dispose of it.

“It could undermine the entire proposition of trying to sell a consumer a product that is environmentally friendly, if you have this back story,” he said.

Even though other countries have nickel available, the increased demand for EVs will require large automakers, like Tesla, to eventually have to source some of the metal from Indonesia. “At some point, it will happen where they can’t avoid Indonesian nickel,” Brown added.

Luckily, Tesla requires its sources to go through due diligence processes, and it is unlikely the company will steer away from them to obtain nickel. Of course, Tesla will benefit from having more nickel, but it has to be sourced responsibly for the company even to consider using it.

On top of that, nickel is the second most expensive metal in EV batteries. It only trails cobalt, which Tesla has worked intensively to get away from because of its environmental and humanitarian impact.

“We use very little cobalt in our system already, and that’s — that may to zero along, so it’s basically about nickel,” Musk said.

There is a delicate balance between positive environmental impact after EVs hit the road and the harmful impact sourcing some of the metals have. However, the automakers do not assume any of the responsibility for the mining companies’ process of getting rid of waste. But it is their responsibility to choose a company that decides to handle the ridding of environmentally-harming materials responsibly.

Tesla has made it a point to choose companies that share their mission for sustainability because the automaker realizes that building an electric car starts with sourcing the materials. If the materials are not responsibly obtained, then the EV isn’t as Earth-friendly as it could be.

Pius Ginting, an environmental activist, summed it up perfectly: “The net result is we have clean air in our cities — but then we destroy a rich biodiversity area.”

News

Tesla Model Y and Model 3 named safest vehicles tested by ANCAP in 2025

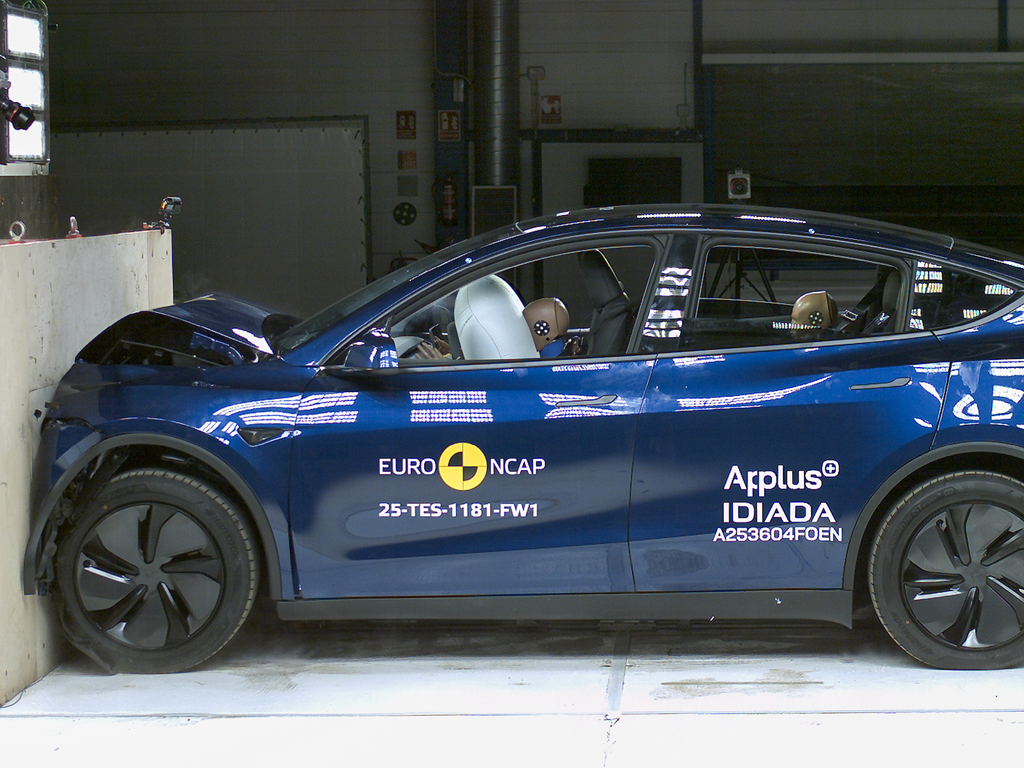

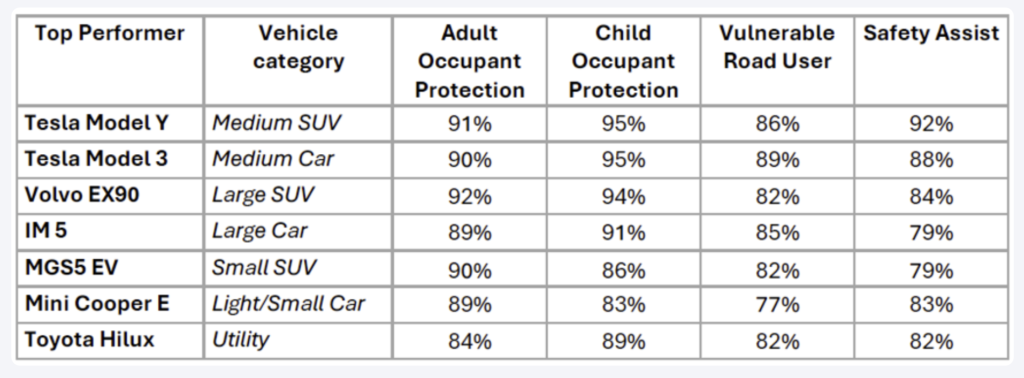

According to ANCAP in a press release, the Tesla Model Y achieved the highest overall weighted score of any vehicle assessed in 2025.

The Tesla Model Y recorded the highest overall safety score of any vehicle tested by ANCAP in 2025. The Tesla Model 3 also delivered strong results, reinforcing the automaker’s safety leadership in Australia and New Zealand.

According to ANCAP in a press release, the Tesla Model Y achieved the highest overall weighted score of any vehicle assessed in 2025. ANCAP’s 2025 tests evaluated vehicles across four key pillars: Adult Occupant Protection, Child Occupant Protection, Vulnerable Road User Protection, and Safety Assist technologies.

The Model Y posted consistently strong results in all four categories, distinguishing itself through a system-based safety approach that combines structural crash protection with advanced driver-assistance features such as autonomous emergency braking, lane support, and driver monitoring.

This marked the second time the Model Y has topped ANCAP’s annual safety rankings. The Model Y’s previous version was also ANCAP’s top performer in 2022.

The Tesla Model 3 also delivered a strong performance in ANCAP’s 2025 tests, contributing to Tesla’s broader safety presence across segments. Similar to the Model Y, the Model 3 also earned impressive scores across the ANCAP’s four pillars. This made the vehicle the top performer in the Medium Car category.

ANCAP Chief Executive Officer Carla Hoorweg stated that the results highlight a growing industry shift toward integrated safety design, with improvements in technologies such as autonomous emergency braking and lane support translating into meaningful real-world protection.

“ANCAP’s testing continues to reinforce a clear message: the safest vehicles are those designed with safety as a system, not a checklist. The top performers this year delivered consistent results across physical crash protection, crash avoidance and vulnerable road user safety, rather than relying on strength in a single area.

“We are also seeing increasing alignment between ANCAP’s test requirements and the safety technologies that genuinely matter on Australian and New Zealand roads. Improvements in autonomous emergency braking, lane support, and driver monitoring systems are translating into more robust protection,” Hoorweg said.

News

Tesla Sweden uses Megapack battery to bypass unions’ Supercharger blockade

Just before Christmas, Tesla went live with a new charging station in Arlandastad, outside Stockholm, by powering it with a Tesla Megapack battery.

Tesla Sweden has successfully launched a new Supercharger station despite an ongoing blockade by Swedish unions, using on-site Megapack batteries instead of traditional grid connections. The workaround has allowed the Supercharger to operate without direct access to Sweden’s electricity network, which has been effectively frozen by labor action.

Tesla has experienced notable challenges connecting its new charging stations to Sweden’s power grid due to industrial action led by Seko, a major Swedish trade union, which has blocked all new electrical connections for new Superchargers. On paper, this made the opening of new Supercharger sites almost impossible.

Despite the blockade, Tesla has continued to bring stations online. In Malmö and Södertälje, new Supercharger locations opened after grid operators E.ON and Telge Nät activated the sites. The operators later stated that the connections had been made in error.

More recently, however, Tesla adopted a different strategy altogether. Just before Christmas, Tesla went live with a new charging station in Arlandastad, outside Stockholm, by powering it with a Tesla Megapack battery, as noted in a Dagens Arbete (DA) report.

Because the Supercharger station does not rely on a permanent grid connection, Tesla was able to bypass the blocked application process, as noted by Swedish car journalist and YouTuber Peter Esse. He noted that the Arlandastad Supercharger is likely dependent on nearby companies to recharge the batteries, likely through private arrangements.

Eight new charging stalls have been launched in the Arlandastad site so far, which is a fraction of the originally planned 40 chargers for the location. Still, the fact that Tesla Sweden was able to work around the unions’ efforts once more is impressive, especially since Superchargers are used even by non-Tesla EVs.

Esse noted that Tesla’s Megapack workaround is not as easily replicated in other locations. Arlandastad is unique because neighboring operators already have access to grid power, making it possible for Tesla to source electricity indirectly. Still, Esse noted that the unions’ blockades have not affected sales as much.

“Many want Tesla to lose sales due to the union blockades. But you have to remember that sales are falling from 2024, when Tesla sold a record number of cars in Sweden. That year, the unions also had blockades against Tesla. So for Tesla as a charging operator, it is devastating. But for Tesla as a car company, it does not matter in terms of sales volumes. People charge their cars where there is an opportunity, usually at home,” Esse noted.

Elon Musk

Elon Musk’s X goes down as users report major outage Friday morning

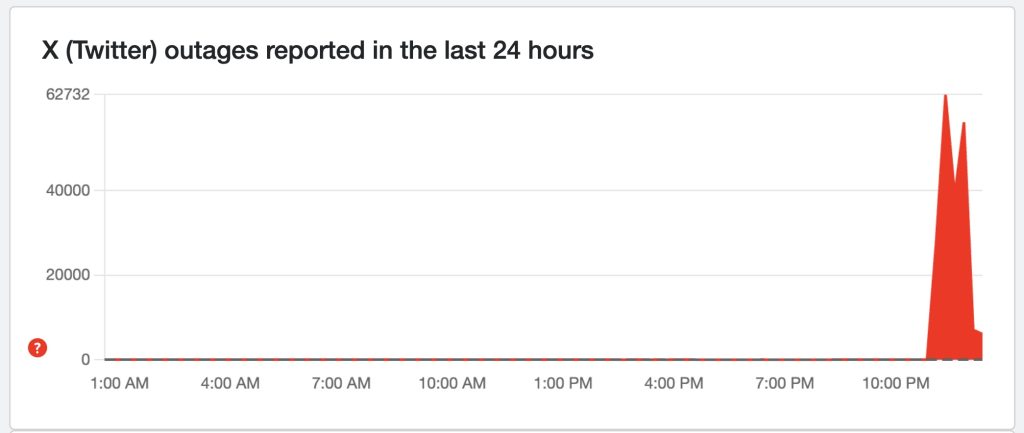

Error messages and stalled loading screens quickly spread across the service, while outage trackers recorded a sharp spike in user reports.

Elon Musk’s X experienced an outage Friday morning, leaving large numbers of users unable to access the social media platform.

Error messages and stalled loading screens quickly spread across the service, while outage trackers recorded a sharp spike in user reports.

Downdetector reports

Users attempting to open X were met with messages such as “Something went wrong. Try reloading,” often followed by an endless spinning icon that prevented access, according to a report from Variety. Downdetector data showed that reports of problems surged rapidly throughout the morning.

As of 10:52 a.m. ET, more than 100,000 users had reported issues with X. The data indicated that 56% of complaints were tied to the mobile app, while 33% were related to the website and roughly 10% cited server connection problems. The disruption appeared to begin around 10:10 a.m. ET, briefly eased around 10:35 a.m., and then returned minutes later.

Previous disruptions

Friday’s outage was not an isolated incident. X has experienced multiple high-profile service interruptions over the past two years. In November, tens of thousands of users reported widespread errors, including “Internal server error / Error code 500” messages. Cloudflare-related error messages were also reported.

In March 2025, the platform endured several brief outages spanning roughly 45 minutes, with more than 21,000 reports in the U.S. and 10,800 in the U.K., according to Downdetector. Earlier disruptions included an outage in August 2024 and impairments to key platform features in July 2023.