News

Tesla’s sole ownership of Giga Shanghai is a silver bullet amid China’s anti-combustion engine initiative

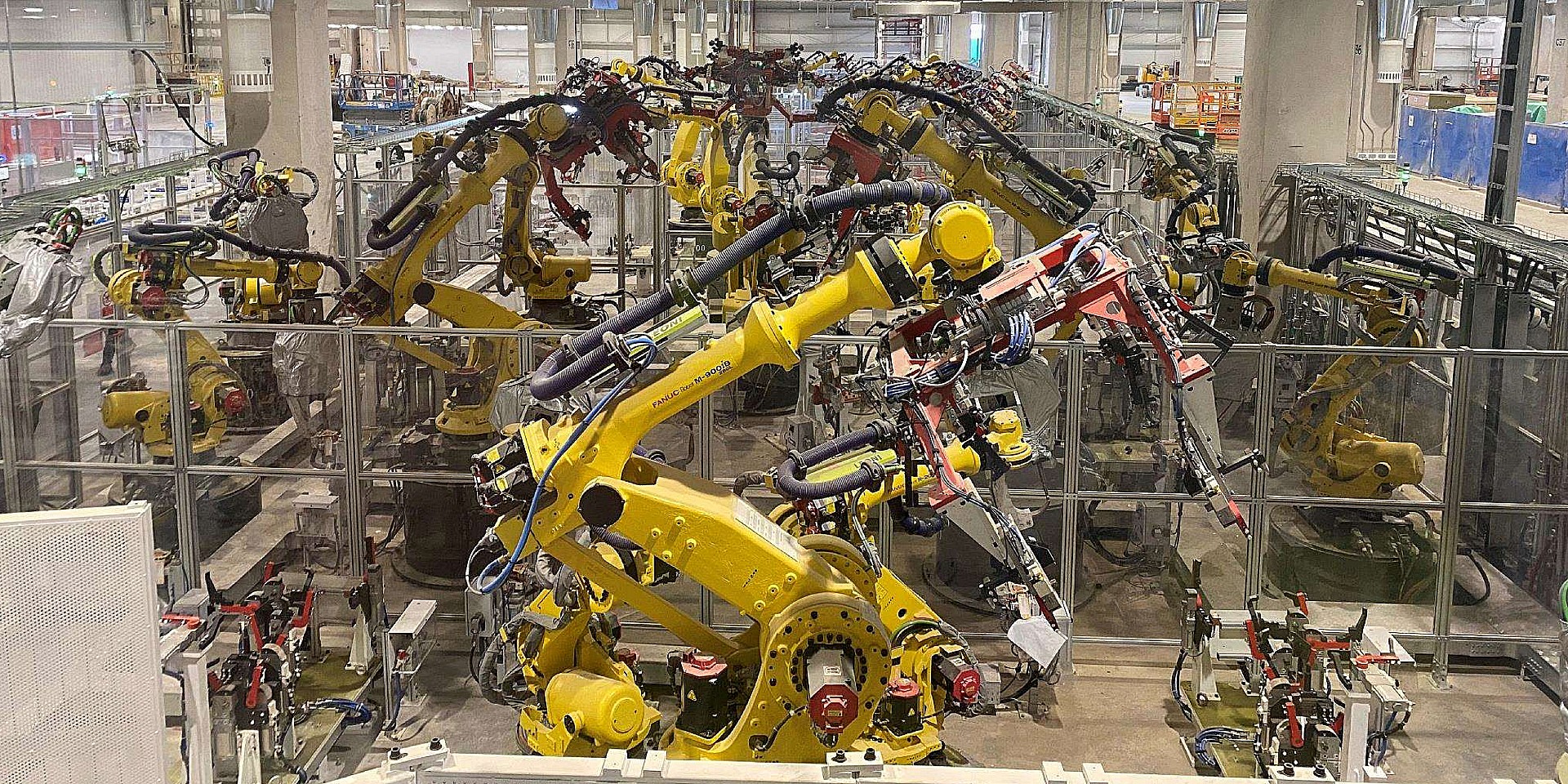

It may seem almost unremarkable today, but the fact that Tesla holds sole ownership of Gigafactory Shanghai is nothing to scoff at. This is especially notable as China implements a strong push against the internal combustion engine, as highlighted by the country’s new rules that make it extremely difficult to establish a factory producing gas-powered cars starting 2021.

In September 2019, a top Chinese industry official announced during an automobile conference that the country was planning on phasing out fossil fuel-powered vehicles. Few details were shared during the time, but recent updates from China show just how serious the initiative would be.

At a press conference on Tuesday, the National Development and Reform Commission, the country’s top economic planner, noted that China will no longer allow new companies that make fossil fuel-powered vehicles to be set up in the country. The new rules, which were published last week, came after the commission announced notable changes to China’s auto industry investment policies earlier this year.

China has taken a very supportive stance for its new energy vehicle segment, which comprises battery-electric, hybrid, and fuel-cell cars. Currently, the country stands as the world’s largest market for electric vehicles, and it has implemented programs that are aimed at discouraging car buyers from purchasing fossil fuel-burning cars. Among these are restrictions for ICE cars in cities to notable subsidies for new energy vehicles.

With China’s updated rules in place, even existing carmakers that have already established a presence in the country will find it difficult to expand their manufacturing operations for gas-powered cars. If an automaker wishes to establish an ICE vehicle factory, the company would have to meet several strict requirements.

These include proving that their manufacturing efficiencies are higher than the industry average. Companies that produce ICE cars must also make more new energy vehicles than the industry average. Automakers must spend at least 3% of their revenue on NEV research and development as well, among other requirements.

China’s update sets the bar for carmakers so high that only a few companies are expected to meet it, such as Geely and SAIC, an automaker that is state-owned and based in Shanghai. Both companies currently stand among China’s top automakers, as per data from the China Association of Automobile Manufacturers, an organization that is affiliated with the government.

Amidst these developments, Tesla’s Gigafactory Shanghai could effectively ramp without being weighed down by restrictions from the Chinese government. Tesla’s sole ownership of the expansive facility also means that the electric car maker will stand to benefit immensely from the facility’s expansion and growth. This could be a massive edge or even a silver bullet of sorts for Tesla next year when the Made-in-China Model Y begins its rollout.

Tesla may only be an emerging carmaker in China today, but the company has received some notable support from the government over the years. Prior to Gigafactory Shanghai’s groundbreaking event, Tesla was able to secure low-interest loans from local banks without any issues. The bidding process for the land where the China-based factory also proved smooth for Tesla, with the electric car maker strangely being the only company that placed a bid for the site.

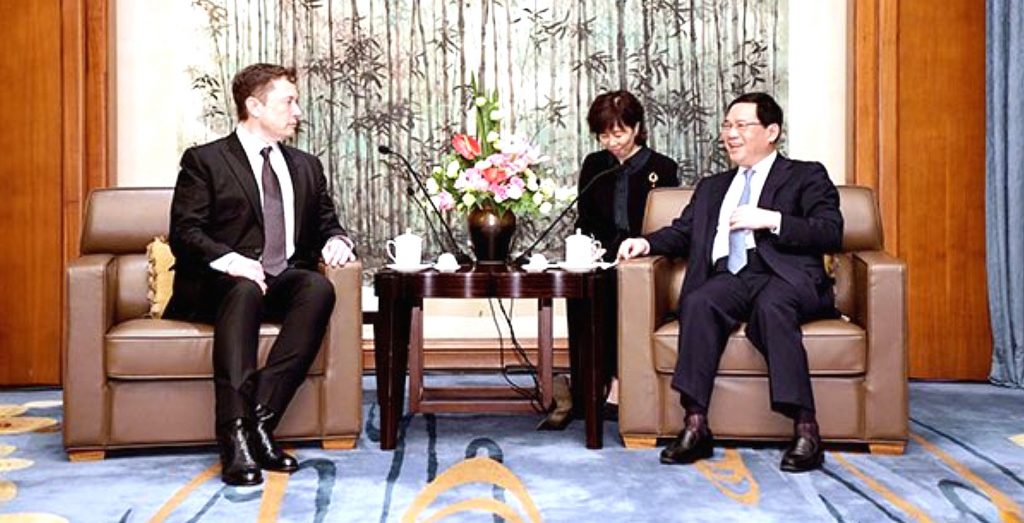

Open support for Tesla was also shown by high-ranking government officials such as Chinese Premier Li Keqiang, who personally hosted CEO Elon Musk in the Tower of Violet Light, a site usually reserved for foreign dignitaries, following Gigafactory Shanghai’s groundbreaking ceremony. During their meeting, Li proved optimistic about Tesla’s future in China, at one point even offering Musk a “Chinese Green Card” so that he could pursue his projects in the country.

Cybertruck

Tesla analyst claims another vehicle, not Model S and X, should be discontinued

Tesla analyst Gary Black of The Future Fund claims that the company is making a big mistake getting rid of the Model S and Model X. Instead, he believes another vehicle within the company’s lineup should be discontinued: the Cybertruck.

Black divested The Future Fund from all Tesla holdings last year, but he still covers the stock as an analyst as it falls in the technology and autonomy sectors, which he covers.

In a new comment on Thursday, Black said the Cybertruck should be the vehicle Tesla gets rid of due to the negatives it has drawn to the company.

The Cybertruck is also selling in an underwhelming fashion considering the production capacity Tesla has set aside for it. It’s worth noting it is still the best-selling electric pickup on the market, and it has outlasted other EV truck projects as other manufacturers are receding their efforts.

Black said:

“IMHO it’s a mistake to keep Tesla Cybertruck which has negative brand equity and sold 10,000 units last year, and discontinue S/X which have strong repeat brand loyalty and together sold 30K units and are highly profitable. Why not discontinue CT and covert S/X to be fully autonomous?”

IMHO it’s a mistake to keep $TSLA Cybertruck which has negative brand equity and sold 10,000 units last year, and discontinue S/X which have strong repeat brand loyalty and together sold 30K units and are highly profitable. Why not discontinue CT and covert S/X to be fully…

— Gary Black (@garyblack00) January 29, 2026

On Wednesday, CEO Elon Musk confirmed that Tesla planned to transition Model S and Model X production lines at the Fremont Factory to handle manufacturing efforts of the Optimus Gen 3 robot.

Musk said that it was time to wind down the S and X programs “with an honorable discharge,” also noting that the two cars are not major contributors to Tesla’s mission any longer, as its automotive division is more focused on autonomy, which will be handled by Model 3, Model Y, and Cybercab.

Tesla begins Cybertruck deliveries in a new region for the first time

The news has drawn conflicting perspectives, with many Tesla fans upset about the decision, especially as it ends the production of the largest car in the company’s lineup. Tesla’s focus is on smaller ride-sharing vehicles, especially as the vast majority of rides consist of two or fewer passengers.

The S and X do not fit in these plans.

Nevertheless, the Cybertruck fits in Tesla’s future plans. Musk said the pickup will be needed for the transportation of local goods. Musk also said Cybertruck would be transitioned to an autonomous line.

Elon Musk

SpaceX reportedly discussing merger with xAI ahead of blockbuster IPO

In a groundbreaking new report from Reuters, SpaceX is reportedly discussing merger possibilities with xAI ahead of the space exploration company’s plans to IPO later this year, in what would be a blockbuster move.

The outlet said it would combine rockets and Starlink satellites, as well as the X social media platform and AI project Grok under one roof. The report cites “a person briefed on the matter and two recent company filings seen by Reuters.”

Musk, nor SpaceX or xAI, have commented on the report, so, as of now, it is unconfirmed.

With that being said, the proposed merger would bring shares of xAI in exchange for shares of SpaceX. Both companies were registered in Nevada to expedite the transaction, according to the report.

On January 21, both entities were registered in Nevada. The report continues:

“One of them, a limited liability company, lists SpaceX and Bret Johnsen, the company’s chief financial officer, as managing members, while the other lists Johnsen as the company’s only officer, the filings show.”

The source also stated that some xAI executives could be given the option to receive cash in lieu of SpaceX stock. No agreement has been reached, nothing has been signed, and the timing and structure, as well as other important details, have not been finalized.

SpaceX is valued at $800 billion and is the most valuable privately held company, while xAI is valued at $230 billion as of November. SpaceX could be going public later this year, as Musk has said as recently as December that the company would offer its stock publicly.

The plans could help move along plans for large-scale data centers in space, something Musk has discussed on several occasions over the past few months.

At the World Economic Forum last week, Musk said:

“It’s a no-brainer for building solar-powered AI data centers in space, because as I mentioned, it’s also very cold in space. The net effect is that the lowest cost place to put AI will be space and that will be true within two to three years, three at the latest.”

He also said on X that “the most important thing in the next 3-4 years is data centers in space.”

If the report is true and the two companies end up coming together, it would not be the first time Musk’s companies have ended up coming together. He used Tesla stock to purchase SolarCity back in 2016. Last year, X became part of xAI in a share swap.

Elon Musk

Tesla hits major milestone with Full Self-Driving subscriptions

Tesla has announced it has hit a major milestone with Full Self-Driving subscriptions, shortly after it said it would exclusively offer the suite without the option to purchase it outright.

Tesla announced on Wednesday during its Q4 Earnings Call for 2025 that it had officially eclipsed the one million subscription mark for its Full Self-Driving suite. This represented a 38 percent increase year-over-year.

This is up from the roughly 800,000 active subscriptions it reported last year. The company has seen significant increases in FSD adoption over the past few years, as in 2021, it reported just 400,000. In 2022, it was up to 500,000 and, one year later, it had eclipsed 600,000.

NEWS: For the first time, Tesla has revealed how many people are subscribed or have purchased FSD (Supervised).

Active FSD Subscriptions:

• 2025: 1.1 million

• 2024: 800K

• 2023: 600K

• 2022: 500K

• 2021: 400K pic.twitter.com/KVtnyANWcs— Sawyer Merritt (@SawyerMerritt) January 28, 2026

In mid-January, CEO Elon Musk announced that the company would transition away from giving the option to purchase the Full Self-Driving suite outright, opting for the subscription program exclusively.

Musk said on X:

“Tesla will stop selling FSD after Feb 14. FSD will only be available as a monthly subscription thereafter.”

The move intends to streamline the Full Self-Driving purchase option, and gives Tesla more control over its revenue, and closes off the ability to buy it outright for a bargain when Musk has said its value could be close to $100,000 when it reaches full autonomy.

It also caters to Musk’s newest compensation package. One tranche requires Tesla to achieve 10 million active FSD subscriptions, and now that it has reached one million, it is already seeing some growth.

The strategy that Tesla will use to achieve this lofty goal is still under wraps. The most ideal solution would be to offer a less expensive version of the suite, which is not likely considering the company is increasing its capabilities, and it is becoming more robust.

Tesla is shifting FSD to a subscription-only model, confirms Elon Musk

Currently, Tesla’s FSD subscription price is $99 per month, but Musk said this price will increase, which seems counterintuitive to its goal of increasing the take rate. With that being said, it will be interesting to see what Tesla does to navigate growth while offering a robust FSD suite.