News

IIHS to develop nighttime AEB evaluation after study finds emergency braking systems make no difference in the dark

A study by the Insurance Institute for Highway Safety (IIHS) found that pedestrian crash rates were lower when vehicles were equipped with pedestrian automatic emergency braking (AEB) systems. However, the agency’s study also revealed that AEB systems practically made no difference in pedestrian crashes that occurred at night.

“This is the first real-world study of pedestrian AEB to cover a broad range of manufacturers, and it proves the technology is eliminating crashes,” says Jessica Cicchino, IIHS vice president of research. “Unfortunately, it also shows these systems are much less effective in the dark, where three-quarters of fatal pedestrian crashes happen.”

The AEB System Study

Cicchino, the IIHS study’s author, looked at nearly 1,500 police-reported crashes involving 2017-2020 model-year vehicles from different manufacturers to determine the impact AEB systems made in pedestrian crashes. The study accounts for the quality of the vehicle’s headlights, along with the driver’s age, gender, and other demographic factors.

The study found that pedestrian crash rates of all severities were 27% lower when vehicles were equipped with AEB systems. Injury crash rates were 30% lower. However, the study also found that AEB systems made no difference in tests conducted in “unlighted areas.”

Cicchino made the discovery among a subset of 650 crashes with more detailed information about lighting conditions, speed limit, and crash configuration. The more detailed data revealed that AEB systems reduced the odds of pedestrian crashes by 32% in daylight and 33% in areas with artificial lighting, during dusk or dawn and nighttime.

Nighttime AEB Evaluation Tests

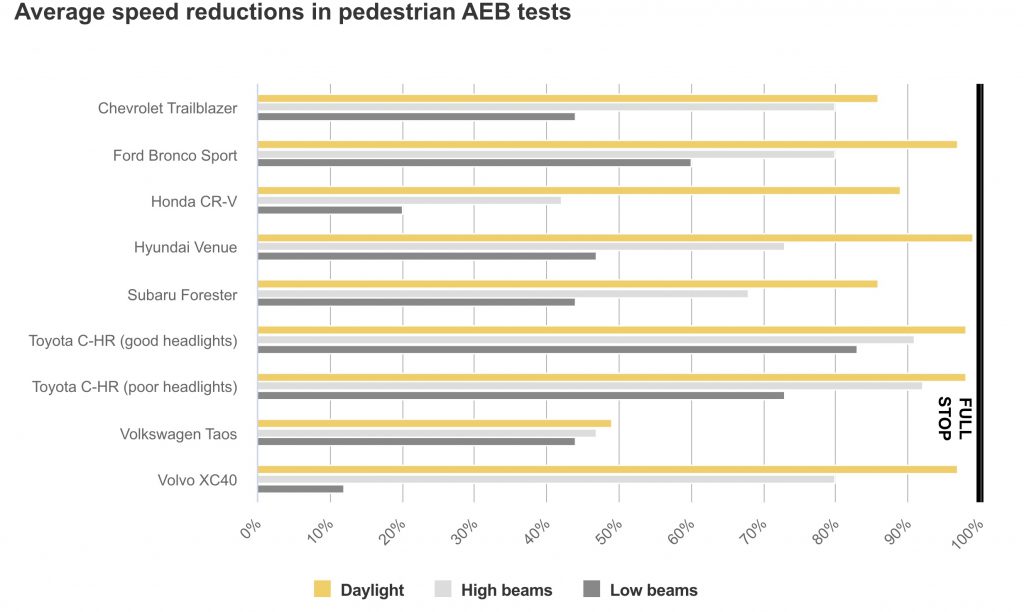

The manager of active safety testing at IIHS, David Taylor, and his team have already conducted some research tests to design the planned nighttime pedestrian AEB evaluation. Eight small SUVs from eight different manufacturers were put through the standard vehicle-to-pedestrian evaluation in complete darkness.

IIHS tested a 2019 Subaru Forester, 2019 Volvo XC40, 2020 Honda CR-V, 2020 Hyundai Venue, 2021 Chevrolet Trailblazer, 2021 Ford Bronco Sport, 2021 Toyota C-HR, and 2022 Volkswagen Taos. Each vehicle went through the evaluation twice.

Current Vehicle-to-Pedestrian Evaluation

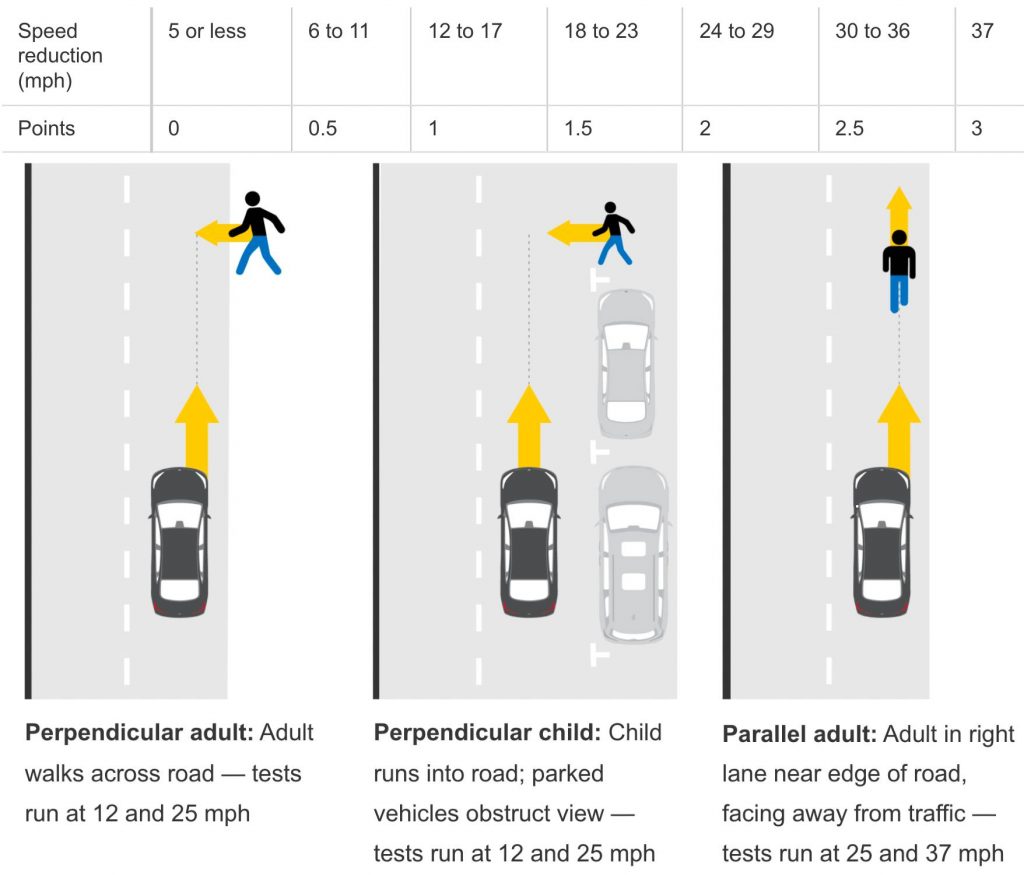

The IIHS vehicle-to-pedestrian evaluation is a 6-point scale, as seen below. The test consists of several scenarios where adult and child-like dummies “walk” perpendicular or parallel to the vehicle at varying speeds. Total points for perpendicular scenarios are weighted at 70%, while points from the parallel scenario are weighted at 30%.

During five test runs, vehicles were awarded points based on their average speed reduction. An additional point is awarded in the 37 mph parallel scenario to cars that provide the driver a warning at least 2.1 seconds before impact.

Nighttime AEB Evaluation Test Results

The vehicles the IIHS chose for the test included cars that used single cameras, dual cameras, single camera and radar, and radar only configurations. The test also had vehicles that already took the vehicle-to-pedestrian front crash prevention evaluation and earned ratings ranging from superior, advanced, and basic.

Except for the radar-only Taos, all the vehicles’ performances declined in the dark, dropping some of their ratings from superior to advanced when using high beams and superior to basic when using low beams. The Taos received essentially the same nighttime tests scores compared to daytime evaluations. However, the IIHS noted that the Taos was also the worst performer during the daytime tests.

The best performers in the nighttime tests were the 2021 Ford Bronco Sport and 2021 Toyota C-HR. Both vehicles use a combination of cameras and radar.

“The better-performing systems are too new to be included in our study of real-world crashes,” noted Aylor. “This may indicate that some manufacturers are already improving the nighttime performance of their pedestrian AEB systems.”

The Teslarati team would appreciate hearing from you. If you have any tips, reach out to me at maria@teslarati.com or via Twitter @Writer_01001101.

News

Tesla is making two big upgrades to the Model 3, coding shows

According to coding found in the European and Chinese configurators, Tesla is planning to make two big upgrades: Black Headliner offerings and a new 16-inch QHD display, similar to that on the Model Y Performance.

Tesla is making two big upgrades to the Model 3, one of which is widely requested by owners and fans, and another that it has already started to make on some trim levels of other models within the lineup.

The changes appear to be taking effect in the European and Chinese markets, but these are expected to come to the United States based on what Tesla has done with the Model Y.

According to coding found in the European and Chinese configurators, Tesla is planning to make two big upgrades: Black Headliner offerings and a new 16-inch QHD display, similar to that on the Model Y Performance.

These changes in the coding were spotted by X user BERKANT, who shared the findings on the social media platform this morning:

🚨 Model 3 changes spotted in Tesla backend

• New interior code: IN3PB (Interior 3 Premium Black)

• Linked to Alcantara-style black headliner

• Mapped to 2026 Model 3 Performance and Premium VINs• EPC now shows: “Display_16_QHD”

• Multiple 2026 builds marked with… pic.twitter.com/OkDM5EdbTu— BERKANT (@Tesla_NL_TR) February 23, 2026

It appears these new upgrades will roll out with the Model 3 Performance and Tesla’s Premium trim levels of the all-electric sedan.

The changes are welcome. Tesla fans have been requesting that its Model 3 and Model Y offerings receive a black headliner, as even with the black interior options, the headliner is grey.

Tesla recently upgraded Model Y vehicles to this black headliner option, even in the United States, so it seems as if the Model 3 will get the same treatment as it appears to be getting in the Eastern hemisphere.

Tesla has been basically accentuating the Model 3 and Model Y with small upgrades that owners have been wanting, and it has been a focal point of the company’s future plans as it phases out other vehicles like the Model S and Model X.

Additionally, Tesla offered an excellent 0.99% APR last week on the Model 3, hoping to push more units out the door to support a strong Q1 delivery figure at the beginning of April.

Elon Musk

SpaceX secures FAA approval for 44 annual Starship launches in Florida

The FAA’s environmental review covers up to 44 launches annually, along with 44 Super Heavy booster landings and 44 upper-stage landings.

SpaceX has received environmental approval from the Federal Aviation Administration (FAA) to conduct up to 44 Starship-Super Heavy launches per year from Kennedy Space Center Launch Complex 39A in Florida.

The decision allows the company to proceed with plans tied to its next-generation launch system and future satellite deployments.

The FAA’s environmental review covers up to 44 launches annually, along with 44 Super Heavy booster landings and 44 upper-stage landings. The approval concludes the agency’s public comment period and outlines required mitigation measures related to noise, emissions, wildlife, and airspace management.

Construction of Starship infrastructure at Launch Complex 39A is nearing completion. The site, previously used for Apollo and space shuttle missions, is transitioning to support Starship operations, as noted in a Florida Today report.

If fully deployed across Kennedy Space Center and nearby Cape Canaveral Space Force Station, Starship activity on the Space Coast could exceed 120 launches annually, excluding tests. Separately, the U.S. Air Force has authorized repurposing Space Launch Complex 37 for potential additional Starship activity, pending further FAA airspace analysis.

The approval supports SpaceX’s long-term strategy, which includes deploying a large constellation of satellites intended to power space-based artificial intelligence data infrastructure. The company has previously indicated that expanded Starship capacity will be central to that effort.

The FAA review identified likely impacts from increased noise, nitrogen oxide emissions, and temporary airspace closures. Commercial flights may experience periodic delays during launch windows. The agency, however, determined these effects would be intermittent and manageable through scheduling, public notification, and worker safety protocols.

Wildlife protections are required under the approval, Florida Today noted. These include lighting controls to protect sea turtles, seasonal monitoring of scrub jays and beach mice, and restrictions on offshore landings to avoid coral reefs and right whale critical habitat. Recovery vessels must also carry trained observers to prevent collisions with protected marine species.

Elon Musk

Texas township wants The Boring Company to build it a Loop system

The township’s board unanimously approved an application to The Boring Company’s “Tunnel Vision Challenge.”

The Woodlands Township, Texas, has formally entered The Boring Company’s tunneling sweepstakes.

The township’s board unanimously approved an application to The Boring Company’s “Tunnel Vision Challenge,” which offers up to one mile of tunnel construction at no cost to a selected community.

The Woodlands’ proposal, dubbed “The Current,” features two parallel 12-foot-diameter tunnels beneath the Town Center corridor near The Waterway. Teslas would shuttle passengers between Waterway Square, Cynthia Woods Mitchell Pavilion, Town Green Park and nearby hotels during concerts and large-scale events, as noted in a Chron report.

Township officials framed the tunnel as a solution for the township’s traffic congestion issues. The Pavilion alone hosts more than 60 shows each year and can accommodate crowds of up to 16,500, often straining Lake Robbins Drive and surrounding intersections.

“We know we have traffic impacts and pedestrian movement challenges, especially in the Town Center area,” Chris Nunes, chief operating officer of The Woodlands Township, stated during the meeting.

“The Current” mirrors the Loop system operating beneath the Las Vegas Convention Center, where Tesla vehicles transport passengers through underground tunnels between venues and resorts.

The Boring Company issued its request for proposals (RFP) in mid-January, inviting cities and districts to pitch local uses for its tunneling technology. The Woodlands must submit its application by Feb. 23, though no timeline has been provided for when a winning community will be announced.

Nunes confirmed that the board has authorized a submission for “The Current’s” proposal, though he emphasized that the project is still in its preliminary stages.

“The Woodlands Township Board of Directors has authorized staff to submit an application to The Boring Company, which has issued an RFP for communities interested in leveraging their technology to address community challenges,” he said in a statement.

“The Board believes that an underground tunnel would provide a safe and efficient means to transport people to and from various high-use community amenities in our Town Center.”