News

SpaceX valuation to grow by 27% as Starship, Starlink programs seek more funding

CNBC reports that SpaceX is seeking to raise at least $1.725 billion in its first funding round of 2022, potentially boosting the private company’s valuation as high as $127 billion.

The report signals just the latest in a long line of high-profile rounds of funding SpaceX has secured over the last seven years, gradually boosting its valuation by a factor of more than 100. More likely than not, this round will also be fully subscribed or even oversubscribed as investors scramble over a relatively rare opportunity to snag a small slice of SpaceX – a demand so high that Equidate once stated that SpaceX effectively had access to ‘an unlimited amount of funding’ in 2018.

Four years later, it’s clear that Equidate’s position and forecast were prescient. After a few slow years post-2015, SpaceX’s fundraising activity returned with a vengeance in 2019. From 2019 to 2021, the company privately raised more than $5.2 billion – nearly triple the amount of private funding SpaceX raised from 2002 to 2018. In the likely event that the latest in a long line of highly sought-after and oversubscribed SpaceX investment rounds, SpaceX will have ultimately raised between $8.6 and $9 billion since 2015, averaging about $1.3 billion per year over the last seven years.

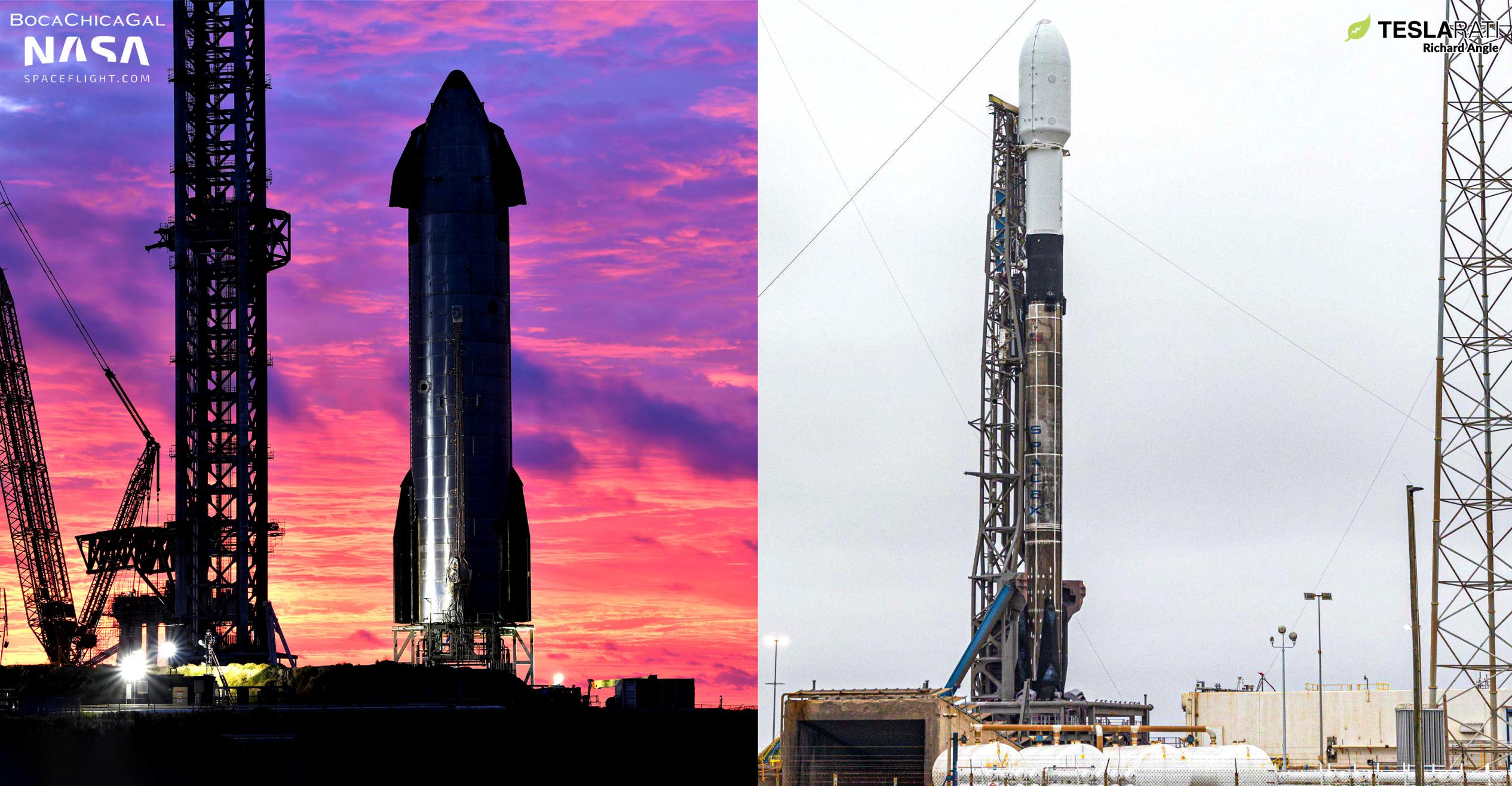

More likely than not, a vast majority of that $9 billion has gone towards Starlink and Starship – both of which are also almost exclusively responsible for the fact that SpaceX’s valuation outmatches its annual revenue by a factor of several dozen. CEO Elon Musk has stated in 2017 and 2018 that SpaceX invested around $1 billion to develop Falcon booster reusability and more than $500 million to develop a triple-booster variant of Falcon 9 known as Falcon Heavy – still the most capable operational rocket in the world four years after its debut. It’s possible that some portion of SpaceX’s fundraising since 2015 has gone towards basic recurring expenses during years with few launches and relatively little revenue.

However, it’s likely that most or all of the remaining $7-7.5 billion – separate from several lucrative contracts awarded by the US military and NASA – has gone towards Starlink and Starship. In the last few years, SpaceX has effectively built a massive factory and launch pad for the largest rocket ever built (Starship) out of empty lots in South Texas. SpaceX has also turned several nondescript buildings near Seattle, Washington into the most productive satellite factory in spaceflight history and is working on additional factories to mass-produce hundreds of thousands to millions of cutting-edge satellite dishes per year to allow millions of people to connect to the internet through Starlink.

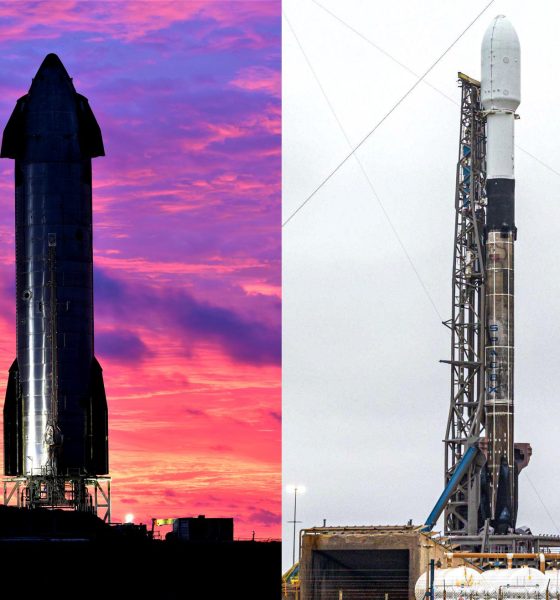

Assuming a rough marginal cost of $500,000 per satellite and $15 million per Falcon 9 launch, SpaceX could have easily spent more than $2 billion just to build and launch the ~2650 Starlink satellites it’s launched to date. Accounting for the annual salaries and overhead needed for the thousands of employees required to build those satellites and conduct more than 50 different Starlink launches, the true cost over several years could be closer to $3-5 billion. Meanwhile, Starbase has rapidly expanded, built vast new infrastructure, mass-produced around two-dozen different Starship tanks and prototypes, completed dozens of tests, built and tested 150-200 Raptor engines, and conducted nine major flight tests.

Up until late 2021, perhaps less than 5-10% of funding for the above activities came directly from US government contracts. While Starlink remains almost entirely privately funded, SpaceX’s Starship program received a major influx of funding and support from NASA through a $3 billion Moon landing contract awarded in April 2021, but protests from two competitors meant that funds from that contract only began reaching SpaceX around the end of the year. Ultimately, it’s not hard to see why SpaceX has needed to raise so much capital in the last three years.

News

Tesla loses Director who designed one of the company’s best features

Thomas Dmytryk, who has spent over 11 years with Tesla and helped to develop Over-the-Air updates and the company’s vehicles’ ability to utilize them to improve, has decided to leave.

Tesla has lost the director who designed one of the company’s best features: Over-the-Air updates.

Thomas Dmytryk, who has spent over 11 years with Tesla and helped to develop Over-the-Air updates and the company’s vehicles’ ability to utilize them to improve, has decided to leave. In a lengthy statement on LinkedIn, Dmytryk said that he’s “closing the book.” He had nothing but good things to say:

“After 11 incredible years at Tesla, I’m closing the book. It’s been the ride of a lifetime: always on the news, innovating relentlessly, constantly pushing the limits. Tesla is THE place for talented, passionate people. I feel insanely lucky to have been part in that culture for so long.”

It appears the intense lifestyle of developing and creating intensively for so long might have caught up to Dmytryk, who did not give his definitive plans for the future, and it appears he may be taking some time off before jumping into a new venture:

“The future? Extremely bright. Ambitions intact, just getting started as a transformative company that could elevate billions of lives. So why leave now?! Human life’s always been my North Star, right now I need to be with mines. I’ve always admired Tesla’s top leadership and vision. But what I’ve always found incredible is the tenacity, brilliance and devotion of people on the front line. YOU make Tesla unstoppable. I wish you all the best and of course EPIC wins.”

The move was first reported by NotaTeslaApp.

Over-the-Air updates are among Tesla’s best features. They are used to improve the Full Self-Driving suite, add features, remedy recalls, and more. Many vehicles have the ability to receive OTA updates, as I did in a Ford Bronco previous to my Model Y. However, Tesla does them better than anyone else: they’re seamless, effective, and frequent. Your car always improves.

The move is a blow to Tesla, of course, considering Dmytryk’s massive contribution to the company and extremely long tenure spent, but not something that is overwhelmingly detrimental. Tesla deals with a lot of extremely intelligent people, some of whom are the best in their field, so they are sure to find a suitable replacement.

However, it’s no secret that the company has been losing some of its top talent, some of whom were in executive roles. Some have left to take on new projects, and others have not revealed their career plans.

It seems at least some of those employees are simply deciding to walk away and try new things after working so hard for so long. According to Dmytryk’s LinkedIn, he also played a large part in Musk’s acquisition of X, as he stated he “worked at Twitter/X ~45/week while working at the same pace for Tesla.”

That averages a 13-hour day, seven days a week, or 18 hours for the normal five-day work week.

News

Tesla’s most wanted Model Y heads to new region with no sign of U.S. entry

Unlike the standard Model Y, the “L” stretches the wheelbase by roughly 150 mm and the overall length by about 177 mm to 4,976 mm. The result is a genuine 2-2-2 seating layout that gives six adults proper legroom and cargo space — a true family hauler without the cramped third-row compromises of many three-row SUVs.

Tesla’s most wanted Model Y configuration is heading to a new region, and although U.S. fans and owners have requested the vehicle since its release last year, it appears the company has no plans to bring it to the market.

According to fresh regulatory filings, the six-seat Model Y L is coming to South Korea with signs indicating an imminent launch. The extended-wheelbase configuration, already a hit in China, just cleared energy-efficiency certification from the Korea Energy Agency, paving the way for deliveries as early as the first half of 2026.

The vehicle is already built at Tesla’s Giga Shanghai facility in China, making it an ideal candidate for the Asian market, as well as the European one, as the factory has been known as a bit of an export hub in the past.

$TSLA

BREAKING: The official launch of Tesla Model Y L in S.Korea seems to be quite imminent.Additional credentials related to Model YL were released today.

✅ Battery Manufacturer: LG Energy Solutions

✅ Number of passengers: 6 people

✅ Total battery capacity: 97.25 kWh… pic.twitter.com/hmy64XYi80— Tsla Chan (@Tslachan) March 6, 2026

It seems like Tesla was prepping for this release anyway, as the timing was no accident. A camouflaged Model Y L prototype was spotted testing on Korean highways the same day the certification dropped. Tesla has already secured similar approvals for Australia and New Zealand, with both markets expecting the larger Model Y in 2026.

Unlike the standard Model Y, the “L” stretches the wheelbase by roughly 150 mm and the overall length by about 177 mm to 4,976 mm. The result is a genuine 2-2-2 seating layout that gives six adults proper legroom and cargo space — a true family hauler without the cramped third-row compromises of many three-row SUVs.

South Korean filings list it as an all-wheel-drive imported electric passenger vehicle with a 97.25 kWh total battery capacity supplied by LG Energy Solution. Local tests show an impressive 543 km (337 miles) combined range at room temperature and 454 km (282 miles) in colder conditions, easing one of the biggest concerns for Korean EV buyers.

Tesla Model Y lineup expansion signals an uncomfortable reality for consumers

But for U.S. fans, things are not looking good for a launch in the market.

CEO Elon Musk has been blunt. The six-seater “wouldn’t arrive in the U.S. until late 2026, if ever,” he said, pointing to the company’s heavy bet on unsupervised Full Self-Driving and robotaxi platforms like the Cybercab. With the Model X slated for discontinuation, many families hoped the stretched Model Y would slide into the lineup as an affordable three-row bridge. So far, that hope remains unfulfilled.

For now, South Korean drivers will be among the first buyers outside China to enjoy the spacious, efficient Model Y L. Tesla continues its global rollout strategy, tailoring vehicles to regional tastes while North American customers keep refreshing their apps and crossing their fingers.

The Model Y L proves the appetite for practical, family-sized electric SUVs is stronger than ever. Hopefully, Tesla will listen to its fans and bring the vehicle to the U.S. where it would likely sell well.

Elon Musk

Tesla is ramping up its advertising strategy on social media

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

Tesla seems to be ramping up its advertising strategy on social media once again. Marketing and advertising have not been a major focus of Tesla’s, something that has brought some criticism to the company from its fans.

However, the company looks to be making adjustments to that narrative, as it has at times in the past, as ads were spotted on several different platforms over the past few days.

On Facebook and YouTube, ads were spotted that were evidently placed by Tesla. On Facebook, Tesla was advertising Full Self-Driving, and on YouTube, an ad for its Energy Division was spotted:

Tesla also threw up some ads on YouTube for Energy https://t.co/19DGQMjBsA pic.twitter.com/XQRfgaDKxY

— TESLARATI (@Teslarati) March 9, 2026

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

In 2022, Tesla’s U.S. ad spend was roughly $152,000, a rounding error compared to General Motors’ $3.6 billion the following year.

Traditional automakers averaged about $495 per vehicle on ads; Tesla spent $0. CEOElon Musk’s stance was explicit: “Tesla does not advertise or pay for endorsements,” he posted on X in 2019. “Instead, we use that money to make the product great.”

The strategy relied on word-of-mouth from delighted owners, Elon’s massive X following, viral product launches, media frenzy, and customer referrals. A great product, Musk argued, sells itself. It does not need Super Bowl spots or billboards. Resources poured into R&D instead, with Tesla investing nearly $3,000 per car, far more than rivals.

Tesla counters jab at lack of advertising with perfect response

This reluctance wasn’t arrogance; it was philosophy, and Musk made it clear that the money was better spent on the product. Heavy spending on ads was seen as wasteful when innovation and authenticity drove organic demand. Shareholder calls for marketing budgets were ignored.

The current shift, paid Facebook ads promoting Full Self-Driving (Supervised) and YouTube Shorts offering up to $1,000 back on Powerwall batteries, marks a pragmatic evolution.

These targeted campaigns coincide with the end of one-time FSD purchases and a March 31 deadline for FSD transfer eligibility on new vehicles.

This move likely signals Tesla adapting to scale, as well as a more concerted effort to stop misinformation regarding its platform. As EV competition intensifies and the company bets big on robotaxis and energy storage, pure organic buzz may not suffice to hit adoption targets. Selective digital ads allow precise, cost-effective reach without abandoning core principles.

If successful, it could foreshadow measured expansion into marketing, boosting high-margin software and home energy revenue while preserving Tesla’s innovative edge. But, it’s nice to see the strategy return, especially as Tesla has been reluctant to change its mind in the past.