Investor's Corner

Tesla Motors Secret Weapon: Thoughts and Lobbying Efforts

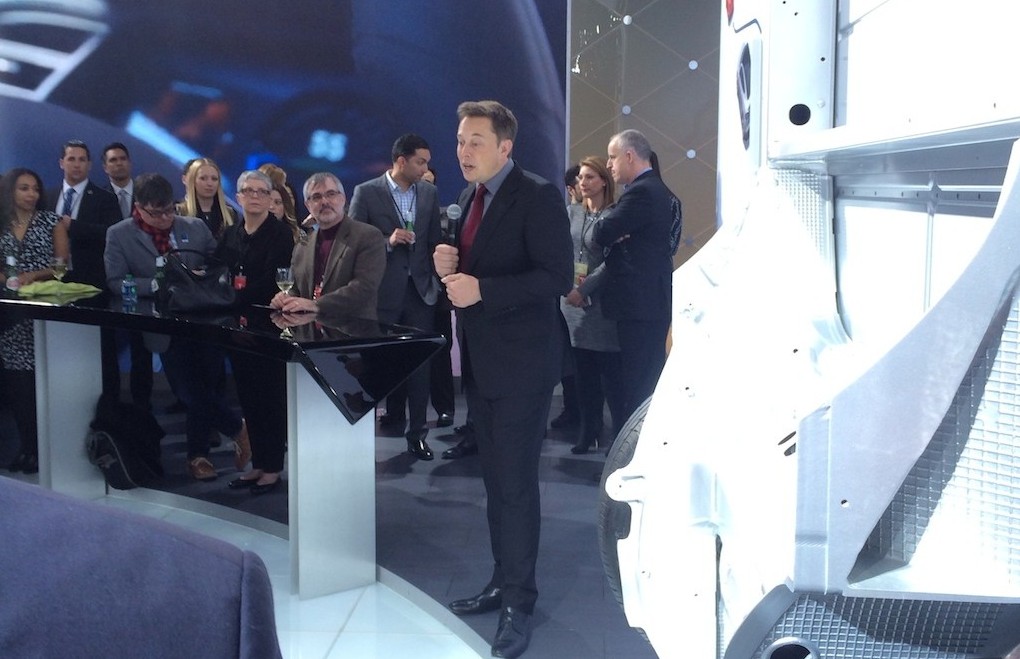

Elon Musk speaking to fans at the North American International Auto Show in Jan. of 2015. (Source: KmanAuto)

Release the hounds and engage the thrusters, Tesla’s 2015 dealer association battles are well underway this year in many states, such as New Jersey, Connecticut and Texas. According to the the Texas Tribune, Tesla Motors has spent between “$625,000 and 1.18 million on lobbyists in the state’s most recent legislative session.” In past legislative sessions, dating back to to 2013, Tesla has spent a much more conservative amount in the range of $170,000 to $370,000.

So how does an investor or an Tesla enthusiast view this current strategy by Tesla Motors? Maybe a more aggressive lobbying strategy should have been done earlier? Or is it good timing or has the Silicon Valley automaker decided it’s the right time to strike?

In 2014, Tesla Motors was an online monster, newsmaker, and discussion board darling. The news came fast and furious, with more superchargers, the new Model P85D, the gigafactory launch and a new machine component facility in Lathrop, CA. With this growth, Musk may have felt it was the right time for better PR and a fully-realized lobbying strategy with state legislators.

The waiting game’s timing seems to have allowed legislators and the dealers to over reach in 2015. A recent dealer association’s argument posits that Tesla might not be around (bankrupt) for the long-term and where will consumers go for service (they may have a point if all legislative bodies adopt anti-capitalism stances–Luddites).

Why lobby now? Maybe Musk saw the writing on the wall in late 2014 with Tesla’s lack of demand in China and knew increased demand for the Model S was probably needed for a big 2015 in the U.S.

>> Related News: Tesla Motors Reassigns Jerome Guillen to Customer Satisfaction position, restructures global sales departments.

In the most recent earnings call, Musk mentioned a “secret weapon against dealerships” as it related to global car demand and Tesla deliveries for 2015. One thing we know, this secret weapon isn’t a legal loophole, otherwise they would have used it by now, right?

With this in mind, I visited some Tesla Motors discussion boards to see what’s being suggested as this “secret weapon” against dealers? Some have suggested an updated battery technology, but Musk has pointed to the gigafactory’s supply chain for near-term innovation and dampened, in general, battery breakthrough ideas.

Others push the idea of more Tesla taxis or rental cars in play to get more “butts in seats.” However, I don’t see that as direct response to dealerships.

An interesting suggestion from “subhuman” (yep, that’s correct username) on the TMC discussion board mentioned “a lifetime warranty or extremely long warranty period” that could highlight the paradigm shift of electric car technology to the car-buying public. On the TMC board, ‘subhuman’ suggests, “Elon has always said that he wants to run the service center at a zero profit, what better then buying a car that you will never have to pay to have serviced.”

With a prolonged dealership lobbying strategy this year and this type of extended service proposal, car buyers will understand more of the electric car proposition. Even libertarians are seeing the raging hypocrisy (listen to Energy Gang, “Why More Tea Partyers Are Rallying Behind Solar”) over the issue of consumer liberties and the ability to buy a car or energy platform that suits their needs.

So does Tesla’s business model and dealer fight have legs beyond just car enthusiast sites, financial blogs and discussion boards? We’ll see.

Investor's Corner

Tesla Earnings Call: Top 5 questions investors are asking

Tesla has scheduled its Earnings Call for Q4 and Full Year 2025 for next Wednesday, January 28, at 5:30 p.m. EST, and investors are already preparing to get some answers from executives regarding a wide variety of topics.

The company accepts several questions from retail investors through the platform Say, which then allows shareholders to vote on the best questions.

Tesla does not answer anything regarding future product releases, but they are willing to shed light on current timelines, progress of certain projects, and other plans.

There are five questions that range over a variety of topics, including SpaceX, Full Self-Driving, Robotaxi, and Optimus, which are currently in the lead to be asked and potentially answered by Elon Musk and other Tesla executives:

- You once said: Loyalty deserves loyalty. Will long-term Tesla shareholders still be prioritized if SpaceX does an IPO?

- Our Take – With a lot of speculation regarding an incoming SpaceX IPO, Tesla investors, especially long-term ones, should be able to benefit from an early opportunity to purchase shares. This has been discussed endlessly over the past year, and we must be getting close to it.

- When is FSD going to be 100% unsupervised?

- Our Take – Musk said today that this is essentially a solved problem, and it could be available in the U.S. by the end of this year.

- What is the current bottleneck to increase Robotaxi deployment & personal use unsupervised FSD? The safety/performance of the most recent models or people to monitor robots, robotaxis, in-car, or remotely? Or something else?

- Our Take – The bottleneck seems to be based on data, which Musk said Tesla needs 10 billion miles of data to achieve unsupervised FSD. Once that happens, regulatory issues will be what hold things up from moving forward.

- Regarding Optimus, could you share the current number of units deployed in Tesla factories and actively performing production tasks? What specific roles or operations are they handling, and how has their integration impacted factory efficiency or output?

- Our Take – Optimus is going to have a larger role in factories moving forward, and later this year, they will have larger responsibilities.

- Can you please tie purchased FSD to our owner accounts vs. locked to the car? This will help us enjoy it in any Tesla we drive/buy and reward us for hanging in so long, some of us since 2017.

- Our Take – This is a good one and should get us some additional information on the FSD transfer plans and Subscription-only model that Tesla will adopt soon.

Tesla will have its Earnings Call on Wednesday, January 28.

Elon Musk

Tesla locks in Elon Musk’s top problem solver as it enters its most ambitious era

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla has granted Senior Vice President of Automotive Tom Zhu more than 520,000 stock options, tying a significant portion of his compensation to the company’s long-term performance.

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla secures top talent

According to a Form 4 filing with the U.S. Securities and Exchange Commission, Tom Zhu received 520,021 stock options with an exercise price of $435.80 per share. Since the award will not fully vest until March 5, 2031, Zhu must remain at Tesla for more than five years to realize the award’s full benefit.

Considering that Tesla shares are currently trading at around the $445 to $450 per share level, Zhu will really only see gains in his equity award if Tesla’s stock price sees a notable rise over the years, as noted in a Sina Finance report.

Still, even at today’s prices, Zhu’s stock award is already worth over $230 million. If Tesla reaches the market cap targets set forth in Elon Musk’s 2025 CEO Performance Award, Zhu would become a billionaire from this equity award alone.

Tesla’s problem solver

Zhu joined Tesla in April 2014 and initially led the company’s Supercharger rollout in China. Later that year, he assumed the leadership of Tesla’s China business, where he played a central role in Tesla’s localization efforts, including expanding retail and service networks, and later, overseeing the development of Gigafactory Shanghai.

Zhu’s efforts helped transform China into one of Tesla’s most important markets and production hubs. In 2023, Tesla promoted Zhu to Senior Vice President of Automotive, placing him among the company’s core global executives and expanding his influence beyond China. He has since garnered a reputation as the company’s problem solver, being tapped by Elon Musk to help ramp Giga Texas’s vehicle production.

With this in mind, Tesla’s recent filing seems to suggest that the company is locking in its top talent as it enters its newest, most ambitious era to date. As could be seen in the targets of Elon Musk’s 2025 pay package, Tesla is now aiming to be the world’s largest company by market cap, and it is aiming to achieve production levels that are unheard of. Zhu’s talents would definitely be of use in this stage of the company’s growth.

Investor's Corner

Tesla analyst teases self-driving dominance in new note: ‘It’s not even close’

Tesla analyst Andrew Percoco of Morgan Stanley teased the company’s dominance in its self-driving initiative, stating that its lead over competitors is “not even close.”

Percoco recently overtook coverage of Tesla stock from Adam Jonas, who had covered the company at Morgan Stanley for years. Percoco is handling Tesla now that Jonas is covering embodied AI stocks and no longer automotive.

His first move after grabbing coverage was to adjust the price target from $410 to $425, as well as the rating from ‘Overweight’ to ‘Equal Weight.’

Percoco’s new note regarding Tesla highlights the company’s extensive lead in self-driving and autonomy projects, something that it has plenty of competition in, but has established its prowess over the past few years.

He writes:

“It’s not even close. Tesla continues to lead in autonomous driving, even as Nvidia rolls out new technology aimed at helping other automakers build driverless systems.”

Percoco’s main point regarding Tesla’s advantage is the company’s ability to collect large amounts of training data through its massive fleet, as millions of cars are driving throughout the world and gathering millions of miles of vehicle behavior on the road.

This is the main point that Percoco makes regarding Tesla’s lead in the entire autonomy sector: data is King, and Tesla has the most of it.

One big story that has hit the news over the past week is that of NVIDIA and its own self-driving suite, called Alpamayo. NVIDIA launched this open-source AI program last week, but it differs from Tesla’s in a significant fashion, especially from a hardware perspective, as it plans to use a combination of LiDAR, Radar, and Vision (Cameras) to operate.

Percoco said that NVIDIA’s announcement does not impact Morgan Stanley’s long-term opinions on Tesla and its strength or prowess in self-driving.

NVIDIA CEO Jensen Huang commends Tesla’s Elon Musk for early belief

And, for what it’s worth, NVIDIA CEO Jensen Huang even said some remarkable things about Tesla following the launch of Alpamayo:

“I think the Tesla stack is the most advanced autonomous vehicle stack in the world. I’m fairly certain they were already using end-to-end AI. Whether their AI did reasoning or not is somewhat secondary to that first part.”

Percoco reiterated both the $425 price target and the ‘Equal Weight’ rating on Tesla shares.