Elon Musk

SpaceX’s Starship program is already bouncing back from Booster 18 fiasco

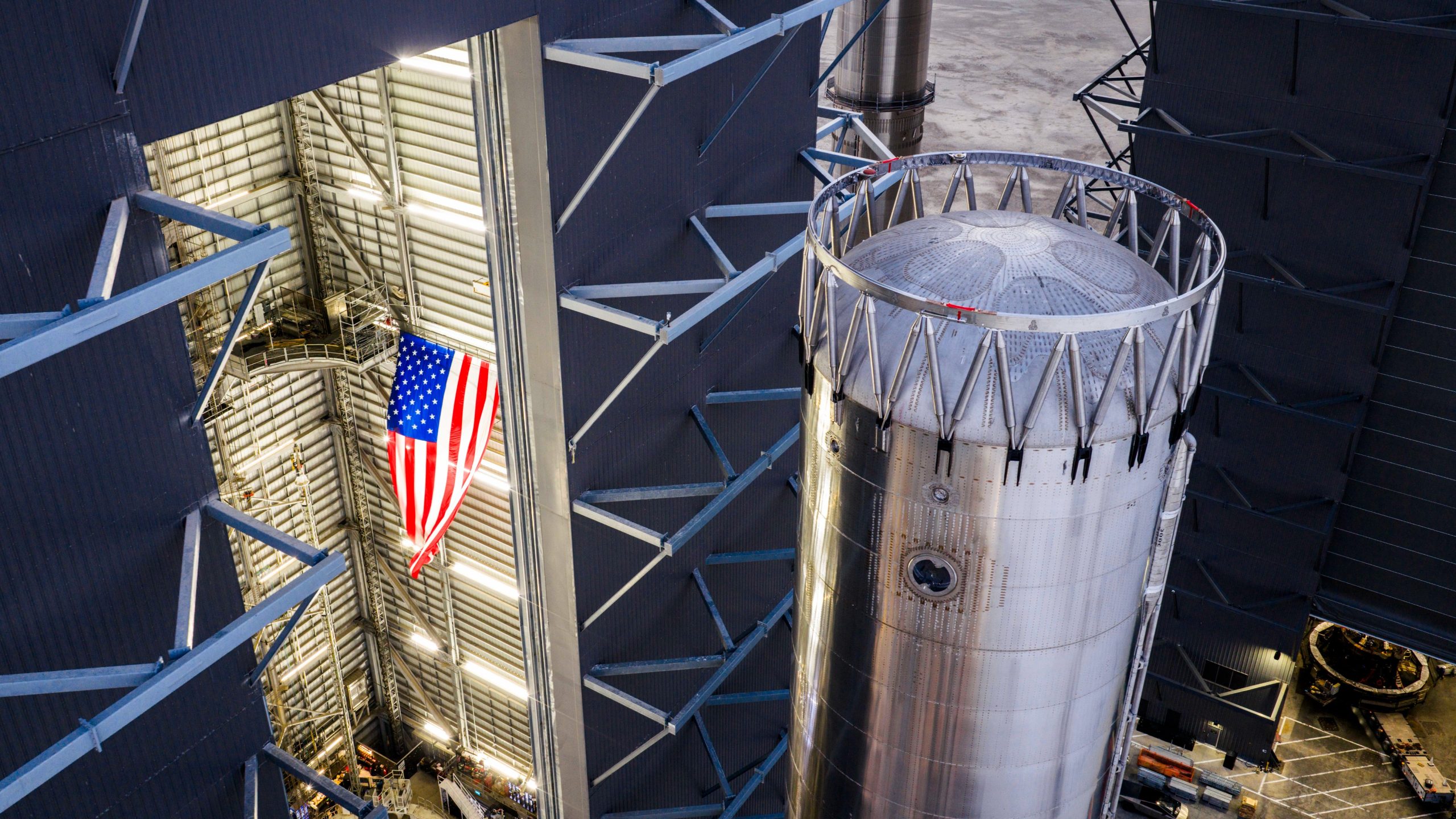

Just over a week since Booster 18 met its untimely end, SpaceX is now busy stacking Booster 19, and at a very rapid pace, too.

SpaceX is already bouncing back from the fiasco that it experienced during Starship Booster 18’s initial tests earlier this month.

Just over a week since Booster 18 met its untimely end, SpaceX is now busy stacking Booster 19, and at a very rapid pace, too.

Starship V3 Booster 19 is rising

As per Starbase watchers on X, SpaceX rolled out the fourth aft section of Booster 19 to Starbase’s MegaBay this weekend, stacking it to reach 15 rings tall with just a few sections remaining. This marks the fastest booster assembly to date at four sections in five days. This is quite impressive, and it bodes well for SpaceX’s Starship V3 program, which is expected to be a notable step up from the V2 program, which was retired after a flawless Flight 11.

Starship watcher TankWatchers noted the tempo on X, stating, “During the night the A4 section of Booster 19 rolled out to the MegaBay. With 4 sections in just 5 days, this is shaping up to be the fastest booster stack ever.” Fellow Starbase watcher TestFlight echoed the same sentiments. “Booster 19 is now 15 rings tall, with 3 aft sections remaining!” the space enthusiast wrote.

Aggressive targets despite Booster 18 fiasco

SpaceX’s V3 program encountered a speed bump earlier this month when Booster 18, just one day after rolling out into the factory, experienced a major anomaly during gas system pressure testing at SpaceX’s Massey facility in Starbase, Texas. While no propellant was loaded, no engines were installed, and no one was injured in the incident, the unexpected end of Booster 18 sparked speculation that the Starship V3 program could face delays.

Despite the Booster 18 fiasco, however, SpaceX announced that “Starship’s twelfth flight test remains targeted for the first quarter of 2026.” Elon Musk shared a similar timeline on X earlier this year, with the CEO stating that “ V3 is a massive upgrade from the current V2 and should be through production and testing by end of year, with heavy flight activity next year.”

Considering that Booster 19 seems to be moving through its production phases quickly, perhaps SpaceX’s Q1 2026 target for Flight 12 might indeed be more than feasible.

Elon Musk

Tesla owners surpass 8 billion miles driven on FSD Supervised

Tesla shared the milestone as adoption of the system accelerates across several markets.

Tesla owners have now driven more than 8 billion miles using Full Self-Driving Supervised, as per a new update from the electric vehicle maker’s official X account.

Tesla shared the milestone as adoption of the system accelerates across several markets.

“Tesla owners have now driven >8 billion miles on FSD Supervised,” the company wrote in its post on X. Tesla also included a graphic showing FSD Supervised’s miles driven before a collision, which far exceeds that of the United States average.

The growth curve of FSD Supervised’s cumulative miles over the past five years has been notable. As noted in data shared by Tesla watcher Sawyer Merritt, annual FSD (Supervised) miles have increased from roughly 6 million in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and 4.25 billion in 2025. In just the first 50 days of 2026, Tesla owners logged another 1 billion miles.

At the current pace, the fleet is trending towards hitting about 10 billion FSD Supervised miles this year. The increase has been driven by Tesla’s growing vehicle fleet, periodic free trials, and expanding Robotaxi operations, among others.

Tesla also recently updated the safety data for FSD Supervised on its website, covering North America across all road types over the latest 12-month period.

As per Tesla’s figures, vehicles operating with FSD Supervised engaged recorded one major collision every 5,300,676 miles. In comparison, Teslas driven manually with Active Safety systems recorded one major collision every 2,175,763 miles, while Teslas driven manually without Active Safety recorded one major collision every 855,132 miles. The U.S. average during the same period was one major collision every 660,164 miles.

During the measured period, Tesla reported 830 total major collisions with FSD (Supervised) engaged, compared to 16,131 collisions for Teslas driven manually with Active Safety and 250 collisions for Teslas driven manually without Active Safety. Total miles logged exceeded 4.39 billion miles for FSD (Supervised) during the same timeframe.

Elon Musk

The Boring Company’s Music City Loop gains unanimous approval

After eight months of negotiations, MNAA board members voted unanimously on Feb. 18 to move forward with the project.

The Metro Nashville Airport Authority (MNAA) has approved a 40-year agreement with Elon Musk’s The Boring Company to build the Music City Loop, a tunnel system linking Nashville International Airport to downtown.

After eight months of negotiations, MNAA board members voted unanimously on Feb. 18 to move forward with the project. Under the terms, The Boring Company will pay the airport authority an annual $300,000 licensing fee for the use of roughly 933,000 square feet of airport property, with a 3% annual increase.

Over 40 years, that totals to approximately $34 million, with two optional five-year extensions that could extend the term to 50 years, as per a report from The Tennesean.

The Boring Company celebrated the Music City Loop’s approval in a post on its official X account. “The Metropolitan Nashville Airport Authority has unanimously (7-0) approved a Music City Loop connection/station. Thanks so much to @Fly_Nashville for the great partnership,” the tunneling startup wrote in its post.

Once operational, the Music City Loop is expected to generate a $5 fee per airport pickup and drop-off, similar to rideshare charges. Airport officials estimate more than $300 million in operational revenue over the agreement’s duration, though this projection is deemed conservative.

“This is a significant benefit to the airport authority because we’re receiving a new way for our passengers to arrive downtown at zero capital investment from us. We don’t have to fund the operations and maintenance of that. TBC, The Boring Co., will do that for us,” MNAA President and CEO Doug Kreulen said.

The project has drawn both backing and criticism. Business leaders cited economic benefits and improved mobility between downtown and the airport. “Hospitality isn’t just an amenity. It’s an economic engine,” Strategic Hospitality’s Max Goldberg said.

Opponents, including state lawmakers, raised questions about environmental impacts, worker safety, and long-term risks. Sen. Heidi Campbell said, “Safety depends on rules applied evenly without exception… You’re not just evaluating a tunnel. You’re evaluating a risk, structural risk, legal risk, reputational risk and financial risk.”

Elon Musk

Tesla announces crazy new Full Self-Driving milestone

The number of miles traveled has contextual significance for two reasons: one being the milestone itself, and another being Tesla’s continuing progress toward 10 billion miles of training data to achieve what CEO Elon Musk says will be the threshold needed to achieve unsupervised self-driving.

Tesla has announced a crazy new Full Self-Driving milestone, as it has officially confirmed drivers have surpassed over 8 billion miles traveled using the Full Self-Driving (Supervised) suite for semi-autonomous travel.

The FSD (Supervised) suite is one of the most robust on the market, and is among the safest from a data perspective available to the public.

On Wednesday, Tesla confirmed in a post on X that it has officially surpassed the 8 billion-mile mark, just a few months after reaching 7 billion cumulative miles, which was announced on December 27, 2025.

Tesla owners have now driven >8 billion miles on FSD Supervisedhttps://t.co/0d66ihRQTa pic.twitter.com/TXz9DqOQ8q

— Tesla (@Tesla) February 18, 2026

The number of miles traveled has contextual significance for two reasons: one being the milestone itself, and another being Tesla’s continuing progress toward 10 billion miles of training data to achieve what CEO Elon Musk says will be the threshold needed to achieve unsupervised self-driving.

The milestone itself is significant, especially considering Tesla has continued to gain valuable data from every mile traveled. However, the pace at which it is gathering these miles is getting faster.

Secondly, in January, Musk said the company would need “roughly 10 billion miles of training data” to achieve safe and unsupervised self-driving. “Reality has a super long tail of complexity,” Musk said.

Training data primarily means the fleet’s accumulated real-world miles that Tesla uses to train and improve its end-to-end AI models. This data captures the “long tail” — extremely rare, complex, or unpredictable situations that simulations alone cannot fully replicate at scale.

This is not the same as the total miles driven on Full Self-Driving, which is the 8 billion miles milestone that is being celebrated here.

The FSD-supervised miles contribute heavily to the training data, but the 10 billion figure is an estimate of the cumulative real-world exposure needed overall to push the system to human-level reliability.