News

SpaceX’s next Starship hop a step closer after ‘cryo proof’ test

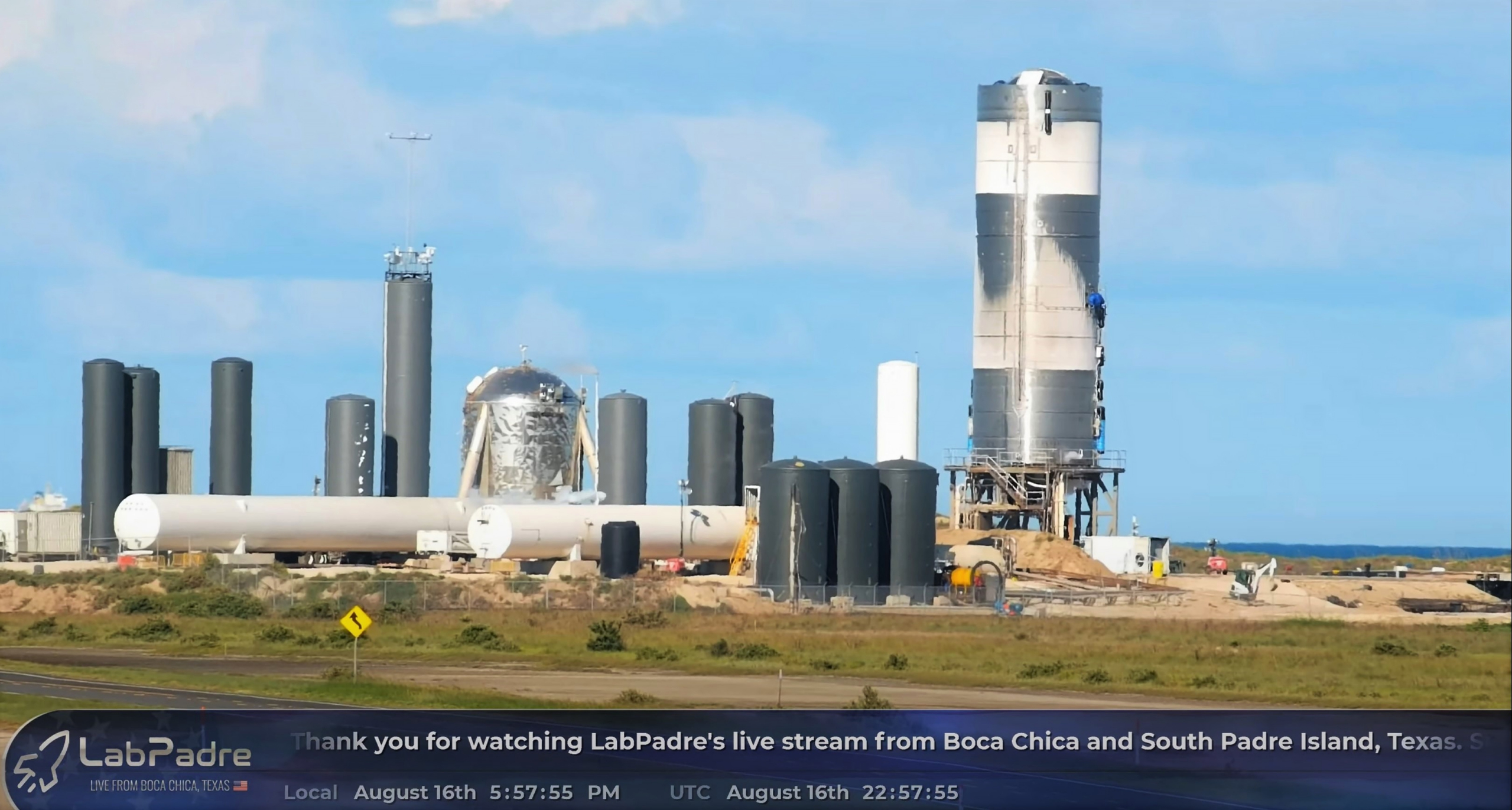

SpaceX appears to have successfully completed one of three major tests standing between a new Starship prototype and the rocket’s next hop.

Known as a cryogenic proof test (“cryo proof”), signs currently point towards a success on Starship SN6’s first try – albeit an hour or two past the end of the planned test window. The proof was planned between 8 am and 5 pm CDT (UTC-5) on August 16th with identical backup windows on Monday and Tuesday in the event of an abort or delay. Thankfully, in a breath of fresh air after many Starship SN5 test delays, SpaceX had no such need.

With the help of local sheriffs, SpaceX closed the highway around 10:15 am and pressurized Starship SN6 with ambient-temperature gas (likely nitrogen) around half an hour later. As usual, the company took its time while the Starship prototype effectively came to life for the first time. Around 2.5 hours later, the Starship began visibly venting for the first time as it operated dozens of valves to maintain safe tank pressures.

To perform a cryogenic pressure test, SpaceX effectively performs a wet dress rehearsal (WDR) – a test that simulates a full launch flow short of liftoff – with no engine installed. To prevent leaks or hull breaches from turning potentially catastrophic during what is often the first major test of a prototype, SpaceX loads Starship with liquid nitrogen (LN2) instead of liquid methane and oxygen propellant. During that process, Starship’s thin steel skin will quickly drop to arctic temperatures, becoming cold enough that it will literally freeze the water vapor out of any ambient air it comes in contact with.

Around 1 pm local, the first sign of that frost sheath appeared but remained a sliver before disappearing around 2 pm. Starship SN6 then hung around for an hour before testing activities appeared to restart. Close to 5:40 pm, almost an hour after SpaceX’s August 16th window was meant to close, frost reappeared on Starship SN6’s hull and rapidly crept up the side of the massive rocket.

Starship SN5’s own cryo proof test – completed on June 30th – debuted apparent upgrades to SpaceX’s South Texas launch facilities, loading the rocket with hundreds of thousands of gallons of LN2 in 15-20 minutes. The ability to load huge quantities of cryogenic propellant very quickly will be critical for SpaceX, as Starship’s efficiency will decrease substantially as its propellant warms. Along those lines, Starship SN6 became the second prototype to be rapidly loaded with liquid nitrogen, going from nearly empty to nearly full in ~15 minutes.

SN6 detanked over the next hour or so and SpaceX opened the road and had a team back on the pad to inspect the rocket by 7:40 pm. At some point during the test, SpaceX likely actuated hydraulic arms attached to Starship’s engine section to simulate the stresses of Raptor thrust under cryogenic loads. Either way, SpaceX was apparently satisfied with the results of Starship SN6’s first cryo proof and proceeded to cancel two backup windows scheduled on August 17th and 18th – a consistent sign that things either went very right or very wrong.

In the case of SN6, nothing was distinctly amiss or different during its cryo proof, pointing towards a successful test. If that’s the case, SpaceX will begin removing the hydraulic Raptor simulator to install an actual Raptor engine and will scheduled road closures for an imminent static fire test. Prior to that actual Raptor ignition test, SpaceX may choose to perform a wet dress rehearsal (WDR) on its own or partially test Raptor by igniting its preburners to momentarily spin up its turbopumps. The company could also integrate both of those precursor tests into the same window as the static fire itself.

If those tests go according to plan, Starship SN6 could be ready for SpaceX’s second full-scale hop ever just a week (or less) later. CEO Elon Musk says that the company’s current goal is to perform multiple Starship tests until the process is fast, smooth, and consistent.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

Elon Musk

Tesla hits major milestone with Full Self-Driving subscriptions

Tesla has announced it has hit a major milestone with Full Self-Driving subscriptions, shortly after it said it would exclusively offer the suite without the option to purchase it outright.

Tesla announced on Wednesday during its Q4 Earnings Call for 2025 that it had officially eclipsed the one million subscription mark for its Full Self-Driving suite. This represented a 38 percent increase year-over-year.

This is up from the roughly 800,000 active subscriptions it reported last year. The company has seen significant increases in FSD adoption over the past few years, as in 2021, it reported just 400,000. In 2022, it was up to 500,000 and, one year later, it had eclipsed 600,000.

NEWS: For the first time, Tesla has revealed how many people are subscribed or have purchased FSD (Supervised).

Active FSD Subscriptions:

• 2025: 1.1 million

• 2024: 800K

• 2023: 600K

• 2022: 500K

• 2021: 400K pic.twitter.com/KVtnyANWcs— Sawyer Merritt (@SawyerMerritt) January 28, 2026

In mid-January, CEO Elon Musk announced that the company would transition away from giving the option to purchase the Full Self-Driving suite outright, opting for the subscription program exclusively.

Musk said on X:

“Tesla will stop selling FSD after Feb 14. FSD will only be available as a monthly subscription thereafter.”

The move intends to streamline the Full Self-Driving purchase option, and gives Tesla more control over its revenue, and closes off the ability to buy it outright for a bargain when Musk has said its value could be close to $100,000 when it reaches full autonomy.

It also caters to Musk’s newest compensation package. One tranche requires Tesla to achieve 10 million active FSD subscriptions, and now that it has reached one million, it is already seeing some growth.

The strategy that Tesla will use to achieve this lofty goal is still under wraps. The most ideal solution would be to offer a less expensive version of the suite, which is not likely considering the company is increasing its capabilities, and it is becoming more robust.

Tesla is shifting FSD to a subscription-only model, confirms Elon Musk

Currently, Tesla’s FSD subscription price is $99 per month, but Musk said this price will increase, which seems counterintuitive to its goal of increasing the take rate. With that being said, it will be interesting to see what Tesla does to navigate growth while offering a robust FSD suite.

News

Tesla confirms Robotaxi expansion plans with new cities and aggressive timeline

Tesla plans to launch in Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas. It lists the Bay Area as “Safety Driver,” and Austin as “Ramping Unsupervised.”

Tesla confirmed its intentions to expand the Robotaxi program in the United States with an aggressive timeline that aims to send the ride-hailing service to several large cities very soon.

The Robotaxi program is currently active in Austin, Texas, and the California Bay Area, but Tesla has received some approvals for testing in other areas of the U.S., although it has not launched in those areas quite yet.

However, the time is coming.

During Tesla’s Q4 Earnings Call last night, the company confirmed that it plans to expand the Robotaxi program aggressively, hoping to launch in seven new cities in the first half of the year.

Tesla plans to launch in Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas. It lists the Bay Area as “Safety Driver,” and Austin as “Ramping Unsupervised.”

These details were released in the Earnings Shareholder Deck, which is published shortly before the Earnings Call:

🚨 BREAKING: Tesla plans to launch its Robotaxi service in Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas in the first half of this year pic.twitter.com/aTnruz818v

— TESLARATI (@Teslarati) January 28, 2026

Late last year, Tesla revealed it had planned to launch Robotaxi in Las Vegas, Phoenix, Dallas, and Houston, but Tampa and Orlando were just added to the plans, signaling an even more aggressive expansion than originally planned.

Tesla feels extremely confident in its Robotaxi program, and that has been reiterated many times.

Although skeptics still remain hesitant to believe the prowess Tesla has seemingly proven in its development of an autonomous driving suite, the company has been operating a successful program in Austin and the Bay Area for months.

In fact, it announced it achieved nearly 700,000 paid Robotaxi miles since launching Robotaxi last June.

🚨 Tesla has achieved nearly 700,000 paid Robotaxi miles since launching in June of last year pic.twitter.com/E8ldSW36La

— TESLARATI (@Teslarati) January 28, 2026

With the expansion, Tesla will be able to penetrate more of the ride-sharing market, disrupting the human-operated platforms like Uber and Lyft, which are usually more expensive and are dependent on availability.

Tesla launched driverless rides in Austin last week, but they’ve been few and far between, as the company is certainly easing into the program with a very cautiously optimistic attitude, aiming to prioritize safety.

Investor's Corner

Tesla (TSLA) Q4 and FY 2025 earnings call: The most important points

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Tesla’s (NASDAQ:TSLA) Q4 and FY 2025 earnings call highlighted improving margins, record energy performance, expanding autonomy efforts, and a sharp acceleration in AI and robotics investments.

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Key takeaways

Tesla reported sequential improvement in automotive gross margins excluding regulatory credits, rising from 15.4% to 17.9%, supported by favorable regional mix effects despite a 16% decline in deliveries. Total gross margin exceeded 20.1%, the highest level in more than two years, even with lower fixed-cost absorption and tariff impacts.

The energy business delivered standout results, with revenue reaching nearly $12.8 billion, up 26.6% year over year. Energy gross profit hit a new quarterly record, driven by strong global demand and high deployments of MegaPack and Powerwall across all regions, as noted in a report from The Motley Fool.

Tesla also stated that paid Full Self-Driving customers have climbed to nearly 1.1 million worldwide, with about 70% having purchased FSD outright. The company has now fully transitioned FSD to a subscription-based sales model, which should create a short-term margin headwind for automotive results.

Free cash flow totaled $1.4 billion for the quarter. Operating expenses rose by $500 million sequentially as well.

Production shifts, robotics, and AI investment

Musk further confirmed that Model S and Model X production is expected to wind down next quarter, and plans are underway to convert Fremont’s S/X line into an Optimus robot factory with a capacity of one million units.

Tesla’s Robotaxi fleet has surpassed 500 vehicles, operating across the Bay Area and Austin, with Musk noting a rapid monthly expansion pace. He also reiterated that CyberCab production is expected to begin in April, following a slow initial S-curve ramp before scaling beyond other vehicle programs.

Looking ahead, Tesla expects its capital expenditures to exceed $20 billion next year, thanks to the company’s operations across its six factories, the expansion of its fleet expansion, and the ramp of its AI compute. Additional investments in AI chips, compute infrastructure, and future in-house semiconductor manufacturing were discussed but are not included in the company’s current CapEx guidance.

More importantly, Tesla ended the year with a larger backlog than in recent years. This is supported by record deliveries in smaller international markets and stronger demand across APAC and EMEA. Energy backlog remains strong globally as well, though Tesla cautioned that margin pressure could emerge from competition, policy uncertainty, and tariffs.