News

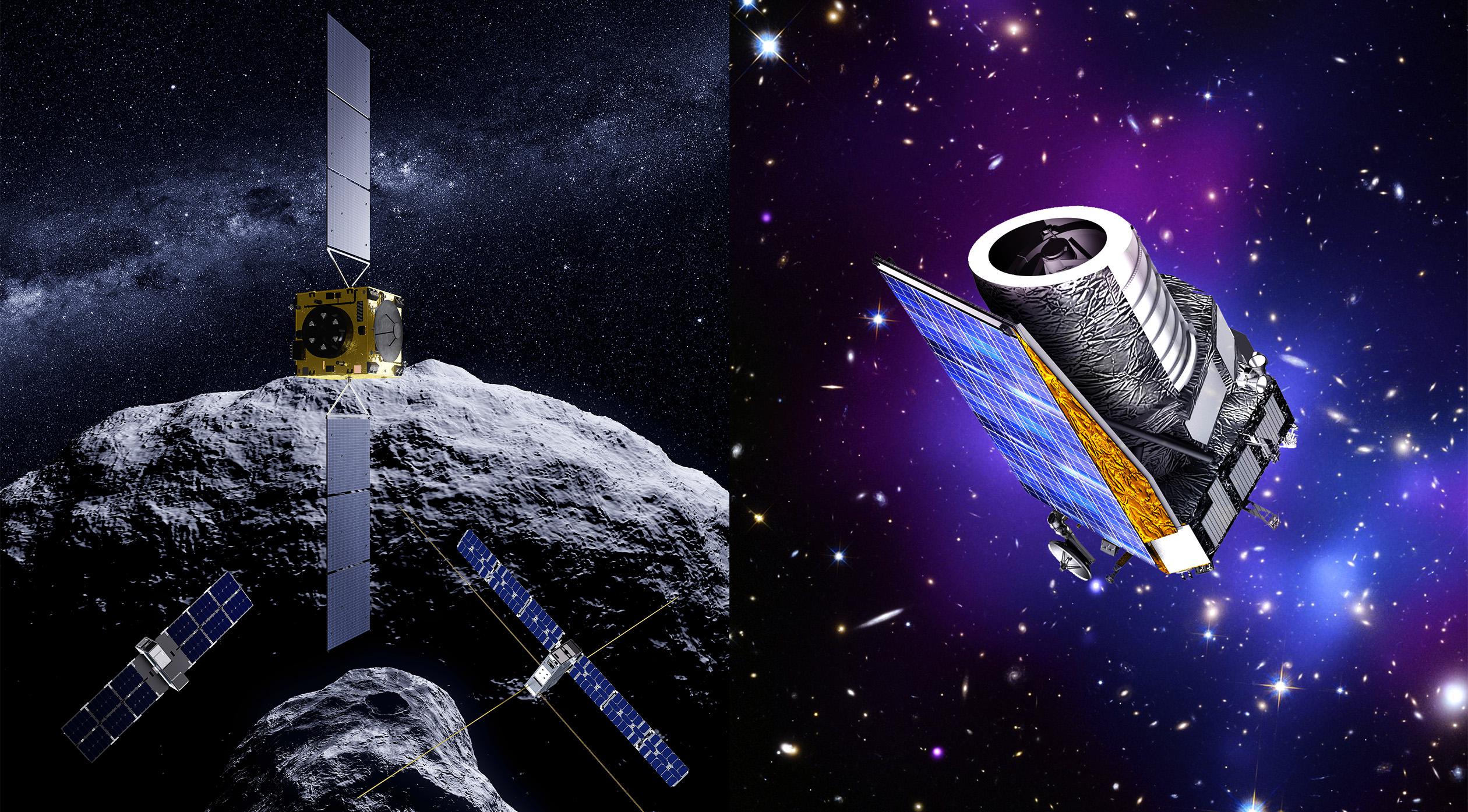

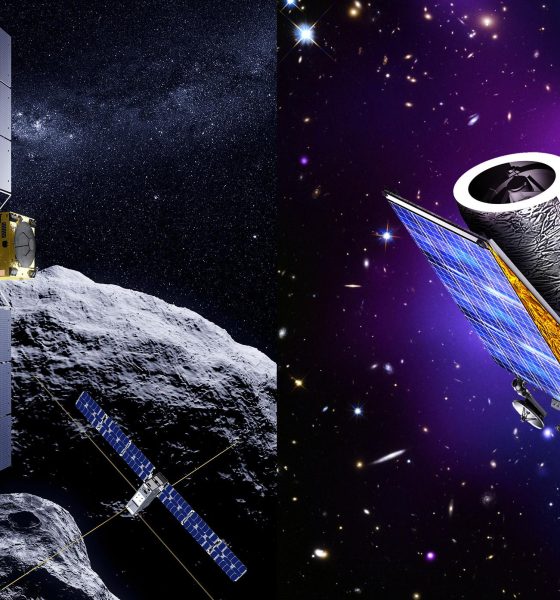

SpaceX to launch Europe’s next deep space telescope, first asteroid orbiter

On October 17th, a NASA official speaking at an Astrophysics Advisory Committee meeting revealed that the European Space Agency (ESA) had begun “exploring options” and studying the feasibility of launching the Euclid near-infrared space telescope on SpaceX’s Falcon 9 rocket.

In a major upset, director Josef Aschbacher confirmed less than three days later that ESA will contract with SpaceX to launch the Euclid telescope and Hera, a multi-spacecraft mission to a near-Earth asteroid, after all domestic alternatives fell through.

The European Union and, by proxy, ESA, are infamously insular and parochial about rocket launch services. That attitude was largely cultivated by ESA and the French company Arianespace’s success in the international commercial launch market in the 1980s, 1990s, and 2000s – a hard-fought position that all parties eventually seemed to take for granted. When that golden era slammed headfirst into the brick wall erected by SpaceX in the mid-2010s, Arianespace found itself facing a truly threatening competitor for the first time in 15+ years.

More importantly, ESA and the EU had minimal sway over SpaceX and could do very little to halt the private company from quickly becoming a leader of the international launch industry. Much like the traditional US launch industry that SpaceX also aggressively disrupted, ESA, EU, and Ariane officials remained in denial well into the late 2010s, even as SpaceX devoured their market share.

When ESA and Arianespace began work on a rocket to follow their highly successful and once-competitive Ariane 5 in the early and mid-2010s, they also ignored SpaceX’s loud pursuit of affordable launches through reusable rockets. European stakeholders ultimately opted to develop a fully-expendable successor – Ariane 6 – that merely tweaked the ingredients of the proven Ariane 5 formula. But after choosing the path of least resistance in 2014, Ariane 6’s launch debut has still slipped from 2020 to “late 2023” at the earliest, causing chaos for many of the commercial and institutional European payloads assigned to the rocket over the years.

Then, in February 2022, Russia illegally invaded Ukraine a second time, throwing all other aspects of Europe into chaos. As part of the hostilities and in response to widespread European criticism, Russia took a batch of US-built, British-owned OneWeb satellites hostage, stole the Soyuz rocket they had already purchased, and reneged on a launch deal in a move that cost the company hundreds of millions of dollars. Doubling down, they also officially withdrew from all partnerships with ESA and Arianespace, ending the practice of Europeanized Soyuz launches and leaving multiple joint missions stranded or in limbo.

Euclid was one such mission. Development of the small near-infrared space telescope began in the early 2010s and was predicted to cost “more than 1 billion Euros” as of 2013. At the time, a European Soyuz 2.1 rocket was scheduled to launch Euclid to the Sun-Earth system’s L2 Lagrange point as early as 2020. After Russia’s second invasion of Ukraine killed Soyuz as an option, ESA briefly claimed that it would instead launch Euclid on Ariane 6.

In October 2022, ESA announced that Ariane 6’s launch debut would be delayed from its current target of late 2022 to late 2023 or even early 2024. As a result, 13 satellites – most of which are European – found themselves at risk of 6, 12, or even 18+ months of guaranteed launch delays. Less than 24 hours after announcing the latest in a long line of major Ariane 6 delays, ESA’s director revealed that two of those 13 satellites were already being transferred to SpaceX Falcon 9 rockets.

Given that Euclid was orphaned by a Russian rocket, it wasn’t a huge surprise for the telescope’s launch to be handed from Arianespace to SpaceX. However, the simultaneous announcement that Hera would follow suit was far more shocking. From the start, Hera was scheduled to be one of the first payloads launched by an Ariane 64 rocket with a new Astris kick stage under development at Arianespace.

Had Hera stuck with the first three-stage Ariane 6 after the two-stage version’s latest delay, the odds of missing its 17-day October 2024 window would have increased significantly. If Hera missed that brief window, orbital mechanics would cause backup opportunities in 2025 and 2026 to extend the mission’s cruise phase (travel time) from two years to more than five years.

The €290 million Hera mission’s primary purpose is to enter orbit around the near-Earth asteroid Didiymos and study a fresh impact crater on its moon, Dimorphos. That crater is fresh because it was intentionally created when NASA’s DART spacecraft slammed into the asteroid moon last month. Fittingly, SpaceX launched DART to Dimoprhos on a Falcon 9 rocket, and will now launch Hera in its footsteps as early as October 2024. Another Falcon 9 rocket will launch the Euclid telescope into deep space as early as mid-2023.

Elon Musk

Elon Musk’s net worth is nearing $800 billion, and it’s no small part due to xAI

A newly confirmed $20 billion xAI funding round valued the business at $250 billion, adding an estimated $62 billion to Musk’s fortune.

Elon Musk moved within reach of an unprecedented $800 billion net worth after private investors sharply increased the valuation of xAI Holdings, his artificial intelligence and social media company.

A newly confirmed $20 billion funding round valued the business at $250 billion, adding an estimated $62 billion to Musk’s fortune and widening his lead as the world’s wealthiest individual.

xAI’s valuation jump

Forbes confirmed that xAI Holdings was valued at $250 billion following its $20 billion funding round. That’s more than double the $113 billion valuation Musk cited when he merged his AI startup xAI with social media platform X last year. Musk owned roughly 49% of the combined company, which Forbes estimated was worth about $122 billion after the deal closed.

xAI’s recent valuation increase pushed Musk’s total net worth to approximately $780 billion, as per Forbes’ Real-Time Billionaires List. The jump represented one of the single largest wealth gains ever recorded in a private funding round.

Interestingly enough, xAI’s funding round also boosted the AI startup’s other billionaire investors. Saudi investor Prince Alwaleed Bin Talal Alsaud held an estimated 1.6% stake in xAI worth about $4 billion, so the recent funding round boosted his net worth to $19.4 billion. Twitter co-founder Jack Dorsey and Oracle co-founder Larry Ellison each owned roughly 0.8% stakes that are now valued at about $2.1 billion, increasing their net worths to $6 billion and $241 billion, respectively.

The backbone of Musk’s net worth

Despite xAI’s rapid rise, Musk’s net worth is still primarily anchored by SpaceX and Tesla. SpaceX represents Musk’s single most valuable asset, with his 42% stake in the private space company estimated at roughly $336 billion.

Tesla ranks second among Musk’s holdings, as he owns about 12% of the EV maker’s common stock, which is worth approximately $307 billion.

Over the past year, Musk crossed a series of historic milestones, becoming the first person ever worth $500 billion, $600 billion, and $700 billion. He also widened his lead over the world’s second-richest individual, Larry Page, by more than $500 billion.

News

Tesla Cybercab sighting confirms one highly requested feature

The feature will likely allow the Cybercab to continue operating even in conditions when its cameras could be covered with dust, mud, or road grime.

A recent sighting of Tesla’s Cybercab prototype in Chicago appears to confirm a long-requested feature for the autonomous two-seater.

The feature will likely allow the Cybercab to continue operating even in conditions when its cameras could be covered with dust, mud, or road grime.

The Cybercab’s camera washer

The Cybercab prototype in question was sighted in Chicago, and its image was shared widely on social media. While the autonomous two-seater itself was visibly dirty, its rear camera area stood out as noticeably cleaner than the rest of the car. Traces of water were also visible on the trunk. This suggested that the Cybercab is equipped with a rear camera washer.

As noted by Model Y owner and industry watcher Sawyer Merritt, a rear camera washer is a feature many Tesla owners have requested for years, particularly in snowy or wet regions where camera obstruction can affect visibility and the performance of systems like Full Self-Driving (FSD).

While only the rear camera washer was clearly visible, the sighting raises the possibility that Tesla may equip the Cybercab’s other external cameras with similar cleaning systems. Given the vehicle’s fully autonomous design, redundant visibility safeguards would be a logical inclusion.

The Cybercab in Tesla’s autonomous world

The Cybercab is Tesla’s first purpose-built autonomous ride-hailing vehicle, and it is expected to enter production later this year. The vehicle was unveiled in October 2024 at the “We, Robot” event in Los Angeles, and it is expected to be a major growth driver for Tesla as it continues its transition toward an AI- and robotics-focused company. The Cybercab will not include a steering wheel or pedals and is intended to carry one or two passengers per trip, a decision Tesla says reflects real-world ride-hailing usage data.

The Cybercab is also expected to feature in-vehicle entertainment through its center touchscreen, wireless charging, and other rider-focused amenities. Musk has also hinted that the vehicle includes far more innovation than is immediately apparent, stating on X that “there is so much to this car that is not obvious on the surface.”

News

Tesla seen as early winner as Canada reopens door to China-made EVs

Tesla had already prepared for Chinese exports to Canada in 2023 by equipping its Shanghai Gigafactory to produce a Canada-specific version of the Model Y.

Tesla seems poised to be an early beneficiary of Canada’s decision to reopen imports of Chinese-made electric vehicles, following the removal of a 100% tariff that halted shipments last year.

Thanks to Giga Shanghai’s capability to produce Canadian-spec vehicles, it might only be a matter of time before Tesla is able to export vehicles to Canada from China once more.

Under the new U.S.–Canada trade agreement, Canada will allow up to 49,000 vehicles per year to be imported from China at a 6.1% tariff, with the quota potentially rising to 70,000 units within five years, according to Prime Minister Mark Carney.

Half of the initial quota is reserved for vehicles priced under CAD 35,000, a threshold above current Tesla models, though the electric vehicle maker could still benefit from the rule change, as noted in a Reuters report.

Tesla had already prepared for Chinese exports to Canada in 2023 by equipping its Shanghai Gigafactory to produce a Canada-specific version of the Model Y. That year, Tesla began shipping vehicles from Shanghai to Canada, contributing to a sharp 460% year-over-year increase in China-built vehicle imports through Vancouver.

When Ottawa imposed a 100% tariff in 2024, however, Tesla halted those shipments and shifted Canadian supply to its U.S. and Berlin factories. With tariffs now reduced, Tesla could quickly resume China-to-Canada exports.

Beyond manufacturing flexibility, Tesla could also benefit from its established retail presence in Canada. The automaker operates 39 stores across Canada, while Chinese brands like BYD and Nio have yet to enter the Canadian market directly. Tesla’s relatively small lineup, which is comprised of four core models plus the Cybertruck, allows it to move faster on marketing and logistics than competitors with broader portfolios.