Investor's Corner

Tesla files to build EV batteries on new production lines at Fremont Factory

Tesla (NASDAQ: TSLA) has filed to build a new battery manufacturing equipment line at the Fremont Factory in Northern California. The factory, which Tesla purchased in 2010, is the only in the company’s lineup to produce all four models. It has not been known as a battery cell or pack manufacturing plant, as the company’s Gigafactory in Sparks, Nevada, produces those EV components. However, the filings indicate Tesla may be looking to slightly expand its cell manufacturing efforts with new production lines at Fremont.

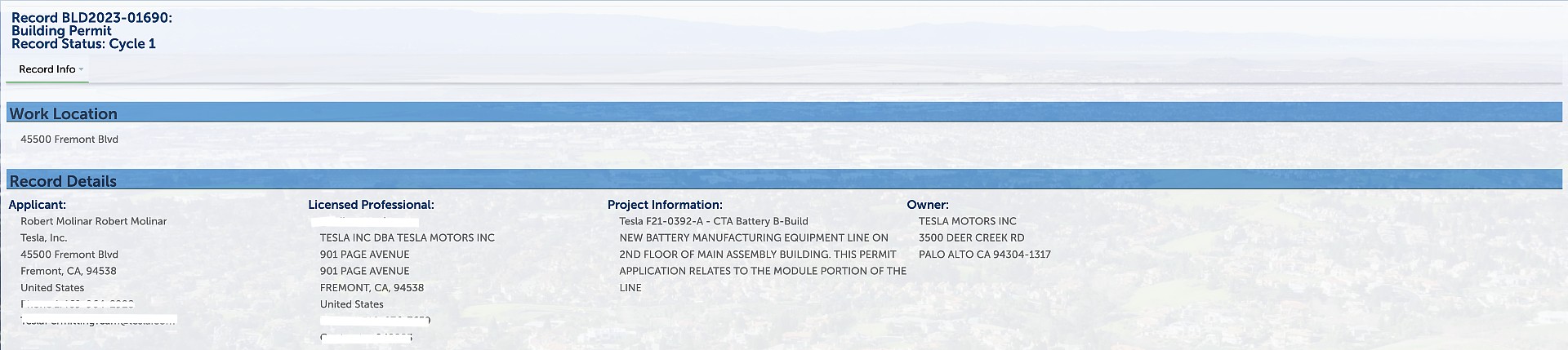

Filed and signed by Tesla on August 30, the permit is labeled as “Tesla F21-0391-A – CTA Battery B-Build.” Tesla gives the following description of the project:

“NEW BATTERY MANUFACTURING EQUIPMENT LINE ON 2ND FLOOR OF MAIN ASSEMBLY BUILDING. THIS PERMIT APPLICATION RELATES TO THE MODULE PORTION OF THE LINE.”

The project is valued at $1.5 million, according to documents seen by Teslarati.

Credit: City of Fremont

Additionally, another application reveals a $1.3 million project that includes the installation of a new maintenance office, a storage area, production cells with equipment for hood, fender, and trunk lids, and offline cell manufacturing equipment. This project is listed to be on the first floor of the assembly building.

Interestingly, the Fremont Factory has been one of Tesla’s more spacially-confined facilities. Earlier this year, during a visit from Morgan Stanley analysts, including Adam Jonas, the firm noted the Fremont Factory was incredibly tight in terms of storage capacity and room in general. Despite running at a capacity of 20 percent above what has been considered its maximum. “The plant was never designed to produce 450k units (at its peak produced ~300k units before Tesla took it over from Toyota), which was immediately apparent at the tour, ” Jonas wrote in his note describing the visit. “Tesla does not shy away from the fact the plant is inefficiently designed with four assembly buildings, one of which is a tent that cars are assembled in,” referring to GA 4.5, which was made permanent last year.

Just two weeks prior to Morgan Stanley’s visit to Fremont, CEO Elon Musk stated Tesla was considering expanding Fremont “significantly.” While many of us just thought this likely meant an expansion of vehicle production alone, Musk may have been hinting toward an expansion of the manufacturing process altogether.

Tesla battery manufacturing efforts

Tesla has held battery supply deals with Panasonic, CATL, and LG Chem, but has also started building its own cells in-house. In 2020, Tesla unveiled its 4680 battery cell, which has already been prototype-tested by Panasonic. Tesla has been building the cell at the Kato Rd. facility just a few blocks away from Fremont’s front doors. However, the automaker has not scaled this cell to mass production as of yet, and Tesla could always use more battery cells.

With the 4680 cell not quite reaching mass production volumes yet, an order log that grows with what seems to be every minute, and a production volume that just simply has not caught up to Tesla’s demand, it would make sense to expand in-house battery manufacturing efforts as supplementary support.

“I think we’ve said this now for many years. I know has proven true. Tesla does not have a demand problem, we have a production problem. And we’ve almost always had it’s a very rare exception it’s always been a production problem,” Musk said after Q2. “I think that will remain the case.”

Rearranging at the Fremont Factory

Over the past month or so, Tesla has filed to make many significant changes at the Fremont Factory. After we reported on the construction efforts that are seemingly underway, Tesla has also been filing several applications with the City of Fremont for equipment repositioning, as well as the construction of new foundations and manufacturing equipment. Even things as simple as light poles are being repositioned to make way for potential new manufacturing buildings.

Tesla Fremont plant is abuzz with activity as nearby construction goes underway

Tesla has also started relocating Model S and X production equipment to other portions of the factory. “GASX,” which we can assume is “General Assembly Model S and X,” has had a hoist relocated, according to filings. Tesla has also filed to install production tools and other associated Model S and Model X manufacturing utilities in the factory. This does not necessarily imply that production lines for the two vehicles will be expanding, especially considering the vehicles make up an extremely small portion of Tesla’s overall sales. However, these manufacturing lines may be shifting to other locations at Fremont to make way for the perhaps imminent installation of cell manufacturing lines at Fremont.

I’d love to hear from you! If you have any comments, concerns, or questions, please email me at joey@teslarati.com. You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla Earnings Call: Top 5 questions investors are asking

Tesla has scheduled its Earnings Call for Q4 and Full Year 2025 for next Wednesday, January 28, at 5:30 p.m. EST, and investors are already preparing to get some answers from executives regarding a wide variety of topics.

The company accepts several questions from retail investors through the platform Say, which then allows shareholders to vote on the best questions.

Tesla does not answer anything regarding future product releases, but they are willing to shed light on current timelines, progress of certain projects, and other plans.

There are five questions that range over a variety of topics, including SpaceX, Full Self-Driving, Robotaxi, and Optimus, which are currently in the lead to be asked and potentially answered by Elon Musk and other Tesla executives:

- You once said: Loyalty deserves loyalty. Will long-term Tesla shareholders still be prioritized if SpaceX does an IPO?

- Our Take – With a lot of speculation regarding an incoming SpaceX IPO, Tesla investors, especially long-term ones, should be able to benefit from an early opportunity to purchase shares. This has been discussed endlessly over the past year, and we must be getting close to it.

- When is FSD going to be 100% unsupervised?

- Our Take – Musk said today that this is essentially a solved problem, and it could be available in the U.S. by the end of this year.

- What is the current bottleneck to increase Robotaxi deployment & personal use unsupervised FSD? The safety/performance of the most recent models or people to monitor robots, robotaxis, in-car, or remotely? Or something else?

- Our Take – The bottleneck seems to be based on data, which Musk said Tesla needs 10 billion miles of data to achieve unsupervised FSD. Once that happens, regulatory issues will be what hold things up from moving forward.

- Regarding Optimus, could you share the current number of units deployed in Tesla factories and actively performing production tasks? What specific roles or operations are they handling, and how has their integration impacted factory efficiency or output?

- Our Take – Optimus is going to have a larger role in factories moving forward, and later this year, they will have larger responsibilities.

- Can you please tie purchased FSD to our owner accounts vs. locked to the car? This will help us enjoy it in any Tesla we drive/buy and reward us for hanging in so long, some of us since 2017.

- Our Take – This is a good one and should get us some additional information on the FSD transfer plans and Subscription-only model that Tesla will adopt soon.

Tesla will have its Earnings Call on Wednesday, January 28.

Elon Musk

Tesla locks in Elon Musk’s top problem solver as it enters its most ambitious era

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla has granted Senior Vice President of Automotive Tom Zhu more than 520,000 stock options, tying a significant portion of his compensation to the company’s long-term performance.

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla secures top talent

According to a Form 4 filing with the U.S. Securities and Exchange Commission, Tom Zhu received 520,021 stock options with an exercise price of $435.80 per share. Since the award will not fully vest until March 5, 2031, Zhu must remain at Tesla for more than five years to realize the award’s full benefit.

Considering that Tesla shares are currently trading at around the $445 to $450 per share level, Zhu will really only see gains in his equity award if Tesla’s stock price sees a notable rise over the years, as noted in a Sina Finance report.

Still, even at today’s prices, Zhu’s stock award is already worth over $230 million. If Tesla reaches the market cap targets set forth in Elon Musk’s 2025 CEO Performance Award, Zhu would become a billionaire from this equity award alone.

Tesla’s problem solver

Zhu joined Tesla in April 2014 and initially led the company’s Supercharger rollout in China. Later that year, he assumed the leadership of Tesla’s China business, where he played a central role in Tesla’s localization efforts, including expanding retail and service networks, and later, overseeing the development of Gigafactory Shanghai.

Zhu’s efforts helped transform China into one of Tesla’s most important markets and production hubs. In 2023, Tesla promoted Zhu to Senior Vice President of Automotive, placing him among the company’s core global executives and expanding his influence beyond China. He has since garnered a reputation as the company’s problem solver, being tapped by Elon Musk to help ramp Giga Texas’s vehicle production.

With this in mind, Tesla’s recent filing seems to suggest that the company is locking in its top talent as it enters its newest, most ambitious era to date. As could be seen in the targets of Elon Musk’s 2025 pay package, Tesla is now aiming to be the world’s largest company by market cap, and it is aiming to achieve production levels that are unheard of. Zhu’s talents would definitely be of use in this stage of the company’s growth.

Investor's Corner

Tesla analyst teases self-driving dominance in new note: ‘It’s not even close’

Tesla analyst Andrew Percoco of Morgan Stanley teased the company’s dominance in its self-driving initiative, stating that its lead over competitors is “not even close.”

Percoco recently overtook coverage of Tesla stock from Adam Jonas, who had covered the company at Morgan Stanley for years. Percoco is handling Tesla now that Jonas is covering embodied AI stocks and no longer automotive.

His first move after grabbing coverage was to adjust the price target from $410 to $425, as well as the rating from ‘Overweight’ to ‘Equal Weight.’

Percoco’s new note regarding Tesla highlights the company’s extensive lead in self-driving and autonomy projects, something that it has plenty of competition in, but has established its prowess over the past few years.

He writes:

“It’s not even close. Tesla continues to lead in autonomous driving, even as Nvidia rolls out new technology aimed at helping other automakers build driverless systems.”

Percoco’s main point regarding Tesla’s advantage is the company’s ability to collect large amounts of training data through its massive fleet, as millions of cars are driving throughout the world and gathering millions of miles of vehicle behavior on the road.

This is the main point that Percoco makes regarding Tesla’s lead in the entire autonomy sector: data is King, and Tesla has the most of it.

One big story that has hit the news over the past week is that of NVIDIA and its own self-driving suite, called Alpamayo. NVIDIA launched this open-source AI program last week, but it differs from Tesla’s in a significant fashion, especially from a hardware perspective, as it plans to use a combination of LiDAR, Radar, and Vision (Cameras) to operate.

Percoco said that NVIDIA’s announcement does not impact Morgan Stanley’s long-term opinions on Tesla and its strength or prowess in self-driving.

NVIDIA CEO Jensen Huang commends Tesla’s Elon Musk for early belief

And, for what it’s worth, NVIDIA CEO Jensen Huang even said some remarkable things about Tesla following the launch of Alpamayo:

“I think the Tesla stack is the most advanced autonomous vehicle stack in the world. I’m fairly certain they were already using end-to-end AI. Whether their AI did reasoning or not is somewhat secondary to that first part.”

Percoco reiterated both the $425 price target and the ‘Equal Weight’ rating on Tesla shares.