News

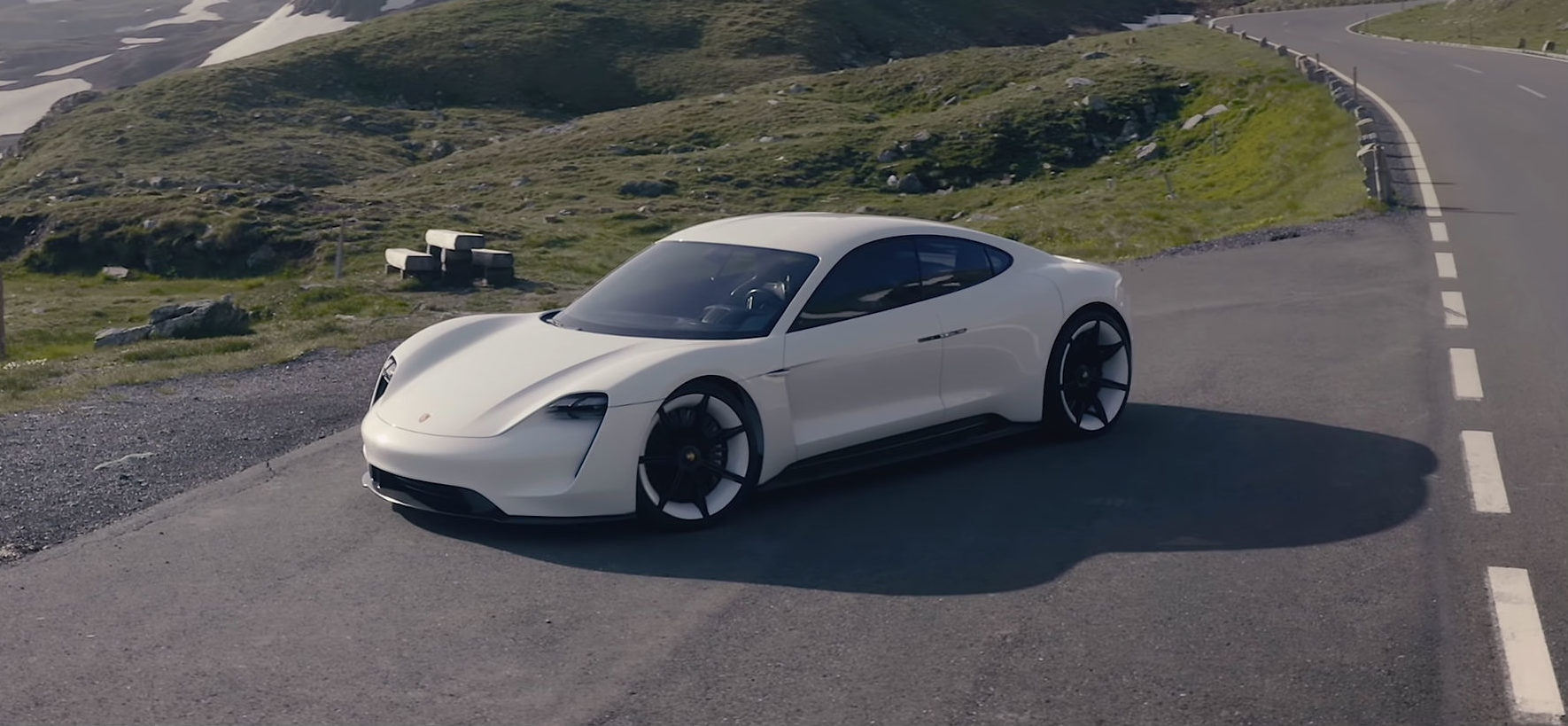

Porsche teases Taycan trim levels, over $130,000 price for “Turbo” variant

Porsche is expected to start the production of the Taycan, its first all-electric car, sometime in 2019. As the carmaker prepares to dip its feet into the premium EV market, some details about the upcoming vehicle are now starting to emerge. Take, for one, the names of the Taycan’s trim levels, as well as their corresponding price range.

Auto journalist Alex Roy recently shared a message he received from a Porsche Global Brand Ambassador as a response to an inquiry about the Taycan. As noted by the journalist, Porsche appears to be adopting a rather unique naming scheme for its Tesla Model S rival, particularly for the vehicle’s top trim.

Following is an excerpt from Porsche’s message to the journalist.

“I am following up on your inquiry on the upcoming Porsche Taycan. We are expecting to see the new model in about one year from now. Porsche is going to build three models — the Taycan, the Taycan 4S, and (the) Taycan Turbo. Pricing will start in the low $90,000 for the Taycan, high $90,000 for the 4S, and over $130,000 for the Turbo before options.”

Immediately noticeable is Porsche’s use of the word “Turbo” to denote the high-performance version of the Taycan. Such a naming scheme is a bit unusual for an electric car, considering that the vehicle would not have a turbo per se. That said, Roy noted in an article on The Drive that Porsche does tend to use the “Turbo” brand as a means to distinguish a halo vehicle from other cars in its lineup.

Thus, as unusual as it might be, calling the top-tier electric car the Taycan Turbo might actually be a very strategic move for the German legacy carmaker. After all, using familiar terminology on the electric car could help the company’s dedicated fanbase be more open to Porsche’s transition towards electrified mobility. Apart from this, using the “Turbo” designation for the Taycan’s top trim also gives the impression that the vehicle is a flagship car — one that the company intends to support for years to come.

Pricing-wise, the Taycan appears to be starting at a price above the entry-level Tesla Model S 75D. If the information provided by the Porsche Global Brand Ambassador proves accurate, the entry-level Taycan will start roughly $12,000 more than the entry-level Model S, which starts at $78,000. The midrange Taycan 4S, though, appears to be directly aimed at the Model S 100D, which starts at $96,000 before incentives.

Quite interestingly, the Taycan Turbo’s $130,000 starting price actually undercuts the Model S P100D’s current $135,000 starting price. That said, if the specs that Porsche announced for the vehicle — such as a 0-60 mph time of 3.5 seconds, a top speed of 155 mph, and a range of 310 miles per charge — are true for the Taycan Turbo, the vehicle would be slower off the line and have a slightly shorter range than Tesla’s flagship performance sedan. This would make the Taycan Turbo’s specs, down to its proficiency on the track, more comparable to the Model 3 Performance, which starts at a far more affordable price of $64,000.

News

Tesla Full Self-Driving v14.2.2.5 might be the most confusing release ever

With each Full Self-Driving release, I am realistic. I know some things are going to get better, and I know some things will regress slightly. However, these instances of improvements are relatively mild, as are the regressions. Yet, this version has shown me that it contains extremes of both.

Tesla Full Self-Driving v14.2.2.5 hit my car back on Valentine’s Day, February 14, and since I’ve had it, it has become, in my opinion, the most confusing release I’ve ever had.

With each Full Self-Driving release, I am realistic. I know some things are going to get better, and I know some things will regress slightly. However, these instances of improvements are relatively mild, as are the regressions. Yet, this version has shown me that it contains extremes of both.

It has been about three weeks of driving on v14.2.2.5; I’ve used it for nearly every mile traveled since it hit my car. I’ve taken short trips of 10 minutes or less, I’ve taken medium trips of an hour or less, and I’ve taken longer trips that are over 100 miles per leg and are over two hours of driving time one way.

These are my thoughts on it thus far:

Speed Profiles Are a Mixed Bag

Speed Profiles are something Tesla seems to tinker with quite frequently, and each version tends to show a drastic difference in how each one behaves compared to the previous version.

I do a vast majority of my FSD travel using Standard and Hurry modes, although in bad weather, I will scale it back to Chill, and when it’s a congested city on a weekend or during rush hour, I’ll throw it into Mad Max so it takes what it needs.

Early on, Speed Profiles really felt great. This is one of those really subjective parts of the FSD where someone might think one mode travels too quickly, whereas another person might see the identical performance as too slow or just right.

To me, I would like to see more consistency from release to release on them, but overall, things are pretty good. There are no real complaints on my end, as I had with previous releases.

In a past release, Mad Max traveled under the speed limit quite frequently, and I only had that experience because Hurry was acting the same way. I’ve had no instances of that with v14.2.2.5.

Strange Turn Signal Behavior

This is the first Full Self-Driving version where I’ve had so many weird things happen with the turn signals.

Two things come to mind: Using a turn signal on a sharp turn, and ignoring the navigation while putting the wrong turn signal on. I’ve encountered both things on v14.2.2.5.

On my way to the Supercharger, I take a road that has one semi-sharp right-hand turn with a driveway entrance right at the beginning of the turn.

Only recently, with the introduction of v14.2.2.5, have I had FSD put on the right turn signal when going around this turn. It’s obviously a minor issue, but it still happens, and it’s not standard practice:

How can we get Full Self-Driving to stop these turn signals?

There’s no need to use one here; the straight path is a driveway, not a public road. The right turn signal here is unnecessary pic.twitter.com/7uLDHnqCfv

— TESLARATI (@Teslarati) February 28, 2026

When sharing this on X, I had Tesla fans (the ones who refuse to acknowledge that the company can make mistakes) tell me that it’s a “valid” behavior that would be taught to anyone who has been “professionally trained” to drive.

Apparently, if you complain about this turn signal, you are also claiming you know more than Tesla engineers…okay.

Nobody in their right mind has ever gone around a sharp turn when driving their car and put on a signal when continuing on the same road. You would put a left turn signal on to indicate you were turning into that driveway if that’s what your intention was.

Like I said, it’s a totally minor issue. However, it’s not really needed, and nor is it normal. If I were in the car with someone who was taking a simple turn on a road they were traveling, and they signaled because the turn was sharp, I’d be scratching my head.

I’ve also had three separate instances of the car completely ignoring the navigation and putting on a signal that is opposite to what the routing says. Really quite strange.

Parking Performance is Still Underwhelming

Parking has been a complaint of mine with FSD for a long time, so much so that it is pretty rare that I allow the vehicle to park itself. More often than not, it is because I want to pick a spot that is relatively isolated.

However, in the times I allow it to pull into a spot, it still does some pretty head-scratching things.

Recently, it tried to back into a spot that was ~60% covered in plowed snow. The snow was piled about six feet high in a Target parking lot.

A few days later, it tried backing into a spot where someone failed the universal litmus test of returning their shopping cart. Both choices were baffling and required me to manually move the car to a different portion of the lot.

I used Autopark on both occasions, and it did a great job of getting into the spot. I notice that the parking performance when I manually choose the spot is much better than when the car does the entire parking process, meaning choosing the spot and parking in it.

It’s Doing Things (For Me) It’s Never Done Before

Two things that FSD has never done before, at least for me, are slow down in School Zones and avoid deer. The first is something I usually take over manually, and the second I surprisingly have not had to deal with yet.

I had my Tesla slow down at a school zone yesterday for the first time, traveling at 20 MPH and not 15 MPH as the sign suggested, but at the speed of other cars in the School Zone. This was impressive and the first time I experienced it.

I would like to see this more consistently, and I think School Zones should be one of those areas where, no matter what, FSD will only travel the speed limit.

Last night, FSD v14.2.2.5 recognized a deer in a roadside field and slowed down for it:

🚨 Cruising home on a rainy, foggy evening and my Tesla on Full Self-Driving begins to slow down suddenly

FSD just wanted Mr. Deer to make it home to his deer family ❤️ pic.twitter.com/cAeqVDgXo5

— TESLARATI (@Teslarati) March 4, 2026

Navigation Still SUCKS

Navigation will be a complaint until Tesla proves it can fix it. For now, it’s just terrible.

It still has not figured out how to leave my neighborhood. I give it the opportunity to prove me wrong each time I leave my house, and it just can’t do it.

It always tries to go out of the primary entrance/exit of the neighborhood when the route needs to take me left, even though that exit is a right turn only. I always leave a voice prompt for Tesla about it.

It still picks incredibly baffling routes for simple navigation. It’s the one thing I still really want Tesla to fix.

Investor's Corner

Tesla gets tip of the hat from major Wall Street firm on self-driving prowess

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet,” BoA wrote.

Tesla received a tip of the hat from major Wall Street firm Bank of America on Wednesday, as it reinitiated coverage on Tesla shares with a bullish stance that comes with a ‘Buy’ rating and a $460 price target.

In a new note that marks a sharp reversal from its neutral position earlier in 2025, the bank declared Tesla’s Full Self-Driving (FSD) technology the “leading consumer autonomy solution.”

Analysts highlighted Tesla’s camera-only architecture, known as Tesla Vision, as a strategic masterstroke. While technically more challenging than the multi-sensor setups favored by rivals, the vision-based approach is dramatically cheaper to produce and maintain.

This cost edge, combined with Tesla’s rapidly expanding real-world data engine, positions the company to scale robotaxis far more profitably than competitors, BofA argues in the new note:

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet.”

The bank now attributes roughly 52% of Tesla’s total valuation to its Robotaxi ambitions. It also flagged meaningful upside from the Optimus humanoid robot program and the fast-growing energy storage business, suggesting the auto segment’s recent headwinds, including expired incentives, are being eclipsed by these higher-margin opportunities.

Tesla’s own data underscores exactly why Wall Street is waking up to FSD’s potential. According to Tesla’s official safety reporting page, the FSD Supervised fleet has now surpassed 8.4 billion cumulative miles driven.

Tesla FSD (Supervised) fleet passes 8.4 billion cumulative miles

That total ballooned from just 6 million miles in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and a staggering 4.25 billion in 2025 alone. In the first 50 days of 2026, owners added another 1 billion miles — averaging more than 20 million miles per day.

This avalanche of real-world, camera-captured footage, much of it on complex city streets, gives Tesla an unmatched training dataset. Every mile feeds its neural networks, accelerating improvement cycles that lidar-dependent rivals simply cannot match at scale.

Tesla owners themselves will tell you the suite gets better with every release, bringing new features and improvements to its self-driving project.

The $460 target implies roughly 15 percent upside from recent trading levels around $400. While regulatory and safety hurdles remain, BofA’s endorsement signals growing institutional conviction that Tesla’s data advantage is not hype; it’s a tangible moat already delivering billions of miles of proof.

News

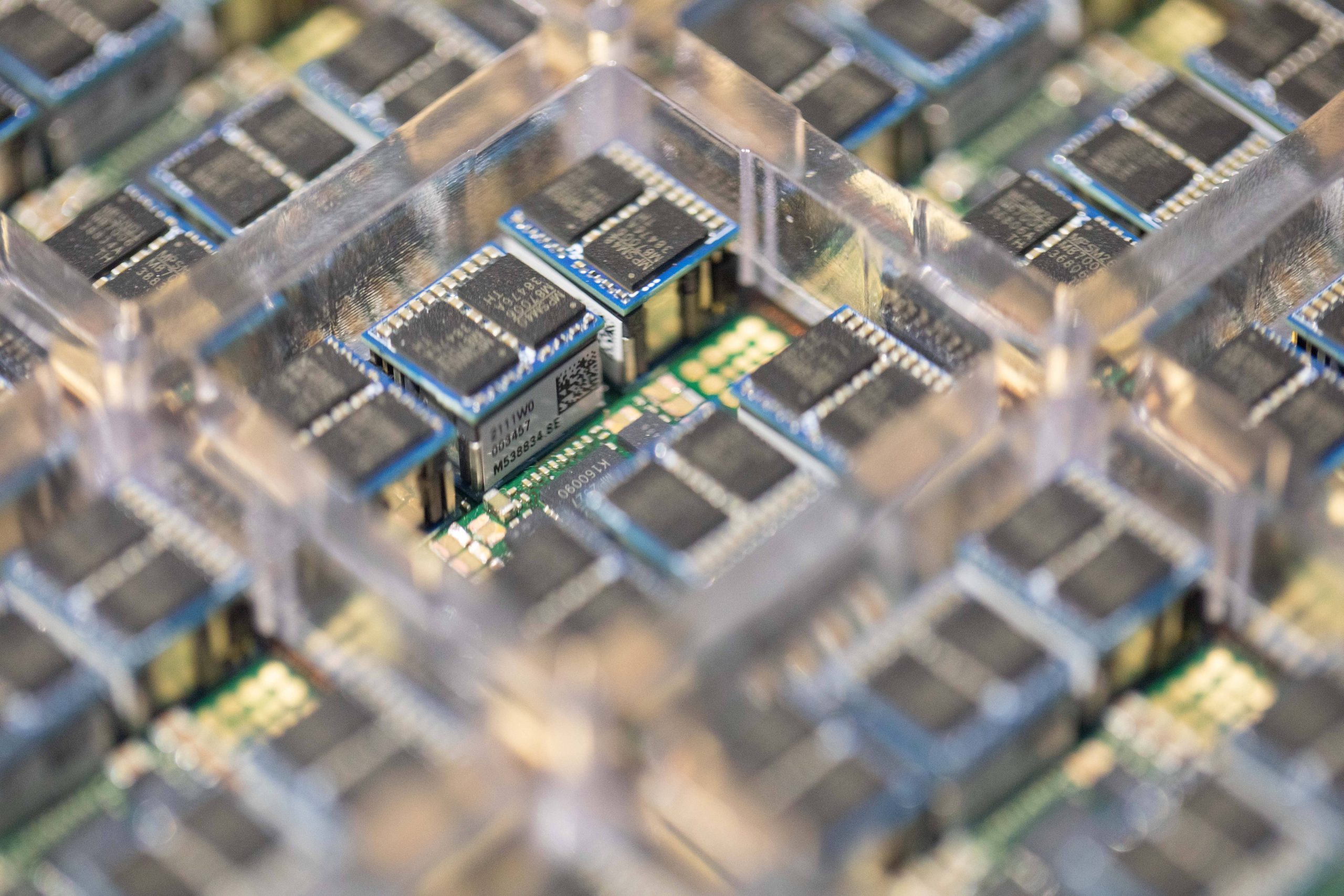

Tesla to discuss expansion of Samsung AI6 production plans: report

Tesla has reportedly requested an additional 24,000 wafers per month, which would bring total production capacity to around 40,000 wafers if finalized.

Tesla is reportedly discussing an expansion of its next-generation AI chip supply deal with Samsung Electronics.

As per a report from Korean industry outlet The Elec, Tesla purchasing executives are reportedly scheduled to meet Samsung officials this week to negotiate additional production volume for the company’s upcoming AI6 chip.

Industry sources cited in the report stated that Tesla is pushing to increase the production volume of its AI6 chip, which will be manufactured using Samsung’s 2-nanometer process.

Tesla previously signed a long-term foundry agreement with Samsung covering AI6 production through December 31, 2033. The deal was reportedly valued at about 22.8 trillion won (roughly $16–17 billion).

Under the existing agreement, Tesla secured approximately 16,000 wafers per month from the facility. The company has reportedly requested an additional 24,000 wafers per month, which would bring total production capacity to around 40,000 wafers if finalized.

Tesla purchasing executives are expected to discuss detailed supply terms during their visit to Samsung this week.

The AI6 chip is expected to support several Tesla technologies. Industry sources stated that the chip could be used for the company’s Full Self-Driving system, the Optimus humanoid robot, and Tesla’s internal AI data centers.

The report also indicated that AI6 clusters could replace the role previously planned for Tesla’s Dojo AI supercomputer. Instead of a single system, multiple AI6 chips would be combined into server-level clusters.

Tesla’s semiconductor collaboration with Samsung dates back several years. Samsung participated in the design of Tesla’s HW3 (AI3) chip and manufactured it using a 14-nanometer process. The HW4 chip currently used in Tesla vehicles was also produced by Samsung using a 5-nanometer node.

Tesla previously planned to split production of its AI5 chip between Samsung and TSMC. However, the company reportedly chose Samsung as the primary partner for the newer AI6 chip.