General Motors (GM) has detailed its first-quarter financial results for the year, citing its gas vehicles and continued growth of electric vehicle (EV) business and software-based platform development.

GM reported its Q1 2024 results on Tuesday, raising its overall guidance on full-year vehicle deliveries, and reporting a revenue increase of 8 percent year-over-year to $43 billion. The automaker also said it achieved consistent revenue growth over the last two years, resulting in a CAGR of over 15 percent.

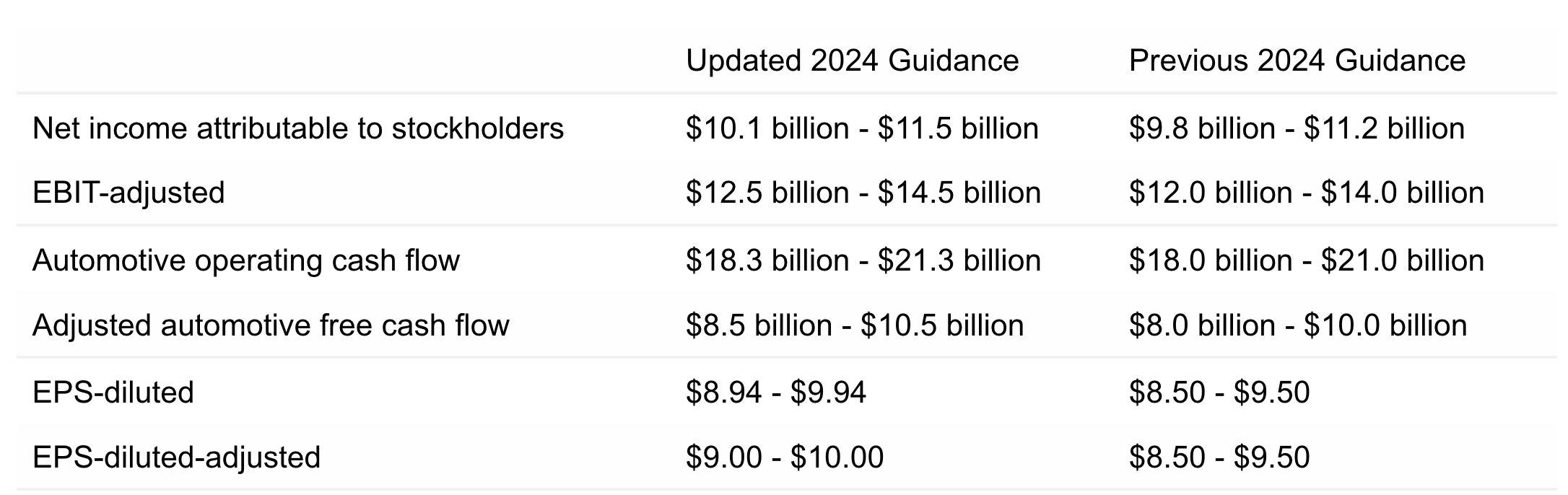

“Globally, our team is leaning into every opportunity with a focus on profitability to build on our strong start to 2024,” wrote CEO Mary Barra in her letter to shareholders. “That’s why we’re raising our full-year earnings, earnings per share and free cash flow guidance.”

“We have ICE launches around the world that will build on our strengths in pickups and SUVs, including the Chevrolet Spin and S10 in South America, the Chevrolet Equinox and Buick GL8 plug-in hybrids in China, and the Chevrolet Traverse, Equinox, Tahoe and Suburban in North America, as well as the Buick Enclave and GMC Acadia.”

GM’s updated 2024 financial guidance

Credit: GM

The automaker said the updated financial guidance includes anticipated capital spending ranging from $10.5 billion to $11.5 billion, including investments in the company’s battery cell manufacturing joint ventures.

GM also highlighted its work to relaunch Cruise, after an accident involving one of its robotaxis in October left a pedestrian severely injured. The automaker has been highlighting greater transparency and a culture of public safety in its attempts to re-launch the service, as it awaits a response from the California Public Utilities Commission (CPUC) on a recent hearing.

Overall, the report highlighted the company’s focus on ICE vehicles, as much of the EV industry struggles.

“There … is the reality that the pricing is staying stronger for longer than anybody anticipated,” said ACR Alpine Capital Research Manager Tim Piechowski (via Reuters).

“The engine of the company is truck and SUV at this point,” he added. “They’re just generating substantial profit and free cash flow that will continue to fund the initiatives in EV. Full steam ahead.”

You can see GM’s Q1 2024 financial results here, along with Barra’s letter to shareholders here. Additionally, you can see GM’s full earnings deck for the financial report here.

GM to factor in EVs, software and Cruise in worker bonus talks

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send your tips to us at tips@teslarati.com.

Elon Musk

Musk bankers looking to trim xAI debt after SpaceX merger: report

xAI has built up $18 billion in debt over the past few years, with some of this being attributed to the purchase of social media platform Twitter (now X) and the creation of the AI development company. A new financing deal would help trim some of the financial burden that is currently present ahead of the plan to take SpaceX public sometime this year.

Elon Musk’s bankers are looking to trim the debt that xAI has taken on over the past few years, following the company’s merger with SpaceX, a new report from Bloomberg says.

xAI has built up $18 billion in debt over the past few years, with some of this being attributed to the purchase of social media platform Twitter (now X) and the creation of the AI development company. Bankers are trying to create some kind of financing plan that would trim “some of the heavy interest costs” that come with the debt.

The financing deal would help trim some of the financial burden that is currently present ahead of the plan to take SpaceX public sometime this year. Musk has essentially confirmed that SpaceX would be heading toward an IPO last month.

The report indicates that Morgan Stanley is expected to take the leading role in any financing plan, citing people familiar with the matter. Morgan Stanley, along with Goldman Sachs, Bank of America, and JPMorgan Chase & Co., are all expected to be in the lineup of banks leading SpaceX’s potential IPO.

Since Musk acquired X, he has also had what Bloomberg says is a “mixed track record with debt markets.” Since purchasing X a few years ago with a $12.5 billion financing package, X pays “tens of millions in interest payments every month.”

That debt is held by Bank of America, Barclays, Mitsubishi, UFJ Financial, BNP Paribas SA, Mizuho, and Société Générale SA.

X merged with xAI last March, which brought the valuation to $45 billion, including the debt.

SpaceX announced the merger with xAI earlier this month, a major move in Musk’s plan to alleviate Earth of necessary data centers and replace them with orbital options that will be lower cost:

“In the long term, space-based AI is obviously the only way to scale. To harness even a millionth of our Sun’s energy would require over a million times more energy than our civilization currently uses! The only logical solution, therefore, is to transport these resource-intensive efforts to a location with vast power and space. I mean, space is called “space” for a reason.”

The merger has many advantages, but one of the most crucial is that it positions the now-merged companies to fund broader goals, fueled by revenue from the Starlink expansion, potential IPO, and AI-driven applications that could accelerate the development of lunar bases.

News

Tesla pushes Full Self-Driving outright purchasing option back in one market

Tesla announced last month that it would eliminate the ability to purchase the Full Self-Driving software outright, instead opting for a subscription-only program, which will require users to pay monthly.

Tesla has pushed the opportunity to purchase the Full Self-Driving suite outright in one market: Australia.

The date remains February 14 in North America, but Tesla has pushed the date back to March 31, 2026, in Australia.

NEWS: Tesla is ending the option to buy FSD as a one-time outright purchase in Australia on March 31, 2026.

It still ends on Feb 14th in North America. https://t.co/qZBOztExVT pic.twitter.com/wmKRZPTf3r

— Sawyer Merritt (@SawyerMerritt) February 13, 2026

Tesla announced last month that it would eliminate the ability to purchase the Full Self-Driving software outright, instead opting for a subscription-only program, which will require users to pay monthly.

If you have already purchased the suite outright, you will not be required to subscribe once again, but once the outright purchase option is gone, drivers will be required to pay the monthly fee.

The reason for the adjustment is likely due to the short period of time the Full Self-Driving suite has been available in the country. In North America, it has been available for years.

Tesla hits major milestone with Full Self-Driving subscriptions

However, Tesla just launched it just last year in Australia.

Full Self-Driving is currently available in seven countries: the United States, Canada, China, Mexico, Australia, New Zealand, and South Korea.

The company has worked extensively for the past few years to launch the suite in Europe. It has not made it quite yet, but Tesla hopes to get it launched by the end of this year.

In North America, Tesla is only giving customers one more day to buy the suite outright before they will be committed to the subscription-based option for good.

The price is expected to go up as the capabilities improve, but there are no indications as to when Tesla will be doing that, nor what type of offering it plans to roll out for owners.

Elon Musk

Starlink terminals smuggled into Iran amid protest crackdown: report

Roughly 6,000 units were delivered following January’s unrest.

The United States quietly moved thousands of Starlink terminals into Iran after authorities imposed internet shutdowns as part of its crackdown on protests, as per information shared by U.S. officials to The Wall Street Journal.

Roughly 6,000 units were delivered following January’s unrest, marking the first known instance of Washington directly supplying the satellite systems inside the country.

Iran’s government significantly restricted online access as demonstrations spread across the country earlier this year. In response, the U.S. purchased nearly 7,000 Starlink terminals in recent months, with most acquisitions occurring in January. Officials stated that funding was reallocated from other internet access initiatives to support the satellite deployment.

President Donald Trump was aware of the effort, though it remains unclear whether he personally authorized it. The White House has not issued a comment about the matter publicly.

Possession of a Starlink terminal is illegal under Iranian law and can result in significant prison time. Despite this, the WSJ estimated that tens of thousands of residents still rely on the satellite service to bypass state controls. Authorities have reportedly conducted inspections of private homes and rooftops to locate unauthorized equipment.

Earlier this year, Trump and Elon Musk discussed maintaining Starlink access for Iranians during the unrest. Tehran has repeatedly accused Washington of encouraging dissent, though U.S. officials have mostly denied the allegations.

The decision to prioritize Starlink sparked internal debate within U.S. agencies. Some officials argued that shifting resources away from Virtual Private Networks (VPNs) could weaken broader internet access efforts. VPNs had previously played a major role in keeping Iranians connected during earlier protest waves, though VPNs are not effective when the actual internet gets cut.

According to State Department figures, about 30 million Iranians used U.S.-funded VPN services during demonstrations in 2022. During a near-total blackout in June 2025, roughly one-fifth of users were still able to access limited connectivity through VPN tools.

Critics have argued that satellite access without VPN protection may expose users to geolocation risks. After funds were redirected to acquire Starlink equipment, support reportedly lapsed for two of five VPN providers operating in Iran.

A State Department official has stated that the U.S. continues to back multiple technologies, including VPNs alongside Starlink, to sustain people’s internet access amidst the government’s shutdowns.