News

Tesla skeptics are hung up about its $465M paid loan, but the fossil fuel industry gets $11M of subsidies every minute

With Elon Musk speaking out about the Biden administration’s recent intentions to tax unrealized gains, it has become a frequent sight on social media for Tesla skeptics and bears to bring up the fact that the EV maker would not exist if the Obama administration did not loan $465 million to Tesla to keep it afloat. This “bailout,” which is how Tesla critics typically dub the $465 million loan, had been paid by the company a full nine years early — and with interest.

What is interesting is that in the grand scheme of things, Tesla’s $465 million loan from the Obama administration is but a drop in the bucket, at least compared to the subsidies that are currently enjoyed by the fossil fuel industry. As per a comprehensive report from the International Monetary Fund (IMF), the fossil fuel industry currently benefits from subsidies of $11 million per minute. That’s a whopping $5.9 trillion worth of subsidies granted for the production and burning of coal, oil, and gas in 2020.

As per the IMF report, setting fossil fuel prices that actually reflect their true cost could cut worldwide CO2 emissions by over 30%, and thus, it would be a substantial step towards meeting the internationally agreed 1.5C target. Ensuring that such a target is still within reach is a goal of the UN’s Cop26 climate summit this coming November. Interestingly enough, among the Cop26’s goal is to agree on rules for carbon markets, which would enable the appropriate pricing for pollution, as per a report from The Guardian.

Ian Parry, the lead author of the IMF report, noted that a reform on how the fossil fuel industry is currently subsidized could result in massive benefits. “There would be enormous benefits from reform, so there’s an enormous amount at stake. Some countries are reluctant to raise energy prices because they think it will harm the poor. But holding down fossil fuel prices is a highly inefficient way to help the poor because most of the benefits accrue to wealthier households. It would be better to target resources towards helping poor and vulnerable people directly,” Parry noted.

Mike Coffin, a senior analyst at Carbon Tracker, a think tank, agreed with this sentiment, noting that it’s crucial for governments to stop supporting an industry that’s already in decline anyway. “To stabilize global temperatures, we must urgently move away from fossil fuels instead of adding fuel to the fire. It’s critical that governments stop propping up an industry that is in decline and look to accelerate the low-carbon energy transition and our future, instead,” Coffin stated.

Tesla CEO Elon Musk has noted in the past that he actually feels bad about people who have made their career in the oil and gas industry. Musk has also made it clear that he is a proponent of a carbon tax, which his companies such as SpaceX would gladly pay. According to the Tesla CEO, however, the Biden administration was hesitant about his proposal.

“I talked to the Biden administration, and they were like ‘Well, this seems too politically difficult.’ And I was like, ‘Well, this is obviously a thing that should happen.’ And by the way, SpaceX would be paying a carbon tax too. So I’m like, you know, I’m like, I think we should pay it too. It’s not like we shouldn’t have carbon generating things. It’s just that there’s got to be a price on this stuff,” Musk said.

Read the IMF’s comprehensive report below.

IMF – Still Not Getting Energy Prices Right: A Global and Country Update of Fossil Fuel Subsidies by Simon Alvarez on Scribd

Don’t hesitate to contact us with news tips. Just send a message to tips@teslarati.com to give us a heads up.

News

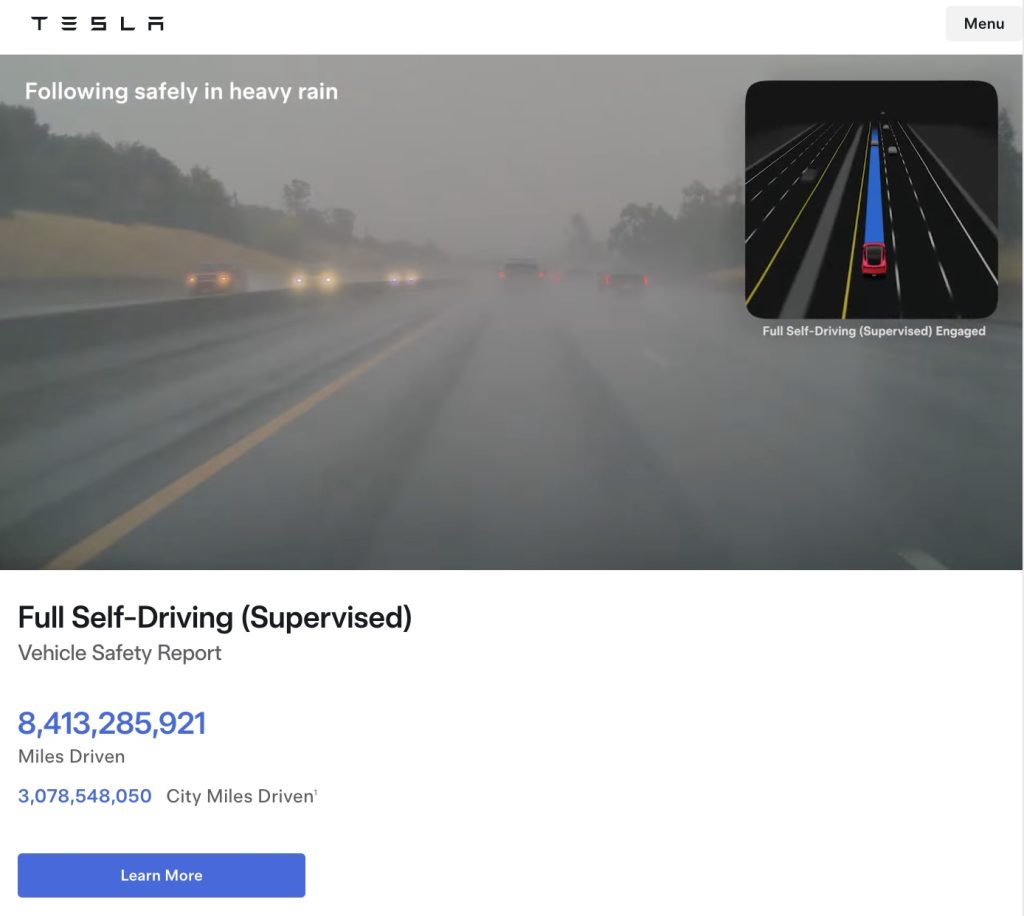

Tesla FSD (Supervised) fleet passes 8.4 billion cumulative miles

Tesla’s Full Self-Driving (Supervised) system has now surpassed 8.4 billion cumulative miles.

The figure appears on Tesla’s official safety page, which tracks performance data for FSD (Supervised) and other safety technologies.

Tesla has long emphasized that large-scale real-world data is central to improving its neural network-based approach to autonomy. Each mile driven with FSD (Supervised) engaged contributes additional edge cases and scenario training for the system.

The milestone also brings Tesla closer to a benchmark previously outlined by CEO Elon Musk. Musk has stated that roughly 10 billion miles of training data may be needed to achieve safe unsupervised self-driving at scale, citing the “long tail” of rare but complex driving situations that must be learned through experience.

The growth curve of FSD Supervised’s cumulative miles over the past five years has been notable.

As noted in data shared by Tesla watcher Sawyer Merritt, annual FSD (Supervised) miles have increased from roughly 6 million in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and 4.25 billion in 2025. In just the first 50 days of 2026, Tesla owners logged another 1 billion miles.

At the current pace, the fleet is trending towards hitting about 10 billion FSD Supervised miles this year. The increase has been driven by Tesla’s growing vehicle fleet, periodic free trials, and expanding Robotaxi operations, among others.

With the fleet now past 8.4 billion cumulative miles, Tesla’s supervised system is approaching that threshold, even as regulatory approval for fully unsupervised deployment remains subject to further validation and oversight.

Tesla’s Full Self-Driving (Supervised) system has now surpassed 8.4 billion cumulative miles.

The figure appears on Tesla’s official safety page, which tracks performance data for FSD (Supervised) and other safety technologies.

Tesla has long emphasized that large-scale real-world data is central to improving its neural network-based approach to autonomy. Each mile driven with FSD (Supervised) engaged contributes additional edge cases and scenario training for the system.

The milestone also brings Tesla closer to a benchmark previously outlined by CEO Elon Musk. Musk has stated that roughly 10 billion miles of training data may be needed to achieve safe unsupervised self-driving at scale, citing the “long tail” of rare but complex driving situations that must be learned through experience.

The growth curve of FSD Supervised’s cumulative miles over the past five years has been notable.

As noted in data shared by Tesla watcher Sawyer Merritt, annual FSD (Supervised) miles have increased from roughly 6 million in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and 4.25 billion in 2025. In just the first 50 days of 2026, Tesla owners logged another 1 billion miles.

At the current pace, the fleet is trending towards hitting about 10 billion FSD Supervised miles this year. The increase has been driven by Tesla’s growing vehicle fleet, periodic free trials, and expanding Robotaxi operations, among others.

With the fleet now past 8.4 billion cumulative miles, Tesla’s supervised system is approaching that threshold, even as regulatory approval for fully unsupervised deployment remains subject to further validation and oversight.

Elon Musk

Elon Musk fires back after Wikipedia co-founder claims neutrality and dubs Grokipedia “ridiculous”

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Elon Musk fired back at Wikipedia co-founder Jimmy Wales after the longtime online encyclopedia leader dismissed xAI’s new AI-powered alternative, Grokipedia, as a “ridiculous” idea that is bound to fail.

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Wales made the comments while answering questions about Wikipedia’s neutrality. According to Wales, Wikipedia prides itself on neutrality.

“One of our core values at Wikipedia is neutrality. A neutral point of view is non-negotiable. It’s in the community, unquestioned… The idea that we’ve become somehow ‘Wokepidea’ is just not true,” Wales said.

When asked about potential competition from Grokipedia, Wales downplayed the situation. “There is no competition. I don’t know if anyone uses Grokipedia. I think it is a ridiculous idea that will never work,” Wales wrote.

After Grokipedia went live, Larry Sanger, also a co-founder of Wikipedia, wrote on X that his initial impression of the AI-powered Wikipedia alternative was “very OK.”

“My initial impression, looking at my own article and poking around here and there, is that Grokipedia is very OK. The jury’s still out as to whether it’s actually better than Wikipedia. But at this point I would have to say ‘maybe!’” Sanger stated.

Musk responded to Sanger’s assessment by saying it was “accurate.” In a separate post, he added that even in its V0.1 form, Grokipedia was already better than Wikipedia.

During a past appearance on the Tucker Carlson Show, Sanger argued that Wikipedia has drifted from its original vision, citing concerns about how its “Reliable sources/Perennial sources” framework categorizes publications by perceived credibility. As per Sanger, Wikipedia’s “Reliable sources/Perennial sources” list leans heavily left, with conservative publications getting effectively blacklisted in favor of their more liberal counterparts.

As of writing, Grokipedia has reportedly surpassed 80% of English Wikipedia’s article count.

News

Tesla Sweden appeals after grid company refuses to restore existing Supercharger due to union strike

The charging site was previously functioning before it was temporarily disconnected in April last year for electrical safety reasons.

Tesla Sweden is seeking regulatory intervention after a Swedish power grid company refused to reconnect an already operational Supercharger station in Åre due to ongoing union sympathy actions.

The charging site was previously functioning before it was temporarily disconnected in April last year for electrical safety reasons. A temporary construction power cabinet supplying the station had fallen over, described by Tesla as occurring “under unclear circumstances.” The power was then cut at the request of Tesla’s installation contractor to allow safe repair work.

While the safety issue was resolved, the station has not been brought back online. Stefan Sedin, CEO of Jämtkraft elnät, told Dagens Arbete (DA) that power will not be restored to the existing Supercharger station as long as the electric vehicle maker’s union issues are ongoing.

“One of our installers noticed that the construction power had been backed up and was on the ground. We asked Tesla to fix the system, and their installation company in turn asked us to cut the power so that they could do the work safely.

“When everything was restored, the question arose: ‘Wait a minute, can we reconnect the station to the electricity grid? Or what does the notice actually say?’ We consulted with our employer organization, who were clear that as long as sympathy measures are in place, we cannot reconnect this facility,” Sedin said.

The union’s sympathy actions, which began in March 2024, apply to work involving “planning, preparation, new connections, grid expansion, service, maintenance and repairs” of Tesla’s charging infrastructure in Sweden.

Tesla Sweden has argued that reconnecting an existing facility is not equivalent to establishing a new grid connection. In a filing to the Swedish Energy Market Inspectorate, the company stated that reconnecting the installation “is therefore not covered by the sympathy measures and cannot therefore constitute a reason for not reconnecting the facility to the electricity grid.”

Sedin, for his part, noted that Tesla’s issue with the Supercharger is quite unique. And while Jämtkraft elnät itself has no issue with Tesla, its actions are based on the unions’ sympathy measures against the electric vehicle maker.

“This is absolutely the first time that I have been involved in matters relating to union conflicts or sympathy measures. That is why we have relied entirely on the assessment of our employer organization. This is not something that we have made any decisions about ourselves at all.

“It is not that Jämtkraft elnät has a conflict with Tesla, but our actions are based on these sympathy measures. Should it turn out that we have made an incorrect assessment, we will correct ourselves. It is no more difficult than that for us,” the executive said.