News

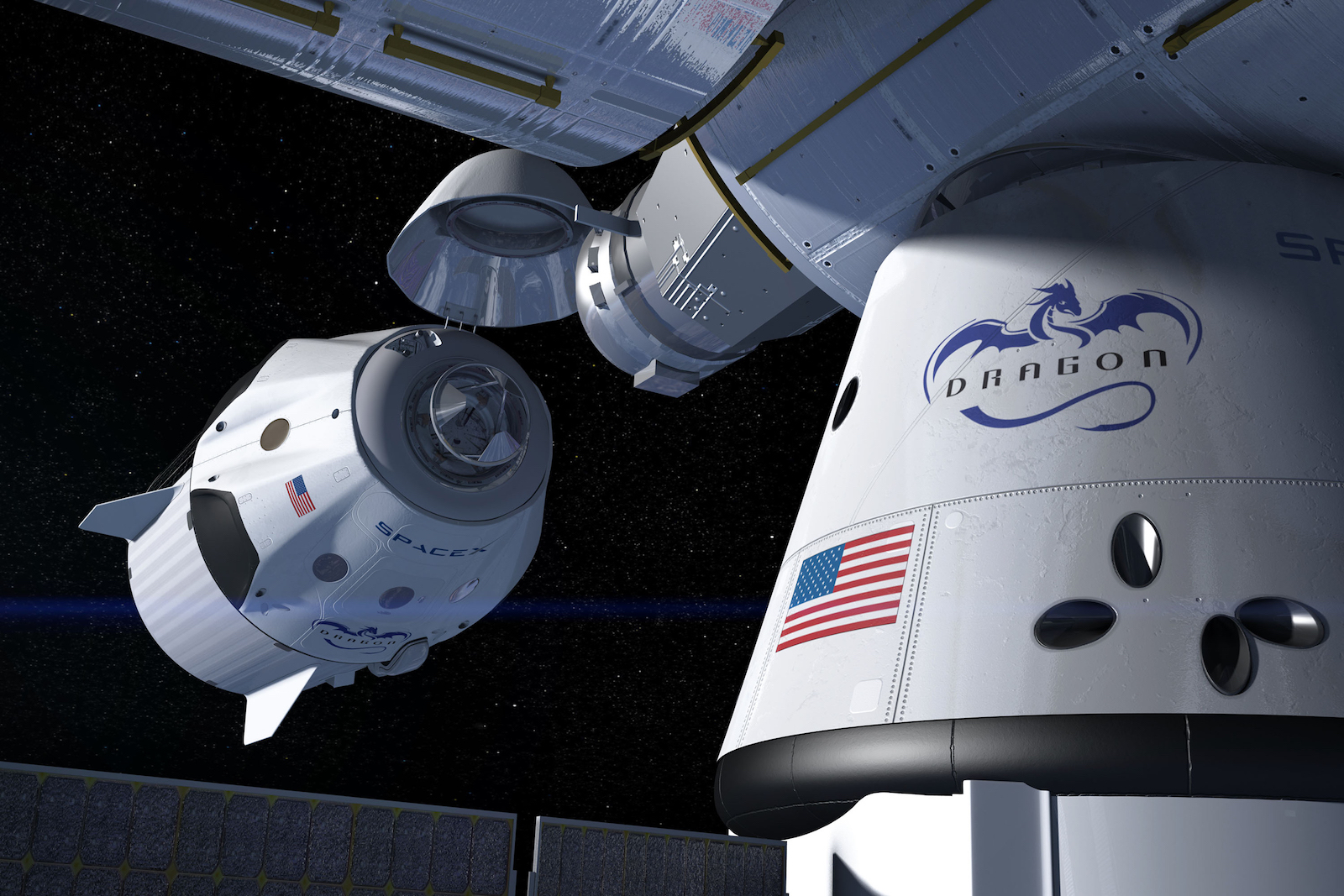

SpaceX and “new space” up against traditionalists for future of NASA

Speculation about the direction of NASA under the Trump Administration has been circling for weeks, and although there are still no definite answers, there’s finally some news about the process being executed.

According to internal White House advisory documents obtained by Politico, there’s a huge push from many advisors for NASA to be used as a driver for privatized space technology; however, that push is bringing the rift between traditional NASA contractors and the “new space” companies like SpaceX and Blue Origin to a head. NASA’s $19 billion dollar budget is simply not large enough to accommodate both commercially-driven and traditional visions for the agency. The struggle is real, apparently, and it isn’t just affecting inner White House circles, either.

Earlier this week, the Commercial Spaceflight Federation (CSF) surprised its audience by endorsing NASA’s Space Launch System (SLS), the heavy lift rocket being built to launch future NASA missions. In his remarks at the FAA’s Commercial Space Conference, CSF chairman Alan Stern characterized the SLS as a “resource” that could be complimentary to commercial space activity.

The surprise at this announcement comes in part from the fact that Boeing, a traditional NASA contractor and one-half of the government-customer-only launch service United Launch Alliance (ULA), is the prime contractor for the SLS. The cost comparison between private and government contracted technology is the issue.

Cost Effectiveness is Key

The billions of dollars it will take to fully develop SLS plus the high cost of launch missions is hard to justify when, for example, SpaceX estimates under $100 million dollars per flight on its upcoming heavy launch vehicle, Falcon Heavy.

SLS is estimated to be capable of carrying many times the payload weight of SpaceX’s vehicle, but it would still cost much less to use multiple SpaceX vehicles for a multi-part payload rather than justify the huge cost for a single launch. That, or one could argue that the cost of a SpaceX or Blue Origin developed vehicle in line with the SLS’s capabilities would be much more cost effective given the pricing record thus far. It also should be noted that such vehicles are, in fact, being designed by these companies already, albeit mostly still in non-tangible state. SpaceX has its Mars-bound Interplanetary Transport System (or “BFR” if you like), and Blue Origin has its “New Armstrong” in the works.

What about Congress?

The push from White House advisers will face obstacles in Congress as well. Space subcommittee members in both the House and Senate have discussed some of the details included in a draft 2017 NASA Authorization Act, the legislation which will define NASA’s priorities, and considering their comments alongside prior legislative drafts, “stay the course” looks to be the general direction. Concern over NASA’s need for “constancy of purpose” is a big driver, as missions requiring long-term development suffer when directives vary too widely from one presidential administration to another.

While prior presentations of NASA Authorization Acts have been lengthy and mostly inviting little to no controversy, they all still contain a requirement to use the SLS and Orion, NASA’s crew capsule under development, for deep space activity and anywhere else suitable. Such emphasis would likely clash with those advocating for transforming NASA’s role to one supporting commercial launch vehicles, especially those promoting the elimination of the SLS entirely.

Also, with thousands of NASA-dependent jobs on the line in the districts hosting SLS development facilities, the stakes are high for any congressional representatives thinking of supporting major shifts for NASA. The lines seem to have been drawn in the proverbial sand.

What about Mars?

News of commercial space supporters advocating for a NASA transition inside the White House may sound hopeful to those rooting for more privatized space technology; however, for colonization dreamers, Mars looks to be a carrot teased at the end of a “Moon first” road. The internal White House documents call for Moon development to begin by 2020, Mars falling under the “and beyond” category of capabilities that could be possible with an overhauled NASA.

In that light, the proposed NASA bills might sound like a Cinderella story for Mars enthusiasts: In order to go to the Prince’s ball (Mars), a whole host of lengthy chores (cis-lunar activity, Moon base, use the SLS, etc.) must be completed first.

If “Moon first” becomes the winner in the end, it still wouldn’t likely interfere with Elon Musk’s Mars plans but rather help them along with all the new space infrastructure launch income for SpaceX. And to continue with the Cinderella bit, we know there’s no way Musk would make it home by midnight anyway, although he does seem to have an affinity for mice.

Cybertruck

Tesla analyst claims another vehicle, not Model S and X, should be discontinued

Tesla analyst Gary Black of The Future Fund claims that the company is making a big mistake getting rid of the Model S and Model X. Instead, he believes another vehicle within the company’s lineup should be discontinued: the Cybertruck.

Black divested The Future Fund from all Tesla holdings last year, but he still covers the stock as an analyst as it falls in the technology and autonomy sectors, which he covers.

In a new comment on Thursday, Black said the Cybertruck should be the vehicle Tesla gets rid of due to the negatives it has drawn to the company.

The Cybertruck is also selling in an underwhelming fashion considering the production capacity Tesla has set aside for it. It’s worth noting it is still the best-selling electric pickup on the market, and it has outlasted other EV truck projects as other manufacturers are receding their efforts.

Black said:

“IMHO it’s a mistake to keep Tesla Cybertruck which has negative brand equity and sold 10,000 units last year, and discontinue S/X which have strong repeat brand loyalty and together sold 30K units and are highly profitable. Why not discontinue CT and covert S/X to be fully autonomous?”

IMHO it’s a mistake to keep $TSLA Cybertruck which has negative brand equity and sold 10,000 units last year, and discontinue S/X which have strong repeat brand loyalty and together sold 30K units and are highly profitable. Why not discontinue CT and covert S/X to be fully…

— Gary Black (@garyblack00) January 29, 2026

On Wednesday, CEO Elon Musk confirmed that Tesla planned to transition Model S and Model X production lines at the Fremont Factory to handle manufacturing efforts of the Optimus Gen 3 robot.

Musk said that it was time to wind down the S and X programs “with an honorable discharge,” also noting that the two cars are not major contributors to Tesla’s mission any longer, as its automotive division is more focused on autonomy, which will be handled by Model 3, Model Y, and Cybercab.

Tesla begins Cybertruck deliveries in a new region for the first time

The news has drawn conflicting perspectives, with many Tesla fans upset about the decision, especially as it ends the production of the largest car in the company’s lineup. Tesla’s focus is on smaller ride-sharing vehicles, especially as the vast majority of rides consist of two or fewer passengers.

The S and X do not fit in these plans.

Nevertheless, the Cybertruck fits in Tesla’s future plans. Musk said the pickup will be needed for the transportation of local goods. Musk also said Cybertruck would be transitioned to an autonomous line.

Elon Musk

SpaceX reportedly discussing merger with xAI ahead of blockbuster IPO

In a groundbreaking new report from Reuters, SpaceX is reportedly discussing merger possibilities with xAI ahead of the space exploration company’s plans to IPO later this year, in what would be a blockbuster move.

The outlet said it would combine rockets and Starlink satellites, as well as the X social media platform and AI project Grok under one roof. The report cites “a person briefed on the matter and two recent company filings seen by Reuters.”

Musk, nor SpaceX or xAI, have commented on the report, so, as of now, it is unconfirmed.

With that being said, the proposed merger would bring shares of xAI in exchange for shares of SpaceX. Both companies were registered in Nevada to expedite the transaction, according to the report.

On January 21, both entities were registered in Nevada. The report continues:

“One of them, a limited liability company, lists SpaceX and Bret Johnsen, the company’s chief financial officer, as managing members, while the other lists Johnsen as the company’s only officer, the filings show.”

The source also stated that some xAI executives could be given the option to receive cash in lieu of SpaceX stock. No agreement has been reached, nothing has been signed, and the timing and structure, as well as other important details, have not been finalized.

SpaceX is valued at $800 billion and is the most valuable privately held company, while xAI is valued at $230 billion as of November. SpaceX could be going public later this year, as Musk has said as recently as December that the company would offer its stock publicly.

The plans could help move along plans for large-scale data centers in space, something Musk has discussed on several occasions over the past few months.

At the World Economic Forum last week, Musk said:

“It’s a no-brainer for building solar-powered AI data centers in space, because as I mentioned, it’s also very cold in space. The net effect is that the lowest cost place to put AI will be space and that will be true within two to three years, three at the latest.”

He also said on X that “the most important thing in the next 3-4 years is data centers in space.”

If the report is true and the two companies end up coming together, it would not be the first time Musk’s companies have ended up coming together. He used Tesla stock to purchase SolarCity back in 2016. Last year, X became part of xAI in a share swap.

Elon Musk

Tesla hits major milestone with Full Self-Driving subscriptions

Tesla has announced it has hit a major milestone with Full Self-Driving subscriptions, shortly after it said it would exclusively offer the suite without the option to purchase it outright.

Tesla announced on Wednesday during its Q4 Earnings Call for 2025 that it had officially eclipsed the one million subscription mark for its Full Self-Driving suite. This represented a 38 percent increase year-over-year.

This is up from the roughly 800,000 active subscriptions it reported last year. The company has seen significant increases in FSD adoption over the past few years, as in 2021, it reported just 400,000. In 2022, it was up to 500,000 and, one year later, it had eclipsed 600,000.

NEWS: For the first time, Tesla has revealed how many people are subscribed or have purchased FSD (Supervised).

Active FSD Subscriptions:

• 2025: 1.1 million

• 2024: 800K

• 2023: 600K

• 2022: 500K

• 2021: 400K pic.twitter.com/KVtnyANWcs— Sawyer Merritt (@SawyerMerritt) January 28, 2026

In mid-January, CEO Elon Musk announced that the company would transition away from giving the option to purchase the Full Self-Driving suite outright, opting for the subscription program exclusively.

Musk said on X:

“Tesla will stop selling FSD after Feb 14. FSD will only be available as a monthly subscription thereafter.”

The move intends to streamline the Full Self-Driving purchase option, and gives Tesla more control over its revenue, and closes off the ability to buy it outright for a bargain when Musk has said its value could be close to $100,000 when it reaches full autonomy.

It also caters to Musk’s newest compensation package. One tranche requires Tesla to achieve 10 million active FSD subscriptions, and now that it has reached one million, it is already seeing some growth.

The strategy that Tesla will use to achieve this lofty goal is still under wraps. The most ideal solution would be to offer a less expensive version of the suite, which is not likely considering the company is increasing its capabilities, and it is becoming more robust.

Tesla is shifting FSD to a subscription-only model, confirms Elon Musk

Currently, Tesla’s FSD subscription price is $99 per month, but Musk said this price will increase, which seems counterintuitive to its goal of increasing the take rate. With that being said, it will be interesting to see what Tesla does to navigate growth while offering a robust FSD suite.