Elon Musk

Tesla teases new AI5 chip that will revolutionize self-driving

Elon Musk revealed new information on Tesla’s AI5, previously known as Hardware 5, chip, for self-driving, which will be manufactured by both Samsung and TSMC.

The AI5 chip is Tesla’s next-generation hardware chip for its self-driving program, Optimus humanoid robots, and other AI-driven features in both vehicles and other applications. It will be the successor to the current AI4, previously known as Hardware 4, which is currently utilized in Tesla’s newest vehicles.

Elon Musk reveals Tesla’s HW5 release date, and that it won’t be called HW5

AI5 is specially optimized for Tesla use, as it will work alongside the company’s Neural Networks to focus on real-time inference to make safe and logical decisions during operation. It was first teased by Tesla in mid-2024 as Musk called it “an amazing design” and “an immense jump” from the current AI4 chip.

It will be roughly 4o times faster, have 8 times the raw compute, 9 times the memory capacity, 5 times the memory bandwidth, and 3 times the efficiency per watt.

It will be manufactured by both TSMC and Samsung at their Arizona and Texas fab locations, respectively.

Here’s what Musk revealed about the chip yesterday:

Different Versions

Samsung and TSMC will make slightly different versions of the AI5 chip, “simply because they translate designs to physical form differently.” However, Musk said the goal is that its AI software would work identically.

This was a real concern for some who are familiar with chip manufacturing, as Apple’s A9 “Chipgate” saga seemed to be echoing through Tesla.

Back in 2015, it was found that Apple’s A9 chips had different performances based on who manufactured them. TSMC and Samsung were both building the chips, but it was found that Samsung’s chips had shorter battery life than TSMC-fabricated versions.

Apple concluded that the variance was about 2-3 percent. However, Tesla will look to avoid this altogether.

Release and Implementation into Vehicles

Musk said that some samples will be available next year, and “maybe a small number of units” would equip the chip as well. However, high-volume production is only possible in 2027.

This means, based on Tesla’s own timeline for Cybercab production in Q2 2026, early iterations of the vehicle would rely on AI4. Many believe AI4 can be utilized for solved self-driving, but the power of subsequent versions, including AI5 and beyond, will be more capable.

AI6 and Beyond

AI6 will utilize the same fabs as AI5, but there would be a theoretical boost in performance by two times with this version.

AI6 could enter volume production by mid-2028. However, AI7, which Musk only briefly mentioned, “will need different fabs, as it is more adventurous.”

Elon Musk

Elon Musk fires back after Wikipedia co-founder claims neutrality and dubs Grokipedia “ridiculous”

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Elon Musk fired back at Wikipedia co-founder Jimmy Wales after the longtime online encyclopedia leader dismissed xAI’s new AI-powered alternative, Grokipedia, as a “ridiculous” idea that is bound to fail.

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Wales made the comments while answering questions about Wikipedia’s neutrality. According to Wales, Wikipedia prides itself on neutrality.

“One of our core values at Wikipedia is neutrality. A neutral point of view is non-negotiable. It’s in the community, unquestioned… The idea that we’ve become somehow ‘Wokepidea’ is just not true,” Wales said.

When asked about potential competition from Grokipedia, Wales downplayed the situation. “There is no competition. I don’t know if anyone uses Grokipedia. I think it is a ridiculous idea that will never work,” Wales wrote.

After Grokipedia went live, Larry Sanger, also a co-founder of Wikipedia, wrote on X that his initial impression of the AI-powered Wikipedia alternative was “very OK.”

“My initial impression, looking at my own article and poking around here and there, is that Grokipedia is very OK. The jury’s still out as to whether it’s actually better than Wikipedia. But at this point I would have to say ‘maybe!’” Sanger stated.

Musk responded to Sanger’s assessment by saying it was “accurate.” In a separate post, he added that even in its V0.1 form, Grokipedia was already better than Wikipedia.

During a past appearance on the Tucker Carlson Show, Sanger argued that Wikipedia has drifted from its original vision, citing concerns about how its “Reliable sources/Perennial sources” framework categorizes publications by perceived credibility. As per Sanger, Wikipedia’s “Reliable sources/Perennial sources” list leans heavily left, with conservative publications getting effectively blacklisted in favor of their more liberal counterparts.

As of writing, Grokipedia has reportedly surpassed 80% of English Wikipedia’s article count.

Elon Musk

Music City Loop could highlight The Boring Company’s real disruption

The real story behind the tunneling startup’s Nashville tunnel project is the company’s targeted $25 million per mile construction cost.

Recent commentary on social media has highlighted what could very well prove to be The Boring Company’s real disruption.

The analysis was shared by tech watcher Aakash Gupta on social media platform X, where he argued that the real story behind the tunneling startup’s Nashville tunnel project is the company’s targeted $25 million per mile construction cost.

According to Gupta’s breakdown, Nashville’s 2018 light rail proposal was priced at roughly $200 million per mile. New York’s East Side Access project reportedly cost about $3.5 billion per mile, while Los Angeles Metro expansion projects have approached $1 billion per mile.

By comparison, The Boring Company has stated it can construct 13 miles of twin tunnels in the Music City Loop for between $240 million and $300 million total. That implies a cost near $25 million per mile, or roughly a 95% reduction from industry averages cited in the post.

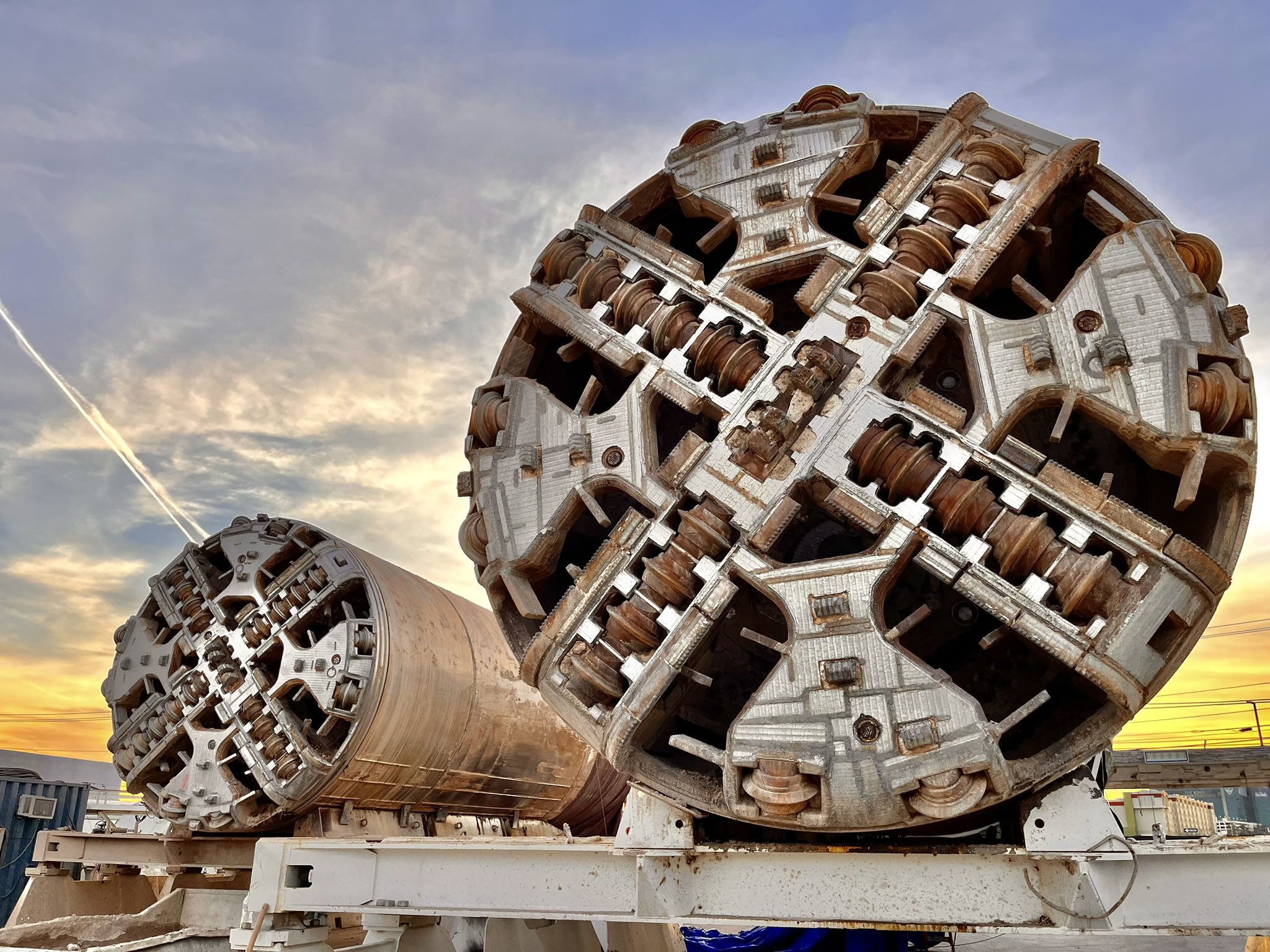

Several technical departures from conventional tunneling allow the Boring Company to lower its costs, from its smaller 12-foot diameter tunnels to its fully electric Prufrock machines that are designed to mine continuously with no personnel inside the tunnel and their capability to “porpoise” for easy launch and retrieval.

Tesla and Space CEO Elon Musk responded to the post on X, stating simply that “Tunnels are so underrated.”

The Boring Company has seen some momentum as of late, with the company recently signing a construction contract in Dubai and the Universal Orlando Loop progressing. Recent reports have also pointed to tunnels potentially being constructed to solve traffic congestion issues near the Giga Nevada area.

While The Boring Company’s tunnels have so far been used for Loop systems publicly for now, Elon Musk recently noted that the tunneling startup’s underground passages would not be limited only to ride-hailing vehicles.

In a reply to a post on X which discussed the specifications of the Music City Loop, Musk clarified that “any fully autonomous electric cars can use the tunnels.” This suggests that vehicles potentially running systems like FSD Supervised, even if they are not Teslas, could be used in systems like the Music City Loop in the future.

Elon Musk

SpaceX IPO could push Elon Musk’s net worth past $1 trillion: Polymarket

The estimates were shared by the official Polymarket Money account on social media platform X.

Recent projections have outlined how a potential $1.75 trillion SpaceX IPO could generate historic returns for early investors. The projections suggest the offering would not only become the largest IPO in history but could also result in unprecedented windfalls for some of the company’s key investors.

The estimates were shared by the official Polymarket Money account on social media platform X.

As noted in a Polymarket Money analysis, Elon Musk invested $100 million into SpaceX in 2002 and currently owns approximately 42% of the company. At a $1.75 trillion valuation following SpaceX’s potential $1.75 trillion IPO, that stake would be worth roughly $735 billion.

Such a figure would dramatically expand Musk’s net worth. When combined with his holdings in Tesla Inc. and other ventures, a public debut at that level could position him as the world’s first trillionaire, depending on market conditions at the time of listing.

The Bloomberg Billionaires Index currently lists Elon Musk with a net worth of $666 billion, though a notable portion of this is tied to his TSLA stock. Tesla currently holds a market cap of $1.51 trillion, and Elon Musk’s currently holds about 13% to 15% of the company’s outstanding common stock.

Founders Fund, co-founded by Peter Thiel, invested $20 million in SpaceX in 2008. Polymarket Money estimates the firm owns between 1.5% and 3% of the private space company. At a $1.75 trillion valuation, that range would translate to approximately $26.25 billion to $52.5 billion in value.

That return would represent one of the most significant venture capital outcomes in modern Silicon Valley history, with a growth of 131,150% to 262,400%.

Alphabet Inc., Google’s parent company, invested $900 million into SpaceX in 2015 and is estimated to hold between 6% and 7% of the private space firm. At the projected IPO valuation, that stake could be worth between $105 billion and $122.5 billion. That’s a growth of 11,566% to 14,455%.

Other major backers highlighted in the post include Fidelity Investments, Baillie Gifford, Valor Equity Partners, Bank of America, and Andreessen Horowitz, each potentially sitting on multibillion-dollar gains.