News

Elon Musk’s SolarCity trial day 1: Arguments, quotes, and testy exchanges

As he faced a lawsuit from Tesla shareholders about the SolarCity acquisition in 2016, Elon Musk was firm in the notion that he didn’t have any sway over the company’s board when it approved the deal. Musk highlighted this point on Monday, as he testified in a Delaware courtroom as part of a lawsuit filed by Tesla shareholders, who alleged that both the CEO and the company’s board breached fiduciary duties when they decided to acquire SolarCity.

When SolarCity was acquired by Tesla, Musk was the chair of the company and its largest shareholder. The CEO later noted that the acquisition was a “no brainer,” and it was completed with over 85% of TSLA shareholders voting in favor of the deal. Considering Musk’s ties to SolarCity and the solar installer company’s financial fluctuations at the time, however, critics argued that the deal was essentially a bailout. Musk was also accused of vowing retaliation against any Tesla director who voted against the acquisition.

According to Musk, Tesla’s now-Chairwoman Robyn Denholm was the one who set the final price of the deal, as well as the terms of the SolarCity acquisition. Musk noted that he was kept abreast on the basic progress of the deal, but he was otherwise recused. The CEO also stated that the notion of him controlling Tesla shareholders was implausible. “I don’t think it’s possible to control” big institutional investors like Fidelity and T. Rowe Price,” Musk said.

Things heated up when Musk started responding to questions from Randy Baron, the plaintiff’s lawyer who had already traded barbs with the CEO in the past. From the start, Baron gave Musk “fair warning” that “we have a long way to go,” and that his questioning would probably take all day and well into Tuesday. Musk joked, stating that he could tell the questioning would be long due to the size of Baron’s binder.

As part of his cross-examination, Baron showed a slide showing how far below forecasts was the amount of solar energy Tesla has deployed since its acquisition of SolarCity, especially as the solar provider was one of the US’ most dominant players in the residential solar market before it was integrated with the EV maker. Musk responded that 2017 to 2019 were the “three hardest years of (his) entire career” and that he was working hard to save Tesla at the time. After this, the pandemic shut down government permitting offices, which was a challenge to the US residential solar market. When Baron warned him that things would be really slow if Musk kept elaborating on his answers, the CEO noted that “some of your questions are tricky and deceptive.”

Musk and Baron’s exchanges only got more heated as the day wore on. When Baron asked Musk if he ever “rage fired” anyone or treated people with derision, the CEO noted that he gives “clear and frank feedback which may be construed as derision,” but he did not “rage fire” anyone. The lawyer then played several clips of Musk’s deposition showing his tense exchanges with the CEO. “That was openly derisive not for some benefit of Tesla, but because you didn’t like what was happening, correct?” Baron asked in an apparent attempt at provoking Musk.

Musk later said that he does not respect Baron because he worked for Milberg Weiss, a law firm whose partners were imprisoned for paying kickbacks to expert witnesses and plaintiffs; and Robbins Geller, whose partners also ended up incarcerated. “You were mentored by criminals. Then you continued to be mentored by criminals and that is why I do not respect you… I have great respect for the court, but not for you. I think you are a bad human being,” Musk said, later accusing Baron of being a “professional bully” who used his words to cut. “That’s very sad,” the CEO remarked.

Other loaded exchanges between Musk and Baron happened after the lawyer asked the CEO if he does not like it when people tell him what to do. Musk calmly responded that this was not exactly the case. “In fact, if I’m not mistaken, I view critical feedback as a gift,” Musk stated. This point could be confirmed by Musk’s reception to critical feedback from automotive veteran Sandy Munro, who heavily criticized the Model 3’s design in a teardown. Musk also added that if it were up to him, he would rather just work as an engineer.

“To be honest, I don’t want to be the boss of anything. I won’t want to be CEO. I tried not to be CEO of Tesla, but I had to, or it would die. I rather hate being a boss. I’m an engineer,” Musk said.

Amidst Musk’s exchanges with Baron, however, the CEO’s point was clear. SolarCity, like any aggressive startup in a high-growth industry, had a tendency to have negative cash flow. Musk noted that Amazon was an example of this, and so was Tesla, and yet, both companies are thriving now. Simply put, the CEO argued that SolarCity’s financial strains when it was acquired were not out of the norm, as even Tesla was in the same place at the time, and if needed, the solar company could have just raised capital.

“Daring enterprises burn cash and take risks to achieve something worthwhile, or even great. Tesla was subject to those risks as much as SolarCity was, but that doesn’t mean they weren’t both worthy ventures. So can’t we acknowledge that even my once-stumbling solar efforts are starting to bear fruit?” Musk noted.

The first day of Elon Musk’s SolarCity trial was adjourned until 9:15 a.m. ET on Tuesday. The CEO is expected to continue his cross-examination with the plaintiff’s lawyer.

Don’t hesitate to contact us with news tips. Just send a message to tips@teslarati.com to give us a heads up.

Energy

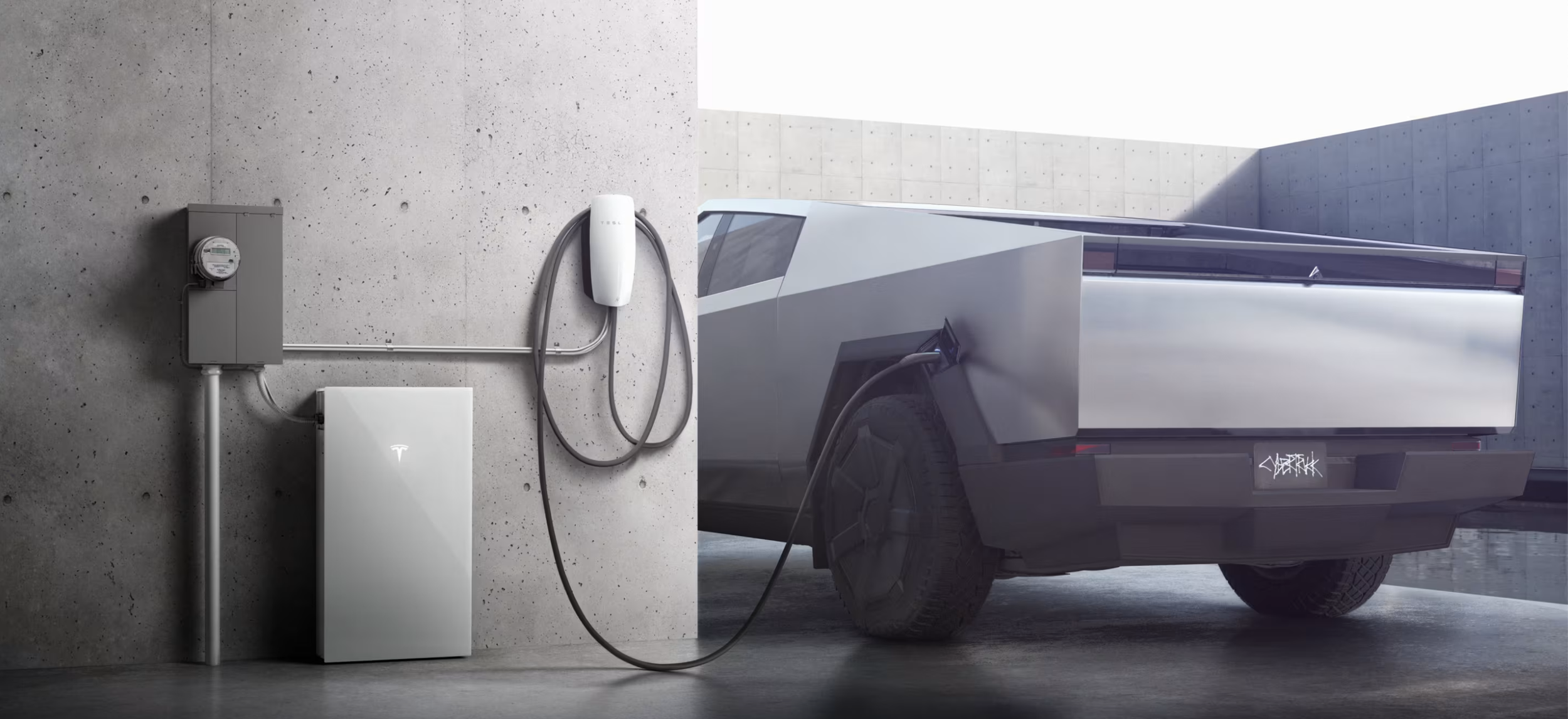

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.

News

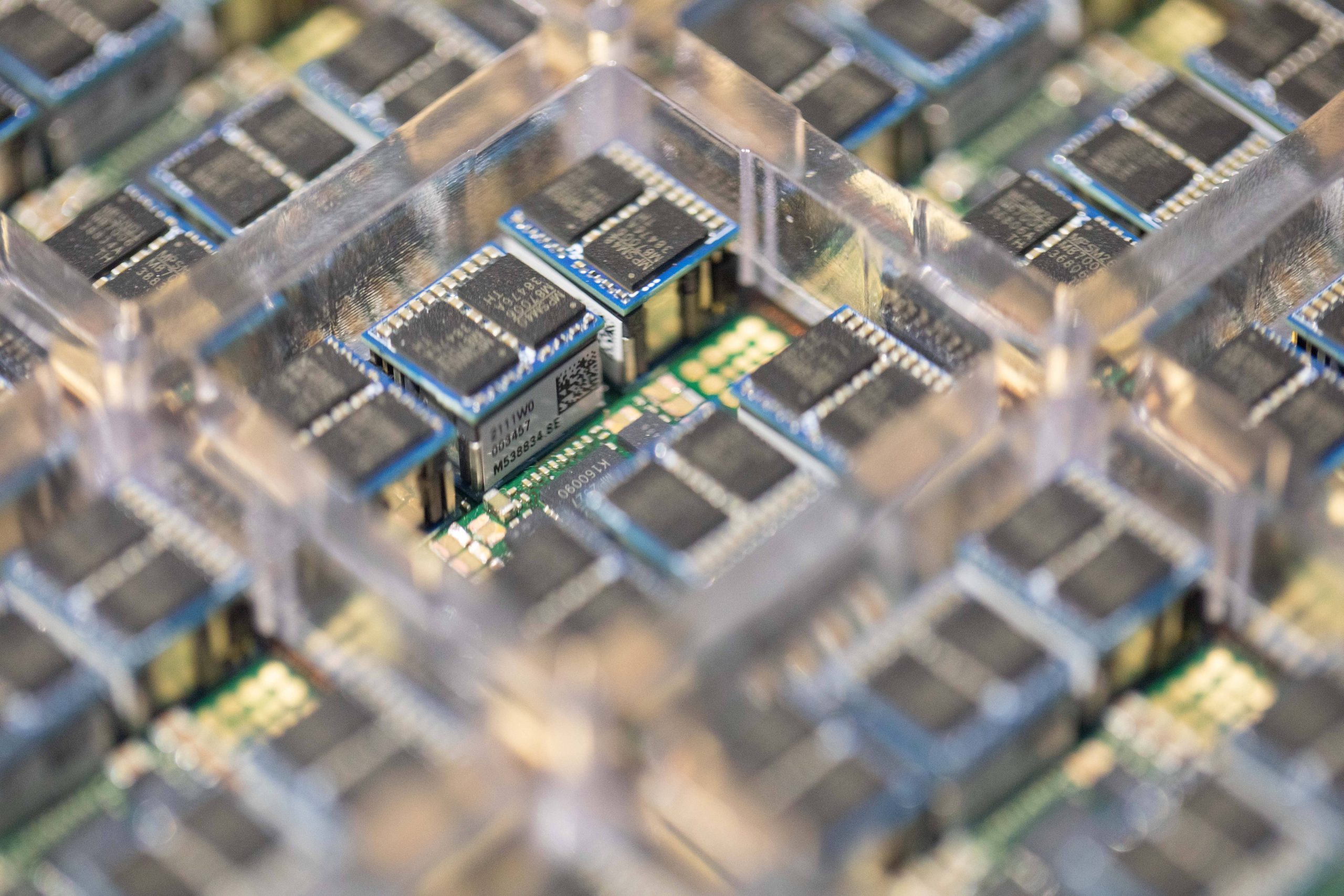

Samsung nears Tesla AI chip ramp with early approval at TX factory

This marks a key step towards the tech giant’s production of Tesla’s next-generation AI5 chips in the United States.

Samsung has received temporary approval to begin limited operations at its semiconductor plant in Taylor, Texas.

This marks a key step towards the tech giant’s production of Tesla’s next-generation AI5 chips in the United States.

Samsung clears early operations hurdle

As noted in a report from Korea JoongAng Daily, Samsung Electronics has secured temporary certificates of occupancy (TCOs) for a portion of its semiconductor facility in Taylor. This should allow the facility to start operations ahead of full completion later this year.

City officials confirmed that approximately 88,000 square feet of Samsung’s Fab 1 building has received temporary approval, with additional areas expected to follow. The overall timeline for permitting the remaining sections has not yet been finalized.

Samsung’s Taylor facility is expected to manufacture Tesla’s AI5 chips once mass production begins in the second half of the year. The facility is also expected to produce Tesla’s upcoming AI6 chips.

Tesla CEO Elon Musk recently stated that the design for AI5 is nearly complete, and the development of AI6 is already underway. Musk has previously outlined an aggressive roadmap targeting nine-month design cycles for successive generations of its AI chips.

Samsung’s U.S. expansion

Construction at the Taylor site remains on schedule. Reports indicate Samsung plans to begin testing extreme ultraviolet (EUV) lithography equipment next month, a critical step for producing advanced 2-nanometer semiconductors.

Samsung is expected to complete 6 million square feet of floor space at the site by the end of this year, with an additional 1 million square feet planned by 2028. The full campus spans more than 1,200 acres.

Beyond Tesla, Samsung Foundry is also pursuing additional U.S. customers as demand for AI and high-performance computing chips accelerates. Company executives have stated that Samsung is looking to achieve more than 130% growth in 2-nanometer chip orders this year.

One of Samsung’s biggest rivals, TSMC, is also looking to expand its footprint in the United States, with reports suggesting that the company is considering expanding its Arizona facility to as many as 11 total plants. TSMC is also expected to produce Tesla’s AI5 chips.

News

Anti-Tesla union leader ditches X, urges use of Threads instead

Tesla Sweden and IF Metall have been engaged in a bitter dispute for over two years now.

Marie Nilsson, chair of Sweden’s IF Metall union and a prominent critic of Tesla, has left X and is urging audiences to follow the union on Meta’s Threads instead.

Tesla Sweden and IF Metall have been engaged in a bitter dispute for over two years now.

Anti-Tesla union leader exits X

In a comment to Dagens Arbete (DA), Nilsson noted that her exit from X is not formally tied to IF Metall’s long-running labor dispute with Tesla Sweden. Still, she stated that her departure is affected by changes to the platform under Elon Musk’s leadership.

“We have stayed because many journalists pick up news there. But as more and more people have left X, we have felt that the standard has now been reached on that platform,” she said.

Jesper Pettersson, press officer at IF Metall, highlighted that the union’s departure from X is only indirectly linked to Tesla Sweden and Elon Musk. “Indirectly it does, since there is a lot of evidence that his ownership has caused the change in the platform to be so significant.

“We have nevertheless assessed that the platform had value for reaching journalists, politicians and other opinion leaders. But it is a microscopic proportion of the public and our members who are there, and now that value has decreased,” Petterson added.

IF Metall sees Threads as an X alternative

After leaving X, IF Metall has begun using Threads, Meta’s alternative to the social media platform. The union described the move as experimental, noting that it is still evaluating how effective the platform will be for outreach and visibility.

Pettersson acknowledged that Meta also does not operate under Sweden’s collective bargaining model, but said the union sees little alternative if it wants to remain visible online.

“In a perfect world, all large international companies would be supporters of the Swedish model when they come here. But unfortunately, the reality is not like that. If we are to be visible at all in this social media world, we have to play by the rules of the game. The alternative would be to become completely invisible, and that would not benefit our members,” he said.