News

SpaceX go for Starlink launch, landing as ULA rocket delays persist

SpaceX is on track for Falcon 9’s latest Starlink launch and landing later today as delays continue to hamper a United Launch Alliance (ULA) rocket meant to lift off more than a month ago.

In fact, an almost identical scenario played out a month ago as SpaceX and ULA coincidentally aligned to attempt two launches less than a day apart. The pad hardware supporting ULA’s Delta IV Heavy NROL-44 mission suffered several delays on August 26th and 27th, followed by a dramatic post-ignition launch abort on August 29th. Throughout, SpaceX effectively had to sit on its hands and wait for permission to launch Falcon 9’s SAOCOM 1B mission. Historically, it’s been safe to assume that a ULA mission – particularly one like NROL-44 – would unilaterally take precedence over a SpaceX launch, forcing the company to wait indefinitely until the range was clear.

Instead, in a major twist, SpaceX received permission to launch – and ultimately did launch – SAOCOM 1B on August 30th with ULA’s Delta IV Heavy and its multibillion-dollar NROL-44 payload still on the launch pad. In essence, one or several stakeholders in the military mission have become confident enough in the reliability of SpaceX’s rockets to no longer perceive a nearby Falcon launch as a major risk. Now, just a month after the development, SpaceX appears to be on track to repeat the feat.

Three days after SAOCOM 1B lifted off from Cape Canaveral Air Force Station (CCAFS) Launch Complex 40 (LC-40), a separate Falcon 9 rocket launched SpaceX’s 12th Starlink mission (Starlink-11) from Kennedy Space Center (KSC) Launch Complex 39A (Pad 39A). Starlink-12 is also scheduled to launch no earlier than (NET) 10:22 am EDT (14:22 UTC), September 28th from Pad 39A, a bit less than six miles (9.5 km) north of the ULA rocket and NROL-44 satellite at LC-37.

SAOCOM 1B was such a surprise because the unique southerly trajectory saw Falcon 9 fly almost directly above LC-37, meaning that an in-flight failure could have very likely showered ULA’s pad, rocket, and payload with debris. LC-40, however, is just a little over two miles (3.5 km) north of LC-37. In other words, a Starlink launch heading northeast from Pad 39A is clearly of little concern to ULA or the NROL-44 launch customer, particularly after SAOCOM 1B was allowed to launch under far riskier conditions.

Instead, the real test of the SAOCOM 1B precedent will come when SpaceX prepares for the mission scheduled after Starlink-12 – the company’s third launch of an upgraded GPS III satellite (SV04) for the US military. As of now, ULA’s next NROL-44 launch attempt is tentatively scheduled around midnight (~04:00 UTC) on September 29th. Shortly thereafter, Falcon 9 is scheduled to launch GPS III SV04 (from LC-40) as early as 9:55 pm EDT (01:55 UTC) that same day.

Given the sheer number of difficulties ULA has had with LC-37 pad systems on this launch attempt, it’s reasonable to assume that NROL-44 will slip beyond September 29th. If that happens, stakeholders will once again have to decide if SpaceX can launch two miles to the north or has to wait for ULA. Either way, tune in tomorrow morning to catch SpaceX’s Starlink-12 launch webcast. Weather at Kennedy Space Center is currently 60% go for launch.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

News

Tesla Full Self-Driving v14.2.2.5 might be the most confusing release ever

With each Full Self-Driving release, I am realistic. I know some things are going to get better, and I know some things will regress slightly. However, these instances of improvements are relatively mild, as are the regressions. Yet, this version has shown me that it contains extremes of both.

Tesla Full Self-Driving v14.2.2.5 hit my car back on Valentine’s Day, February 14, and since I’ve had it, it has become, in my opinion, the most confusing release I’ve ever had.

With each Full Self-Driving release, I am realistic. I know some things are going to get better, and I know some things will regress slightly. However, these instances of improvements are relatively mild, as are the regressions. Yet, this version has shown me that it contains extremes of both.

It has been about three weeks of driving on v14.2.2.5; I’ve used it for nearly every mile traveled since it hit my car. I’ve taken short trips of 10 minutes or less, I’ve taken medium trips of an hour or less, and I’ve taken longer trips that are over 100 miles per leg and are over two hours of driving time one way.

These are my thoughts on it thus far:

Speed Profiles Are a Mixed Bag

Speed Profiles are something Tesla seems to tinker with quite frequently, and each version tends to show a drastic difference in how each one behaves compared to the previous version.

I do a vast majority of my FSD travel using Standard and Hurry modes, although in bad weather, I will scale it back to Chill, and when it’s a congested city on a weekend or during rush hour, I’ll throw it into Mad Max so it takes what it needs.

Early on, Speed Profiles really felt great. This is one of those really subjective parts of the FSD where someone might think one mode travels too quickly, whereas another person might see the identical performance as too slow or just right.

To me, I would like to see more consistency from release to release on them, but overall, things are pretty good. There are no real complaints on my end, as I had with previous releases.

In a past release, Mad Max traveled under the speed limit quite frequently, and I only had that experience because Hurry was acting the same way. I’ve had no instances of that with v14.2.2.5.

Strange Turn Signal Behavior

This is the first Full Self-Driving version where I’ve had so many weird things happen with the turn signals.

Two things come to mind: Using a turn signal on a sharp turn, and ignoring the navigation while putting the wrong turn signal on. I’ve encountered both things on v14.2.2.5.

On my way to the Supercharger, I take a road that has one semi-sharp right-hand turn with a driveway entrance right at the beginning of the turn.

Only recently, with the introduction of v14.2.2.5, have I had FSD put on the right turn signal when going around this turn. It’s obviously a minor issue, but it still happens, and it’s not standard practice:

How can we get Full Self-Driving to stop these turn signals?

There’s no need to use one here; the straight path is a driveway, not a public road. The right turn signal here is unnecessary pic.twitter.com/7uLDHnqCfv

— TESLARATI (@Teslarati) February 28, 2026

When sharing this on X, I had Tesla fans (the ones who refuse to acknowledge that the company can make mistakes) tell me that it’s a “valid” behavior that would be taught to anyone who has been “professionally trained” to drive.

Apparently, if you complain about this turn signal, you are also claiming you know more than Tesla engineers…okay.

Nobody in their right mind has ever gone around a sharp turn when driving their car and put on a signal when continuing on the same road. You would put a left turn signal on to indicate you were turning into that driveway if that’s what your intention was.

Like I said, it’s a totally minor issue. However, it’s not really needed, and nor is it normal. If I were in the car with someone who was taking a simple turn on a road they were traveling, and they signaled because the turn was sharp, I’d be scratching my head.

I’ve also had three separate instances of the car completely ignoring the navigation and putting on a signal that is opposite to what the routing says. Really quite strange.

Parking Performance is Still Underwhelming

Parking has been a complaint of mine with FSD for a long time, so much so that it is pretty rare that I allow the vehicle to park itself. More often than not, it is because I want to pick a spot that is relatively isolated.

However, in the times I allow it to pull into a spot, it still does some pretty head-scratching things.

Recently, it tried to back into a spot that was ~60% covered in plowed snow. The snow was piled about six feet high in a Target parking lot.

A few days later, it tried backing into a spot where someone failed the universal litmus test of returning their shopping cart. Both choices were baffling and required me to manually move the car to a different portion of the lot.

I used Autopark on both occasions, and it did a great job of getting into the spot. I notice that the parking performance when I manually choose the spot is much better than when the car does the entire parking process, meaning choosing the spot and parking in it.

It’s Doing Things (For Me) It’s Never Done Before

Two things that FSD has never done before, at least for me, are slow down in School Zones and avoid deer. The first is something I usually take over manually, and the second I surprisingly have not had to deal with yet.

I had my Tesla slow down at a school zone yesterday for the first time, traveling at 20 MPH and not 15 MPH as the sign suggested, but at the speed of other cars in the School Zone. This was impressive and the first time I experienced it.

I would like to see this more consistently, and I think School Zones should be one of those areas where, no matter what, FSD will only travel the speed limit.

Last night, FSD v14.2.2.5 recognized a deer in a roadside field and slowed down for it:

🚨 Cruising home on a rainy, foggy evening and my Tesla on Full Self-Driving begins to slow down suddenly

FSD just wanted Mr. Deer to make it home to his deer family ❤️ pic.twitter.com/cAeqVDgXo5

— TESLARATI (@Teslarati) March 4, 2026

Navigation Still SUCKS

Navigation will be a complaint until Tesla proves it can fix it. For now, it’s just terrible.

It still has not figured out how to leave my neighborhood. I give it the opportunity to prove me wrong each time I leave my house, and it just can’t do it.

It always tries to go out of the primary entrance/exit of the neighborhood when the route needs to take me left, even though that exit is a right turn only. I always leave a voice prompt for Tesla about it.

It still picks incredibly baffling routes for simple navigation. It’s the one thing I still really want Tesla to fix.

Investor's Corner

Tesla gets tip of the hat from major Wall Street firm on self-driving prowess

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet,” BoA wrote.

Tesla received a tip of the hat from major Wall Street firm Bank of America on Wednesday, as it reinitiated coverage on Tesla shares with a bullish stance that comes with a ‘Buy’ rating and a $460 price target.

In a new note that marks a sharp reversal from its neutral position earlier in 2025, the bank declared Tesla’s Full Self-Driving (FSD) technology the “leading consumer autonomy solution.”

Analysts highlighted Tesla’s camera-only architecture, known as Tesla Vision, as a strategic masterstroke. While technically more challenging than the multi-sensor setups favored by rivals, the vision-based approach is dramatically cheaper to produce and maintain.

This cost edge, combined with Tesla’s rapidly expanding real-world data engine, positions the company to scale robotaxis far more profitably than competitors, BofA argues in the new note:

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet.”

The bank now attributes roughly 52% of Tesla’s total valuation to its Robotaxi ambitions. It also flagged meaningful upside from the Optimus humanoid robot program and the fast-growing energy storage business, suggesting the auto segment’s recent headwinds, including expired incentives, are being eclipsed by these higher-margin opportunities.

Tesla’s own data underscores exactly why Wall Street is waking up to FSD’s potential. According to Tesla’s official safety reporting page, the FSD Supervised fleet has now surpassed 8.4 billion cumulative miles driven.

Tesla FSD (Supervised) fleet passes 8.4 billion cumulative miles

That total ballooned from just 6 million miles in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and a staggering 4.25 billion in 2025 alone. In the first 50 days of 2026, owners added another 1 billion miles — averaging more than 20 million miles per day.

This avalanche of real-world, camera-captured footage, much of it on complex city streets, gives Tesla an unmatched training dataset. Every mile feeds its neural networks, accelerating improvement cycles that lidar-dependent rivals simply cannot match at scale.

Tesla owners themselves will tell you the suite gets better with every release, bringing new features and improvements to its self-driving project.

The $460 target implies roughly 15 percent upside from recent trading levels around $400. While regulatory and safety hurdles remain, BofA’s endorsement signals growing institutional conviction that Tesla’s data advantage is not hype; it’s a tangible moat already delivering billions of miles of proof.

News

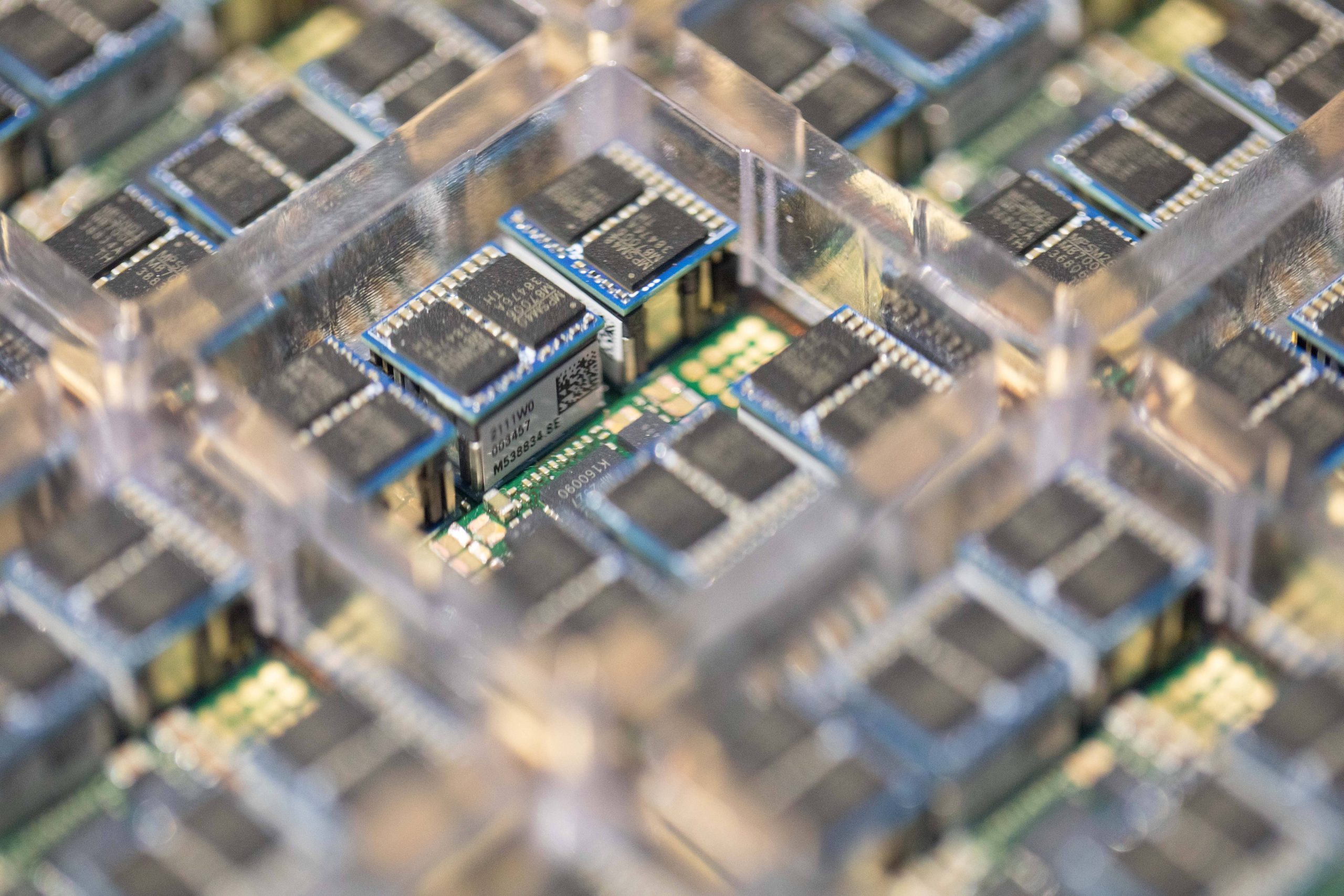

Tesla to discuss expansion of Samsung AI6 production plans: report

Tesla has reportedly requested an additional 24,000 wafers per month, which would bring total production capacity to around 40,000 wafers if finalized.

Tesla is reportedly discussing an expansion of its next-generation AI chip supply deal with Samsung Electronics.

As per a report from Korean industry outlet The Elec, Tesla purchasing executives are reportedly scheduled to meet Samsung officials this week to negotiate additional production volume for the company’s upcoming AI6 chip.

Industry sources cited in the report stated that Tesla is pushing to increase the production volume of its AI6 chip, which will be manufactured using Samsung’s 2-nanometer process.

Tesla previously signed a long-term foundry agreement with Samsung covering AI6 production through December 31, 2033. The deal was reportedly valued at about 22.8 trillion won (roughly $16–17 billion).

Under the existing agreement, Tesla secured approximately 16,000 wafers per month from the facility. The company has reportedly requested an additional 24,000 wafers per month, which would bring total production capacity to around 40,000 wafers if finalized.

Tesla purchasing executives are expected to discuss detailed supply terms during their visit to Samsung this week.

The AI6 chip is expected to support several Tesla technologies. Industry sources stated that the chip could be used for the company’s Full Self-Driving system, the Optimus humanoid robot, and Tesla’s internal AI data centers.

The report also indicated that AI6 clusters could replace the role previously planned for Tesla’s Dojo AI supercomputer. Instead of a single system, multiple AI6 chips would be combined into server-level clusters.

Tesla’s semiconductor collaboration with Samsung dates back several years. Samsung participated in the design of Tesla’s HW3 (AI3) chip and manufactured it using a 14-nanometer process. The HW4 chip currently used in Tesla vehicles was also produced by Samsung using a 5-nanometer node.

Tesla previously planned to split production of its AI5 chip between Samsung and TSMC. However, the company reportedly chose Samsung as the primary partner for the newer AI6 chip.