Elon Musk

Tesla stock: Morgan Stanley says eVTOL is calling Elon Musk for new chapter

Could Tesla dive into the eVTOL market? Morgan Stanley takes a look.

Tesla shares are up nearly 20 percent in the past month, but that is not stopping the only trillion-dollar automaker from attracting all types of new potential sectors to disrupt, at least from an investor and analyst perspective.

Morgan Stanley’s Adam Jonas is not one to shy away from some ideas that many investors would consider far-fetched. In a recent note, Jonas brought up some interesting discussion regarding Tesla’s potential in the eVTOL industry, and how he believes CEO Elon Musk’s answer was not convincing enough to put it off altogether.

Tesla’s Elon Musk says electric planes would be ‘fun problem to work on’

Musk said that Tesla was “stretched pretty thin” when a question regarding a plane being developed came up. Jonas said:

“In our opinion, that’s a decidedly different type of answer. Is Tesla an aviation/defense-tech company in auto/consumer clothing?”

Musk has been pretty clear about things that Tesla won’t do. Although he has not unequivocally denied aviation equipment, including planes and drones, as he has with things like motorcycles, it does not seem like something that is on Musk’s mind.

Instead, he has focused the vast majority of his time at Tesla on vehicle autonomy, AI, and robotics, things he sees as the future.

Tesla and China, Robotics, Pricing

Morgan Stanley’s note also discussed Tesla’s prowess in its various areas of expertise, how it will keep up with Chinese competitors, as there are several, and the race for affordable EVs in the country.

Tesla is the U.S.’s key to keeping up with China

“In our view, Tesla’s expertise in manufacturing, data collection, robotics/ physical AI, energy, supply chain, and infrastructure are more critical than ever before to put the US on an even footing with China in embodied AI,” Jonas writes.

It is no secret that Tesla is the leader in revolutionizing things. To generalize, the company has truly dipped its finger in all the various pies, but it is also looked at as a leader in tech, which is where Chinese companies truly have an advantage.

Robotics and the ‘Humanoid Olympics’

Jonas mentioned China’s recent showcasing of robots running half marathons and competing in combat sports as “gamification of robotic innovation.”

Tesla could be at the forefront of the effort to launch something similar, as the analyst predicts the U.S. version could be called “Humanoid Ninja Warrior.”

Pricing

Tesla is set to launch affordable models before the end of Q2, leaving this month for the company to release some details.

While the pricing of those models remains in limbo with the $7,500 tax credit likely disappearing at the end of 2024, companies in China have been able to tap incredibly aggressive pricing models. Jonas, for example, brings up the BYD Seagull, which is priced at just about $8,000.

Tesla can tap into an incredibly broader market if it can manage to bring pricing to even below $30,000, which is where many hope the affordable models end up.

During the Q3 2024 Earnings Call, Musk said that $30,000 is where it would be with the tax credit:

“Yeah. It will be like with incentive. So, 30K, which is kind of a key threshold.”

Elon Musk

SpaceX officially acquires xAI, merging rockets with AI expertise

SpaceX has officially acquired xAI, merging rockets with AI expertise in what is the first move to bring Elon Musk’s companies under one umbrella.

On February 2, SpaceX officially announced the acquisition of xAI, uniting two powerhouse companies under a single entity, creating what the space exploration company called in a blog post “one of the most ambitious, vertically integrated innovation engines on (and off) Earth.”

🚨 BREAKING: Elon Musk has posted a new blog on SpaceX’s website confirming the acquisition of xAI pic.twitter.com/TFgeHGMpXc

— TESLARATI (@Teslarati) February 2, 2026

The deal will integrate xAI’s advanced AI capabilities, including the Grok chatbot and massive training infrastructure, with SpaceX’s rocket technology, Starlink satellite network, and ambitious space exploration goals.

The acquisition comes at a pivotal moment: xAI is valued at around $230 billion as of late 2025, and has been racing to scale AI compute amid global competition from companies like OpenAI, Google, and Meta. Meanwhile, SpaceX, which was recently valued at $800 billion, is facing escalating costs for its multiplanetary ambitions.

By combining forces, the merged entity gains a unified approach to tackle one of AI’s biggest bottlenecks: the enormous energy and infrastructure demands of next-gen models.

Musk wrote in a blog post on SpaceX’s website that:

“In the long term, space-based AI is obviously the only way to scale. To harness even a millionth of our Sun’s energy would require over a million times more energy than our civilization currently uses! The only logical solution therefore is to transport these resource-intensive efforts to a location with vast power and space. I mean, space is called “space” for a reason.”

Musk details the need for orbital data centers, stating that his estimate is that “within 2 to 3 years, the lowest cost way to generate AI compute will be in space.

This cost-efficiency alone will enable innovative companies to forge ahead in training their AI models and processing data at unprecedented speeds and scales, accelerating breakthroughs in our understanding of physics and invention of technologies to benefit humanity.”

SpaceX recently filed for approval from the FCC to launch up to one million solar-powered satellites configured as high-bandwidth, optically linked compute platforms.

These facilities would harness near-constant sunlight with minimal maintenance, delivering what the company projects as transformative efficiency.

Musk has long argued that space offers the ultimate solution for power-hungry AI projects. But that’s not all the merger will take care of.

Additionally, it positions the company to fund broader goals. Revenue from the Starlink expansion, potential SpaceX IPO, and AI-driven applications could accelerate the development of lunar bases, as Musk believes multiplanetary life will be crucial to saving civilization.

Critics question the feasibility of massive constellations amid orbital debris concerns and regulatory hurdles. Yet, proponents see it as a bold step toward a multiplanetary computing infrastructure that extends human civilization beyond Earth.

Elon Musk

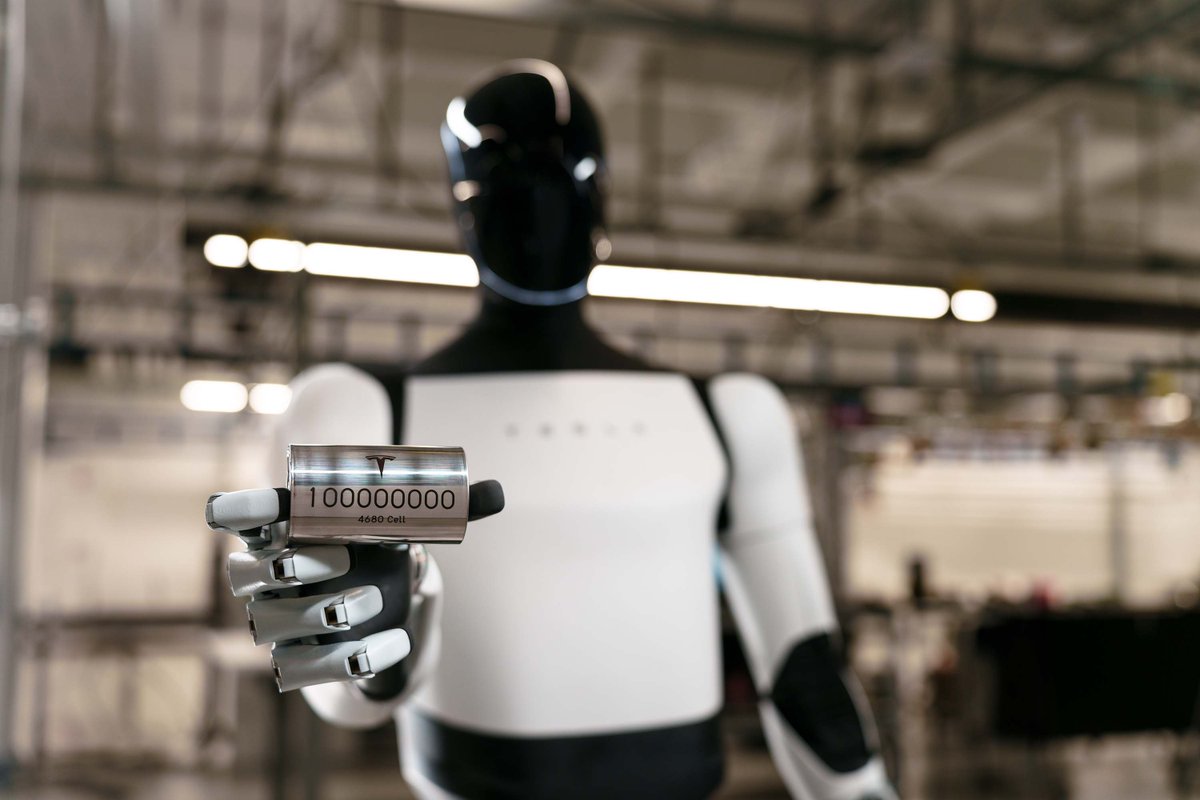

Elon Musk explains why Tesla’s 4680 battery breakthrough is a big deal

Tesla confirmed in its Q4 and FY 2025 update letter that it is now producing 4680 cells whose anode and cathode were produced during the dry electrode process.

Tesla’s breakthroughs with its 4680 battery cell program mark a significant milestone for the electric vehicle maker. This was, at least, as per Elon Musk in a recent post on social media platform X.

Tesla confirmed in its Q4 and FY 2025 update letter that it is now producing 4680 cells whose anode and cathode were produced during the dry electrode process.

Why dry-electrode matters

In a post on X, Elon Musk stated that making the dry-electrode process work at scale was “incredibly difficult,” calling it a major achievement for Tesla’s engineering, production, and supply chain teams, as well as its partner suppliers. He also shared his praise for the Tesla team for overcoming such a difficult task.

“Making the dry electrode process work at scale, which is a major breakthrough in lithium battery production technology, was incredibly difficult. Congratulations to the @Tesla engineering, production and supply chain teams and our strategic partner suppliers for this excellent achievement!” Musk wrote in his post.

Tesla’s official X account expanded on Musk’s remarks, stating that dry-electrode manufacturing “cuts cost, energy use & factory complexity while dramatically increasing scalability.” Bonne Eggleston, Tesla’s Vice President of 4680 batteries, also stated that “Getting dry electrode technology to scale is just the beginning.”

Tesla’s 4680 battery program

Tesla first introduced the dry-electrode concept at Battery Day in 2020, positioning it as a way to eliminate solvent-based electrode drying, shrink factory footprints, and lower capital expenditures. While Tesla has produced 4680 cells for some time, the dry cathode portion of the process proved far more difficult to industrialize than expected.

Together with its confirmation that it is producing 4680 cells in Austin with both electrodes manufactured using the dry process, Tesla has also stated that it has begun producing Model Y vehicles with 4680 battery packs. As per Tesla, this strategy was adopted as a safety layer against trade barriers and tariff risks.

“We have begun to produce battery packs for certain Model Ys with our 4680 cells, unlocking an additional vector of supply to help navigate increasingly complex supply chain challenges caused by trade barriers and tariff risks,” Tesla wrote in its Q4 and FY 2025 update letter.

Elon Musk

Tesla director pay lawsuit sees lawyer fees slashed by $100 million

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

The Delaware Supreme Court has cut more than $100 million from a legal fee award tied to a shareholder lawsuit challenging compensation paid to Tesla directors between 2017 and 2020.

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

Delaware Supreme Court trims legal fees

As noted in a Bloomberg Law report, the case targeted pay granted to Tesla directors, including CEO Elon Musk, Oracle founder Larry Ellison, Kimbal Musk, and Rupert Murdoch. The Delaware Chancery Court had awarded $176 million to the plaintiffs. Tesla’s board must also return stock options and forego years worth of pay.

As per Chief Justice Collins J. Seitz Jr. in an opinion for the Delaware Supreme Court’s full five-member panel, however, the decision of the Delaware Chancery Court to award $176 million to a pension fund’s law firm “erred by including in its financial benefit analysis the intrinsic value” of options being returned by Tesla’s board.

The justices then reduced the fee award from $176 million to $70.9 million. “As we measure it, $71 million reflects a reasonable fee for counsel’s efforts and does not result in a windfall,” Chief Justice Seitz wrote.

Other settlement terms still intact

The Supreme Court upheld the settlement itself, which requires Tesla’s board to return stock and options valued at up to $735 million and to forgo three years of additional compensation worth about $184 million.

Tesla argued during oral arguments that a fee award closer to $70 million would be appropriate. Interestingly enough, back in October, Justice Karen L. Valihura noted that the $176 award was $60 million more than the Delaware judiciary’s budget from the previous year. This was quite interesting as the case was “settled midstream.”

The lawsuit was brought by a pension fund on behalf of Tesla shareholders and focused exclusively on director pay during the 2017–2020 period. The case is separate from other high-profile compensation disputes involving Elon Musk.