News

Engineers use the heart’s energy to self-charge a bio-implant device

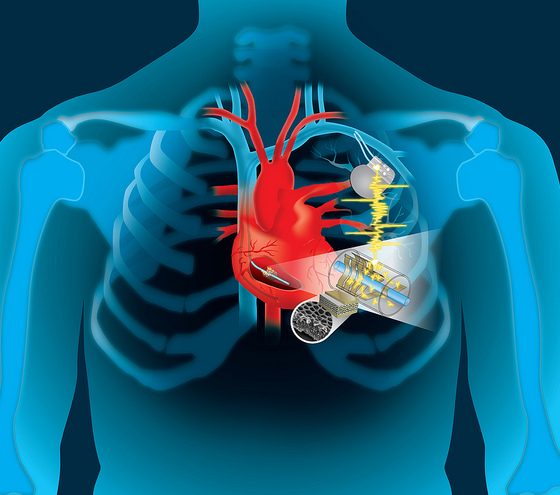

Engineers from Dartmouth College have created a dime-sized device that could allow implanted biomedical devices to be charged indefinitely using the natural kinetic (motion) energy of the heart. In a study conducted over the last three years and published in the journal Advanced Materials Technologies in January this year, an implant with piezoelectric materials was combined with a pacemaker to convert heartbeats into electricity. Considering the 5-10 year replacement requirement for the average battery-powered implantable biomedical device, this invention could soon mean a significant reduction in invasive and risky surgeries.

Piezoelectricity is mechanical stress converted into electricity. Pressure, sound waves, and other vibrations coming into contact with piezoelectric materials cause the materials’ atoms to shift, creating positive and negative charges. In the Dartmouth invention, moving heart tissue squeezes a flexible container with piezoelectric material inside, creating charges which are sent through the pacemaker’s lead wire back to its battery. This continuous charging cycle, in theory, would enable any biomedical implant where motion was a component of the device’s location to last for the lifetime of a patient.

The project’s engineers have two more years of National Institutes of Health (NIH) funding to complete a pre-clinical and regulatory approval process, and a commercially available version is expected to be about five years away. The potential for the device has already been recognized by significant players in the biotech industry. Andrew Closson, one of the study’s authors, explained in a news article about the device, “There is already a lot of expressed interest from the major medical technology companies…[and we are]…moving forward with the entrepreneurial phase of this effort.”

The idea of harvesting heart energy is not a new one. A team of researchers from the University of Illinois demonstrated a proof-of-concept in 2014 using a flexible, piezoelectric patch on anesthetized sheep. After stitching multiple patches in an optimal orientation on the sheep’s heart, the voltage produced was found to be sufficient to power a standard pacemaker. Other devices that could be powered by this type of technology include cochlear implants and implantable defibrillators.

Implantable electronic medical devices are frequently seeing improvements in the field of biotechnology and thus directly relevant to the Dartmouth engineers’ invention. In November of last year, a study was published demonstrating the effectiveness of a spinal implant used to amplify brain signals. After epidural electrical stimulation was delivered to the spinal cords of three paralyzed participants, all were able to regain motion in their lower limbs. Piezoelectric functionality in a device like this one would be a natural inclusion.

News

Tesla lands massive deal to expand charging for heavy-duty electric trucks

Tesla has landed a massive deal to expand its charging infrastructure for heavy-duty electric trucks — and not just theirs, but all manufacturers.

Tesla entered an agreement with Pilot Travel Centers, the largest operator of travel centers in the United States. Tesla’s Semi Chargers, which are used to charge Class 8 electric trucks, will be responsible for providing energy to various vehicles from a variety of manufacturers.

The first sites are expected to open later this Summer, and will be built at select locations along I-5 and I-10, major routes for commercial vehicles and significant logistics companies. The chargers will be available in California, Georgia, Nevada, New Mexico, and Texas.

Each station will have between four and eight chargers, delivering up to 1.2 megawatts of power at each stall.

The project is the latest in Tesla’s plans to expand Semi Charging availability. The effort is being put forth to create more opportunities for the development of sustainable logistics.

Senior Vice President of Alternative Fuels at Pilot, Shannon Sturgil, said:

“Helping to shape the future of energy is a strategic pillar in meeting the needs of our guests and the North American transportation industry. Heavy-duty charging is yet another extension of our exploration into alternative fuel offerings, and we’re happy to partner with a leader in the space that provides turnkey solutions and deploys them quickly.”

Tesla currently has 46 public Semi Charger sites in progress or planned across the United States, mostly positioned along major trucking routes and industrial areas. Perhaps the biggest bottleneck with owning an EV early on was charging availability, and that is no different with electric Class 8 trucks. They simply need an area to charge.

Tesla is spearheading the effort to expand Semicharging availability, and the latest partnership with Pilot shows the company has allies in the program.

The company plans to build 50,000 units of the Tesla Semi in the coming years, and with early adopters like PepsiCo, DHL, and others already contributing millions of miles of data, fleets are going to need reliable public charging.

🚨 Pilot working with Tesla to install and expand Semi Chargers is a perfect example of two industry leaders working together for the greater good.

As more commerce companies expand into EVs, Semi Charger will be more commonly available for electrified fleets, making efforts… pic.twitter.com/VPLIYyq15b

— TESLARATI (@Teslarati) January 27, 2026

Tesla is partnering with other companies for the development of the Semi program, most notably, a conglomeration with Uber was announced last year.

Tesla lands new partnership with Uber as Semi takes center stage

The ride-sharing platform plans to launch the Dedicated EV Fleet Accelerator Program, which it calls a “first-of-its-kind buyer’s program designed to make electric freight more affordable and accessible by addressing key adoption barriers.”

The Semi is one of several projects that will take Tesla into a completely different realm. Along with Optimus and its growing Energy division, the Semi will expand Tesla to new heights, and its prioritization of charging infrastructure.

Elon Musk

Elon Musk’s Boring Company opens Vegas Loop’s newest station

The Fontainebleau is the latest resort on the Las Vegas Strip to embrace the tunneling startup’s underground transportation system.

Elon Musk’s tunneling startup, The Boring Company, has welcomed its newest Vegas Loop station at the Fontainebleau Las Vegas.

The Fontainebleau is the latest resort on the Las Vegas Strip to embrace the tunneling startup’s underground transportation system.

Fontainebleau Loop station

The new Vegas Loop station is located on level V-1 of the Fontainebleau’s south valet area, as noted in a report from the Las Vegas Review-Journal. According to the resort, guests will be able to travel free of charge to the stations serving the Las Vegas Convention Center, as well as to Loop stations in Encore and Westgate.

The Fontainebleau station connects to the Riviera Station, which is located in the northwest parking lot of the convention center’s West Hall. From there, passengers will be able to access the greater Vegas Loop.

Vegas Loop expansion

In December, The Boring Company began offering Vegas Loop rides to and from Harry Reid International Airport. Those trips include a limited above-ground segment, following approval from the Nevada Transportation Authority to allow surface street travel tied to Loop operations.

Under the approval, airport rides are limited to no more than four miles of surface street travel, and each trip must include a tunnel segment. The Vegas Loop currently includes more than 10 miles of tunnels. From this number, about four miles of tunnels are operational.

The Boring Company President Steve Davis previously told the Review-Journal that the University Center Loop segment, which is currently under construction, is expected to open in the first quarter of 2026. That extension would allow Loop vehicles to travel beneath Paradise Road between the convention center and the airport, with a planned station located just north of Tropicana Avenue.

News

Tesla leases new 108k-sq ft R&D facility near Fremont Factory

The lease adds to Tesla’s presence near its primary California manufacturing hub as the company continues investing in autonomy and artificial intelligence.

Tesla has expanded its footprint near its Fremont Factory by leasing a 108,000-square-foot R&D facility in the East Bay.

The lease adds to Tesla’s presence near its primary California manufacturing hub as the company continues investing in autonomy and artificial intelligence.

A new Fremont lease

Tesla will occupy the entire building at 45401 Research Ave. in Fremont, as per real estate services firm Colliers. The transaction stands as the second-largest R&D lease of the fourth quarter, trailing only a roughly 115,000-square-foot transaction by Figure AI in San Jose.

As noted in a Silicon Valley Business Journal report, Tesla’s new Fremont lease was completed with landlord Lincoln Property Co., which owns the facility. Colliers stated that Tesla’s Fremont expansion reflects continued demand from established technology companies that are seeking space for engineering, testing, and specialized manufacturing.

Tesla has not disclosed which of its business units will be occupying the building, though Colliers has described the property as suitable for office and R&D functions. Tesla has not issued a comment about its new Fremont lease as of writing.

AI investments

Silicon Valley remains a key region for automakers as vehicles increasingly rely on software, artificial intelligence, and advanced electronics. Erin Keating, senior director of economics and industry insights at Cox Automotive, has stated that Tesla is among the most aggressive auto companies when it comes to software-driven vehicle development.

Other automakers have also expanded their presence in the area. Rivian operates an autonomy and core technology hub in Palo Alto, while GM maintains an AI center of excellence in Mountain View. Toyota is also relocating its software and autonomy unit to a newly upgraded property in Santa Clara.

Despite these expansions, Colliers has noted that Silicon Valley posted nearly 444,000 square feet of net occupancy losses in Q4 2025, pushing overall vacancy to 11.2%.