News

Panasonic deepens ties with Tesla and bets big on Auto Tech

The following post was originally published on EVANNEX

As the inevitability of a major disruption in the auto industry becomes clearer, we’ve been reading (and writing) a lot about the companies that seem likely to lose out – Big Oil, incumbent automakers, some parts suppliers. But who will be the winners? Battery-makers obviously, but also providers of “auto tech.” This term includes the electronics that make electric powertrains go – motor controllers, inverters, chargers and the like – as well as self-driving hardware and software, and customer-facing components such as touchscreens, head-up displays and infotainment systems.

Tech companies are infiltrating the automotive space, making acquisitions and alliances to position themselves for profits under the new order. Last year, GM paid a billion bucks for Cruise Automation and invested half a billion in Lyft. Intel is putting its recent acquisition, Mobileye, to work in a partnership with BMW to build self-driving vehicles. Google is working with Fiat Chrysler on self-driving cars and providing display systems for Volvo. Israeli startup Otonomo is competing with Google and Apple to sell user data to Daimler and other automakers.

No company is better placed to thrive in the electric, automated future than Panasonic, which is steadily redirecting its focus from consumer electronics to auto tech. In February, Panasonic named Tom Gebhardt Chairman and CEO of its North American operations. Gebhardt’s former post was leading the company’s Automotive Systems subsidiary.

“Our business has evolved… from purely a consumer business to a B2B business,” Gebhardt recently told Business Insider. “There’s a number of reasons for that: The commoditization of consumer products [and] the unfavorability in some of the cost models led us to look for better values in in-vehicle technologies.”

Gebhardt said Panasonic is devoting more resources to digital cockpits and vehicle entertainment systems as self-driving vehicles get closer to reality. “If the scenario says the car drives itself, it’s similar to sitting in an airplane seat, because you’re no longer actively driving,” he said. “We see that as an evolution of the space that has infinite possibilities for us.”

Panasonic offered several glimpses of those possibilities at CES in January. Fiat Chrysler’s semi-autonomous Portal concept car featured a Panasonic touchscreen with facial and voice recognition. Panasonic also revealed a new system with a head-up display and augmented reality that’s designed to replace the traditional instrument cluster and many of the car’s physical controls. Some speculated that it was a preview of Model 3’s user interface. A few days later, Panasonic CEO Kazuhiro Tsuga said in an interview, “We are deeply interested in Tesla’s self-driving system. We are hoping to expand our collaboration by jointly developing devices for that, such as sensors.”

Meanwhile, Panasonic’s collaboration with Tesla on batteries gives it a large stake in the potential profits as electrification gathers momentum. Panasonic is one of the largest battery manufacturers in the world, and it plans to invest $1.6 billion in Tesla’s Gigafactory. And looking back, in 2007 Panasonic began working with Tesla on the Roadster and has established a strong track record supporting Tesla over the past decade — even investing $30 million with Tesla at a critical juncture (in 2010) in order to develop lithium-ion battery cells for its forthcoming Model S sedan.

A lot has changed since those early days. Nevertheless, global electric vehicle sales are still hovering around 1% of the market. That said, there are many reasons to expect a breakout soon. Orders for Tesla’s upcoming Model 3 keep growing, and legacy automakers from VW to BMW to Ford are responding with plans for new electric models.

“The future is definitely electric, no question in my mind,” Gebhardt said. “What is the future timeline? Is it 10 years, 15 years, 40 years? It’s just a matter of what the adoption hits at the scale that makes this a slam dunk… We’re pretty bullish on the fact that this is a space that will continue to grow and there’s value there.”

Gebhardt conceded that EV adoption is slow in the US, a trend that may continue now that the federal government has shifted from supporting electrification to trying to revive the elderly fossil fuel industries. However, he characterizes this as “a short-term problem,” and points out that it’s a very different scene in China, the world’s largest car market. “If they adopt in a big way, that changes the balance of where electric is today versus where it will be going.”

Panasonic’s increasing investment in auto tech is already paying off, according to Nikkei Asian Review. At a recent financial briefing, President Kazuhiro Tsuga said the company is expecting an increase in net profit in fiscal year 2017, its first gain in two years, largely because of strong growth in EV batteries and other auto tech-related products. “We are confident we can achieve increases both in sales and profit for the year through March 2018 and later years,” he said.

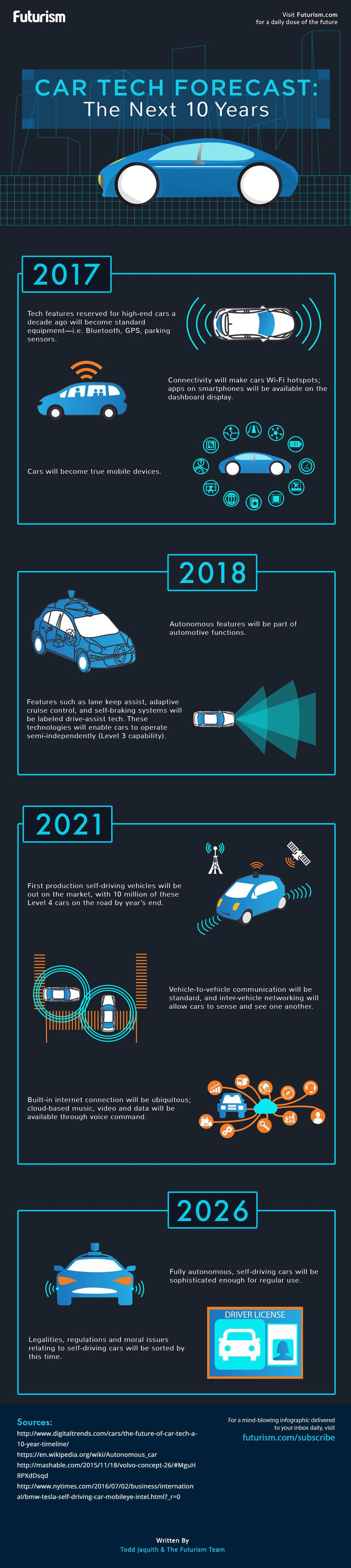

Infographic

What auto tech opportunities are coming in the next decade? Check out this infographic for a few possibilities…

Sources: Business Insider, Nikkei Asian Review / Infographic: Futurism

Elon Musk

Tesla Megapack powers $1.1B AI data center project in Brazil

By integrating Tesla’s Megapack systems, the facility will function not only as a major power consumer but also as a grid-supporting asset.

Tesla’s Megapack battery systems will be deployed as part of a 400MW AI data center campus in Uberlândia, Brazil. The initiative is described as one of Latin America’s largest AI infrastructure projects.

The project is being led by RT-One, which confirmed that the facility will integrate Tesla Megapack battery energy storage systems (BESS) as part of a broader industrial alliance that includes Hitachi Energy, Siemens, ABB, HIMOINSA, and Schneider Electric. The project is backed by more than R$6 billion (approximately $1.1 billion) in private capital.

According to RT-One, the data center is designed to operate on 100% renewable energy while also reinforcing regional grid stability.

“Brazil generates abundant energy, particularly from renewable sources such as solar and wind. However, high renewable penetration can create grid stability challenges,” RT-One President Fernando Palamone noted in a post on LinkedIn. “Managing this imbalance is one of the country’s growing infrastructure priorities.”

By integrating Tesla’s Megapack systems, the facility will function not only as a major power consumer but also as a grid-supporting asset.

“The facility will be capable of absorbing excess electricity when supply is high and providing stabilization services when the grid requires additional support. This approach enhances resilience, improves reliability, and contributes to a more efficient use of renewable generation,” Palamone added.

The model mirrors approaches used in energy-intensive regions such as California and Texas, where large battery systems help manage fluctuations tied to renewable energy generation.

The RT-One President recently visited Tesla’s Megafactory in Lathrop, California, where Megapacks are produced, as part of establishing the partnership. He thanked the Tesla team, including Marcel Dall Pai, Nicholas Reale, and Sean Jones, for supporting the collaboration in his LinkedIn post.

Elon Musk

Starlink powers Europe’s first satellite-to-phone service with O2 partnership

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools.

Starlink is now powering Europe’s first commercial satellite-to-smartphone service, as Virgin Media O2 launches a space-based mobile data offering across the UK.

The new O2 Satellite service uses Starlink’s low-Earth orbit network to connect regular smartphones in areas without terrestrial coverage, expanding O2’s reach from 89% to 95% of Britain’s landmass.

Under the rollout, compatible Samsung devices automatically connect to Starlink satellites when users move beyond traditional mobile coverage, according to Reuters.

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools. O2 is pricing the add-on at £3 per month.

By leveraging Starlink’s satellite infrastructure, O2 can deliver connectivity in remote and rural regions without building additional ground towers. The move represents another step in Starlink’s push beyond fixed broadband and into direct-to-device mobile services.

Virgin Media O2 chief executive Lutz Schuler shared his thoughts about the Starlink partnership. “By launching O2 Satellite, we’ve become the first operator in Europe to launch a space-based mobile data service that, overnight, has brought new mobile coverage to an area around two-thirds the size of Wales for the first time,” he said.

Satellite-based mobile connectivity is gaining traction globally. In the U.S., T-Mobile has launched a similar satellite-to-cell offering. Meanwhile, Vodafone has conducted satellite video call tests through its partnership with AST SpaceMobile last year.

For Starlink, the O2 agreement highlights how its network is increasingly being integrated into national telecom systems, enabling standard smartphones to connect directly to satellites without specialized hardware.

Elon Musk

Elon Musk’s Starbase, TX included in $84.6 million coastal funding round

The funds mark another step in the state’s ongoing beach restoration and resilience efforts along the Gulf Coast.

Elon Musk’s Starbase, Texas has been included in an $84.6 million coastal funding round announced by the Texas General Land Office (GLO). The funds mark another step in the state’s ongoing beach restoration and resilience efforts along the Gulf Coast.

Texas Land Commissioner Dawn Buckingham confirmed that 14 coastal counties will receive funding through the Coastal Management Program (CMP) Grant Cycle 31 and Coastal Erosion Planning and Response Act (CEPRA) program Cycle 14. Among the Brownsville-area recipients listed was the City of Starbase, which is home to SpaceX’s Starship factory.

“As someone who spent more than a decade living on the Texas coast, ensuring our communities, wildlife, and their habitats are safe and thriving is of utmost importance. I am honored to bring this much-needed funding to our coastal communities for these beneficial projects,” Commissioner Buckingham said in a press release.

“By dedicating this crucial assistance to these impactful projects, the GLO is ensuring our Texas coast will continue to thrive and remain resilient for generations to come.”

The official Starbase account acknowledged the support in a post on X, writing: “Coastal resilience takes teamwork. We appreciate @TXGLO and Commissioner Dawn Buckingham for their continued support of beach restoration projects in Starbase.”

The funding will support a range of coastal initiatives, including beach nourishment, dune restoration, shoreline stabilization, habitat restoration, and water quality improvements.

CMP projects are backed by funding from the National Oceanic and Atmospheric Administration and the Gulf of Mexico Energy Security Act, alongside local partner matches. CEPRA projects focus specifically on reducing coastal erosion and are funded through allocations from the Texas Legislature, the Texas Hotel Occupancy Tax, and GOMESA.

Checks were presented in Corpus Christi and Brownsville to counties, municipalities, universities, and conservation groups. In addition to Starbase, Brownsville-area recipients included Cameron County, the City of South Padre Island, Willacy County, and the Willacy County Navigation District.