Nine profitable quarters and counting. With its blockbuster Q3 2021 results, Tesla (NASDAQ:TSLA) has all but proven that is a sustainable business. An earnings per share (EPS) of $1.86 and a monster 30.5% automotive gross margin just proves that. Tesla was bold in its Q3 2021 Update Letter, and for good reason. In the third quarter, Tesla achieved its best-ever net income, operating profit, and gross profit — all while its ASP decreased by 6% year-over-year.

As discussed in the company’s Q3 2021 Update Letter, Tesla achieved some milestones in the third quarter. The Fremont Factory has produced more than 430,000 vehicles on its own in the last four quarters, and it’s still being improved. Giga Shanghai has settled into its role as the company’s export hub, Giga Texas is in the pre-production stage of the Model Y, and Giga Berlin is ready to hit the ground running. Tesla Energy also continues to ramp.

The following are live updates from Tesla’s Q3 2021 earnings call. I will be updating this article in real-time, so please keep refreshing the page to view the latest updates on this story. The first entry starts at the bottom of the page.

15:33 PT: And that wraps up Tesla’s first Elon-less earnings call! Thanks so much for staying with us for today’s coverage. Until the next time then!

15:31 PT: Jonathan Dorsheimer from Cannacord. Kirkhorn noted that Tesla is aiming to produce its first vehicles in both Berlin and Texas by the end of the year. With this in mind, there is quite an execution journey ahead of the company. There should be no expectation that there will be cars delivered from Giga Berlin and Giga Texas this year, however, partly due to regulatory reasons. As for how this impacts margins, it’s difficult to predict. It’s tricky to really tell how ramping production will effect margins.

15:28 PT: Trip Chowdry asks about the differences about Giga Berlin and Giga Texas. He also asks about the supply for the Cybertruck’s exoskeleton.

Tesla notes that the Cybertruck is designed for durability. There are some early decisions that were made, but there’s progress being made. Suppliers are being tapped to ensure that the Cybertruck could be ramped fairly well. That being said, Tesla has already begun the casting of the Cybertruck’s initial exoskeleton.

As for the differences between Giga Berlin and Giga Texas, their differences are more unique to their respective regional locations.

15:24 PT: Brian Johnson from Barclays takes the floor. He thanks Tesla for not making the earnings call into a “one man show.” He asks about the progress on FSD and its timetable for Level 4 capability.

Kirkhorn noted that it’s difficult to be specific on FSD’s timelines. Tesla can only state that it’s working very hard on this, and the company has been very transparent on its development. “Tesla Autopilot is working extremely hard. “You can feel the progress,” Kirkhorn said. The team is moving quickly too, so improvements should be substantial.

Lars Moravy adds that Tesla always works with regulatory bodies, including the NHTSA. He noted that Tesla is providing the information as incidents occur, and it is one of the only companies that responded to these probes.

15:20 PT: Collin Rusch from Oppenheimer asks about battery anode materials. With regards to this inquiry, Tesla notes that the anode materials are not at the same place in terms of commodities. The company also reiterated the notion that its primary focus on the anode side is to reduce costs, at least without impeding the long-term recyclability.

As for the company’s vehicle pricing strategies, the CFO noted that there seems to be a profound awakening among consumers about electric vehicles. “There has been a profound awakening of desirability for EVs,” Kirkhorn said. It’s so notable that Tesla has practically been caught off guard. The company has installed capacity to produce products like its vehicles more, but the grind is real.

Addressing Tesla’s price volatility, the CFO noted that all car companies do this. Tesla just happens to be pretty transparent about it. These fluctuations are due to a variety of factors.

15:15 PT: Colin Langan from Wells Fargo takes the floor. He asks about any possible impact from the battery material price hikes. Kirkhorn noted that Tesla has indeed seen the impact of this, though the company is focused on nickel. The CFO notes that some of these costs have been passed on to the company. It’s also possible for Tesla to see some cost headwinds in the coming year, at least considering the volatility of the market right now. Kirkhorn noted that Tesla must lower the price of its products, and optimize its operations even further. “We have no choice but to continue on that path,” the CFO said.

15:11 PT: Joseph Spak from RBC takes the floor. He asks if Tesla has a aspirational gross margin target when in the long term? Kirkhorn notes that Tesla is implementing lots of efficiencies and production ramps in multiple sites. This would likely put downward pressure on the company’s gross margins in the near term. Cost increases on the commodity side are also present. “There are a number of unknown unknowns that we need to work through. We are seeing costs increase on the commodity side,” the CFO said.

Kirkhorn also noted that Tesla’s operating expenses are decreasing, and the company hopes to improve this in the next four to five quarters. Tesla, at least for now, is focused on lowering overhead expenses and operating expenses.

15:07 PT: Looks like Tesla’s Safety Score system is working so far. There are about 150,000 cars currently using the Safety Score system, and the company has so far noted that the probability of a collision for a customer using the safety score is about 30% lower. That’s not bad at all. “We’re off to a good start here,” Kirkhorn said.

15:05 PT: And Pierre Ferragu is here! He asks about Tesla Insurance, especially since the company has launched the service in Texas. He asks how Tesla will distribute this service. Will there be a marketing push? What’s the expansion plan? How fast will it happen?

Kirkhorn noted that he is extremely passionate about Tesla Insurance. Tesla is doing a lot if work in its efforts to enter the insurance market. “We want as many people as possible to afford our products,” the CFO said, noting that this is key to the company’s mission. As such, lowering insurance costs helps Tesla and its customers at the same time.

The CFO noted that traditional insurance typically utilizes limited data. And this causes some insurance rates for Teslas to be quite unfair. “Low-risk customers end up paying more, essentially subsidizing high-risk customers,” Kirkhorn said. Tesla Insurance aims to change this. There’s the Safety Score system, as well as the immense amount of data that Tesla can access from its vehicles. With this data, insurance pricing becomes a lot fairer.

14:59 PT: Looks like some tech issues there. Tesla is now checking in to solve the analysts’ technical issues. To pass the time, more investor questions are taken. An inquiry about transferring FSD to another vehicle was asked. Kirkhorn noted that a premium is paid by the company when it buys back vehicles that are equipped with FSD. “We’re already actually doing the sentiment of this question,” he said.

14:57 PT: Pierre Ferragu from New Street Research is up. His mic is not working, however. Joseph Spak of RBC is called on to take Pierre’s spot temporarily. But his mic is also not working. Strange.

14:56 PT: Final question from investors is about FSD and its pricing. Kirkhorn declined to comment on any pricing strategies in the near term. However, he did state that Tesla is learning what it can from FSD subscriptions today. The CFO also noted that Tesla has observed how owners become curious about the company’s software offerings when they purchase vehicles.

14:53 PT: As for Supercharger wait ties, a dedicated team is monitoring congestions. Average congestion has decreased over the past 18 months, and the company is focused on accelerating the expansion of the rapid charging network. Tesla plans to double its Superchargers in the near future, potentially tripling the network later on. The company is also focused on lowering Supercharging time, and rolling out strategies like encouraging owners to charge their vehicles in off-peak hours.

14:51 PT: As for Tesla service issues and Supercharger wait times, Kirkhorn noted that these issues are not unique to Tesla. Returning to normalcy amidst a pandemic is no joke, after all. More people are driving now, and thus, the need for service has also increased. Logistics-wise, sourcing parts has also been challenging.

Tesla is so far focused on just expanding its service network, with the company’s service footprint growing by 35%. Mobile service footprint has grown by 40%. The company is adding staffing as fast as it can as well.

14:48 PT: As for NHTSA officials that seem engaged with TSLAQ and the potential tightening of regulations, Baglino noted that Tesla is also working with safety regulators in the United States. He did state that Tesla keeps safety as a key pillar in its vehicle development, so all I could really do is be as transparent as possible. “We expect and embrace this scrutiny. We take safety as a top priority. We will continue to be transparent on how our software is developing,” Baglino said.

“Safety is extremely important for Tesla. It’s the right thing to do,” Kirkhorn noted, adding that Tesla’s “goal is to go beyond what the software can provide.”

14:44 PT: As for the capacity of the company’s production facilities by 2024, Kirkhorn noted that Tesla’s goal is to grow about 50% every year. Estimates can be extrapolated from this goal. That being said, Tesla has pushed the boundaries in facilities like the Fremont Factory, which is still being optimized. “”Our goal is to grow on an average pace of 50% per year,” he said.

The CFO also mentioned Giga Shanghai, which is currently producing the Model Y. Kirkhorn noted that Austin and Berlin are both launching with the Model Y, but they were built in areas where massive expansions are possible. He quotes an estimate of 10,000 vehicles per week as a possible target.

14:41 PT: Next question is about FSD Beta. The CTO noted that it’s not a matter of how much data can be collected, but how quickly the data can be processed. Baglino noted that this is really where Dojo comes in.

14:40 PT: Retail investor questions begin. First up is are the 4680 cells. According to Drew Baglino, the testing of 4680 cells has gone well. The development of the $25K car is also progressing fairly, with estimates still poised for a potential 2023 release. For now, however, Baglino noted that Tesla is heavily focused on vehicles like the Cybertruck and Model Y.

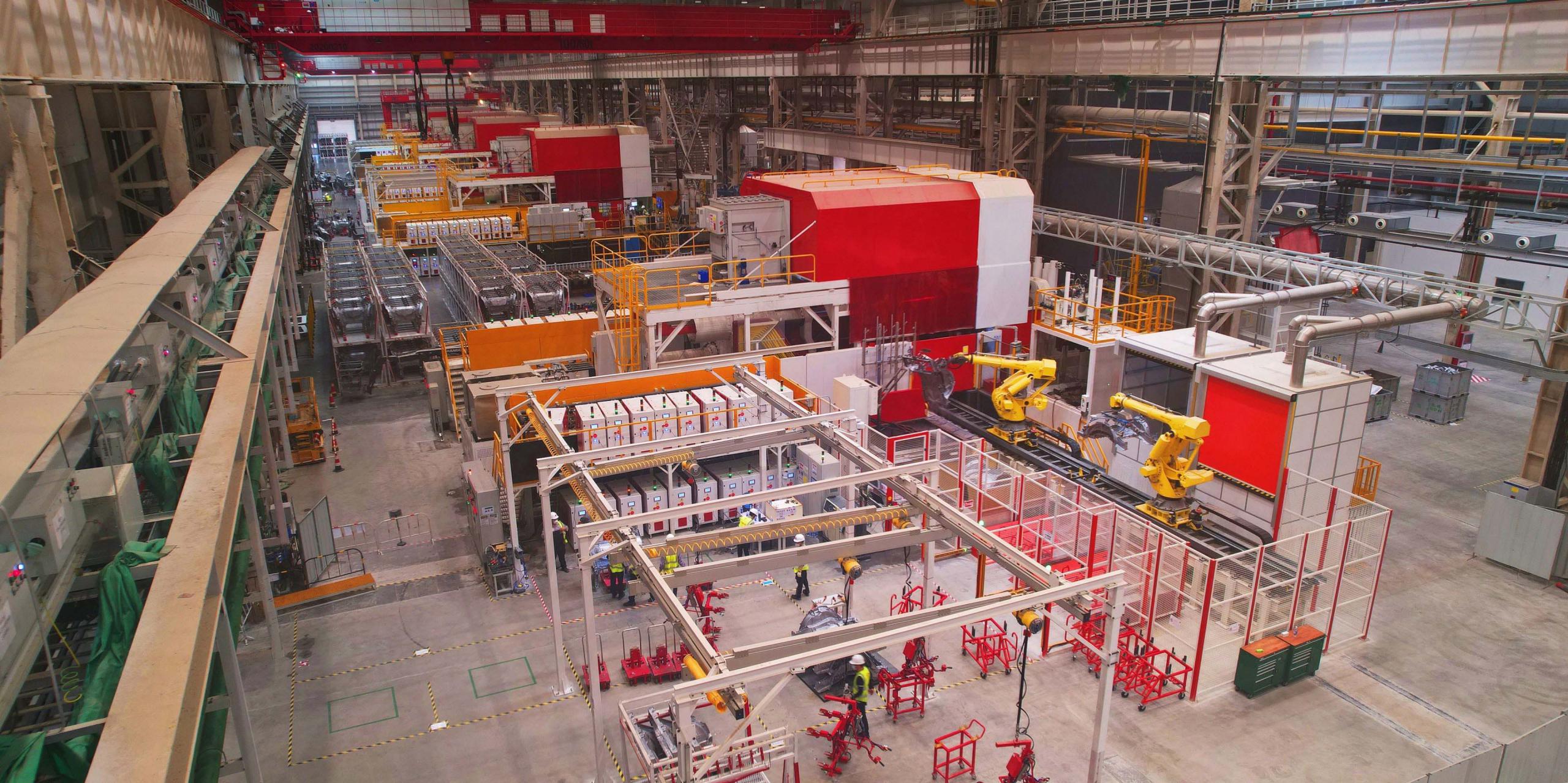

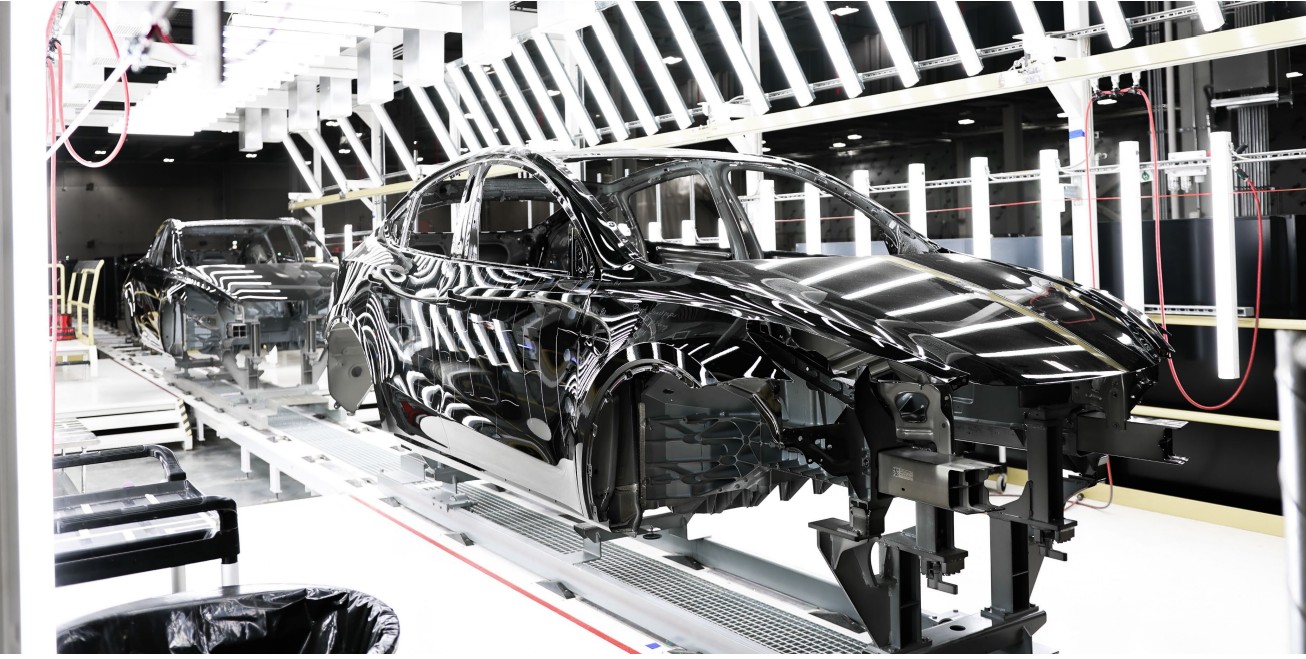

14:38 PT: Giga Berlin and Texas are poised to start ramping. Echoing Elon’s typical comments, Zach noted that the two sites are nearing the built of their first production cars. The CFO noted, however, that the hardest work lies in ramping Austin and Berlin production lines. “Overall, I’m very proud of what the team has accomplished,” Kirkhorn said.

14:35 PT: Zach takes the floor, noting that Tesla is making great progress as a company. He states that Tesla has achieved an annualized production run rate of 1 million cars per year. He does note that Model S and Model X would take some time to get back to their previous volumes, but he is optimistic.

He adds that while Tesla has practically doubled its deliveries, the company is still heavily challenged by the supply chain shortage. Factories are still not at full capacity. Tesla is just making things work by sheer hard work. Backlog is also increasing. As for energy storage, Powerwall and Megapack production is getting better. The production of 4680 cells is also making some headway. Model S is back to positive gross margins too.

14:32 PT: It begins! NO ELON on today’s call. Just Zach and Drew. Martin Viecha is doing the preliminaries.

14:30 PT: As we wait for the start of the Q3 2021 earnings call, a particularly interesting question that would be answered in a few minutes is if Tesla CEO Elon Musk would be on the call itself. He did say that he’d probably stop attending these things last quarter, but there’s a ton of stuff that Elon would probably like to address today. If the Q3 2021 Update Letter is any indication, Tesla achieved a ton this quarter, and much of those milestones deserve some in-depth insights.

14:25 PT: Good day, everyone, and welcome to another live blog of Tesla’s earnings call! Well, look what we have here. Nine profitable quarters. Something like this would have gotten a Tesla bull beaten up on Twitter just a couple years ago, but here we are. Now we wait.

Disclaimer: I am long TSLA.

Don’t hesitate to contact us with news tips. Just send a message to tips@teslarati.com to give us a heads up.

Elon Musk

Tesla to a $100T market cap? Elon Musk’s response may shock you

There are a lot of Tesla bulls out there who have astronomical expectations for the company, especially as its arm of reach has gone well past automotive and energy and entered artificial intelligence and robotics.

However, some of the most bullish Tesla investors believe the company could become worth $100 trillion, and CEO Elon Musk does not believe that number is completely out of the question, even if it sounds almost ridiculous.

To put that number into perspective, the top ten most valuable companies in the world — NVIDIA, Apple, Alphabet, Microsoft, Amazon, TSMC, Meta, Saudi Aramco, Broadcom, and Tesla — are worth roughly $26 trillion.

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

Cathie Wood of ARK Invest believes the number is reasonable considering Tesla’s long-reaching industry ambitions:

“…in the world of AI, what do you have to have to win? You have to have proprietary data, and think about all the proprietary data he has, different kinds of proprietary data. Tesla, the language of the road; Neuralink, multiomics data; nobody else has that data. X, nobody else has that data either. I could see $100 trillion. I think it’s going to happen because of convergence. I think Tesla is the leading candidate [for $100 trillion] for the reason I just said.”

Musk said late last year that all of his companies seem to be “heading toward convergence,” and it’s started to come to fruition. Tesla invested in xAI, as revealed in its Q4 Earnings Shareholder Deck, and SpaceX recently acquired xAI, marking the first step in the potential for a massive umbrella of companies under Musk’s watch.

SpaceX officially acquires xAI, merging rockets with AI expertise

Now that it is happening, it seems Musk is even more enthusiastic about a massive valuation that would swell to nearly four-times the value of the top ten most valuable companies in the world currently, as he said on X, the idea of a $100 trillion valuation is “not impossible.”

It’s not impossible

— Elon Musk (@elonmusk) February 6, 2026

Tesla is not just a car company. With its many projects, including the launch of Robotaxi, the progress of the Optimus robot, and its AI ambitions, it has the potential to continue gaining value at an accelerating rate.

Musk’s comments show his confidence in Tesla’s numerous projects, especially as some begin to mature and some head toward their initial stages.

Elon Musk

Tesla director pay lawsuit sees lawyer fees slashed by $100 million

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

The Delaware Supreme Court has cut more than $100 million from a legal fee award tied to a shareholder lawsuit challenging compensation paid to Tesla directors between 2017 and 2020.

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

Delaware Supreme Court trims legal fees

As noted in a Bloomberg Law report, the case targeted pay granted to Tesla directors, including CEO Elon Musk, Oracle founder Larry Ellison, Kimbal Musk, and Rupert Murdoch. The Delaware Chancery Court had awarded $176 million to the plaintiffs. Tesla’s board must also return stock options and forego years worth of pay.

As per Chief Justice Collins J. Seitz Jr. in an opinion for the Delaware Supreme Court’s full five-member panel, however, the decision of the Delaware Chancery Court to award $176 million to a pension fund’s law firm “erred by including in its financial benefit analysis the intrinsic value” of options being returned by Tesla’s board.

The justices then reduced the fee award from $176 million to $70.9 million. “As we measure it, $71 million reflects a reasonable fee for counsel’s efforts and does not result in a windfall,” Chief Justice Seitz wrote.

Other settlement terms still intact

The Supreme Court upheld the settlement itself, which requires Tesla’s board to return stock and options valued at up to $735 million and to forgo three years of additional compensation worth about $184 million.

Tesla argued during oral arguments that a fee award closer to $70 million would be appropriate. Interestingly enough, back in October, Justice Karen L. Valihura noted that the $176 award was $60 million more than the Delaware judiciary’s budget from the previous year. This was quite interesting as the case was “settled midstream.”

The lawsuit was brought by a pension fund on behalf of Tesla shareholders and focused exclusively on director pay during the 2017–2020 period. The case is separate from other high-profile compensation disputes involving Elon Musk.

Investor's Corner

Tesla (TSLA) Q4 and FY 2025 earnings call: The most important points

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Tesla’s (NASDAQ:TSLA) Q4 and FY 2025 earnings call highlighted improving margins, record energy performance, expanding autonomy efforts, and a sharp acceleration in AI and robotics investments.

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Key takeaways

Tesla reported sequential improvement in automotive gross margins excluding regulatory credits, rising from 15.4% to 17.9%, supported by favorable regional mix effects despite a 16% decline in deliveries. Total gross margin exceeded 20.1%, the highest level in more than two years, even with lower fixed-cost absorption and tariff impacts.

The energy business delivered standout results, with revenue reaching nearly $12.8 billion, up 26.6% year over year. Energy gross profit hit a new quarterly record, driven by strong global demand and high deployments of MegaPack and Powerwall across all regions, as noted in a report from The Motley Fool.

Tesla also stated that paid Full Self-Driving customers have climbed to nearly 1.1 million worldwide, with about 70% having purchased FSD outright. The company has now fully transitioned FSD to a subscription-based sales model, which should create a short-term margin headwind for automotive results.

Free cash flow totaled $1.4 billion for the quarter. Operating expenses rose by $500 million sequentially as well.

Production shifts, robotics, and AI investment

Musk further confirmed that Model S and Model X production is expected to wind down next quarter, and plans are underway to convert Fremont’s S/X line into an Optimus robot factory with a capacity of one million units.

Tesla’s Robotaxi fleet has surpassed 500 vehicles, operating across the Bay Area and Austin, with Musk noting a rapid monthly expansion pace. He also reiterated that CyberCab production is expected to begin in April, following a slow initial S-curve ramp before scaling beyond other vehicle programs.

Looking ahead, Tesla expects its capital expenditures to exceed $20 billion next year, thanks to the company’s operations across its six factories, the expansion of its fleet expansion, and the ramp of its AI compute. Additional investments in AI chips, compute infrastructure, and future in-house semiconductor manufacturing were discussed but are not included in the company’s current CapEx guidance.

More importantly, Tesla ended the year with a larger backlog than in recent years. This is supported by record deliveries in smaller international markets and stronger demand across APAC and EMEA. Energy backlog remains strong globally as well, though Tesla cautioned that margin pressure could emerge from competition, policy uncertainty, and tariffs.