General Motors says it has a plan to dethrone Tesla: the undisputed king of electric vehicles.

GM CEO Mary Barra said in November that the company responsible for the Chevy Volt would build a million EVs in 2025. The question is, how will it get there, and what steps will it take to dethrone Tesla, who produced more than 509,000 EVs in 2020 and delivered 98% of them.

“We are committed to fighting for EV market share until we are number one in North America,” Barra said after detailing the plans for 30 EV models by 2025. The project requires a $27 billion investment from one of the U.S’s most notorious automakers. But in the past, car companies have outlined their plans to beat Tesla, and they’ve continuously fallen short, not accounting for Tesla’s planned growth.

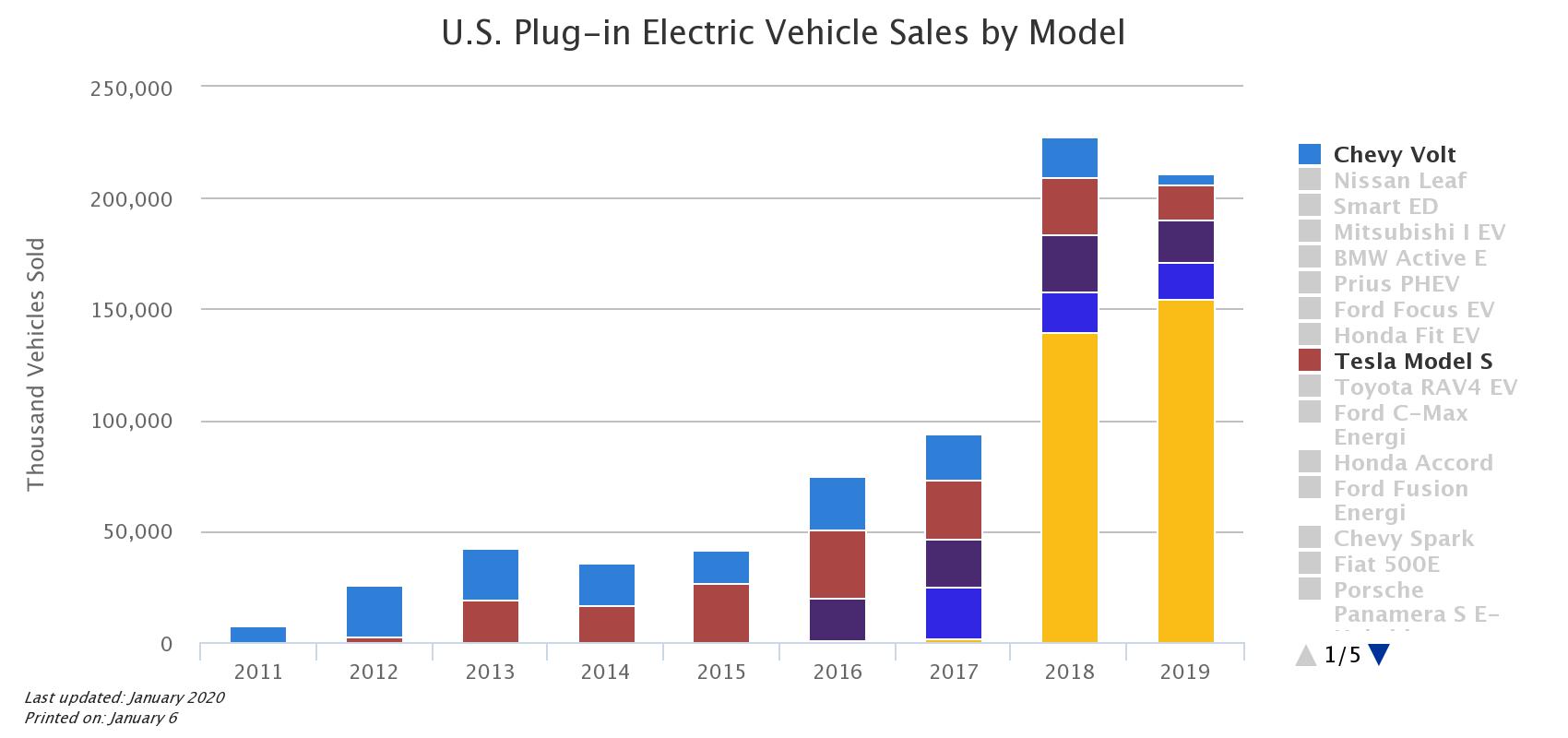

In 2012, GM was the undisputed leader in EVs. The Chevy Volt sold 23,461 units that year. Then Tesla came along with the Model S. Five years later, Tesla had figured out that it could build a mass-market vehicle with the Model 3, proving that it’s not about the number of models. Still, the focus should be on affordability and efficiency. Tesla showed that it had figured out the formula for a fun, fast, efficient, and affordable electric car. It was a riddle that legacy automakers that had the cash and infrastructure to develop hadn’t solved.

Credit: U.S. Department of Energy, Alternative Fuel Vehicle Data Key: Blue: Chevy Volt, Burgundy: Tesla Model S, Purple: Tesla Model X, Royal Blue: Chevy Bolt, Yellow: Tesla Model 3

Despite the Model 3 giving Tesla and its frontman Elon Musk significant production issues, the vehicle has become the most popular EV in the U.S., China, and other territories. Led by the Model 3, Tesla held 58 percent of the U.S. EV market share in 2019, and Financial Post states that the automaker could own as much as 80 percent of the market share for 2020.

GM’s plan is simple: depend on its Ultium battery, which will amplify production and the development new, all-electric models. It plans to decrease the cost of battery production to the $100/kWh threshold, which will activate price parity with gas cars, in three years. It then plans to get that down to $75/kWh in 2025. These projections come from Emmanuel Rosner, an analyst with Deutsche Bank.

The problem is: Tesla detailed its complete roadmap to decrease the cost of its price per kWh during the company’s Battery Day event in September 2020, and it shows prices as low as $50/kWh.

This brings in significant possibilities for GM moving forward, especially if it can continue to leverage more affordable battery costs past 2025. However, it will need more help beating Tesla, which at this time, analysts see as the leader for the foreseeable future.

A Tesla Model 3 recently battled a Chevy Bolt on a drag race in Moscow. [Credit: KindelTech/YouTube]

“Price is going to be what determines who is the market leader, and Tesla looks set to win on price for the foreseeable future,” Luke Gear, an analyst at IDTechEX, says.

Past the financials, Tesla’s growth, which is fueled by a strict and non-diversified focus on EVs only, gives the company an explicit advantage moving forward. On the other hand, GM has to combat the development of its 30 planned EVs with its existing fleet of gas-powered vehicles. Tesla can continue developing its EVs without any other distractions. Its name and reputation as the leader in the sector will help attract young and fresh engineering talent, especially in software and manufacturing, which are some of the company’s main focuses.

ALSO READ:

GM watches Tesla go from “graveyard-bound” to inspiration in pursuit of million-mile battery

GM’s goal is considerably lofty, and its words will not win over the Tesla faithful who are critical of the companies who talk a big game but fail to back it up. Many automakers have come along with a plan to disrupt Tesla’s domination in the EV sector, only to figure out that building an effective EV goes past putting a battery pack into a familiar chassis. But even if they don’t become the leader, will it be considered a complete failure?

“If they keep putting out tons of great products…and they take a ton of share from Tesla, are their EV efforts a failure then? I would say no,” David Whiston of Morningstar said.

What do you think? Leave a comment down below. Got a tip? Email us at tips@teslarati.com or reach out to me at joey@teslarati.com.

Elon Musk

FCC chair criticizes Amazon over opposition to SpaceX satellite plan

Carr made the remarks in a post on social media platform X.

U.S. Federal Communications Commission (FCC) Chairman Brendan Carr criticized Amazon after the company opposed SpaceX’s proposal to launch a large satellite constellation that could function as an orbital data center network.

Carr made the remarks in a post on social media platform X.

Amazon recently urged the FCC to reject SpaceX’s application to deploy a constellation of up to 1 million low Earth orbit satellites that could serve as artificial intelligence data centers in space.

The company described the proposal as a “lofty ambition rather than a real plan,” arguing that SpaceX had not provided sufficient details about how the system would operate.

Carr responded by pointing to Amazon’s own satellite deployment progress.

“Amazon should focus on the fact that it will fall roughly 1,000 satellites short of meeting its upcoming deployment milestone, rather than spending their time and resources filing petitions against companies that are putting thousands of satellites in orbit,” Carr wrote on X.

Amazon has declined to comment on the statement.

Amazon has been working to deploy its Project Kuiper satellite network, which is intended to compete with SpaceX’s Starlink service. The company has invested more than $10 billion in the program and has launched more than 200 satellites since April of last year.

Amazon has also asked the FCC for a 24-month extension, until July 2028, to meet a requirement to deploy roughly 1,600 satellites by July 2026, as noted in a CNBC report.

SpaceX’s Starlink network currently has nearly 10,000 satellites in orbit and serves roughly 10 million customers. The FCC has also authorized SpaceX to deploy 7,500 additional satellites as the company continues expanding its global satellite internet network.

Energy

Tesla Energy gains UK license to sell electricity to homes and businesses

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

Tesla Energy has received a license to supply electricity in the United Kingdom, opening the door for the company to serve homes and businesses in the country.

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

According to Ofgem, the license took effect at 6 p.m. local time on Wednesday and applies to Great Britain.

The approval allows Tesla’s energy business to sell electricity directly to customers in the region, as noted in a Bloomberg News report.

Tesla has already expanded similar services in the United States. In Texas, the company offers electricity plans that allow Tesla owners to charge their vehicles at a lower cost while also feeding excess electricity back into the grid.

Tesla already has a sizable presence in the UK market. According to price comparison website U-switch, there are more than 250,000 Tesla electric vehicles in the country and thousands of Tesla home energy storage systems.

Ofgem also noted that Tesla Motors Ltd., a separate entity incorporated in England and Wales, received an electricity generation license in June 2020.

The new UK license arrives as Tesla continues expanding its global energy business.

Last year, Tesla Energy retained the top position in the global battery energy storage system (BESS) integrator market for the second consecutive year. According to Wood Mackenzie’s latest rankings, Tesla held about 15% of global market share in 2024.

The company also maintained a dominant position in North America, where it captured roughly 39% market share in the region.

At the same time, competition in the energy storage sector is increasing. Chinese companies such as Sungrow have been expanding their presence globally, particularly in Europe.

Elon Musk

Elon Musk shares big Tesla Optimus 3 production update

According to Musk, Tesla is in the final stages of completing Optimus 3, which he described as one of the world’s most advanced humanoid robots.

Tesla CEO Elon Musk has stated that production of Optimus 3 could begin this summer. Musk shared the update in his interview at the Abundance Summit.

According to Musk, Tesla is in the final stages of completing Optimus 3, which he described as one of the world’s most advanced humanoid robots.

“We’re in the final stages of completion of Optimus 3, which is really going to be by far the most advanced robot in the world. Nothing’s even close. In fact, I haven’t even seen demos of robots that are as good as Optimus 3,” Musk said.

He also set expectations on the pace of Optimus 3’s production ramp, stating that the initial volumes of the humanoid robot will likely be very low. Musk did, however, also state that high production rates for Optimus 3 should be possible in 2027.

“I think we’ll start production on Optimus 3 this summer, but very slow at first, like sort of this classic S-curve ramp of manufacturing units versus time. And then, probably reach high volume production around summer next year,” he said.

Interestingly enough, the CEO hinted that Tesla is looking to iterate on the robot quickly, potentially releasing a new Optimus design every year.

“We’ll have Optimus 4 design complete next year. We’ll try to release a new robot design every year,” Musk stated.

Tesla has already outlined broader plans for scaling Optimus production beyond its first manufacturing line. Musk previously stated that Optimus 4 will be built at Gigafactory Texas at significantly higher production volumes.

Initial production lines for the robot are expected to be located at Tesla’s Fremont Factory, where the company plans to establish a line capable of producing up to 1 million robots per year.

A larger production ramp is expected to occur at Gigafactory Texas, where Musk has previously suggested could eventually support production of up to 10 million robots per year.

“We’re going to launch on the fastest production ramp of any product of any large complex manufactured product ever, starting with building a one-million-unit production line in Fremont. And that’s Line one. And then a ten million unit per year production line here,” Musk said previously.

The comments suggest that while Optimus 3 will likely begin production at Fremont, Tesla’s larger-scale manufacturing push could arrive with Optimus 4 at Gigafactory Texas.