News

Tesla Battery Day can mean doomsday for legacy carmakers shifting to electric

Tesla is expected to hold its Battery Day in April as Elon Musk announced during the company’s Q4 earnings call. The chief executive said the company has a “compelling story” to tell about things that can “blow people’s minds.” These statements do not only pique the interest of the electric vehicle community; they also hint of updates that can spell disaster for legacy car manufacturers trying to catch up with Tesla in the electric vehicle market.

Batteries are key to staying on top of the electric vehicle segment and Tesla is the leader of the pack when it comes to batteries and energy efficiency. This has been validated by organizations such as Consumer Reports and even by competitors who go deep into their pockets and go as far as cutting their workforces to catch Tesla in terms of hardware, software, and battery technology.

Come Tesla Battery Day, the obvious would be made more obvious. Tesla could further widen the gap and set itself apart from the rest, not just as the maker of the Model 3, Model Y, Cybertruck or other vehicles in its lineup but as an energy company.

Mass Production Of Cheaper Batteries

Batteries are among the most expensive components of an electric vehicle. This is true for Tesla and other electric vehicle manufacturers. With pricey batteries, car manufacturers cannot lower prices of their vehicles and therefore cannot encourage the mass adoption of zero-emission cars.

Tesla has reportedly been running its “Roadrunner” secret project that can lead to mass production of battery cells at $100/kWh. According to rumors, Tesla already has a pilot manufacturing line in its Fremont facility that can produce higher-density batteries using technology advancements developed in-house and gained through the Maxwell acquisition. With a $100/kWh battery, the prices of Tesla’s vehicles can be competitive even without government subsidies.

Aside from the Roadrunner project, Tesla has also been setting itself up to succeed in the battery game and dominate the market with its partnerships. It has a long relationship with Panasonic that helped it manufacture batteries in Giga Nevada, but has also signed battery supply agreements with LG Chem and CATL in China.

Battery prices have been going down significantly in the last decade. According to BloombergNEF, the cost of batteries dropped by 13% last year. From $1,100/kWh in 2010, the price went down to around $156.kWh in 2019. This is predicted to come close to the target $100/kWh by 2023. If Tesla achieves the $100/kWH cost sooner than the rest, it will give the company a massive advantage over its competitors and that will eventually lead to better profit margins.

Aside from cheaper batteries, the increased battery production capacity is also key in bringing products such as the all-electric Cybertruck and Tesla Semi to life.

“The thing we’re going to be really focused on is increasing battery production capacity because that’s very fundamental because if you don’t improve battery production capacity, then you end up just shifting unit volume from one product to another and you haven’t actually produced more electric vehicles… make sure we get a very steep ramp in battery production and continue to improve the cost per kilowatt-hour of the batteries,” Musk said during the Q4 2019 earnings call.

Enhanced Tesla Batteries

Tesla already has good batteries through its years of research, experimentation, and partnerships with battery producers. It has invested a good amount of money and effort to make sure it’s leading the battery game.

This advantage is made very clear on how Tesla was able to produce the most efficient electric SUV today in the form of the soon-to-be-released Model Y crossover with an EPA rating of 315 miles per single charge versus the Porsche Taycan with a range of around 200 miles.

With the acquired technologies from companies such as Maxwell and recently a possible purchase of a lithium-ion battery cell specialist startup in Colorado, Tesla demonstrates it’s not stopping its efforts to perfect its battery technology. Maxwell manufactures battery components and ultracapacitors and it’s just a matter of time before Tesla makes use of these technologies.

When asked about Maxwell’s ultracapacitor technology during the Q4 2019 earnings call, Musk said, “It’s an important piece of the puzzle.”

Musk also referenced the Maxwell acquisition during an extensive interview at the Third Row Podcast. “It’s kind of a big deal. Maxwell has a bunch of technologies that if they are applied in the right way I think can have a very big impact,” Musk said during a Third Row Podcast interview.

There are rumors out of China claiming that Tesla may come up with a battery that combines the best traits of Maxwell’s supercapacitors and dry electrode technologies. This could mean batteries that could charge faster, pack more energy density, and last longer.

Controlling Battery Supply

Knowing what works and what doesn’t for electric car batteries puts Tesla on top of the game. Of course, add to that what could be the best battery management system that makes Tesla vehicles among the most efficient if not the best in utilizing their batteries. With the advantage on hardware and software fronts, the thought of Tesla becoming a battery supplier is far from being a crazy idea.

Its competitors such as Audi and Jaguar have recently expressed concerns about their battery supplies as they both depend on LG Chem. Tesla– aside from its partnerships with Panasonic, LG Chem, and CATL — pushes the limit to develop its new battery cells in-house and that opens up a lot of possibilities for Tesla as a business.

“It would be consistent with the mission of Tesla to help other car companies with electric vehicles on the battery and powertrain front, possibly on other fronts. So it’s something we’re open to. We’re definitely open to supplying batteries and powertrains and perhaps other things to other car companies,” Musk was quoted as saying.

Recent job postings for a cell development engineer and equipment development engineers suggest that Tesla might actually be considering the idea of introducing a battery line of its own. But of course, the next-generation batteries would be first used for its vehicle lineup. Once it meets that demand and hits economies of scale, one can only imagine how Tesla could play the important role of supplying batteries to other carmakers.

Whether Tesla would announce cheaper batteries, enhanced electric car batteries, or give updates about its efforts, Battery Day in April will most definitely be worth the wait. For other car manufacturers, time would pause during that day as they listen to what Elon Musk and his team will say. And most likely, after the company talk, other car manufacturers will have to go back to their drawing boards once more in an attempt to catch up.

News

I figured out how to charge my Tesla at my rented townhouse – Here’s how

I hope that this article is able to help the prospective EV buyer or the current Tesla owner who is living in a rental and does not have a straightforward solution to home charging. My situation will be presented in this article, and I will tell you why I went with the solution I went with, and alternatives, because there is more than one way to do this.

When I bought my Tesla Model Y Premium All-Wheel-Drive last year, I knew I would have to try to figure out a way not become totally reliant on Superchargers. After about six months of ownership, it came time to resolve that problem once and for good, and being a tenant in a rented townhouse community definitely added to my challenge.

Before I even bought my Tesla, I emailed my leasing office to see if the community had any plans to bring EV charging to the neighborhood. I had made myself available to them as I am familiar with a lot of the solutions out there and how much of an advantage this could be for the community, and attracting new tenants. After months of trying, I bought my Tesla in August anyway, and figured I’d be able to find an answer — whether positive or negative — and go from there.

I hope that this article is able to help the prospective EV buyer or the current Tesla owner who is living in a rental and does not have a straightforward solution to home charging. My situation will be presented in this article, and I will tell you why I went with the solution I went with, and alternatives, because there is more than one way to do this.

My Challenge with Home Charging

In a rental community, apartment complex, or even townhouse row, parking spots are a little complicated. I have assigned parking at my house, and unfortunately, my parking spot is not right in front of my front door. Instead, it is staggered, so my car is parked in front of my neighbor’s front door.

Initially, I had spoken to my neighbor whose spot is right in front of my front door and had gotten permission to park in their spot during the day while it is vacant. However, I was not going to be able to upgrade my outlet from a 110v-120v to the typical and suggested 220v-240v alternative.

I knew that this would mean I would need to be in my permanent spot because charging sufficiently, especially in preparation for trips or errands, would require overnight charging.

The Tesla Mobile Connector is 20 feet long, which is sufficient for most applications. Mine, however, required about 30 feet, maybe even a little more, to charge.

My Options

I had a few options: Use the Mobile Connector and park in my neighbor’s spot and charge when I could, buy an 8 or 10-gauge extension cord that could handle moving power from the Mobile Connector to my car, or buy an NACS to NACS extension cord.

I didn’t really want to do the first option, considering I knew that spot would only be available when my neighbor was not there. It didn’t seem like a viable option, and I figured it would be better to figure out something from my personal, permanent parking spot anyway.

The 10-gauge extension cord option was what I first considered: it was less expensive than buying an NACS extension, it was more readily available, and it was the first thing my friends who are electricians recommended.

However, running this option would have put the Mobile Connector in the grass or on the ground, and I was not interested in doing that. Running the risk of having that $300 connector that came with the car in the grass and exposing it to dew, dogs, and various other things just did not seem like the best idea.

I looked around for some NACS to NACS connectors, and there are a lot of options. Given that this was something that was going to plug into a $50,000 car, I chose to spend the additional money on one that was not from Amazon, and I went with this one from A2Z, which was recommended by other owners, and their reputation seemed more than positive. I was leaning toward this option anyway because it would keep the Mobile Connector off the ground, and it gave me an additional 16 feet of length to work with.

This was the solution.

Putting It Into Action

It was a relatively simple process: Plug the Mobile Connector into my house, plug the NACS to NACS extension into the Mobile Connector, plug the NACS extension into the car. It all worked immediately, but there are some things you should know if you are also planning to do this.

The first is that you should be very aware that these cables are going to be a target of thieves. I don’t have too much of an issue with this in my area, but if you’re in a place where copper wiring is heavily sought after, be sure to keep these in a place where they won’t be stolen. I put mine away when they’re not charging, and at night, they’re visible from my Ring camera, so I’m not overly concerned. Definitely be aware of it, though.

Additionally, if you’re going to run it across the sidewalk like I am, you’re going to want to pick up some sort of cable cover from a local hardware store. I picked up this one from Amazon because it was a little more heavy-duty, and it was big enough to cover the thicker gauge of the NACS to NACS extension:

I’ve considered picking up a second one for the visible cable, but I am undecided.

So far, I’ve been able to add some range to my car three times using this strategy, and while it is very slow, it is definitely worth it. It’s better than it sitting there stagnant.

Speed of Charging

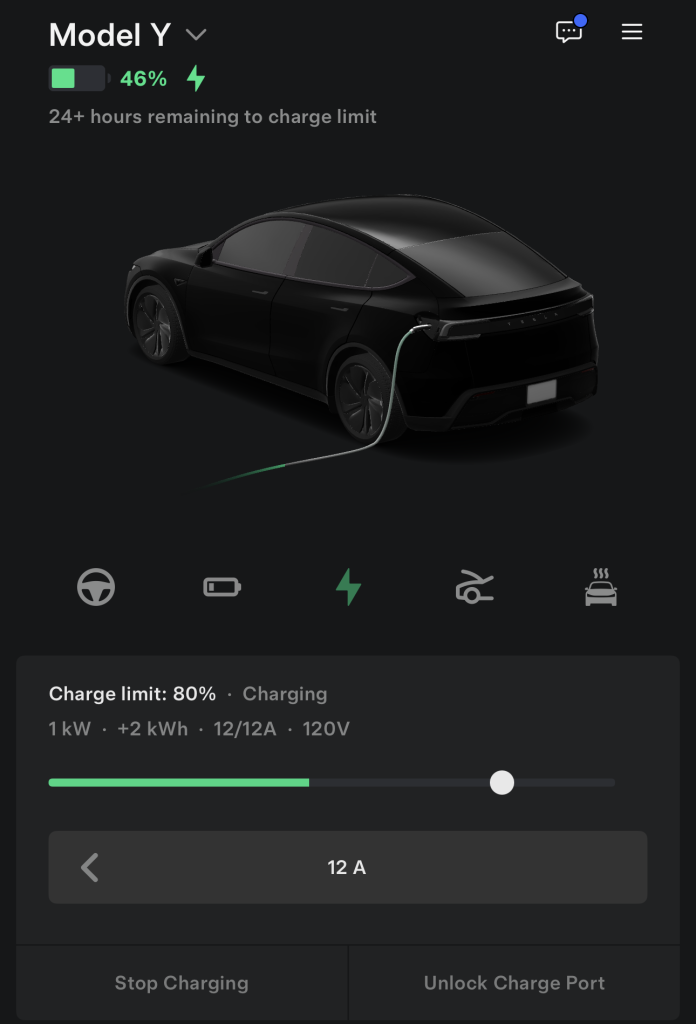

Tesla says the Mobile Connector will provide you with between 3 and 5 miles of range per hour when plugged into a typical wall outlet. That is about what I’ve gotten with it. From 30 percent to 80 percent, be aware that it will take well over 24 hours to charge your car.

I plan to cover some additional details on this as time goes on, including any troubleshooting I might have to do, how much my electric bill goes up, and whether or not I run into any issues with my neighbors or my leasing office.

If you’re looking for some help on an at-home charging solution or have any questions about my setup, please email me at joey@teslarati.com.

🚨 I FINALLY figured out a way to charge my Tesla at home as a renter — Using Superchargers exclusively was inconvenient, tough on the battery, and expensive

Here’s how I did it: https://t.co/TZokpc6Fh3 pic.twitter.com/UtRYKLvB2Y

— TESLARATI (@Teslarati) March 2, 2026

Elon Musk

Starlink V2 to bring satellite-to-phone service to Deutsche Telekom in Europe

Starlink stated that the system is designed to deliver 5G speeds directly to compatible smartphones in remote areas.

Starlink is partnering with Deutsche Telekom to roll out satellite-to-mobile connectivity across Europe, extending coverage to more than 140 million subscribers across 10 countries.

The service, planned for launch in 2028 in several Telekom markets, including Germany, will use Starlink’s next-generation V2 satellites and Mobile Satellite Service (MSS) spectrum to enable direct-to-device connectivity.

In a post on X, the official Starlink account stated that the agreement will be the first in Europe to deploy its V2 next-generation satellite-to-mobile technology using new MSS spectrum. The company added that the system is designed to deliver 5G speeds directly to compatible smartphones in remote areas.

Abdu Mudesir, Board Member for Product and Technology at Deutsche Telekom, shared his excitement for the partnership in a press release. “We provide our customers with the best mobile network. And we continue to invest heavily in expanding our infrastructure. At the same time, there are regions where expansion is especially complex due to topographical conditions or official constraints,” he said.

“We want to ensure reliable connectivity for our customers in those areas as well. That is why we are strategically complementing our network with satellite-to-mobile connectivity. For us, it is clear: connectivity creates security and trust. And we deliver. Everywhere.”

Under the partnership, compatible smartphones will automatically switch to Starlink’s satellite network when terrestrial coverage is unavailable, enabling access to data, voice, video, and messaging services.

Telekom reports 5G geographic coverage approaching 90% in Germany, with LTE exceeding 92% and voice coverage reaching up to 99%. Starlink’s satellite layer is intended to extend connectivity beyond those terrestrial limits, particularly in topographically challenging or infrastructure-constrained areas.

Stephanie Bednarek, VP of Starlink Sales, also shared her thoughts on the partnership. “We’re so pleased to bring reliable satellite-to-mobile connectivity to millions of people across 10 countries in partnership with Deutsche Telekom. This agreement will be the first-of-its-kind in Europe to launch Starlink’s V2 next-generation technology that will expand on data, voice and messaging by providing broadband directly to mobile phones,” she said.

Starlink’s V2 constellation is designed to expand bandwidth and capacity compared to its predecessor. If implemented as outlined, the 2028 launch would mark one of the first large-scale European deployments of integrated satellite-to-phone connectivity by a major telecom operator.

News

Tesla back on top as Norway’s EV market surges to 98% share in February

Tesla became Norway’s top-selling brand with 1,210 registrations, representing a 16.6% share.

Tesla reclaimed the top spot in Norway’s auto market in February as electric vehicles captured more than 98% of all new car registrations.

The rebound follows a sharp January slump triggered by VAT rule changes, which prompted numerous car buyers to advance their purchases into late 2025.

As per data from the Norwegian Road Traffic Information Council (OFV), 7,127 new electric vehicles were registered in February, representing a 98.01% market share. Fossil-fuel vehicles and hybrids accounted for just 2% of total new registrations.

Total new car registrations reached 7,272 units in February, hinting at a rapid recovery after January sales fell nearly 75% year-over-year following VAT adjustments.

OFV Director Geir Inge Stokke noted that similar patterns were observed after previous VAT changes in 2022, with demand temporarily weakening before normalizing, as noted in an Allt Om Elbil report.

“We are now seeing signs that the market is returning to a more normal level of activity, which we also experienced after the VAT change in 2022. At that time, changes in demand led to a weak start to 2023. We have seen the same pattern this year,” he said.

Amidst this trend, the Tesla Model Y made a strong comeback in the domestic market. After an unusually weak January that saw the Tesla Model Y drop to seventh place, the model returned to the top of Norway’s sales chart in February.

The Model Y recorded 1,073 registrations, giving it a 14.8% market share for the month. Tesla also became Norway’s top-selling brand with 1,210 registrations, representing a 16.6% share. Toyota followed with 941 registrations, while Volkswagen, Volvo, and Skoda rounded out the top five brands.

The February data suggests that Tesla’s January dip was tied more to timing effects around VAT adjustments than to structural demand shifts. It would then be interesting to see how the rest of the year unfolds for Tesla, particularly as the company pushes for the release of its Full Self-Driving (Supervised) system to Europe this year.