News

SpaceX’s ultimate ace in the hole is its Starlink satellite internet business

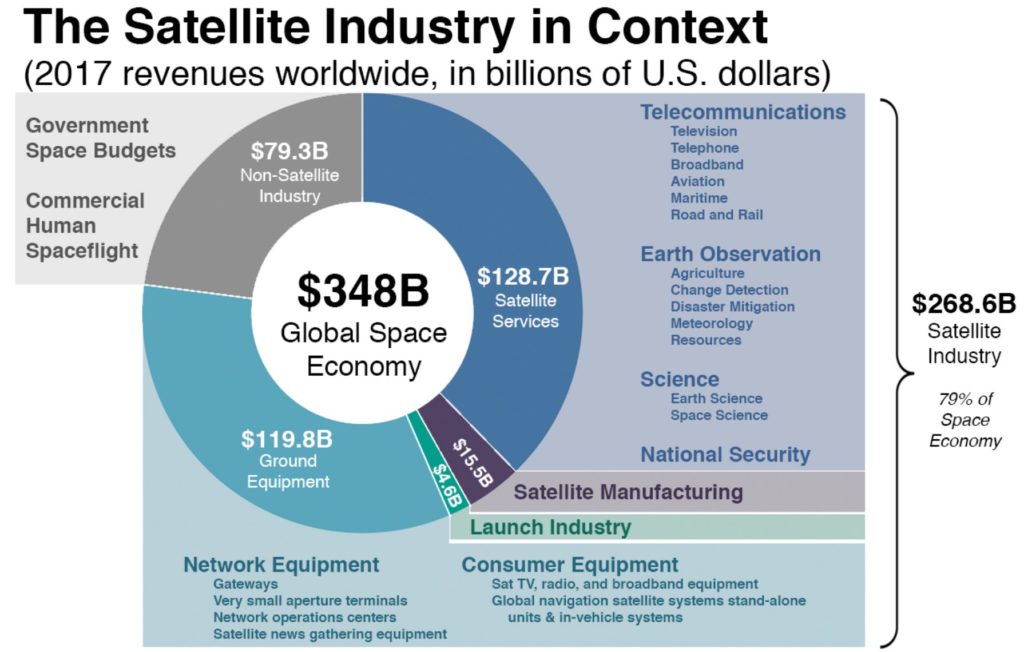

In a 2018 report on the current state of the satellite industry, the rationale behind SpaceX’s decision to expand its business into the construction and operation of a large satellite network – known as Starlink – was brought into sharp contrast, demonstrating just how tiny the market for orbital launches is compared with the markets those same launches create.

First and foremost, it must be acknowledged that SpaceX’s incredible strides in launch vehicles over the last decade or so have been explicitly focused on lowering the cost of access to orbit, the consequences of which basic economics suggests should be a subsequent growth in demand for orbital access. If a sought-after good is somehow sold for less, one would expect that more people would be able and willing to buy it. The launch market is similar, but also very different in the sense that simply reaching orbit has almost no inherent value on its own – what makes it valuable are the payloads, satellites, spacecraft, and humans that are delivered there.

- An overview of space industry in 2017, produced by Bryce Space & Technology for the 2018 State of Satellite Industry Report.

- SpaceX’s first two Starlink prototype satellites are pictured here before their inaugural Feb. 2018 launch, showing off a utilitarian design. (SpaceX)

As a consequence, if the cost of access to orbit plummets (as SpaceX hopes to do with reusability) but the cost of the cargo still being placed there does not, there would essentially be no reason at all for demand for launches to increase. For there to be more demand for cheaper launches, the cost of the satellites that predominately fuel the launch market also needs to decrease.

One of the first two prototype Starlink satellites separates from Falcon 9’s upper stage, March 2018. (SpaceX)

Enter Starlink, SpaceX’s internal effort to develop – nearly from scratch – its own highly reliable, cheap, and mass-producible satellite bus, as well as the vast majority of all the hardware and software required to build and operate a vast, orbiting broadband network. Add in comparable companies like OneWeb and an exploding landscape of companies focused on creating a new generation of miniaturized satellites, and the stage has truly begun to be set for a future where the cost of orbital payloads themselves wind up dropping just as dramatically as the cost of launching them.

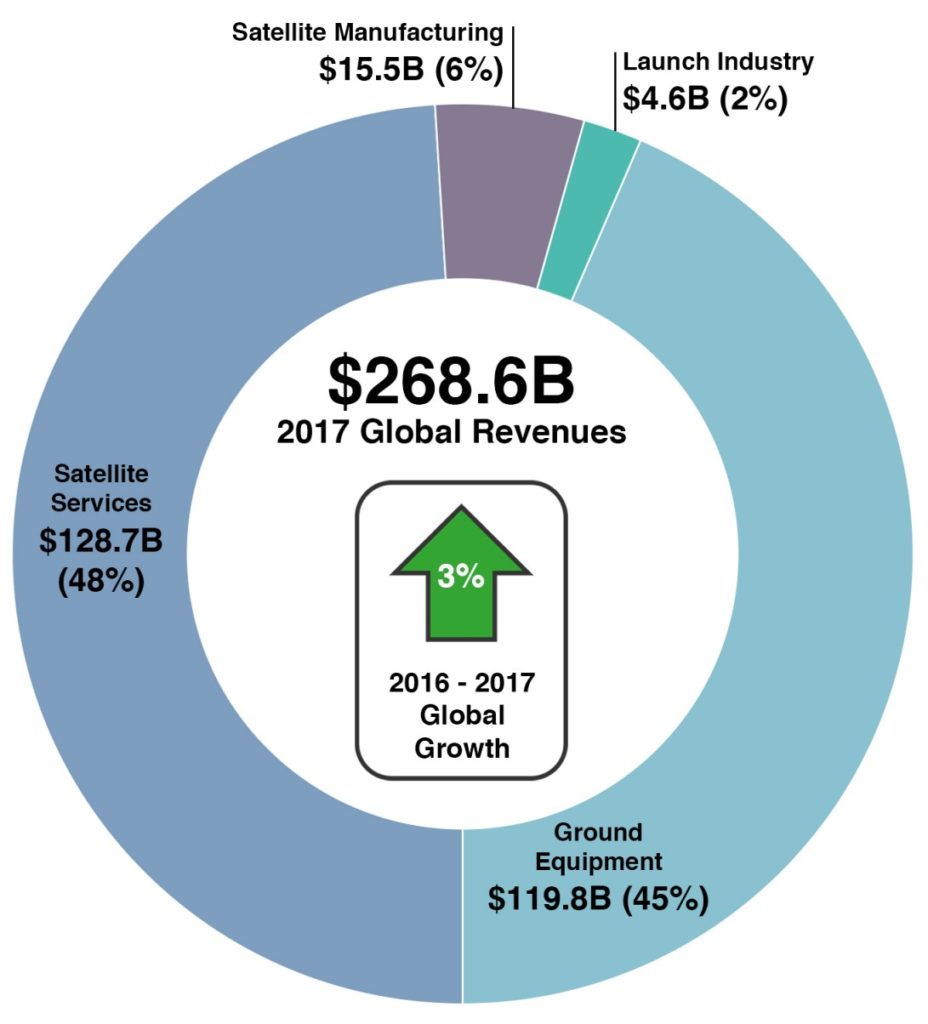

Just by sheer numbers alone, stepping from launch vehicle and spacecraft production and operations into the satellite manufacturing, services, and connectivity industries is a no-brainer. Bluntly speaking, the market for rocket launches makes up barely more than one-sixtieth – less than 2% – of the entire commercial satellite industry, while services (telecommunications, Earth observation, science, etc.) and equipment (user terminals, GPS receivers, antennae, etc) account for more than 93%. Even the satellite manufacturing industry taken on its own is more than three times as large as the launch industry – $15.5b versus $4.6b in 2017.

In other words, even if SpaceX was to drop the cost of Falcon 9, Heavy, and BFR launches by a factor of 10 and the market for launches expanded exponentially as a result (say 50-100x), the market for launches would still be a tiny fraction of the stagnant, unchanged, unimproved satellite services and production industries. Put simply, there is scarcely any money to be made in rocket launches when compared with literally any other space-related industry.

- An overview of just the commercial aspects of the satellite industry. (SIA)

- Falcon Heavy’s inaugural launch, February 2018. (Tom Cross)

While far from a done deal, Starlink is thus without a doubt the most promising established method for SpaceX to dramatically increase its profitable income, income which could thus be invested directly in launch vehicles, space resource utilization, sustainable interplanetary colonies, and more, all while potentially revolutionizing global freedom of connectivity.

Cybertruck

Tesla confirms date when new Cybertruck trim will go up in price

Tesla has officially revealed that this price will only be available until February 28, as the company has placed a banner atop the Design Configurator on its website reflecting this.

Tesla has confirmed the date when its newest Cybertruck trim level will increase in price, after CEO Elon Musk noted that the All-Wheel-Drive configuration of the all-electric pickup would only be priced at its near-bargain level for ten days.

Last week, Tesla launched the All-Wheel-Drive configuration of the Cybertruck. Priced at $59,990, the Cybertruck featured many excellent features and has seemingly brought some demand to the pickup, which has been underwhelming in terms of sales figures over the past couple of years.

Tesla launches new Cybertruck trim with more features than ever for a low price

When Tesla launched it, many fans and current owners mulled the possibility of ordering it. However, Musk came out and said just hours after launching the pickup that Tesla would only keep it at the $59,990 price level for ten days.

What it would be priced at subsequently was totally dependent on how much demand Tesla felt for the new trim level, which is labeled as a “Dual Motor All-Wheel-Drive” configuration.

Tesla has officially revealed that this price will only be available until February 28, as the company has placed a banner atop the Design Configurator on its website reflecting this:

NEWS: Tesla has officially announced that the price of the new Cybertruck Dual-Motor AWD will be increasing after February 28th. pic.twitter.com/vZpA521ZwC

— Sawyer Merritt (@SawyerMerritt) February 24, 2026

Many fans and owners have criticized Tesla’s decision to unveil a trim this way, and then price it at something, only to change that price a few days later based on how well it sells.

Awful way to treat customers – particularly when they already sent out a marketing email announcing the $59,990 truck…with zero mention of it being a limited-time offer.

— Ryan McCaffrey (@DMC_Ryan) February 24, 2026

It seems the most ideal increase in price would be somewhere between $5,000 and $10,000, but it truly depends on how many orders Tesla sees for this new trim level. The next step up in configuration is the Premium All-Wheel-Drive, which is priced at $79,990.

The difference between the Dual Motor AWD Cybertruck and the Premium AWD configuration comes down to towing, interior quality, and general features. The base package is only capable of towing up to 7,500 pounds, while the Premium can handle 11,000 pounds. Additionally, the seats in the Premium build are Vegan Leather, while the base trim gets the textile seats.

It also has only 7 speakers compared to the 15 that the Premium trim has. Additionally, the base model does not have an adjustable ride height, although it does have a coil spring with an adaptive damping suspension package.

Cybertruck

Tesla set to activate long-awaited Cybertruck feature

Tesla will officially activate the Active Noise Cancellation (ANC) feature on Cybertruck soon, as the company has officially added the feature to its list of features by trim on its website.

Tesla is set to activate a long-awaited Cybertruck feature, and no matter when you bought your all-electric pickup, it has the hardware capable of achieving what it is designed to do.

Tesla simply has to flip the switch, and it plans to do so in the near future.

Tesla will officially activate the Active Noise Cancellation (ANC) feature on Cybertruck soon, according to Not a Tesla App, as the company has officially added the feature to its list of features by trim on its website.

Tesla rolls out Active Road Noise Reduction for new Model S and Model X

The ANC feature suddenly appeared on the spec sheet for the Premium All-Wheel-Drive and Cyberbeast trims, which are the two configurations that have been delivered since November 2023.

However, those trims have both had the ANC disabled, and although they are found in the Model S and Model X, and are active in those vehicles, Tesla is planning to activate them.

In Tesla’s Service Toolbox, it wrote:

“ANC software is not enabled on Cybertruck even though the hardware is installed.”

Tesla has utilized an ANC system in the Model S and Model X since 2021. The system uses microphones embedded in the front seat headrests to detect low-frequency road noise entering the cabin. It then generates anti-noise through phase-inverted sound waves to cancel out or reduce that noise, creating quieter zones, particularly around the vehicle’s front occupants.

The Model S and Model X utilize six microphones to achieve this noise cancellation, while the Cybertruck has just four.

Tesla Cybertruck Dual Motor AWD estimated delivery slips to early fall 2026

As previously mentioned, this will be activated through a software update, as the hardware is already available within Cybertruck and can simply be activated at Tesla’s leisure.

The delays in activating the system are likely due to Tesla Cybertruck’s unique design, which is unlike anything before. In the Model S and Model X, Tesla did not have to do too much, but the Cybertruck has heavier all-terrain tires and potentially issues from the aluminum castings that make up the vehicle’s chassis, which are probably presenting some challenges.

Unfortunately, this feature will not be available on the new Dual Motor All-Wheel-Drive configuration, which was released last week.

News

Tesla Model S and X customization options begin to thin as their closure nears

Tesla’s Online Design Studio for both vehicles now shows the first color option to be listed as “Sold Out,” as Lunar Silver is officially no longer available for the Model S or Model X. This color is exclusive to these cars and not available on the Model S or Model X.

Tesla Model S and Model X customization options are beginning to thin for the first time as the closure of the two “sentimental” vehicles nears.

We are officially seeing the first options disappear as Tesla begins to work toward ending production of the two cars and the options that are available to those vehicles specifically.

Tesla’s Online Design Studio for both vehicles now shows the first color option to be listed as “Sold Out,” as Lunar Silver is officially no longer available for the Model S or Model X. This color is exclusive to these cars and not available on the Model S or Model X.

🚨 Tesla Model S and Model X availability is thinning, as Tesla has officially shown that the Lunar Silver color option on both vehicles is officially sold out

To be fair, Frost Blue is still available so no need to freak out pic.twitter.com/YnwsDbsFOv

— TESLARATI (@Teslarati) February 25, 2026

Tesla is making way for the Optimus humanoid robot project at the Fremont Factory, where the Model S and Model X are produced. The two cars are low-volume models and do not contribute more than a few percent to Tesla’s yearly delivery figures.

With CEO Elon Musk confirming that the Model S and Model X would officially be phased out at the end of the quarter, some of the options are being thinned out.

This is an expected move considering Tesla’s plans for the two vehicles, as it will make for an easier process of transitioning that portion of the Fremont plant to cater to Optimus manufacturing. Additionally, this is likely one of the least popular colors, and Tesla is choosing to only keep around what it is seeing routine demand for.

During the Q4 Earnings Call in January, Musk confirmed the end of the Model S and Model X:

“It is time to bring the Model S and Model X programs to an end with an honorable discharge. It is time to bring the S/X programs to an end. It’s part of our overall shift to an autonomous future.”

Fremont will now build one million Optimus units per year as production is ramped.