News

(Update: nope) SpaceX looks to double its valuation on Starlink, Starship promise

SpaceX CEO Elon Musk has responded, stating that it is “incorrect” to say that the company is seeking to double its valuation with a new round of funding.

Broken by Business Insider, SpaceX was said to be working with investors to close another round of funding sometime in early 2021 with the intention of growing its valuation from around $46 billion to $92 billion or more. Bloomberg reiterated BI’s reporting not long after. According to Musk, however, that’s incorrect. The CEO didn’t specify the error, meaning that SpaceX is probably pursuing more funding – a never-ending process – but isn’t trying to double its valuation and share price in a single round.

Business Insider reports that SpaceX is hard at work securing another massive round of funding on the promise of Starlink and Starship just months after raising almost $2 billion.

Aside from raising a truly massive amount of capital, SpaceX’s primary goal, according to BI, is to double its valuation from some $46 billion to $92 billion.

In the history of “unicorn” startups, generally referring to primarily venture capital-funded private technology companies worth more than $1 billion, doubling valuation with a single funding round is rare – particularly in the few private startups worth more than $10 billion. Typically, in large unicorns, nothing short of a highly successful stock market IPO is capable of doubling a company’s valuation.

In SpaceX’s own prolific fundraising history, the company has occasionally pulled off similar feats. In a 2015 funding round led by Google and Fidelity, SpaceX’s valuation exploded tenfold from ~$1 billion to more than $10 billion. Closed in 2017, the company’s next funding round again pulled off a valuation multiplication, leaping from $10.1 billion to $21.3 billion. However, of the seven additional rounds completed since then, ranging from $214 million to $1.9 billion, SpaceX’s valuation has never jumped by more than ~28%.

In the wild and wacky world of private startup valuation, SpaceX could technically sell a single share for ~$500 – twice the current price of ~$250 – and retroactively raise the price of all outstanding shares. Doubling an already massive valuation on a low-volume equity sale would not exactly inspire confidence, however, and SpaceX has no obvious reason not to shoot for the stars given the company’s massive $1.9 billion Series N windfall just four months ago.

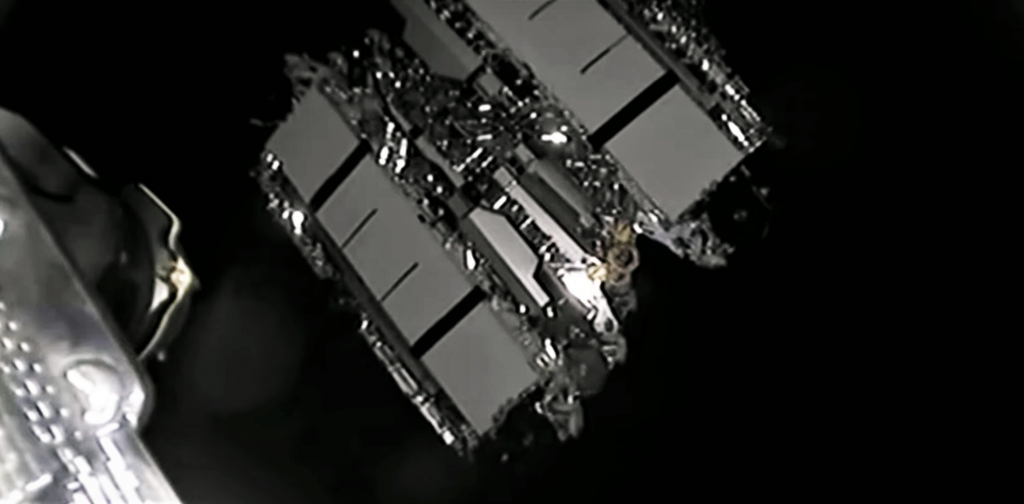

As has been the case for several years, now, SpaceX is most likely pitching investors on the potentially extraordinary promise of its Starlink and Starship programs, both of which could easily grow the company’s annual revenue by one or several magnitudes. In just 13 months, SpaceX has launched some 875 operational Starlink satellites, built and tested a dozen full-scale Starship prototypes, hopped two of those rockets to 150m (~500 ft), and flown one to 12.5 km (~7.8 mi). The company is also on track to launch an unprecedented 26 times in 2020 alone, 14 of which were Starlink missions.

As such, while a twofold, $46-billion leap in valuation is extraordinarily outlandish, SpaceX is perhaps the one private company in the world that can actually point to a track record of success and potential sources of growth that might warrant it. Stay tuned for details as they begin to trickle out.

Cybertruck

Tesla analyst claims another vehicle, not Model S and X, should be discontinued

Tesla analyst Gary Black of The Future Fund claims that the company is making a big mistake getting rid of the Model S and Model X. Instead, he believes another vehicle within the company’s lineup should be discontinued: the Cybertruck.

Black divested The Future Fund from all Tesla holdings last year, but he still covers the stock as an analyst as it falls in the technology and autonomy sectors, which he covers.

In a new comment on Thursday, Black said the Cybertruck should be the vehicle Tesla gets rid of due to the negatives it has drawn to the company.

The Cybertruck is also selling in an underwhelming fashion considering the production capacity Tesla has set aside for it. It’s worth noting it is still the best-selling electric pickup on the market, and it has outlasted other EV truck projects as other manufacturers are receding their efforts.

Black said:

“IMHO it’s a mistake to keep Tesla Cybertruck which has negative brand equity and sold 10,000 units last year, and discontinue S/X which have strong repeat brand loyalty and together sold 30K units and are highly profitable. Why not discontinue CT and covert S/X to be fully autonomous?”

IMHO it’s a mistake to keep $TSLA Cybertruck which has negative brand equity and sold 10,000 units last year, and discontinue S/X which have strong repeat brand loyalty and together sold 30K units and are highly profitable. Why not discontinue CT and covert S/X to be fully…

— Gary Black (@garyblack00) January 29, 2026

On Wednesday, CEO Elon Musk confirmed that Tesla planned to transition Model S and Model X production lines at the Fremont Factory to handle manufacturing efforts of the Optimus Gen 3 robot.

Musk said that it was time to wind down the S and X programs “with an honorable discharge,” also noting that the two cars are not major contributors to Tesla’s mission any longer, as its automotive division is more focused on autonomy, which will be handled by Model 3, Model Y, and Cybercab.

Tesla begins Cybertruck deliveries in a new region for the first time

The news has drawn conflicting perspectives, with many Tesla fans upset about the decision, especially as it ends the production of the largest car in the company’s lineup. Tesla’s focus is on smaller ride-sharing vehicles, especially as the vast majority of rides consist of two or fewer passengers.

The S and X do not fit in these plans.

Nevertheless, the Cybertruck fits in Tesla’s future plans. Musk said the pickup will be needed for the transportation of local goods. Musk also said Cybertruck would be transitioned to an autonomous line.

Elon Musk

SpaceX reportedly discussing merger with xAI ahead of blockbuster IPO

In a groundbreaking new report from Reuters, SpaceX is reportedly discussing merger possibilities with xAI ahead of the space exploration company’s plans to IPO later this year, in what would be a blockbuster move.

The outlet said it would combine rockets and Starlink satellites, as well as the X social media platform and AI project Grok under one roof. The report cites “a person briefed on the matter and two recent company filings seen by Reuters.”

Musk, nor SpaceX or xAI, have commented on the report, so, as of now, it is unconfirmed.

With that being said, the proposed merger would bring shares of xAI in exchange for shares of SpaceX. Both companies were registered in Nevada to expedite the transaction, according to the report.

On January 21, both entities were registered in Nevada. The report continues:

“One of them, a limited liability company, lists SpaceX and Bret Johnsen, the company’s chief financial officer, as managing members, while the other lists Johnsen as the company’s only officer, the filings show.”

The source also stated that some xAI executives could be given the option to receive cash in lieu of SpaceX stock. No agreement has been reached, nothing has been signed, and the timing and structure, as well as other important details, have not been finalized.

SpaceX is valued at $800 billion and is the most valuable privately held company, while xAI is valued at $230 billion as of November. SpaceX could be going public later this year, as Musk has said as recently as December that the company would offer its stock publicly.

The plans could help move along plans for large-scale data centers in space, something Musk has discussed on several occasions over the past few months.

At the World Economic Forum last week, Musk said:

“It’s a no-brainer for building solar-powered AI data centers in space, because as I mentioned, it’s also very cold in space. The net effect is that the lowest cost place to put AI will be space and that will be true within two to three years, three at the latest.”

He also said on X that “the most important thing in the next 3-4 years is data centers in space.”

If the report is true and the two companies end up coming together, it would not be the first time Musk’s companies have ended up coming together. He used Tesla stock to purchase SolarCity back in 2016. Last year, X became part of xAI in a share swap.

Elon Musk

Tesla hits major milestone with Full Self-Driving subscriptions

Tesla has announced it has hit a major milestone with Full Self-Driving subscriptions, shortly after it said it would exclusively offer the suite without the option to purchase it outright.

Tesla announced on Wednesday during its Q4 Earnings Call for 2025 that it had officially eclipsed the one million subscription mark for its Full Self-Driving suite. This represented a 38 percent increase year-over-year.

This is up from the roughly 800,000 active subscriptions it reported last year. The company has seen significant increases in FSD adoption over the past few years, as in 2021, it reported just 400,000. In 2022, it was up to 500,000 and, one year later, it had eclipsed 600,000.

NEWS: For the first time, Tesla has revealed how many people are subscribed or have purchased FSD (Supervised).

Active FSD Subscriptions:

• 2025: 1.1 million

• 2024: 800K

• 2023: 600K

• 2022: 500K

• 2021: 400K pic.twitter.com/KVtnyANWcs— Sawyer Merritt (@SawyerMerritt) January 28, 2026

In mid-January, CEO Elon Musk announced that the company would transition away from giving the option to purchase the Full Self-Driving suite outright, opting for the subscription program exclusively.

Musk said on X:

“Tesla will stop selling FSD after Feb 14. FSD will only be available as a monthly subscription thereafter.”

The move intends to streamline the Full Self-Driving purchase option, and gives Tesla more control over its revenue, and closes off the ability to buy it outright for a bargain when Musk has said its value could be close to $100,000 when it reaches full autonomy.

It also caters to Musk’s newest compensation package. One tranche requires Tesla to achieve 10 million active FSD subscriptions, and now that it has reached one million, it is already seeing some growth.

The strategy that Tesla will use to achieve this lofty goal is still under wraps. The most ideal solution would be to offer a less expensive version of the suite, which is not likely considering the company is increasing its capabilities, and it is becoming more robust.

Tesla is shifting FSD to a subscription-only model, confirms Elon Musk

Currently, Tesla’s FSD subscription price is $99 per month, but Musk said this price will increase, which seems counterintuitive to its goal of increasing the take rate. With that being said, it will be interesting to see what Tesla does to navigate growth while offering a robust FSD suite.