General Motors (GM) may not be catching up to electric vehicle leaders like Tesla anytime soon, but CFO Paul Jacobson has noted that the automaker’s EV business is still on the right path. The executive seemed optimistic about GM’s electric vehicle business, even noting that he sees variable profitability being achieved sometime in the second half of 2024.

With variable profitability achieved in 2024, Jacobson noted that fully-accounted profit in GM’s electric vehicle business could be anticipated about a year later, in 2025. The CFO did state that a number of factors would affect the profitability of GM’s EV business, such as lower costs of commodities and improvements in EV manufacturing, as noted in a Yahoo Finance report.

While GM’s stance on its EV business is quite optimistic, CFRA analyst Garrett Nelson has stated that it would be pretty shocking if the automaker does achieve profitability in 2024. “I would be shocked if they hit EV profitability this year,” Nelson said. He also noted in a segment with Yahoo Finance that GM might not achieve profitability in its EV business for “at least the next two or three years.”

GM’s electric vehicle efforts were hampered somewhat in 2023, with a company spokesperson noting that the automaker would have $1.7 billion in reserves for losses related to the company’s existing EV inventory in Q4 2023. GM CEO Mary Barra also noted that it’s true the “pace of EV growth has slowed, which has created some uncertainty.” Barra also stated during the automaker’s earnings call that the automaker has the flexibility to build more hybrids if necessary, though growth in EVs remains a top priority.

Apart from a potential shift in the company’s EV strategy, GM also noted that it is working to refocus and relaunch its self-driving robotaxi efforts in its Cruise subsidiary, which uses heavily modified all-electric Chevy Bolt EVs. In GM’s 2023 financial results, the company noted that it lost nearly $2.7 billion before taxes in Cruise. The automaker also intends to reduce its spending on the self-driving unit this 2024.

CFRA analyst Garrett Nelson’s Yahoo Finance segment can be viewed below.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.

News

I figured out how to charge my Tesla at my rented townhouse – Here’s how

I hope that this article is able to help the prospective EV buyer or the current Tesla owner who is living in a rental and does not have a straightforward solution to home charging. My situation will be presented in this article, and I will tell you why I went with the solution I went with, and alternatives, because there is more than one way to do this.

When I bought my Tesla Model Y Premium All-Wheel-Drive last year, I knew I would have to try to figure out a way not become totally reliant on Superchargers. After about six months of ownership, it came time to resolve that problem once and for good, and being a tenant in a rented townhouse community definitely added to my challenge.

Before I even bought my Tesla, I emailed my leasing office to see if the community had any plans to bring EV charging to the neighborhood. I had made myself available to them as I am familiar with a lot of the solutions out there and how much of an advantage this could be for the community, and attracting new tenants. After months of trying, I bought my Tesla in August anyway, and figured I’d be able to find an answer — whether positive or negative — and go from there.

I hope that this article is able to help the prospective EV buyer or the current Tesla owner who is living in a rental and does not have a straightforward solution to home charging. My situation will be presented in this article, and I will tell you why I went with the solution I went with, and alternatives, because there is more than one way to do this.

My Challenge with Home Charging

In a rental community, apartment complex, or even townhouse row, parking spots are a little complicated. I have assigned parking at my house, and unfortunately, my parking spot is not right in front of my front door. Instead, it is staggered, so my car is parked in front of my neighbor’s front door.

Initially, I had spoken to my neighbor whose spot is right in front of my front door and had gotten permission to park in their spot during the day while it is vacant. However, I was not going to be able to upgrade my outlet from a 110v-120v to the typical and suggested 220v-240v alternative.

I knew that this would mean I would need to be in my permanent spot because charging sufficiently, especially in preparation for trips or errands, would require overnight charging.

The Tesla Mobile Connector is 20 feet long, which is sufficient for most applications. Mine, however, required about 30 feet, maybe even a little more, to charge.

My Options

I had a few options: Use the Mobile Connector and park in my neighbor’s spot and charge when I could, buy an 8 or 10-gauge extension cord that could handle moving power from the Mobile Connector to my car, or buy an NACS to NACS extension cord.

I didn’t really want to do the first option, considering I knew that spot would only be available when my neighbor was not there. It didn’t seem like a viable option, and I figured it would be better to figure out something from my personal, permanent parking spot anyway.

The 10-gauge extension cord option was what I first considered: it was less expensive than buying an NACS extension, it was more readily available, and it was the first thing my friends who are electricians recommended.

However, running this option would have put the Mobile Connector in the grass or on the ground, and I was not interested in doing that. Running the risk of having that $300 connector that came with the car in the grass and exposing it to dew, dogs, and various other things just did not seem like the best idea.

I looked around for some NACS to NACS connectors, and there are a lot of options. Given that this was something that was going to plug into a $50,000 car, I chose to spend the additional money on one that was not from Amazon, and I went with this one from A2Z, which was recommended by other owners, and their reputation seemed more than positive. I was leaning toward this option anyway because it would keep the Mobile Connector off the ground, and it gave me an additional 16 feet of length to work with.

This was the solution.

Putting It Into Action

It was a relatively simple process: Plug the Mobile Connector into my house, plug the NACS to NACS extension into the Mobile Connector, plug the NACS extension into the car. It all worked immediately, but there are some things you should know if you are also planning to do this.

The first is that you should be very aware that these cables are going to be a target of thieves. I don’t have too much of an issue with this in my area, but if you’re in a place where copper wiring is heavily sought after, be sure to keep these in a place where they won’t be stolen. I put mine away when they’re not charging, and at night, they’re visible from my Ring camera, so I’m not overly concerned. Definitely be aware of it, though.

Additionally, if you’re going to run it across the sidewalk like I am, you’re going to want to pick up some sort of cable cover from a local hardware store. I picked up this one from Amazon because it was a little more heavy-duty, and it was big enough to cover the thicker gauge of the NACS to NACS extension:

I’ve considered picking up a second one for the visible cable, but I am undecided.

So far, I’ve been able to add some range to my car three times using this strategy, and while it is very slow, it is definitely worth it. It’s better than it sitting there stagnant.

Speed of Charging

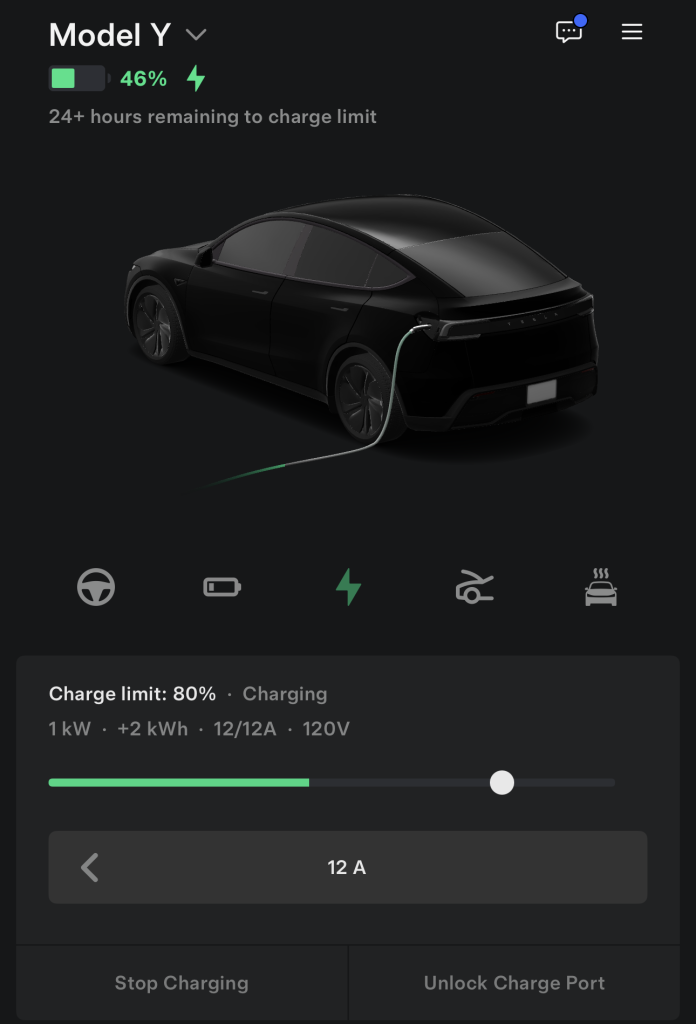

Tesla says the Mobile Connector will provide you with between 3 and 5 miles of range per hour when plugged into a typical wall outlet. That is about what I’ve gotten with it. From 30 percent to 80 percent, be aware that it will take well over 24 hours to charge your car.

I plan to cover some additional details on this as time goes on, including any troubleshooting I might have to do, how much my electric bill goes up, and whether or not I run into any issues with my neighbors or my leasing office.

If you’re looking for some help on an at-home charging solution or have any questions about my setup, please email me at joey@teslarati.com.

🚨 I FINALLY figured out a way to charge my Tesla at home as a renter — Using Superchargers exclusively was inconvenient, tough on the battery, and expensive

Here’s how I did it: https://t.co/TZokpc6Fh3 pic.twitter.com/UtRYKLvB2Y

— TESLARATI (@Teslarati) March 2, 2026

Elon Musk

Starlink V2 to bring satellite-to-phone service to Deutsche Telekom in Europe

Starlink stated that the system is designed to deliver 5G speeds directly to compatible smartphones in remote areas.

Starlink is partnering with Deutsche Telekom to roll out satellite-to-mobile connectivity across Europe, extending coverage to more than 140 million subscribers across 10 countries.

The service, planned for launch in 2028 in several Telekom markets, including Germany, will use Starlink’s next-generation V2 satellites and Mobile Satellite Service (MSS) spectrum to enable direct-to-device connectivity.

In a post on X, the official Starlink account stated that the agreement will be the first in Europe to deploy its V2 next-generation satellite-to-mobile technology using new MSS spectrum. The company added that the system is designed to deliver 5G speeds directly to compatible smartphones in remote areas.

Abdu Mudesir, Board Member for Product and Technology at Deutsche Telekom, shared his excitement for the partnership in a press release. “We provide our customers with the best mobile network. And we continue to invest heavily in expanding our infrastructure. At the same time, there are regions where expansion is especially complex due to topographical conditions or official constraints,” he said.

“We want to ensure reliable connectivity for our customers in those areas as well. That is why we are strategically complementing our network with satellite-to-mobile connectivity. For us, it is clear: connectivity creates security and trust. And we deliver. Everywhere.”

Under the partnership, compatible smartphones will automatically switch to Starlink’s satellite network when terrestrial coverage is unavailable, enabling access to data, voice, video, and messaging services.

Telekom reports 5G geographic coverage approaching 90% in Germany, with LTE exceeding 92% and voice coverage reaching up to 99%. Starlink’s satellite layer is intended to extend connectivity beyond those terrestrial limits, particularly in topographically challenging or infrastructure-constrained areas.

Stephanie Bednarek, VP of Starlink Sales, also shared her thoughts on the partnership. “We’re so pleased to bring reliable satellite-to-mobile connectivity to millions of people across 10 countries in partnership with Deutsche Telekom. This agreement will be the first-of-its-kind in Europe to launch Starlink’s V2 next-generation technology that will expand on data, voice and messaging by providing broadband directly to mobile phones,” she said.

Starlink’s V2 constellation is designed to expand bandwidth and capacity compared to its predecessor. If implemented as outlined, the 2028 launch would mark one of the first large-scale European deployments of integrated satellite-to-phone connectivity by a major telecom operator.

News

Tesla back on top as Norway’s EV market surges to 98% share in February

Tesla became Norway’s top-selling brand with 1,210 registrations, representing a 16.6% share.

Tesla reclaimed the top spot in Norway’s auto market in February as electric vehicles captured more than 98% of all new car registrations.

The rebound follows a sharp January slump triggered by VAT rule changes, which prompted numerous car buyers to advance their purchases into late 2025.

As per data from the Norwegian Road Traffic Information Council (OFV), 7,127 new electric vehicles were registered in February, representing a 98.01% market share. Fossil-fuel vehicles and hybrids accounted for just 2% of total new registrations.

Total new car registrations reached 7,272 units in February, hinting at a rapid recovery after January sales fell nearly 75% year-over-year following VAT adjustments.

OFV Director Geir Inge Stokke noted that similar patterns were observed after previous VAT changes in 2022, with demand temporarily weakening before normalizing, as noted in an Allt Om Elbil report.

“We are now seeing signs that the market is returning to a more normal level of activity, which we also experienced after the VAT change in 2022. At that time, changes in demand led to a weak start to 2023. We have seen the same pattern this year,” he said.

Amidst this trend, the Tesla Model Y made a strong comeback in the domestic market. After an unusually weak January that saw the Tesla Model Y drop to seventh place, the model returned to the top of Norway’s sales chart in February.

The Model Y recorded 1,073 registrations, giving it a 14.8% market share for the month. Tesla also became Norway’s top-selling brand with 1,210 registrations, representing a 16.6% share. Toyota followed with 941 registrations, while Volkswagen, Volvo, and Skoda rounded out the top five brands.

The February data suggests that Tesla’s January dip was tied more to timing effects around VAT adjustments than to structural demand shifts. It would then be interesting to see how the rest of the year unfolds for Tesla, particularly as the company pushes for the release of its Full Self-Driving (Supervised) system to Europe this year.