News

SpaceX’s Falcon 9 rideshare program secures its first customer

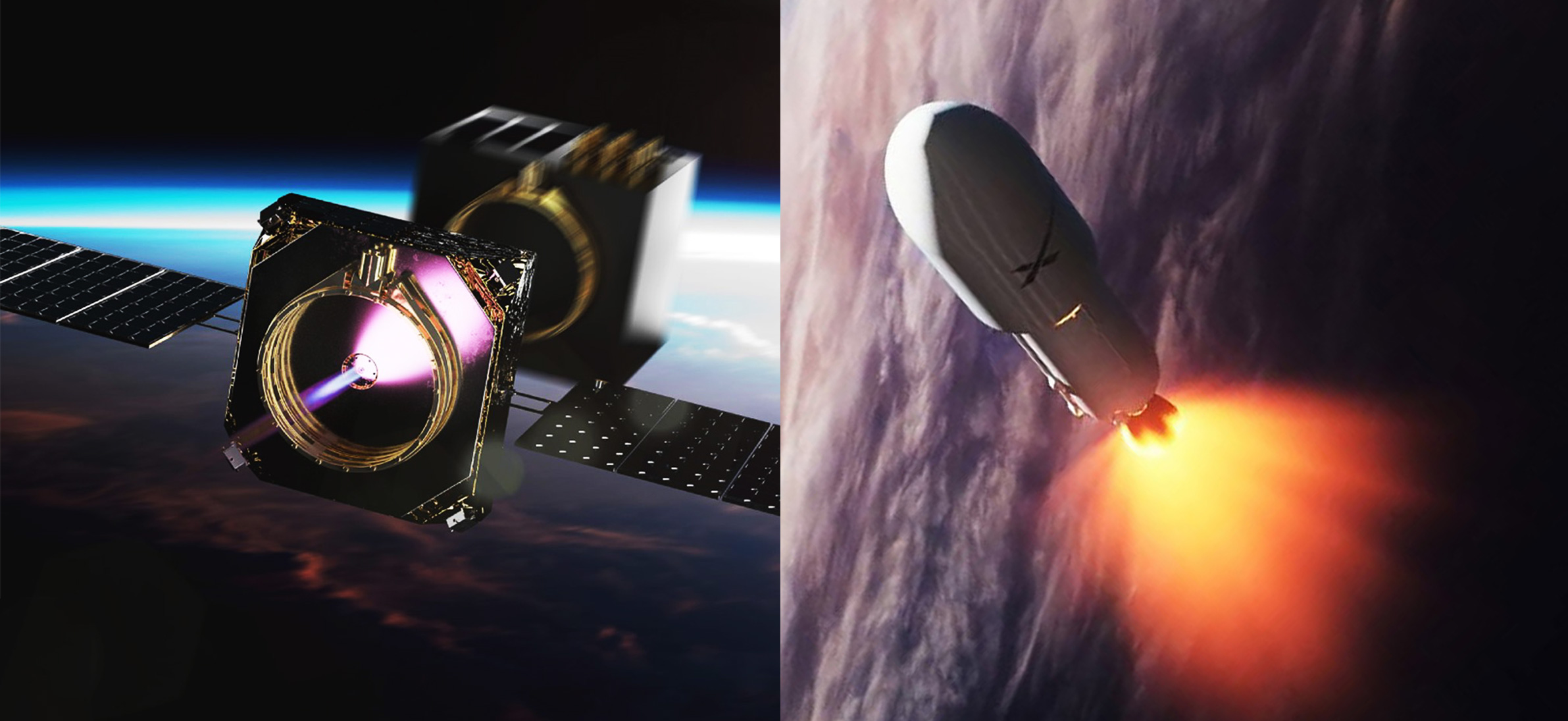

On August 22nd, spaceflight startup Momentus Space and launch heavyweight SpaceX announced the first public launch contract to fall under the umbrella of the latter company’s recently-announced Satellite Rideshare Program.

Meant to provide a reliable, consistent, and affordable form of shuttle-like access to orbit, SpaceX’s rideshare program will – pending demand – involve no less than one dedicated Falcon 9 launch per year, capable of placing 15+ metric tons (33,000+ lbs) into low Earth orbit. Although SpaceX’s rideshare proposal is far from revolutionary, the company’s contract with Momentus Space appears to be more than a basic launch service agreement, potentially opening doors for far more flexible rideshare launches in the future.

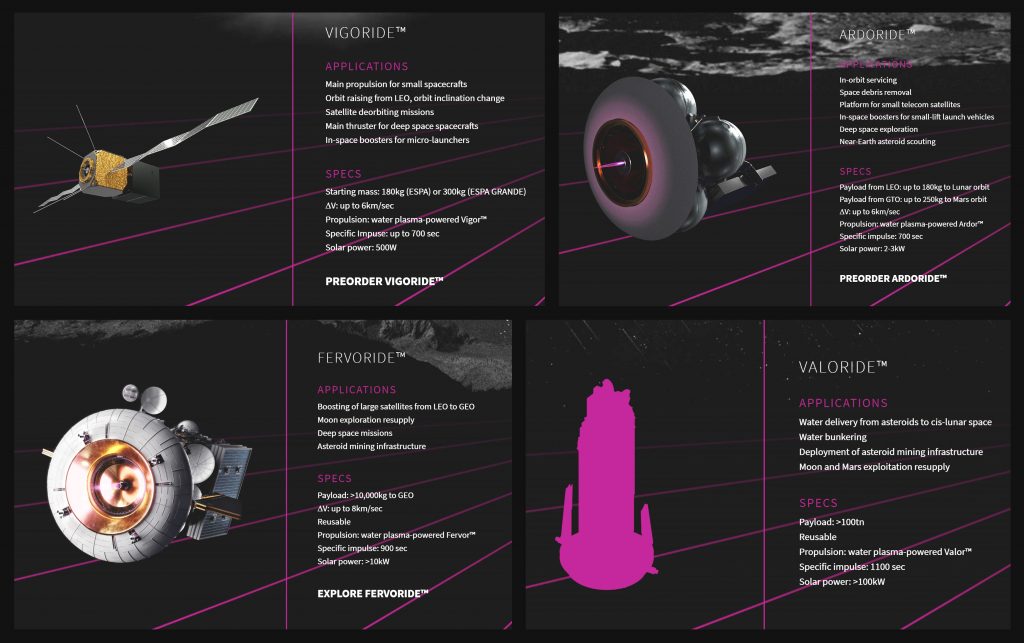

Since its November 2017 founding, Momentus Space has been able to put money where its mouth is far more so than any comparable space tug hopeful, of which there are several. The concept that has helped Momentus raise nearly $34M in just 1.5 years is relatively simple: build a spacecraft whose sole purpose is to propel other spacecraft to their final orbit(s).

Known as a space tug, the concept is about as old as practical spaceflight itself, and interest in actually developing the concept from paper to hardware has grown exponentially in the last 5-10 years, thanks in large part to an unprecedented boom in commercial spaceflight activity. Applied more specifically, modern efforts like Momentus tend to have ambitious goals couched behind much more achievable (and marketable) concepts.

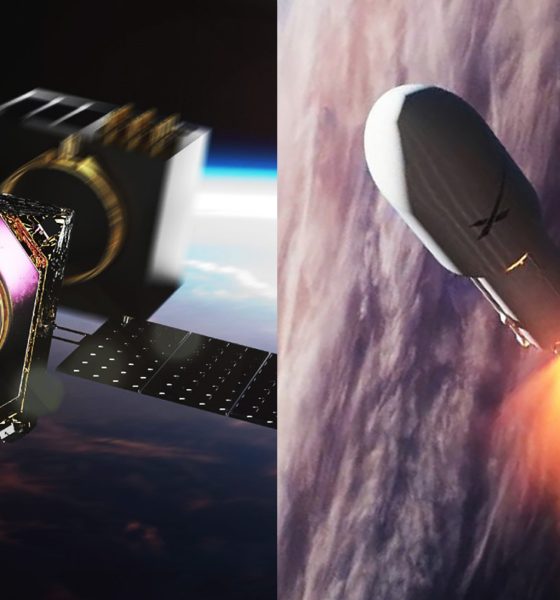

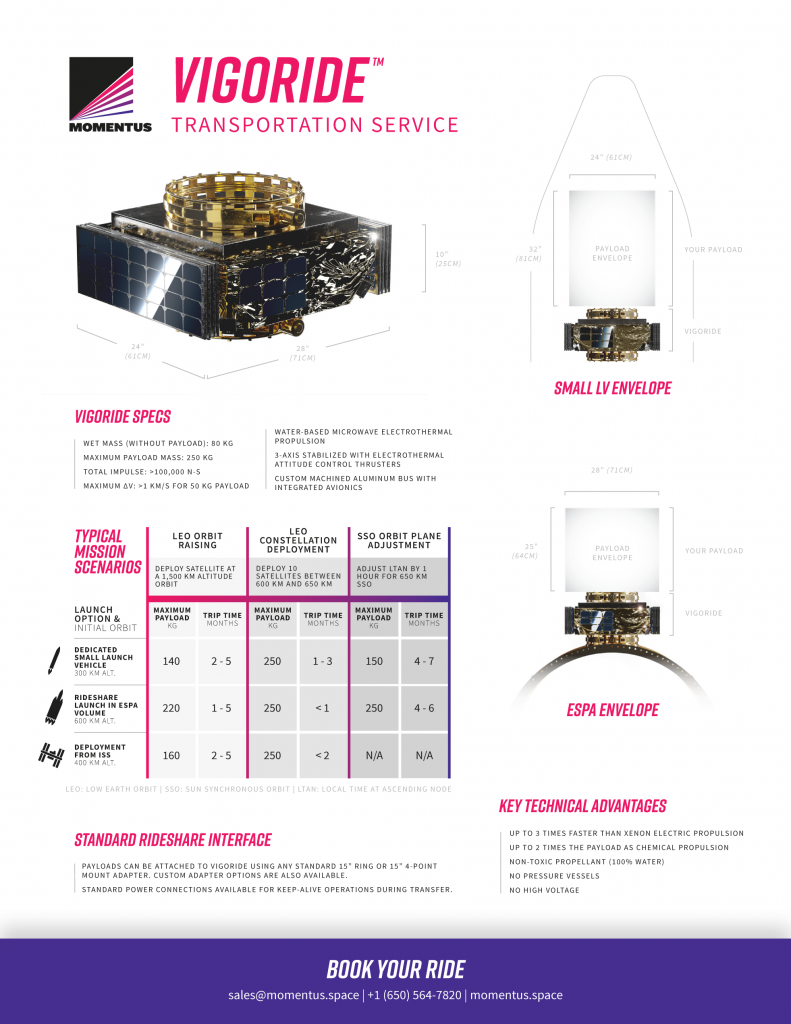

Momentus Space’s first goal is to bridge the gap between the low cost of smallsat rideshare missions on large rockets and the convenience of smallsat launches on much smaller rockets by building lightweight, simple, and cheap orbital tugs. The first tug the company wants to field is called Vigoride and will measure approximately 2ft x 2ft (0.4m²) and weigh just 80 kg (175 lb) fully fueled. If launched to a 600 km (370 mi) sun-synchronous orbit (SSO), Vigoride will be able to deliver as much as 220 kg (~500 lb) to a final circular orbit of ~1500 km (930 mi) or place 250 kg (550 lb) of satellites into 10+ separate orbits.

Water plasma rockets (!?)

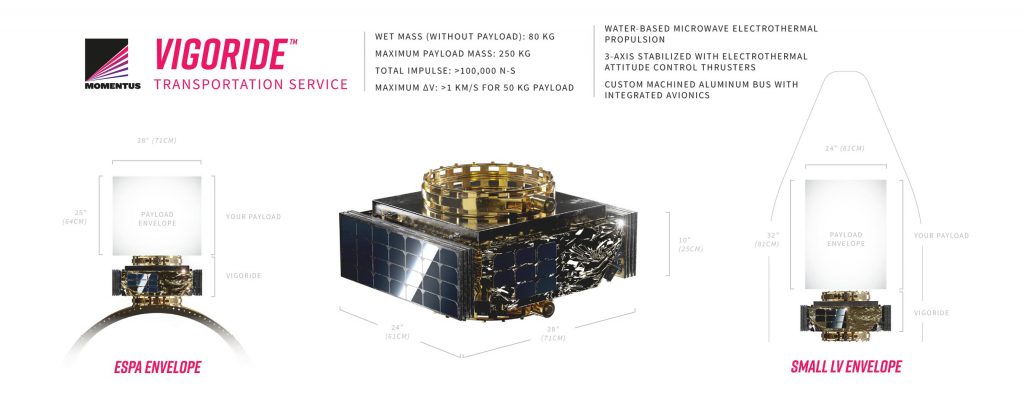

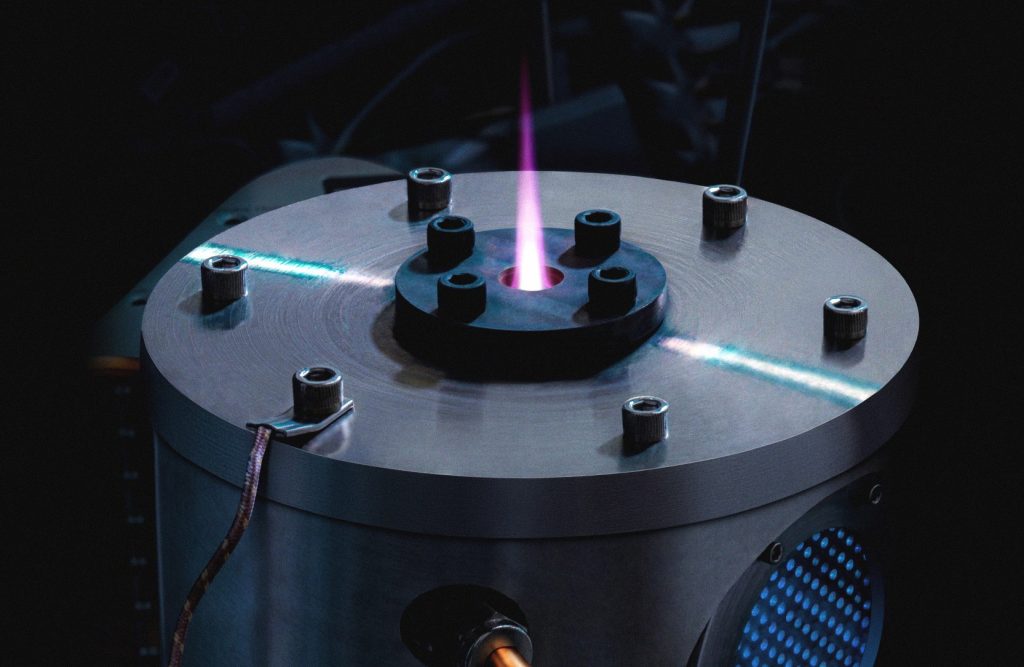

By far the most innovative and potentially revolutionary aspect of Momentus’ plans is its custom propulsion system of choice: water plasma rockets. In simple terms, Momentus space tugs would quite literally turn water and sunlight into a method of in-space propulsion that can offer both moderate efficiency and relatively high thrust. Using solar arrays, the space tug would charge batteries that would then power an extremely high-power microwave electrothermal thruster (MET).

In the case of Momentus, the exotic form of propulsion uses microwaves to almost instantaneously turn liquid water into plasma, an ionized, electrically-charged gas that can then be directed with a magnetic nozzle to produce thrust. Aside from the decent performance it offers, water-based MET allows a given satellite to completely avoid heavy pressure vessels, doesn’t require extremely high voltages, and uses a fully non-toxic propellant (water).

The fact that pure water is so incredibly benign, non-toxic, and accessible opens up a realm of possibilities. Momentus already has plans to launch Vigorides from the International Space Station, and that could eventually expand into actual in-space reuse in which water-powered satellites might dock with the ISS to load more water and pick up new payloads.

In the case of SpaceX, it appears that the company has inked a more two-way agreement with Momentus, in the sense that prospective customers of SpaceX’s Satellite Rideshare Program might actually be able to arrange for their satellites to be included on Vigoride. Vigoride would then be able to deliver each payload – up to 250 kg worth – to its own orbit, potentially far more convenient than simply being kicked off at a lone orbital bus stop. As Momentus matures its technology and moves from Vigoride to Vigoride Extended and beyond, a partnership with SpaceX’s Satellite Rideshare Program could grow into an almost unbeatable turnkey option for the smallsat industry.

Momentus took its first major step towards building capable and marketable space tugs in July 2019 when the company launched X1, its first orbit-worthy satellite prototype. Although the company has been dead silent as to the actual status of that prototype, even a failure would still serve as an invaluable learning opportunity, even if it would be an inconvenient setback. Vigoride’s first test flight was planned as early as late 2019, although the status of that schedule is uncertain.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

News

Tesla announces massive investment into xAI

“On January 16, 2026, Tesla entered into an agreement to invest approximately $2 billion to acquire shares of Series E Preferred Stock of xAI as part of their recent publicly-disclosed financing round,” it said.

Tesla has announced a major development in its ventures outside of electric vehicles, as it confirmed today that it invested $2 billion into xAI on January 16.

The move is significant, as it marks the acquisition of shares of Series E Preferred Stock, executed on market terms alongside other investors. The company officially announced it in its Q4 2025 Shareholder Deck, which was released at market close on Wednesday.

The investment follows shareholder approval in 2025 for potential equity stakes in xAI and echoes SpaceX’s earlier $2 billion contribution to xAI’s $10 billion fundraising round.

Tesla said that, earlier this month, it entered an agreement to invest $2 billion to acquire shares of Series E Preferred Stock of xAI:

“Tesla’s investment was made on market terms consistent with those previously agreed to by other investors in the financing round. As set forth… pic.twitter.com/HgtrcHdB2U

— TESLARATI (@Teslarati) January 28, 2026

CEO Elon Musk, who is behind both companies, is now weaving what appears to be an even tighter ecosystem among his ventures, blending Tesla’s hardware prowess with xAI’s cutting-edge AI models, like Grok.

Tesla confirmed the investment in a statement in its Shareholder Deck:

“On January 16, 2026, Tesla entered into an agreement to invest approximately $2 billion to acquire shares of Series E Preferred Stock of xAI as part of their recent publicly-disclosed financing round. Tesla’s investment was made on market terms consistent with those previously agreed to by other investors in the financing round. As set forth in Master Plan Part IV, Tesla is building products and services that bring AI into the physical world. Meanwhile, xAI is developing leading digital AI products and services, such as its large language model (Grok).”

It continued:

“In that context, and as part of Tesla’s broader strategy under Master Plan Part IV, Tesla and xAI also entered into a framework agreement in connection with the investment. Among other things, the framework agreement builds upon the existing relationship between Tesla and xAI by providing a framework for evaluating potential AI collaborations between the companies. Together, the investment and the related framework agreement are intended to enhance Tesla’s ability to develop and deploy AI products and services into the physical world at scale. This investment is subject to customary regulatory conditions with the expectation to close in Q1’2026.”

The history of the partnership traces back to xAI’s founding in July 2023, as Musk launched the company as a counterweight to dominant AI players like OpenAI and Google.

xAI aimed to “understand the true nature of the universe” through unbiased, truth-seeking AI. Tesla, meanwhile, has long invested in AI for its Full Self-Driving (FSD) software and Optimus robots, training models on vast datasets from its vehicle fleet.

The investment holds profound significance for both companies.

For Tesla, it accelerates its Master Plan Part IV, which envisions AI-driven autonomy in vehicles and humanoid robots. xAI’s Grok could enhance Tesla’s real-world AI applications, from optimizing battery management to predictive maintenance, potentially giving Tesla an edge over its biggest rivals, like Waymo.

Investors, on the other hand, stand to gain from this symbiosis. Tesla Shareholders may see boosted stock value through AI innovations, with analysts projecting enhanced margins and significant future growth in robotics. xAI’s valuation could soar, attracting more capital.

Investor's Corner

Tesla (TSLA) Q4 and FY 2025 earnings results

Tesla’s Q4 and FY 2025 earnings come on the heels of a quarter where the company produced over 434,000 vehicles, delivered over 418,000 vehicles, and deployed 14.2 GWh of energy storage products.

Tesla (NASDAQ:TSLA) has released its Q4 and FY 2025 earnings results in an update letter. The document was posted on the electric vehicle maker’s official Investor Relations website after markets closed today, January 28, 2025.

Tesla’s Q4 and FY 2025 earnings come on the heels of a quarter where the company produced over 434,000 vehicles, delivered over 418,000 vehicles, and deployed 14.2 GWh of energy storage products.

For the Full Year 2025, Tesla produced 1,654,667 and delivered 1,636,129 vehicles. The company also deployed a total of 46.7 GWh worth of energy storage products.

Tesla’s Q4 and FY 2025 results

As could be seen in Tesla’s Q4 and FY 2025 Update Letter, the company posted GAAP EPS of $0.24 and non-GAAP EPS of $0.50 per share in the fourth quarter. Tesla also posted total revenues of $24.901 billion. GAAP net income is also listed at $840 million in Q4.

Analyst consensus for Q4 has Tesla earnings per share falling 38% to $0.45 with revenue declining 4% to $24.74 billion, as per estimates from FactSet. In comparison, the consensus compiled by Tesla last week forecasted $0.44 per share on sales totaling $24.49 billion.

For FY 2025, Tesla posted GAAP EPS of $1.08 and non-GAAP EPS of $1.66 per share. Tesla also posted total revenues of $94.827 billion, which include $69.526 billion from automotive and $12.771 billion from the battery storage business. GAAP net income is also listed at $3.794 billion in FY 2025.

xAI Investment

Tesla entered an agreement to invest approximately $2 billion to acquire Series E preferred shares in Elon Musk’s artificial intelligence startup, xAI, as part of the company’s recently disclosed financing round. Tesla said the investment was made on market terms consistent with those agreed to by other participants in the round.

The investment aligns with Tesla’s strategy under Master Plan Part IV, which centers on bringing artificial intelligence into the physical world through products and services. While Tesla focuses on real-world AI applications, xAI is developing digital AI platforms, including its Grok large language model.

Below is Tesla’s Q4 and FY 2025 update letter.

TSLA-Q4-2025-Update by Simon Alvarez

News

Tesla rolls out new Supercharging safety feature in the U.S.

Tesla has rolled out a new Supercharging safety feature in the United States, one that will answer concerns that some owners may have if they need to leave in a pinch.

It is also a suitable alternative for non-Tesla chargers, like third-party options that feature J1772 or CCS to NACS adapters.

The feature has been available in Europe for some time, but it is now rolling out to Model 3 and Model Y owners in the U.S.

With Software Update 2026.2.3, Tesla is launching the Unlatching Charge Cable function, which will now utilize the left rear door handle to release the charging cable from the port. The release notes state:

“Charging can now be stopped and the charge cable released by pulling and holding the rear left door handle for three seconds, provided the vehicle is unlocked, and a recognized key is nearby. This is especially useful when the charge cable doesn’t have an unlatch button. You can still release the cable using the vehicle touchscreen or the Tesla app.”

The feature was first spotted by Not a Tesla App.

This is an especially nice feature for those who commonly charge at third-party locations that utilize plugs that are not NACS, which is the Tesla standard.

For example, after plugging into a J1772 charger, you will still be required to unlock the port through the touchscreen, which is a minor inconvenience, but an inconvenience nonetheless.

Additionally, it could be viewed as a safety feature, especially if you’re in need of unlocking the charger from your car in a pinch. Simply holding open the handle on the rear driver’s door will now unhatch the port from the car, allowing you to pull it out and place it back in its housing.

This feature is currently only available on the Model 3 and Model Y, so Model S, Model X, and Cybertruck owners will have to wait for a different solution to this particular feature.