Investor's Corner

Tesla becomes 4th-largest US short amid countdown for Q3’s earnings

Earlier this year, Tesla stock (NASDAQ:TSLA) held the title of being the most-shorted company in the US stock market. But at the end of August, Tesla became second to Amazon as the US’ most-shorted stock, before being overtaken by Apple in early September. On Tuesday, Tesla’s place in the list fell again, putting the carmaker directly behind e-commerce behemoth Amazon (NASDAQ:AMZN), tech giant Apple (NASDAQ:AAPL), and chipmaker Qualcomm (NASDAQ:QCOM). With this, Tesla has now become the 4th-largest short in the US market.

The recent updates on Tesla’s short interest were posted yesterday by S3 Partners LLC Managing Director of Predictive Analytics Ihor Dusaniwsky. The S3 Partners exec noted that Tesla’s short interest is currently at $8.16 billion with 32.58 million shares shorted, corresponding to 25.55% of the company’s float. Dusaniwsky stated that over the past week, 1.2 million shares were covered amidst the steep 17% drop in TSLA stock. Tesla shorts are also up $416 million in mark-to-market profits.

$TSLA short interest is $8.16 billion, the 4th largest U.S. short behind $AAPL, $AMZN & $QCOM; 32.58 million shares shorted; 25.55% of float. 1.2 million shares covered over the last week as #Tesla's stock price fell 17%. Shorts up $416 million in mark-to-market October profits pic.twitter.com/5iXW8KWpvB

— Ihor Dusaniwsky🇺🇦 (@ihors3) October 9, 2018

Tesla stock saw a sharp decline last week when Elon Musk courted renewed controversy by posting a series of tweets critical of the Securities and Exchange Commission. Musk tweeted against the SEC on Thursday, at a time when Tesla stock was already down 4.4%. After Musk posted his criticism of the agency on Twitter, Tesla shares dipped 2% more. The following trading days were equally cruel to TSLA, with the stock ending Monday at a nearly 18-month low. The electric car maker showed some recovery on Tuesday, though, with shares rising 4.89% amidst a positive note from Macquarie Capital Inc, which gave Tesla an Outperform rating and a price target of $430 per share.

Despite its lower rankings in the list of most-shorted companies in the US market, Tesla remains a heavily-shorted stock. That said, the number of TSLA shares held short today is considerably lower than May’s figures, when Tesla had 39 million shares were held short – the highest in the company’s history. TSLA short interest has mostly decreased since then, recently falling to just 32.58 million shares as of Tuesday.

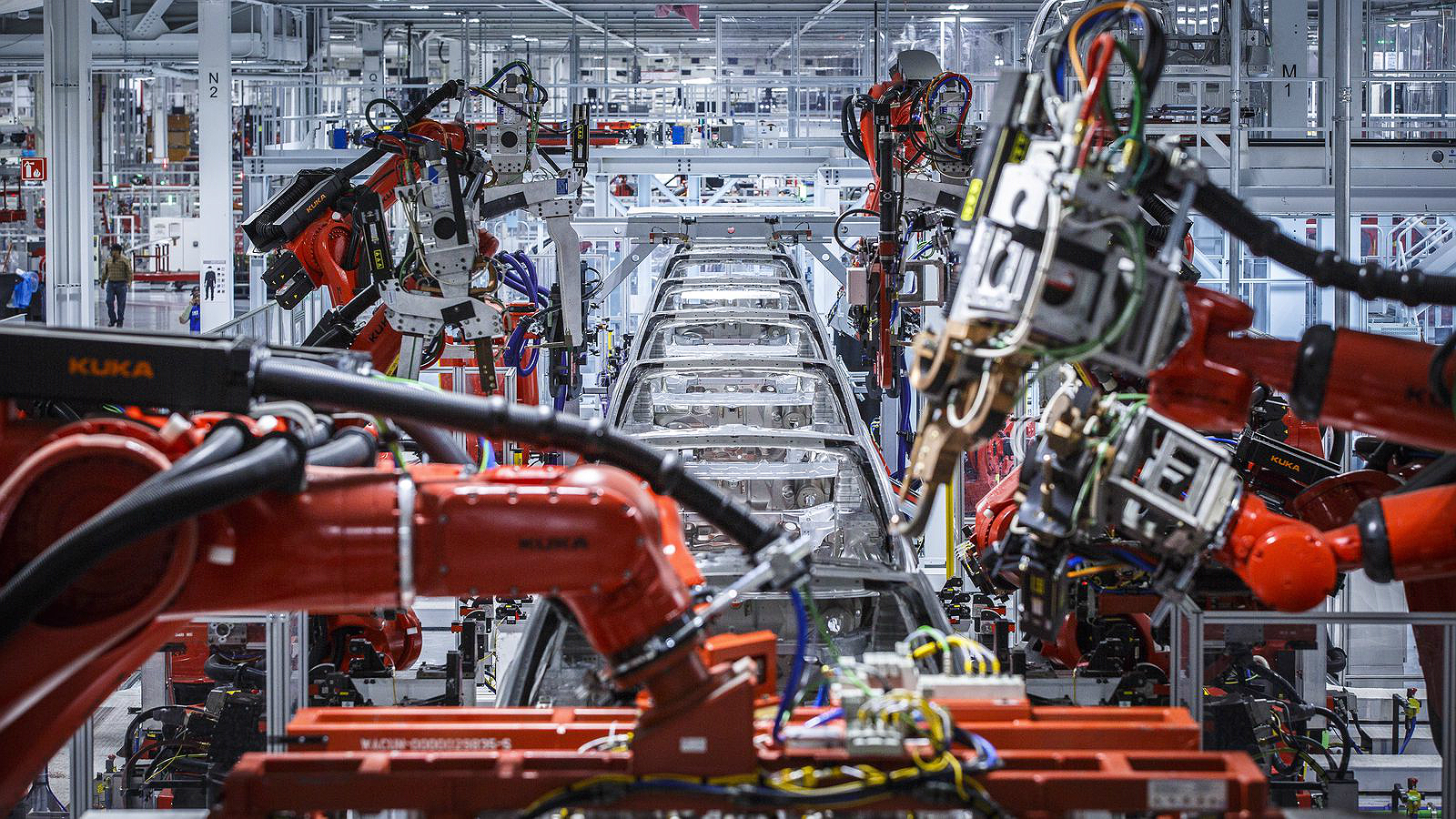

The apparent decline in Tesla’s short interest comes as the countdown for the release of Tesla’s Q3 2018 earnings report continues. Tesla had ambitious targets in the third quarter, as the company aimed to produce and deliver more than 50,000 Model 3 from July to September – a goal that was achieved. That said, while Tesla was able to set new delivery and production records in Q3, it remains to be seen if the company was able to turn a profit – target set by Elon Musk earlier this year.

A critical factor that can contribute to Tesla’s earnings in Q3 would lie in the Model 3, the company’s first attempt at a mass-market car. That said, if the company’s Q3 production and delivery figures are any indication, it appears that Q3 was the quarter when the Model 3 ramp started hitting its stride. Less than 48 hours before Q3 ended, Elon Musk even sent an email to Tesla employees, encouraging them to push harder since the company was “very close to profitability.”

“We are very close to achieving profitability and proving the naysayers wrong, but, to be certain, we must execute really well tomorrow (Sunday). If we go all out tomorrow, we will achieve an epic victory beyond all expectations,” Musk wrote.

This November, the market would see if Tesla achieved the “epic victory” that Elon Musk teased in his email. Despite the controversy stirred by Musk on Twitter, after all, Tesla’s fundamentals appear to be steadily improving.

Investor's Corner

Tesla Earnings Call: Top 5 questions investors are asking

Tesla has scheduled its Earnings Call for Q4 and Full Year 2025 for next Wednesday, January 28, at 5:30 p.m. EST, and investors are already preparing to get some answers from executives regarding a wide variety of topics.

The company accepts several questions from retail investors through the platform Say, which then allows shareholders to vote on the best questions.

Tesla does not answer anything regarding future product releases, but they are willing to shed light on current timelines, progress of certain projects, and other plans.

There are five questions that range over a variety of topics, including SpaceX, Full Self-Driving, Robotaxi, and Optimus, which are currently in the lead to be asked and potentially answered by Elon Musk and other Tesla executives:

- You once said: Loyalty deserves loyalty. Will long-term Tesla shareholders still be prioritized if SpaceX does an IPO?

- Our Take – With a lot of speculation regarding an incoming SpaceX IPO, Tesla investors, especially long-term ones, should be able to benefit from an early opportunity to purchase shares. This has been discussed endlessly over the past year, and we must be getting close to it.

- When is FSD going to be 100% unsupervised?

- Our Take – Musk said today that this is essentially a solved problem, and it could be available in the U.S. by the end of this year.

- What is the current bottleneck to increase Robotaxi deployment & personal use unsupervised FSD? The safety/performance of the most recent models or people to monitor robots, robotaxis, in-car, or remotely? Or something else?

- Our Take – The bottleneck seems to be based on data, which Musk said Tesla needs 10 billion miles of data to achieve unsupervised FSD. Once that happens, regulatory issues will be what hold things up from moving forward.

- Regarding Optimus, could you share the current number of units deployed in Tesla factories and actively performing production tasks? What specific roles or operations are they handling, and how has their integration impacted factory efficiency or output?

- Our Take – Optimus is going to have a larger role in factories moving forward, and later this year, they will have larger responsibilities.

- Can you please tie purchased FSD to our owner accounts vs. locked to the car? This will help us enjoy it in any Tesla we drive/buy and reward us for hanging in so long, some of us since 2017.

- Our Take – This is a good one and should get us some additional information on the FSD transfer plans and Subscription-only model that Tesla will adopt soon.

Tesla will have its Earnings Call on Wednesday, January 28.

Elon Musk

Tesla locks in Elon Musk’s top problem solver as it enters its most ambitious era

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla has granted Senior Vice President of Automotive Tom Zhu more than 520,000 stock options, tying a significant portion of his compensation to the company’s long-term performance.

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla secures top talent

According to a Form 4 filing with the U.S. Securities and Exchange Commission, Tom Zhu received 520,021 stock options with an exercise price of $435.80 per share. Since the award will not fully vest until March 5, 2031, Zhu must remain at Tesla for more than five years to realize the award’s full benefit.

Considering that Tesla shares are currently trading at around the $445 to $450 per share level, Zhu will really only see gains in his equity award if Tesla’s stock price sees a notable rise over the years, as noted in a Sina Finance report.

Still, even at today’s prices, Zhu’s stock award is already worth over $230 million. If Tesla reaches the market cap targets set forth in Elon Musk’s 2025 CEO Performance Award, Zhu would become a billionaire from this equity award alone.

Tesla’s problem solver

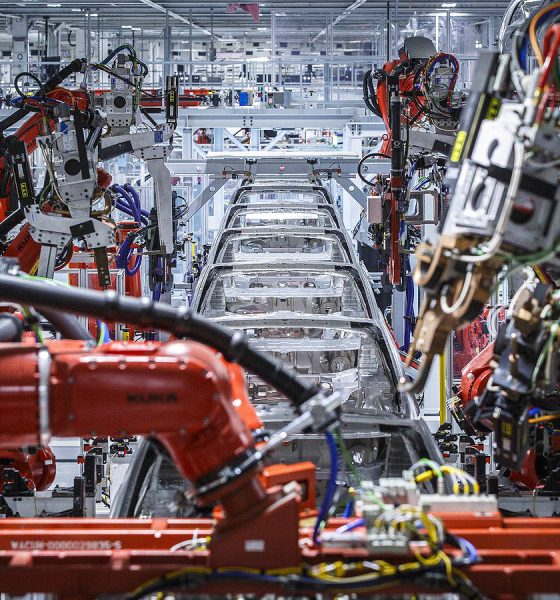

Zhu joined Tesla in April 2014 and initially led the company’s Supercharger rollout in China. Later that year, he assumed the leadership of Tesla’s China business, where he played a central role in Tesla’s localization efforts, including expanding retail and service networks, and later, overseeing the development of Gigafactory Shanghai.

Zhu’s efforts helped transform China into one of Tesla’s most important markets and production hubs. In 2023, Tesla promoted Zhu to Senior Vice President of Automotive, placing him among the company’s core global executives and expanding his influence beyond China. He has since garnered a reputation as the company’s problem solver, being tapped by Elon Musk to help ramp Giga Texas’s vehicle production.

With this in mind, Tesla’s recent filing seems to suggest that the company is locking in its top talent as it enters its newest, most ambitious era to date. As could be seen in the targets of Elon Musk’s 2025 pay package, Tesla is now aiming to be the world’s largest company by market cap, and it is aiming to achieve production levels that are unheard of. Zhu’s talents would definitely be of use in this stage of the company’s growth.

Investor's Corner

Tesla analyst teases self-driving dominance in new note: ‘It’s not even close’

Tesla analyst Andrew Percoco of Morgan Stanley teased the company’s dominance in its self-driving initiative, stating that its lead over competitors is “not even close.”

Percoco recently overtook coverage of Tesla stock from Adam Jonas, who had covered the company at Morgan Stanley for years. Percoco is handling Tesla now that Jonas is covering embodied AI stocks and no longer automotive.

His first move after grabbing coverage was to adjust the price target from $410 to $425, as well as the rating from ‘Overweight’ to ‘Equal Weight.’

Percoco’s new note regarding Tesla highlights the company’s extensive lead in self-driving and autonomy projects, something that it has plenty of competition in, but has established its prowess over the past few years.

He writes:

“It’s not even close. Tesla continues to lead in autonomous driving, even as Nvidia rolls out new technology aimed at helping other automakers build driverless systems.”

Percoco’s main point regarding Tesla’s advantage is the company’s ability to collect large amounts of training data through its massive fleet, as millions of cars are driving throughout the world and gathering millions of miles of vehicle behavior on the road.

This is the main point that Percoco makes regarding Tesla’s lead in the entire autonomy sector: data is King, and Tesla has the most of it.

One big story that has hit the news over the past week is that of NVIDIA and its own self-driving suite, called Alpamayo. NVIDIA launched this open-source AI program last week, but it differs from Tesla’s in a significant fashion, especially from a hardware perspective, as it plans to use a combination of LiDAR, Radar, and Vision (Cameras) to operate.

Percoco said that NVIDIA’s announcement does not impact Morgan Stanley’s long-term opinions on Tesla and its strength or prowess in self-driving.

NVIDIA CEO Jensen Huang commends Tesla’s Elon Musk for early belief

And, for what it’s worth, NVIDIA CEO Jensen Huang even said some remarkable things about Tesla following the launch of Alpamayo:

“I think the Tesla stack is the most advanced autonomous vehicle stack in the world. I’m fairly certain they were already using end-to-end AI. Whether their AI did reasoning or not is somewhat secondary to that first part.”

Percoco reiterated both the $425 price target and the ‘Equal Weight’ rating on Tesla shares.