News

SpaceX’s next Falcon Heavy launch and landing could be more than a year away

According to comments made by US Air Force officials prior to SpaceX’s latest Falcon Heavy launch, the payload assigned to the military’s first fully-certified Falcon Heavy has been swapped with another, although the mission’s late-2020 launch target remains relatively unchanged.

This new information comes on the heels of the June 25th launch of Space Test Program 2 (STP-2), SpaceX’s third successful Falcon Heavy mission and a huge milestone for the rocket’s future as a competitive option for US military launches. Perhaps most importantly, it confirms – barring a surprise launch contract or internal Starlink mission – that Falcon Heavy’s next (and fourth) launch is unlikely to occur until late next year, a gap of at least 15-17 months.

Announced roughly four months after Falcon Heavy’s inaugural February 2018 launch debut, the USAF contracted with SpaceX to launch the ~6350 kg (14,000 lb) AFSPC-52 satellite no earlier than (NET) September 2020. In February 2019, Department of Defense contract announcements revealed that SpaceX had been awarded three military launch contracts, two for the National Reconnaissance Office (NROL-85 & NROL-87) and one for the USAF (AFSPC-44), all tentatively scheduled to launch in 2021.

First reported by Spaceflight Now, Col. Robert Bongiovi – director of the launch enterprise systems directorate at the Air Force’s Space and Missile Systems Center (AFSMC) – recently indicated that AFSPC-44 – not AFSPC-52 – is now scheduled to be the US military’s first post-certification Falcon Heavy launch. 52 and 44 have essentially swapped spots, with AFSPC-44 moving forward to NET Q4 (fall) 2020 while AFSPC-52 has been delayed to NET Q2 (spring) 2021.

The trouble with launch gaps

Although Bongiovi did not explicitly state that AFSPC-44 will be SpaceX’s next Falcon Heavy launch, there are no publicly-disclosed missions set to launch on the rocket in the interim. That could theoretically change, especially if SpaceX has plans to launch the massive rocket in support of an internal Starlink mission or even something more exotic, but the loss of both Block 5 center core B1055 and B1057 means that the company will have to build an entirely new center core.

SpaceX’s Falcon Heavy lead times are far superior to competitor ULA’s Delta IV Heavy production line, but the process of manufacturing new center cores is still quite lengthy. Critically, Falcon Heavy Block 5 center cores require strengthened octawebs, custom interstages, and propellant tanks that are significantly thicker than those used on Falcon 9. For all intents and purposes, a center core is a totally different rocket relative to a Falcon 9 booster, the latter being SpaceX’s primary focus at the company’s assembly line-style Hawthorne factory. It’s theoretically possible for a dedicated Falcon Heavy center core build to be expedited or leapfrogged forward in the production queue, but most long-lead Falcon 9 booster hardware physically cannot be redirected to speed up center core production.

Unless SpaceX was already in the process of building a new center core prior B1057’s unsuccessful landing attempt, it’s safe to assume that the next custom Falcon Heavy booster is unlikely to be completed until early 2020, if not later. In theory, this means that Falcon Heavy could be dormant for no less than 16 months between STP-2 and its next launch. Traditionally, that sort of lengthy gap between launches has been frowned upon by NASA, ULA, and oversight groups like GAO. If a given rocket doesn’t launch for a year or more, it can potentially pose a risk to reliability and raise costs as its production and launch teams have no satisfactory way to fully preserve their technical expertise.

This can be compared to attempting to become an expert at a musical instrument while only having access to said instrument one or two months a year, essentially impossible. In fact, at one point, NASA hoped to require its Space Launch System (SLS) rocket be able to launch no less than once per year, partly motivated by a desire to mitigate some of the deterioration that can follow extremely low launch cadences. Years later, financial constraints and years upon years of delays and budget overruns have made such a cadence effectively impossible for SLS/Orion, but the fact remains that launching a rocket just once every 18-24 months is likely to inflate both costs and risks.

Thankfully, SpaceX’s Falcon Heavy could scarcely be more different than NASA’s SLS and the retired Space Shuttle it derives most of its hardware from. Even if all things are held equal and not flying a Falcon Heavy center core for 16+ months increases risk and cost, center cores are still heavily derived from Falcon 9 booster technology, including plumbing, avionics, attitude control thrusters, Merlin 1D engines, landing legs, and launch facilities.

Furthermore, the center core is just one of five distinct assemblies that make up a given Falcon Heavy. Both side boosters are effectively Falcon 9 Block 5 boosters with nose cones instead of interstages and slight modifications to support booster attachment hardware, while the upper stage and payload fairing are the same for all Falcon launches. In other words, SpaceX’s workforce will continue to build, launch, land, and reuse dozens of Falcon 9 boosters – as well as upper stages payload fairings – between now and Falcon Heavy Flight 4, even if it’s NET Q4 2020. In a worst-case scenario, SpaceX production and launch staff will be unfamiliar and inexperienced with maybe 20% of Falcon Heavy – at least in a very rough sense. Even then, much of that unfamiliarity may still be tempered by the fact that Falcon Heavy center cores share a large amount of commonality with the Falcon 9 first stages SpaceX’s workforce will remain deeply familiar with.

Indeed, Falcon Heavy’s second launch has already demonstrated this to some extent, occurring without issue more than 14 months after the rocket’s inaugural launch. It seems that the only real loss incurred by a ~16-month delay between Flights 3 and 4 will be having to wait another year (or more) to witness Falcon Heavy’s next launch.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

News

Tesla Robotaxi ride-hailing without a Safety Monitor proves to be difficult

Tesla Robotaxi ride-hailing without a Safety Monitor is proving to be a difficult task, according to some riders who made the journey to Austin to attempt to ride in one of its vehicles that has zero supervision.

Last week, Tesla officially removed Safety Monitors from some — not all — of its Robotaxi vehicles in Austin, Texas, answering skeptics who said the vehicles still needed supervision to operate safely and efficiently.

BREAKING: Tesla launches public Robotaxi rides in Austin with no Safety Monitor

Tesla aimed to remove Safety Monitors before the end of 2025, and it did, but only to company employees. It made the move last week to open the rides to the public, just a couple of weeks late to its original goal, but the accomplishment was impressive, nonetheless.

However, the small number of Robotaxis that are operating without Safety Monitors has proven difficult to hail for a ride. David Moss, who has gained notoriety recently as the person who has traveled over 10,000 miles in his Tesla on Full Self-Driving v14 without any interventions, made it to Austin last week.

He has tried to get a ride in a Safety Monitor-less Robotaxi for the better part of four days, and after 38 attempts, he still has yet to grab one:

Wow just wow!

It’s 8:30PM, 29° out ice storm hailing & Tesla Robotaxi service has turned back on!

Waymo is offline & vast majority of humans are home in the storm

Ride 38 was still supervised but by far most impressive yet pic.twitter.com/1aUnJkcYm8

— David Moss (@DavidMoss) January 25, 2026

Tesla said last week that it was rolling out a controlled test of the Safety Monitor-less Robotaxis. Ashok Elluswamy, who heads the AI program at Tesla, confirmed that the company was “starting with a few unsupervised vehicles mixed in with the broader Robotaxi fleet with Safety Monitors,” and that “the ratio will increase over time.”

This is a good strategy that prioritizes safety and keeps the company’s controlled rollout at the forefront of the Robotaxi rollout.

However, it will be interesting to see how quickly the company can scale these completely monitor-less rides. It has proven to be extremely difficult to get one, but that is understandable considering only a handful of the cars in the entire Austin fleet are operating with no supervision within the vehicle.

News

Tesla gives its biggest hint that Full Self-Driving in Europe is imminent

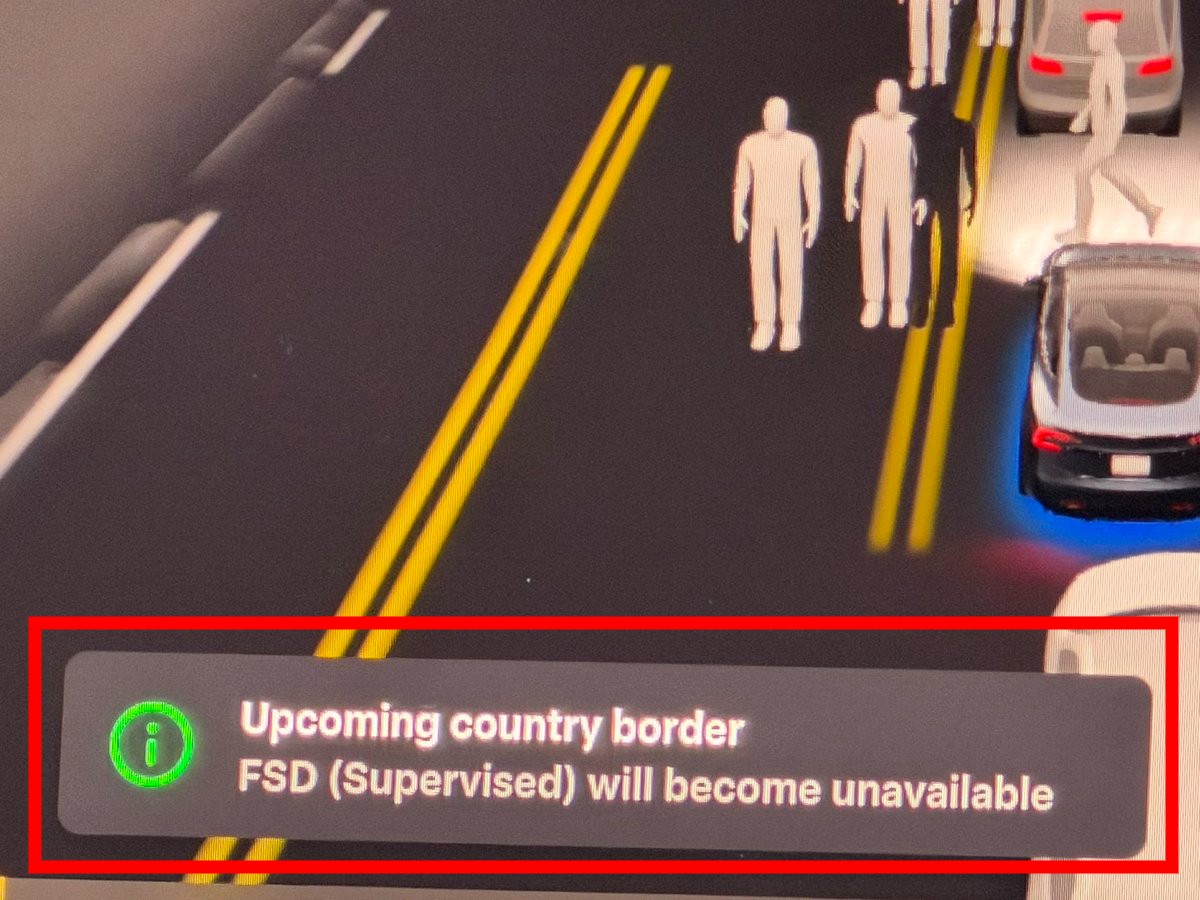

Tesla has given its biggest hint that Full Self-Driving in Europe is imminent, as a new feature seems to show that the company is preparing for frequent border crossings.

Tesla owner and influencer BLKMDL3, also known as Zack, recently took his Tesla to the border of California and Mexico at Tijuana, and at the international crossing, Full Self-Driving showed an interesting message: “Upcoming country border — FSD (Supervised) will become unavailable.”

FSD now shows a new message when approaching an international border crossing.

Stayed engaged the whole way as we crossed the border and worked great in Mexico! pic.twitter.com/bDzyLnyq0g

— Zack (@BLKMDL3) January 26, 2026

Due to regulatory approvals, once a Tesla operating on Full Self-Driving enters a new country, it is required to comply with the laws and regulations that are applicable to that territory. Even if legal, it seems Tesla will shut off FSD temporarily, confirming it is in a location where operation is approved.

This is something that will be extremely important in Europe, as crossing borders there is like crossing states in the U.S.; it’s pretty frequent compared to life in America, Canada, and Mexico.

Tesla has been working to get FSD approved in Europe for several years, and it has been getting close to being able to offer it to owners on the continent. However, it is still working through a lot of the red tape that is necessary for European regulators to approve use of the system on their continent.

This feature seems to be one that would be extremely useful in Europe, considering the fact that crossing borders into other countries is much more frequent than here in the U.S., and would cater to an area where approvals would differ.

Tesla has been testing FSD in Spain, France, England, and other European countries, and plans to continue expanding this effort. European owners have been fighting for a very long time to utilize the functionality, but the red tape has been the biggest bottleneck in the process.

Tesla Europe builds momentum with expanding FSD demos and regional launches

Tesla operates Full Self-Driving in the United States, China, Canada, Mexico, Puerto Rico, Australia, New Zealand, and South Korea.

Elon Musk

SpaceX Starship V3 gets launch date update from Elon Musk

The first flight of Starship Version 3 and its new Raptor V3 engines could happen as early as March.

Elon Musk has announced that SpaceX’s next Starship launch, Flight 12, is expected in about six weeks. This suggests that the first flight of Starship Version 3 and its new Raptor V3 engines could happen as early as March.

In a post on X, Elon Musk stated that the next Starship launch is in six weeks. He accompanied his announcement with a photo that seemed to have been taken when Starship’s upper stage was just about to separate from the Super Heavy Booster. Musk did not state whether SpaceX will attempt to catch the Super Heavy Booster during the upcoming flight.

The upcoming flight will mark the debut of Starship V3. The upgraded design includes the new Raptor V3 engine, which is expected to have nearly twice the thrust of the original Raptor 1, at a fraction of the cost and with significantly reduced weight. The Starship V3 platform is also expected to be optimized for manufacturability.

The Starship V3 Flight 12 launch timeline comes as SpaceX pursues an aggressive development cadence for the fully reusable launch system. Previous iterations of Starship have racked up a mixed but notable string of test flights, including multiple integrated flight tests in 2025.

Interestingly enough, SpaceX has teased an aggressive timeframe for Starship V3’s first flight. Way back in late November, SpaceX noted on X that it will be aiming to launch Starship V3’s maiden flight in the first quarter of 2026. This was despite setbacks like a structural anomaly on the first V3 booster during ground testing.

“Starship’s twelfth flight test remains targeted for the first quarter of 2026,” the company wrote in its post on X.