News

Biden’s $3bn EV battery manufacturing allocation is only half the battle: mining expert

Mining expert Trent Mell, CEO of Electra Battery Materials, is pleased about the Biden Administration’s allocation of $3.1 billion to promote the domestic manufacturing of electric vehicle batteries in the United States. However, Mell says the manufacturing is only half the battle, as more focus will be needed on the upstream activities of the EV battery manufacturing supply chain.

Yesterday, we reported the Biden Administration had officially announced it would launch a $3.16 billion plan to boost U.S.-based manufacturing of electric vehicle batteries. The funding will support grants to build and develop battery and battery component manufacturing facilities within the United States.

Biden Administration announces $3bn plan for U.S.-based EV battery manufacturing

The move is a small part of a much larger shift to electric vehicles, a plan that the U.S. has put in place to catch up with leaders China and Europe, who have adopted EVs at a much larger rate than Americans have. The U.S. government has set aside external goals of having 50 percent of all passenger sales be electric by 2030. Additionally, the U.S. government wants 600,000 cars and trucks within the federal fleet to be EVs by 2035.

Mell, who has pushed for domestic manufacturing of batteries and mining practices in North America, has positive thoughts regarding the new $3.14 billion Biden plan to push for more battery production in the U.S. A nudge to the largest battery manufacturers globally to invest with plants in the United States is undoubtedly a good thing, but Mell has concerns about sourcing materials and whether more facilities means more mining.

“It appears that this $3.1 billion in funding for cell plants will largely end up in the hands of some of the largest companies already operating in the EV supply chain,” Mell told Teslarati. “If my assessment is correct, the opportunity here is to convince the large, established battery makers to invest in America over other western economies. “

It is true that many of the largest battery manufacturers in the world have been scouting land in the United States, Canada, and other North American territories for potential cell production projects. CATL, the world’s largest supplier of lithium-ion battery cells, has been scouting sites for a new $5 billion manufacturing plant in the region to supplement the growing EV transition and its need for EV batteries. Building the cells is not an issue, but sourcing materials for them is.

This is where Mell’s concerns begin to rise. As battery manufacturing plants are great, there needs to be a bigger focus on upstream and midstream activities that would supplement the entire supply chain’s ability to remain consistent. “What western economies really need are new investments in upstream activities (mining) and in the midstream (chemical plants),” Mell told us in an emailed statement. “This part of the supply chain is more capital constrained and the investment cycle is a much longer one. If we don’t invest further up the supply chain, all of these battery plants will face a shortage of raw materials.”

Mell pushed for automotive CEOs, like Tesla’s Elon Musk and Ford’s Jim Farley, to pressure more EV battery material sourcing within the U.S. to reduce dependence on foreign sources. After nickel prices rose from $30,000 to $100,000 per metric ton, President Biden invoked the Defense Production Act to surge domestic production of EV materials. However, more long-tail investments need to be pushed on mining and obtaining these materials domestically, which could affect the production of EV batteries down the road.

I’d love to hear from you! f you have any comments, concerns, or questions, please email me at joey@teslarati.com. You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Elon Musk

Tesla Megapack powers $1.1B AI data center project in Brazil

By integrating Tesla’s Megapack systems, the facility will function not only as a major power consumer but also as a grid-supporting asset.

Tesla’s Megapack battery systems will be deployed as part of a 400MW AI data center campus in Uberlândia, Brazil. The initiative is described as one of Latin America’s largest AI infrastructure projects.

The project is being led by RT-One, which confirmed that the facility will integrate Tesla Megapack battery energy storage systems (BESS) as part of a broader industrial alliance that includes Hitachi Energy, Siemens, ABB, HIMOINSA, and Schneider Electric. The project is backed by more than R$6 billion (approximately $1.1 billion) in private capital.

According to RT-One, the data center is designed to operate on 100% renewable energy while also reinforcing regional grid stability.

“Brazil generates abundant energy, particularly from renewable sources such as solar and wind. However, high renewable penetration can create grid stability challenges,” RT-One President Fernando Palamone noted in a post on LinkedIn. “Managing this imbalance is one of the country’s growing infrastructure priorities.”

By integrating Tesla’s Megapack systems, the facility will function not only as a major power consumer but also as a grid-supporting asset.

“The facility will be capable of absorbing excess electricity when supply is high and providing stabilization services when the grid requires additional support. This approach enhances resilience, improves reliability, and contributes to a more efficient use of renewable generation,” Palamone added.

The model mirrors approaches used in energy-intensive regions such as California and Texas, where large battery systems help manage fluctuations tied to renewable energy generation.

The RT-One President recently visited Tesla’s Megafactory in Lathrop, California, where Megapacks are produced, as part of establishing the partnership. He thanked the Tesla team, including Marcel Dall Pai, Nicholas Reale, and Sean Jones, for supporting the collaboration in his LinkedIn post.

Elon Musk

Starlink powers Europe’s first satellite-to-phone service with O2 partnership

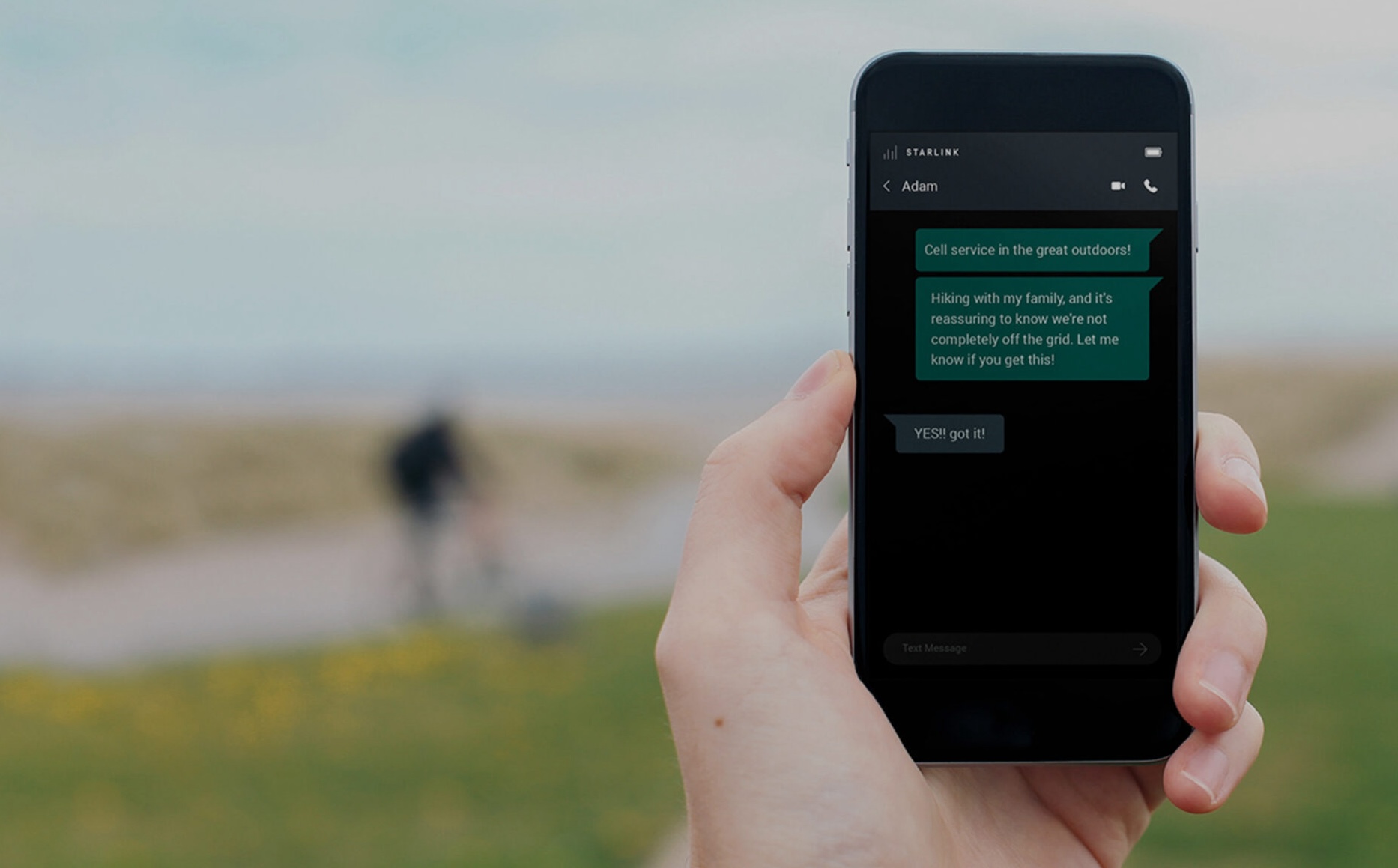

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools.

Starlink is now powering Europe’s first commercial satellite-to-smartphone service, as Virgin Media O2 launches a space-based mobile data offering across the UK.

The new O2 Satellite service uses Starlink’s low-Earth orbit network to connect regular smartphones in areas without terrestrial coverage, expanding O2’s reach from 89% to 95% of Britain’s landmass.

Under the rollout, compatible Samsung devices automatically connect to Starlink satellites when users move beyond traditional mobile coverage, according to Reuters.

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools. O2 is pricing the add-on at £3 per month.

By leveraging Starlink’s satellite infrastructure, O2 can deliver connectivity in remote and rural regions without building additional ground towers. The move represents another step in Starlink’s push beyond fixed broadband and into direct-to-device mobile services.

Virgin Media O2 chief executive Lutz Schuler shared his thoughts about the Starlink partnership. “By launching O2 Satellite, we’ve become the first operator in Europe to launch a space-based mobile data service that, overnight, has brought new mobile coverage to an area around two-thirds the size of Wales for the first time,” he said.

Satellite-based mobile connectivity is gaining traction globally. In the U.S., T-Mobile has launched a similar satellite-to-cell offering. Meanwhile, Vodafone has conducted satellite video call tests through its partnership with AST SpaceMobile last year.

For Starlink, the O2 agreement highlights how its network is increasingly being integrated into national telecom systems, enabling standard smartphones to connect directly to satellites without specialized hardware.

Elon Musk

Elon Musk’s Starbase, TX included in $84.6 million coastal funding round

The funds mark another step in the state’s ongoing beach restoration and resilience efforts along the Gulf Coast.

Elon Musk’s Starbase, Texas has been included in an $84.6 million coastal funding round announced by the Texas General Land Office (GLO). The funds mark another step in the state’s ongoing beach restoration and resilience efforts along the Gulf Coast.

Texas Land Commissioner Dawn Buckingham confirmed that 14 coastal counties will receive funding through the Coastal Management Program (CMP) Grant Cycle 31 and Coastal Erosion Planning and Response Act (CEPRA) program Cycle 14. Among the Brownsville-area recipients listed was the City of Starbase, which is home to SpaceX’s Starship factory.

“As someone who spent more than a decade living on the Texas coast, ensuring our communities, wildlife, and their habitats are safe and thriving is of utmost importance. I am honored to bring this much-needed funding to our coastal communities for these beneficial projects,” Commissioner Buckingham said in a press release.

“By dedicating this crucial assistance to these impactful projects, the GLO is ensuring our Texas coast will continue to thrive and remain resilient for generations to come.”

The official Starbase account acknowledged the support in a post on X, writing: “Coastal resilience takes teamwork. We appreciate @TXGLO and Commissioner Dawn Buckingham for their continued support of beach restoration projects in Starbase.”

The funding will support a range of coastal initiatives, including beach nourishment, dune restoration, shoreline stabilization, habitat restoration, and water quality improvements.

CMP projects are backed by funding from the National Oceanic and Atmospheric Administration and the Gulf of Mexico Energy Security Act, alongside local partner matches. CEPRA projects focus specifically on reducing coastal erosion and are funded through allocations from the Texas Legislature, the Texas Hotel Occupancy Tax, and GOMESA.

Checks were presented in Corpus Christi and Brownsville to counties, municipalities, universities, and conservation groups. In addition to Starbase, Brownsville-area recipients included Cameron County, the City of South Padre Island, Willacy County, and the Willacy County Navigation District.