News

Tesla’s apparent red carpet treatment in India an effective tool against rivals

While Tesla has seen notable challenges breaking into India in the past, the electric vehicle maker appears to be receiving a red carpet welcome of sorts this time around. This bodes well for Tesla, and it could result in the company not competing with some of its strongest rivals in the country, at least in the near future.

Tesla is the world leader in pure electric vehicles, but in China, the company has a number of strong competitors. These include BYD, which outsell Tesla in China in terms of New Energy Vehicles (NEVs) sales. BYD’s sales of pure electric cars lag against Tesla’s, but in terms of raw NEV volumes, the Chinese automaker is far ahead of the American EV company.

India is an increasingly important market in the auto industry. Thus, companies that could attain a lead against rivals in the Indian market could establish a notable lead against their rivals. This was hinted at by Jasmeet Khurana of the World Economic Forum in a comment to Reuters.

“The future of who wins in India will have some bearing on who wins globally in the EV race,” Khurana said.

Tesla CEO Elon Musk and Indian Prime Minister Narendra Modi met in New York back in June, and since then, it appears that the EV maker is being fast-tracked for its entry into the country. Tesla is reportedly in discussions with Indian officials for the buildout of a plant that would have the capacity to produce a new low-cost electric car that’s expected to be priced at around $24,000.

Sources reportedly close to the matter have noted that the talks had continued over the past week, with Tesla allegedly discussing the details of its plans. Modi is reportedly tracking the discussions’ developments as well.

Amidst these circumstances, Chinese automaker BYD, which is arguably Tesla’s largest rival in China, seems to be taking a backseat in India. BYD had previously aimed to secure clearance for a $1 billion investment into the country, but later reports suggested that the company is no longer keen to secure the deal. BYD is also facing an investigation over allegations that it had underpaid import taxes in the country.

Indian officials are reportedly worried as well about the national security implications of Chinese-made vehicles in the country. An official has reportedly noted that India is “uncomfortable with Chinese automakers” as well.

Without some of its strongest rivals in India, Tesla could very well expand its reach into the country’s growing EV sector without any issues. This bodes well for Tesla, especially if it is able to release a small, affordable car that’s a good fit for the Indian market. Sam Fiorani of AutoForecast Solutions stated that ultimately, India presents some great possibilities for Tesla.

“Tesla has become a desirable product in name alone. Add to that an affordable product tailored for the Indian market, and it has the potential to be a hit locally,” Fiorani said.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads-up.

Elon Musk

Elon Musk’s xAI and X to pay off $17.5B debt in full: report

The update was shared initially in a report from Bloomberg News, which cited people reportedly familiar with the matter.

Elon Musk’s social platform X and artificial intelligence startup xAI are reportedly preparing to repay approximately $17.5 billion in outstanding debt in full.

The update was shared initially in a report from Bloomberg News, which cited people reportedly familiar with the matter.

Morgan Stanley, which arranged the debt financing for both companies, has reportedly informed existing lenders that X and xAI plan to pay back the full amount of the $17.5 billion debt. Bloomberg’s sources did not disclose where the capital for the repayment would be coming from.

X, formerly known as Twitter, assumed roughly $12.5 billion in debt during Musk’s acquisition of the company. xAI separately borrowed about $5 billion through bonds and loans last June. The two firms merged last year under xAI Holdings.

Bloomberg noted that portions of the debt are relatively recent and may carry early repayment penalties. xAI’s $3 billion in high-yield bonds are expected to be redeemed at 117 cents on the dollar, reflecting a premium since the debt was expected to stay outstanding for at least two years.

X has been servicing tens of millions of dollars in monthly debt payments, while xAI has reportedly been burning approximately $1 billion in cash per month as it invests heavily in data centers, chips, and AI talent. That being said, xAI also concluded a funding round in January, where it raised $20 billion of new equity.

The repayment plans come as Musk consolidates several of his businesses. SpaceX recently acquired xAI, making it a subsidiary as the company explores plans for space-based data centers. The combined entity has been valued at approximately $1.25 trillion.

Bloomberg previously reported that SpaceX is targeting a confidential IPO filing as soon as this month, potentially positioning the private space firm for a public listing later this year. Representatives for Morgan Stanley declined to comment, and X and xAI did not immediately respond to requests for comment.

News

Tesla Giga Berlin head calls out Handelsblatt’s claimed 2025 production figures

Andre Thierig, Senior Director of Manufacturing at Giga Berlin, published a detailed post on LinkedIn challenging several points made in the publication’s coverage of the Grünheide facility.

Tesla Gigafactory Berlin’s plant manager has publicly pushed back against recent reporting by German business publication Handelsblatt, which cited reportedly erroneous data about the factory’s production figures and financial performance.

Andre Thierig, Senior Director of Manufacturing at Giga Berlin, published a detailed post on LinkedIn challenging several points made in the publication’s coverage of the Grünheide facility.

In his LinkedIn post, Thierig called out Handelsblatt’s claim that 149,000 Model Y vehicles were produced at Giga Berlin in 2025. He noted that “the article is simply filled from front to back with false information and claims!

“I have to set the record straight here! In the last article about Tesla in Grünheide, the Handelsblatt speaks e.g. of 149,000 Model Ys built in 2025. WRONG!

“In 2025, we again produced over 200,000 vehicles. And this despite the fact that we stopped production in Q1 for the changeover to the new Model Y and then ramped it up again to 5,000 units per week over several weeks,” Thierig wrote.

He added that production increased each quarter in 2025 compared to the prior quarter and stated that more than 700,000 Model Y units have been produced at Grünheide since manufacturing began in 2022. For the first quarter of 2026, he stated that the factory is planning another production increase compared to the fourth quarter of 2025.

Thierig also questioned Handelsblatt’s reported 0.74% profit margin, writing that how the publication calculated the figure “remains reserved for their secret ‘calculation skills.’”

Beyond production data, Thierig highlighted Tesla’s broader footprint in Germany, stating that the company has invested more than €5 billion in Grünheide since 2020 and created nearly 11,000 permanent, above-tariff jobs. He added that Tesla is currently investing nearly €100 million into battery cell production at the site, which is expected to generate several hundred additional positions.

In a follow-up comment, Thierig noted that he did communicate with the publication’s editor-in-chief in an effort to “start fresh,” but he was informed that Handelsblatt’s current approach works just fine.

“Last year, I spoke to a representative of the Handelsblatt editor-in-chief and suggested that we “start anew” again. Handelsblatt turned down this offer on the grounds that their current approach works well for them,” Thierig noted.

Sönke Iwersen, Head of Investigative Research at Handelsblatt, responded to Thierig’s post, stating that the newspaper’s figures were based on Tesla’s own annual financial statements for the Grünheide entity.

He cited reported 2024 revenue of €7.68 billion, operating profit of €156.8 million, and net income after taxes of €55.6 million. Iwersen also referenced prior public comments from Elon Musk about Cybertruck demand, noting the gap between reported pre-orders and subsequent annual sales figures.

He also stated that the works council election eligibility figures Giga Berlin had dropped to 10,703 employees today from 12,415 two years ago.

“As far as production figures are concerned, these are figures from the data service provider Inovev. This is also stated in the article. Please compare this with Elon Musk’s information on demand for the Cybertruck. According to Musk, there were one million pre-orders. In the first year, 39,000 units were sold, in the second year 20,000. How can this be explained? With a million pre-orders?

“You yourself have repeatedly pointed out in recent months that no jobs would be cut in Grünheide because Tesla is different from the competition. Now a new works council is being elected in Grünheide. 10,703 people are eligible to vote. Two years ago, 12,415 people were eligible to vote. So there were exactly 1712 fewer from 2024 to 2026,” Iwersen wrote.

News

I figured out how to charge my Tesla at my rented townhouse – Here’s how

I hope that this article is able to help the prospective EV buyer or the current Tesla owner who is living in a rental and does not have a straightforward solution to home charging. My situation will be presented in this article, and I will tell you why I went with the solution I went with, and alternatives, because there is more than one way to do this.

When I bought my Tesla Model Y Premium All-Wheel-Drive last year, I knew I would have to try to figure out a way not become totally reliant on Superchargers. After about six months of ownership, it came time to resolve that problem once and for good, and being a tenant in a rented townhouse community definitely added to my challenge.

Before I even bought my Tesla, I emailed my leasing office to see if the community had any plans to bring EV charging to the neighborhood. I had made myself available to them as I am familiar with a lot of the solutions out there and how much of an advantage this could be for the community, and attracting new tenants. After months of trying, I bought my Tesla in August anyway, and figured I’d be able to find an answer — whether positive or negative — and go from there.

I hope that this article is able to help the prospective EV buyer or the current Tesla owner who is living in a rental and does not have a straightforward solution to home charging. My situation will be presented in this article, and I will tell you why I went with the solution I went with, and alternatives, because there is more than one way to do this.

My Challenge with Home Charging

In a rental community, apartment complex, or even townhouse row, parking spots are a little complicated. I have assigned parking at my house, and unfortunately, my parking spot is not right in front of my front door. Instead, it is staggered, so my car is parked in front of my neighbor’s front door.

Initially, I had spoken to my neighbor whose spot is right in front of my front door and had gotten permission to park in their spot during the day while it is vacant. However, I was not going to be able to upgrade my outlet from a 110v-120v to the typical and suggested 220v-240v alternative.

I knew that this would mean I would need to be in my permanent spot because charging sufficiently, especially in preparation for trips or errands, would require overnight charging.

The Tesla Mobile Connector is 20 feet long, which is sufficient for most applications. Mine, however, required about 30 feet, maybe even a little more, to charge.

My Options

I had a few options: Use the Mobile Connector and park in my neighbor’s spot and charge when I could, buy an 8 or 10-gauge extension cord that could handle moving power from the Mobile Connector to my car, or buy an NACS to NACS extension cord.

I didn’t really want to do the first option, considering I knew that spot would only be available when my neighbor was not there. It didn’t seem like a viable option, and I figured it would be better to figure out something from my personal, permanent parking spot anyway.

The 10-gauge extension cord option was what I first considered: it was less expensive than buying an NACS extension, it was more readily available, and it was the first thing my friends who are electricians recommended.

However, running this option would have put the Mobile Connector in the grass or on the ground, and I was not interested in doing that. Running the risk of having that $300 connector that came with the car in the grass and exposing it to dew, dogs, and various other things just did not seem like the best idea.

I looked around for some NACS to NACS connectors, and there are a lot of options. Given that this was something that was going to plug into a $50,000 car, I chose to spend the additional money on one that was not from Amazon, and I went with this one from A2Z, which was recommended by other owners, and their reputation seemed more than positive. I was leaning toward this option anyway because it would keep the Mobile Connector off the ground, and it gave me an additional 16 feet of length to work with.

This was the solution.

Putting It Into Action

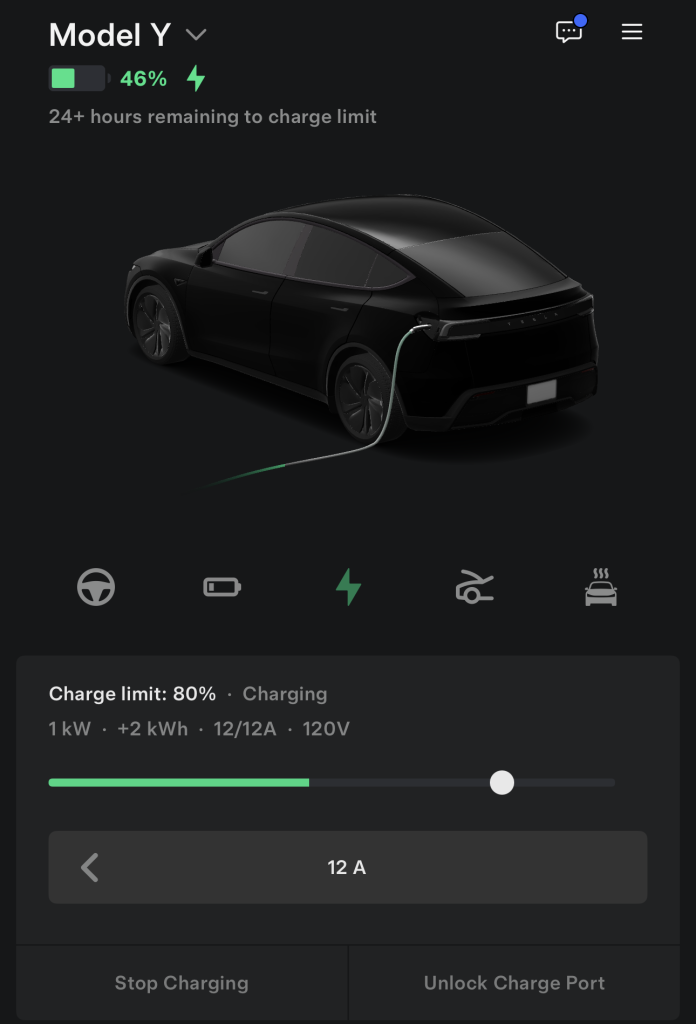

It was a relatively simple process: Plug the Mobile Connector into my house, plug the NACS to NACS extension into the Mobile Connector, plug the NACS extension into the car. It all worked immediately, but there are some things you should know if you are also planning to do this.

The first is that you should be very aware that these cables are going to be a target of thieves. I don’t have too much of an issue with this in my area, but if you’re in a place where copper wiring is heavily sought after, be sure to keep these in a place where they won’t be stolen. I put mine away when they’re not charging, and at night, they’re visible from my Ring camera, so I’m not overly concerned. Definitely be aware of it, though.

Additionally, if you’re going to run it across the sidewalk like I am, you’re going to want to pick up some sort of cable cover from a local hardware store. I picked up this one from Amazon because it was a little more heavy-duty, and it was big enough to cover the thicker gauge of the NACS to NACS extension:

I’ve considered picking up a second one for the visible cable, but I am undecided.

So far, I’ve been able to add some range to my car three times using this strategy, and while it is very slow, it is definitely worth it. It’s better than it sitting there stagnant.

Speed of Charging

Tesla says the Mobile Connector will provide you with between 3 and 5 miles of range per hour when plugged into a typical wall outlet. That is about what I’ve gotten with it. From 30 percent to 80 percent, be aware that it will take well over 24 hours to charge your car.

I plan to cover some additional details on this as time goes on, including any troubleshooting I might have to do, how much my electric bill goes up, and whether or not I run into any issues with my neighbors or my leasing office.

If you’re looking for some help on an at-home charging solution or have any questions about my setup, please email me at joey@teslarati.com.

🚨 I FINALLY figured out a way to charge my Tesla at home as a renter — Using Superchargers exclusively was inconvenient, tough on the battery, and expensive

Here’s how I did it: https://t.co/TZokpc6Fh3 pic.twitter.com/UtRYKLvB2Y

— TESLARATI (@Teslarati) March 2, 2026