Just as quickly as Elon Musk and Mark Zuckerberg went from casual acquaintances to full-on foes, 2017 is more than halfway over.

Tesla had a lot of lofty goals for the year, and made some big moves like the release of the Model 3, but there are still a few ideas brewing that Musk would like to execute by year’s end.

Anticipated Model 3 Release

Source: Tesla

As mentioned above, the Tesla Model 3 graced the world with its presence this year, and its official unveiling is in two days at a company handover party.

As we previously reported, production is expected to kick into a higher gear and Musk’s processes and logistics will be tested following the official Model 3 event. For investors, this will be the defining moment on whether Musk’s vision for a high volume, affordable electric car is possible.

The delivery event will also feature presentations from Musk on Tesla’s grand vision for a sustainable future.

The Model 3, Musk’s entry into the mass vehicle market, will be $35,000 and have a range of more than 215 miles per charge.

Next Level Semi

Source: Tesla

The Tesla Semi-truck, which Musk touted as “seriously next level,” is due for an unveiling in September.

Semis typically drive millions of miles and are some of the largest polluters in the world. Tesla’s electric truck could take thousands of these off the road, making the air cleaner and quieter, but battery technology and Tesla’s charging network would need to be able to support the extreme long distance travel and weight often associated with this industry.

The semi initiative is being led by former VP of Worldwide Sales and Service Jerome Guillen. Could the recent rumors about a “4416” cell be pointing to a larger battery cell for the upcoming Tesla Semi?

“A lot of people don’t think you can do a heavy duty long-range truck that is electric. But, we are confident that this can be done,” Musk said.

10,000 superchargers globally

Source: Teslarati

Tesla says it plans to have more than 10,000 Superchargers and 15,000 destination chargers in its network by the end of 2017, doubling that of the existing charging network.

“As Tesla prepares for our first mass-market vehicle and continues to increase our Model S and Model X fleet, we’re making charging an even greater priority,” Tesla said back in April. “It is extremely important to us and our mission that charging is convenient, abundant, and reliable for all owners, current and future. In 2017, we’ll be doubling the Tesla charging network, expanding existing sites so drivers never wait to charge, and broadening our charging locations within city centers.”

As of right now, Tesla has 6,118 superchargers and 909 supercharging stations.

Your Car Will Be Able to Drive Others One Day

Source: Tesla

As our own Margaret Gach reported, the Tesla Network has the potential to upset ride-hailing giants Uber and Lyft.

The basic idea of the Tesla Network is for the car to drive itself while you’re busy.

Given that the typical car owner only uses their vehicle during about 5 to 10 percent of the day, having your car make money for the other 90 to 95 percent of the day could be lucrative. While you’re at work, asleep, or even on vacation, your Tesla could be driving around the city, picking up and dropping off passengers without any extra effort on your part.

Musk and company still have some way to go though as a 2017 Deloitte study shows that 74 percent of Americans don’t currently trust self-driving cars.

Though Musk didn’t specifically outline a timeframe for Tesla’s ride-sharing network, rapid developments taking place on the company’s Autopilot program and Full Self-Driving Capabilities would lead us to believe that a major announcement related to the Tesla Network will be coming, as Tesla demonstrates a fully autonomous, California to New York drive by year end.

An Eye Toward The Future

With the Model 3 delivery event being Friday, it will become clear if Tesla was able to knock out another one of its goals for the year. Even if it does, the company still has to execute a few more of its 2017 plans before the ball drops into 2018.

News

Tesla to discuss expansion of Samsung AI6 production plans: report

Tesla has reportedly requested an additional 24,000 wafers per month, which would bring total production capacity to around 40,000 wafers if finalized.

Tesla is reportedly discussing an expansion of its next-generation AI chip supply deal with Samsung Electronics.

As per a report from Korean industry outlet The Elec, Tesla purchasing executives are reportedly scheduled to meet Samsung officials this week to negotiate additional production volume for the company’s upcoming AI6 chip.

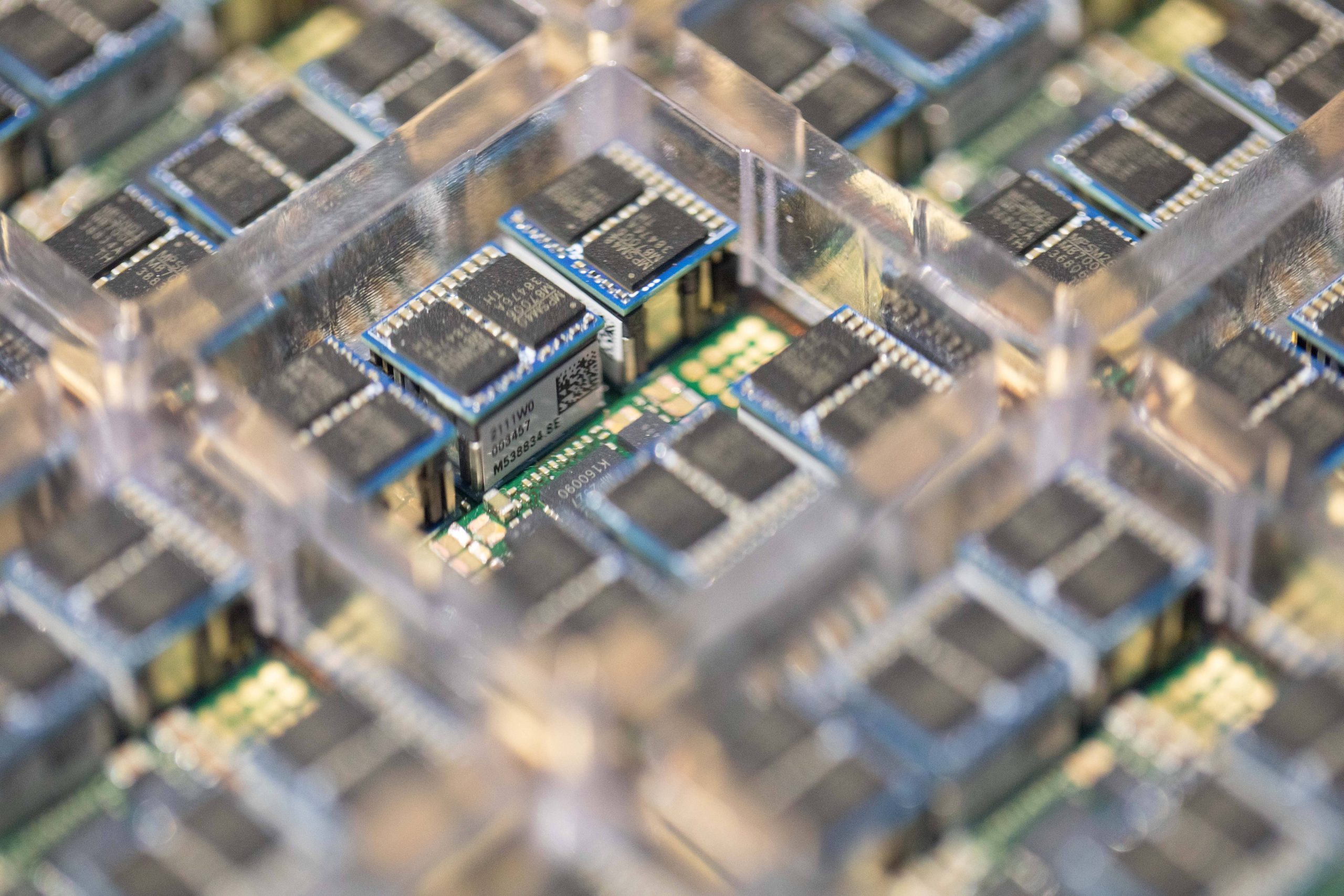

Industry sources cited in the report stated that Tesla is pushing to increase the production volume of its AI6 chip, which will be manufactured using Samsung’s 2-nanometer process.

Tesla previously signed a long-term foundry agreement with Samsung covering AI6 production through December 31, 2033. The deal was reportedly valued at about 22.8 trillion won (roughly $16–17 billion).

Under the existing agreement, Tesla secured approximately 16,000 wafers per month from the facility. The company has reportedly requested an additional 24,000 wafers per month, which would bring total production capacity to around 40,000 wafers if finalized.

Tesla purchasing executives are expected to discuss detailed supply terms during their visit to Samsung this week.

The AI6 chip is expected to support several Tesla technologies. Industry sources stated that the chip could be used for the company’s Full Self-Driving system, the Optimus humanoid robot, and Tesla’s internal AI data centers.

The report also indicated that AI6 clusters could replace the role previously planned for Tesla’s Dojo AI supercomputer. Instead of a single system, multiple AI6 chips would be combined into server-level clusters.

Tesla’s semiconductor collaboration with Samsung dates back several years. Samsung participated in the design of Tesla’s HW3 (AI3) chip and manufactured it using a 14-nanometer process. The HW4 chip currently used in Tesla vehicles was also produced by Samsung using a 5-nanometer node.

Tesla previously planned to split production of its AI5 chip between Samsung and TSMC. However, the company reportedly chose Samsung as the primary partner for the newer AI6 chip.

Elon Musk

Elon Musk: Tesla could be first to build AGI in humanoid form

Musk’s statement was shared in a post on social media platform X.

Elon Musk predicted that Tesla could become one of the developers of Artificial General Intelligence (AGI) in humanoid form. Musk’s statement was shared in a post on social media platform X.

In his post, Musk stated that “Tesla will be one of the companies to make AGI and probably the first to make it in humanoid/atom-shaping form.”

The comment comes as Tesla expands development of its Optimus humanoid robot.

During Tesla’s Q4 earnings report, Elon Musk stated that production of the Model S and Model X would be phased out at its Fremont, California, facility. The vehicles’ production line will then be converted to a pilot line for Optimus. Tesla is looking to produce 1 million units of the humanoid robots annually to start.

Musk has previously stated that Optimus could eventually function as a von Neumann probe. The concept, proposed by mathematician John von Neumann, describes a machine capable of replicating itself using planetary resources and sending those replicas to other worlds.

Optimus would likely only be able to achieve this potential if it manages to achieve Artificial General Intelligence.

Other leaders in the AI sector have also expressed strong expectations about AGI’s potential. Demis Hassabis, CEO of Google DeepMind, recently spoke about the technology at the India AI Impact Summit 2026, as noted in a Benzinga report.

“It’s going to be something like ten times the impact of the Industrial Revolution, but happening at ten times the speed,” Hassabis said.

Elon Musk’s recent comments about Tesla producing a product with AGI could hint at further collaboration among his companies. So far, Tesla is actively pursuing autonomous driving, but it is xAI that is pursuing AGI with its Grok program.

Considering that Elon Musk mentioned a Tesla humanoid product with AGI, it appears that an Optimus robot running xAI’s AI models could become a reality.

xAI had recently merged with SpaceX, though reports suggest that Elon Musk is also considering an even bigger merger for all his companies, including Tesla.

News

Tesla influencers argue company’s polarizing Full Self-Driving transfer decision

Tesla maintains it will honor transfers for orders with initial delivery windows before the deadline and offers full deposit refunds otherwise, citing longstanding fine print that the program is “subject to change at any time.”

Tesla’s decision to tighten its Full Self-Driving (FSD) transfer promotion has ignited fierce debate among owners and enthusiasts.

The company quietly updated its terms in late February 2026, changing the eligibility from “order by March 31, 2026” to “take delivery by March 31, 2026.”

What began as a flexible incentive to boost sales, allowing buyers to transfer their paid FSD (Supervised) to a new vehicle, now excludes many, particularly Cybertruck owners facing delivery delays into summer or later.

Tesla maintains it will honor transfers for orders with initial delivery windows before the deadline and offers full deposit refunds otherwise, citing longstanding fine print that the program is “subject to change at any time.”

The reversal has polarized the Tesla community, with accusations of a “bait-and-switch” clashing against defenses of corporate pragmatism. Many owners who placed orders under the original wording feel betrayed, especially as production backlogs and new unsupervised FSD rollout complicate timelines.

However, Tesla has allowed them to cancel their orders and receive a refund.

Critics of the decision argue that the change disadvantages loyal customers who helped fund FSD development, calling it poor communication and a revenue grab as Tesla pivots toward subscriptions.

Popular influencers have amplified the divide. Whole Mars Catalog struck a measured but firm tone, acknowledging the original “order by” language but emphasizing Tesla’s right to adjust terms. He has continued to defend Tesla in this particular issue:

Sad to see so many fans trashing Tesla with such extreme language.

LIARS!!! PATHETIC!!! And if you aren’t as furious and angry as they are they are you’re “worshipping” and saying “they can do no wrong”.

Let’s get real here. They’re not liars. They offered FSD transfer to us… https://t.co/3Ay7vGaVR6

— Whole Mars Catalog (@wholemars) March 3, 2026

He criticized extreme backlash as “dramatization” and “spoiled kids,” noting the unsupervised FSD era and broader sales challenges make blanket transfers financially risky. Whole Mars advocated for polite outreach to CEO Elon Musk over the issue.

Rather than “calling them out”, I would simply say “Hey Elon, really hoped to be able to do FSD transfer on my cybertruck but the terms changed. Would really appreciate if Tesla could extend this to everyone who ordered before the terms changes”

that would probably work

— Whole Mars Catalog (@wholemars) March 3, 2026

In a contrasting perspective, Dirty TesLA voiced sharper frustration, posting that blocking transfers feels “crazy” and distancing himself from “people that want to worship a corporation and say they can do no wrong.” His stance resonated with owners who view the policy flip as disrespectful to early adopters.

Popular Tesla influencer Sawyer Merritt captured the frustration felt by thousands. In a widely shared thread viewed over 700,000 times, Merritt detailed how pre-change Cybertruck orders now risk losing FSD eligibility unless their initial delivery window falls before March 31.

It’s not a contradiction, it’s a change in policy that Tesla just made an hour ago. I am trying to check if the change is retroactive to all existing orders, including Cybertruck AWD orders, because if it is, that sucks big time.

— Sawyer Merritt (@SawyerMerritt) February 28, 2026

The controversy underscores deeper tensions—between Tesla’s need for revenue discipline and owners’ expectations of goodwill. As FSD evolves toward unsupervised capability, the community remains split: some see the change as necessary business, others as a broken promise. Whether Tesla reconsiders under pressure or holds firm remains to be seen, but it does not appear they are planning to budge.