Investor's Corner

Tesla Earnings: What to Expect

This is a brief update on a few things to watch in Wednesday release of quarterly results and subsequent conference call with company officers.

Model X Deliveries

Tesla reported deliveries of 2,400 Model X vehicles in Q1, below their expected projections, due to supplier part shortages. Tesla stated that “once these these issues were resolved, delivery rates improved dramatically.” But just this weekend, in response to a customer that complained that his Model X 90D, promised by April 15, still had no ETA, Elon Musk tweeted “Have been reviewing end of line production quality personally. Slowed things down temporarily, but its’s for the Best.”

@MacTechGenius @SacEV Have been reviewing end of line production quality personally. Slowed things down temporarily, but it's for the best.

— Elon Musk (@elonmusk) May 1, 2016

Elon response tells me that there are still production quality issues with the Model X and as a result delivery has “slowed down” even in Q2. A second consecutive quarter of Model X deliveries slower than expected would likely affect the annual sales goal of 80,000 to 90,000 for 2016, one of the closest-watched metrics, since it correlates to both the amount of cash needed and the expectation of being able to scale the business, and obtain higher margins.

Analyst Sentiment

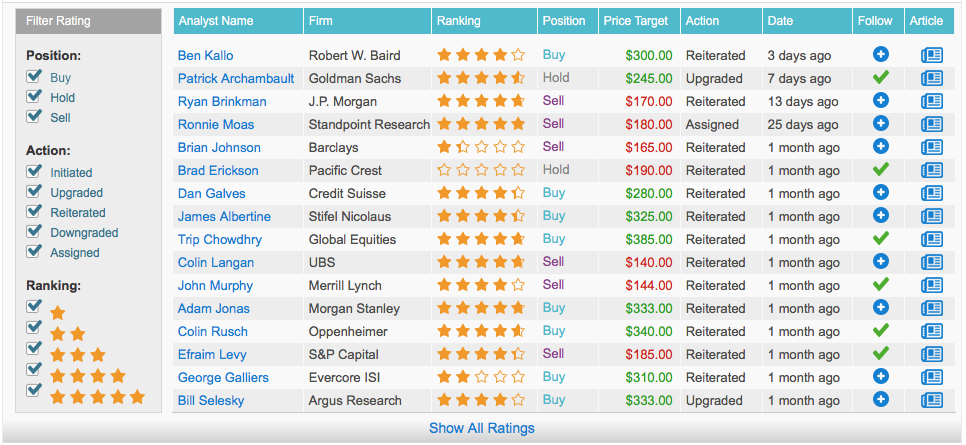

Of the top 16 analysts listed on TipRanks covering Tesla, 8 rate the stock as a BUY, 6 as a SELL and 2 as a HOLD (tipranks.com). Only one, Patrick Archambault of Goldman Sachs, recently upgraded its price target to 245, on “Model 3 order strength.” All others reiterated their target, with an average of $244.

Earnings

The consensus estimate is a per share $ -.57 loss for the quarter. Tesla has a mixed record regarding beating or missing estimates. Zacks Equity Research reports that “Tesla delivered mixed earnings surprises in the last four quarters. It outperformed in two and missed the other two.”

On the other hand, a miss does not seem to affect TSLA as it does other hi-tech stocks like Apple, Netflix, or Google. While Tesla missed the consensus on 4th quarter 2015 earnings, reported on February 10, on that date it started a 78% run to $269.

Short-Term Action

During the past month, TSLA stock has been in “compression”, i.e. without much direction, up or down, hovering between 240 and 260. Moreover, on several occasions, the stock has changed by over $10 during the same session. This type of behavior makes TSLA fairly difficult to trade as there is no momentum, and the stock can swing back and forth fairly quickly. These are periods where I stay out of trying to trade TSLA and look for other more predictable stocks.

Now this latest behavior in TSLA stock was to be expected after such a dramatic move as we had in February and March, and it is actually “healthy” for the stock. After such an incredible run, a cool period, and possibly even a drop, is needed to refuel the bulls.

Live Q&A Webcast

Join the webcast on May 4 at 2:30pm Pacific Time, where officers will discuss the Company’s financial and business results and outlook.

I’ll be listening to the Webcast and will report on my analysis in my next post.

Elon Musk

SpaceX IPO could push Elon Musk’s net worth past $1 trillion: Polymarket

The estimates were shared by the official Polymarket Money account on social media platform X.

Recent projections have outlined how a potential $1.75 trillion SpaceX IPO could generate historic returns for early investors. The projections suggest the offering would not only become the largest IPO in history but could also result in unprecedented windfalls for some of the company’s key investors.

The estimates were shared by the official Polymarket Money account on social media platform X.

As noted in a Polymarket Money analysis, Elon Musk invested $100 million into SpaceX in 2002 and currently owns approximately 42% of the company. At a $1.75 trillion valuation following SpaceX’s potential $1.75 trillion IPO, that stake would be worth roughly $735 billion.

Such a figure would dramatically expand Musk’s net worth. When combined with his holdings in Tesla Inc. and other ventures, a public debut at that level could position him as the world’s first trillionaire, depending on market conditions at the time of listing.

The Bloomberg Billionaires Index currently lists Elon Musk with a net worth of $666 billion, though a notable portion of this is tied to his TSLA stock. Tesla currently holds a market cap of $1.51 trillion, and Elon Musk’s currently holds about 13% to 15% of the company’s outstanding common stock.

Founders Fund, co-founded by Peter Thiel, invested $20 million in SpaceX in 2008. Polymarket Money estimates the firm owns between 1.5% and 3% of the private space company. At a $1.75 trillion valuation, that range would translate to approximately $26.25 billion to $52.5 billion in value.

That return would represent one of the most significant venture capital outcomes in modern Silicon Valley history, with a growth of 131,150% to 262,400%.

Alphabet Inc., Google’s parent company, invested $900 million into SpaceX in 2015 and is estimated to hold between 6% and 7% of the private space firm. At the projected IPO valuation, that stake could be worth between $105 billion and $122.5 billion. That’s a growth of 11,566% to 14,455%.

Other major backers highlighted in the post include Fidelity Investments, Baillie Gifford, Valor Equity Partners, Bank of America, and Andreessen Horowitz, each potentially sitting on multibillion-dollar gains.

Elon Musk

Elon Musk hints Tesla investors will be rewarded heavily

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet,” Musk said.

Elon Musk recently hinted that he believes Tesla investors will be rewarded heavily if they continue to hold onto their shares, and he reiterated that in a new interview that the company released on its social accounts this week.

Musk is one of the most successful CEOs in the modern era and has mammothed competitors on the Forbes Net Worth List over the past year as his holdings in his various companies have continued to swell.

Tesla investors, especially those who have been holding shares for several years, have also felt substantial gains in their portfolios. Over the past five years, the stock is up over 78 percent. Since February 2019, nearly seven years ago to the day, the stock is up over 1,800 percent.

Musk said in the interview:

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet.”

Elon Musk in new interview: “Hold on to your $TSLA stock. It’s going to be worth a lot, I think. That’s my bet.” pic.twitter.com/cucirBuhq0

— Sawyer Merritt (@SawyerMerritt) February 26, 2026

It’s no secret Musk has been extremely bullish on his own companies, but Tesla in particular, because it is publicly traded.

However, the company has so many amazing projects that have an opportunity to revolutionize their respective industries. There is certainly a path to major growth on Wall Street for Tesla through its various future projects, including Optimus, Cybercab, Semi, and Unsupervised FSD.

- Optimus (Tesla’s humanoid robot): Musk has discussed its potential for tasks like childcare, walking dogs, or assisting elderly parents, positioning it as a massive long-term driver of company value.

- Cybercab (Tesla’s robotaxi/autonomous ride-hailing vehicle): a fully autonomous vehicle geared specifically for Tesla’s ride-sharing ambitions.

- Semi (Tesla’s electric truck, with mentions of expansion, like in Europe): brings Tesla into the commercial logistics sector.

- Unsupervised FSD (Full Self-Driving software achieving full autonomy without human supervision): turns every Tesla owner’s vehicle into a fully-autonomous vehicle upon release

These projects specifically are some of the highest-growth pillars Tesla has ever attempted to develop, especially in Musk’s eyes, as he has said Optimus will be the best-selling product of all-time.

Many analysts agree, but the bullish ones, like Cathie Wood of ARK Invest, are perhaps the one who believes Tesla has incredible potential on Wall Street, predicting a $2,600 price target for 2030, but this is not even including Optimus.

She told Bloomberg last March that she believes that the project will present a potential additive if Tesla can scale faster than anticipated.

Elon Musk

Tesla stock gets latest synopsis from Jim Cramer: ‘It’s actually a robotics company’

“Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session,” Cramer said.

Tesla stock (NASDAQ: TSLA) got its latest synopsis from Wall Street analyst Jim Cramer, who finally realized something that many fans of the company have known all along: it’s not a car company. Instead, it’s a robotics company.

In a recent note that was released after Tesla reported Earnings in late January, Cramer seemed to recognize that the underwhelming financials and overall performance of the automotive division were not representative of the current state of affairs.

Instead, we’re seeing a company transition itself away from its early identity, essentially evolving like a caterpillar into a butterfly.

The narrative of the Earnings Call was simple: We’re not a car company, at least not from a birds-eye view. We’re an AI and Robotics company, and we are transitioning to this quicker than most people realize.

Tesla stock gets another analysis from Jim Cramer, and investors will like it

Tesla’s Q4 Earnings Call featured plenty of analysis from CEO Elon Musk and others, and some of the more minor details of the call were even indicative of a company that is moving toward AI instead of its cars. For example, the Model S and Model X will be no more after Q2, as Musk said that they serve relatively no purpose for the future.

Instead, Tesla is shifting its focus to the vehicles catered for autonomy and its Robotaxi and self-driving efforts.

Cramer recognizes this:

“…we got results from Tesla, which actually beat numbers, but nobody cares about the numbers here, as electric vehicles are the past. And according to CEO Elon Musk, the future of this company comes down to Cybercabs and humanoid robots. Stock fell more than 3% the next day. That may be because their capital expenditures budget was higher than expected, or maybe people wanted more details from the new businesses. At this point, I think Musk acolytes might be more excited about SpaceX, which is planning to come public later this year.”

He continued, highlighting the company’s true transition away from vehicles to its Cybercab, Optimus, and AI ambitions:

“I know it’s hard to believe how quickly this market can change its attitude. Last night, I heard a disastrous car company speak. Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session. I didn’t like it as a car company. Boy, I love it as a Cybercab and humanoid robot juggernaut. Call me a buyer and give me five robots while I’m at it.”

Cramer’s narrative seems to fit that of the most bullish Tesla investors. Anyone who is labeled a “permabull” has been echoing a similar sentiment over the past several years: Tesla is not a car company any longer.

Instead, the true focus is on the future and the potential that AI and Robotics bring to the company. It is truly difficult to put Tesla shares in the same group as companies like Ford, General Motors, and others.

Tesla shares are down less than half a percent at the time of publishing, trading at $423.69.