News

Rocket Lab assembling first reusable Neutron rocket hardware

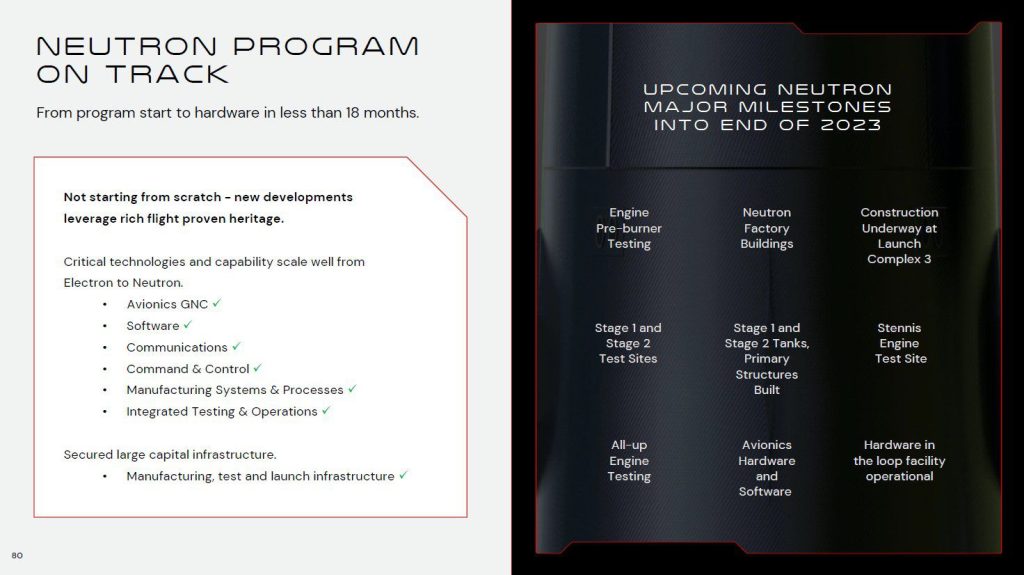

Rocket Lab appears to have made significant progress since revealing the state of hardware development for its next-generation Neutron rocket in a September 2022 investor update.

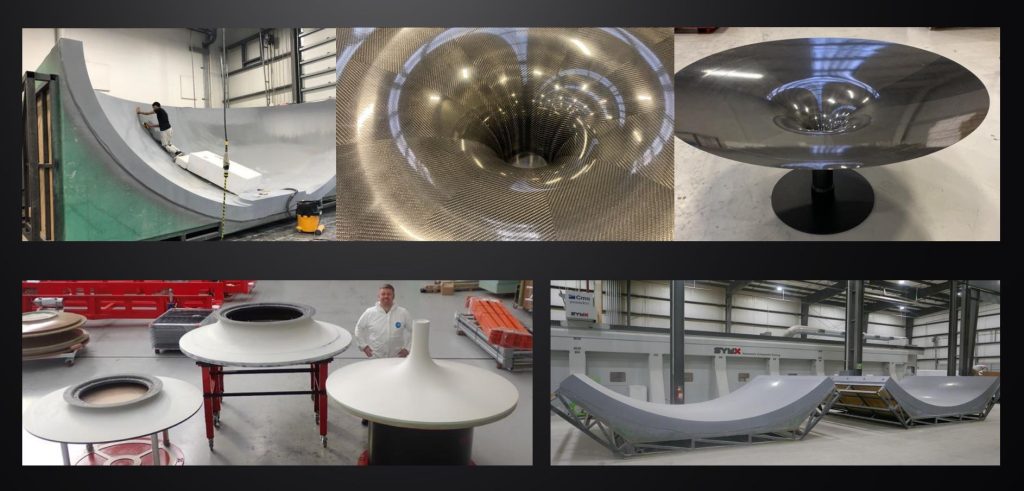

At the time, the company shared photos of early work on prototypes of smaller Neutron structural elements, as well as progress building the giant molds that will be used to ‘lay up’ the rocket’s carbon fiber composite tanks and airframe. Rocket Lab also showed off acquisitions of some of the supersized manufacturing equipment that will be used to build the giant rocket, as well as the beginnings of a dedicated Neutron factory in Virginia.

Four months later, photos shared by CEO Peter Beck show that Rocket Lab has progressed to full-scale carbon fiber hardware manufacturing. In December 2022, Beck shared a photo of a full-size Neutron tank dome in the middle of production. A month later, Beck shared a photo of work on both halves of a Neutron booster tank dome. Measuring around seven meters (23 ft) wide, the latter component is already on track to become one of the largest carbon fiber structures ever prepared for a rocket once the halves are joined. And once two more halves are built and assembled, Rocket Lab could soon be ready to start testing full-scale Neutron tank hardware – a crucial milestone for any new rocket.

The update that's rolling out to the fleet makes full use of the front and rear steering travel to minimize turning circle. In this case a reduction of 1.6 feet just over the air— Wes (@wmorrill3) April 16, 2024

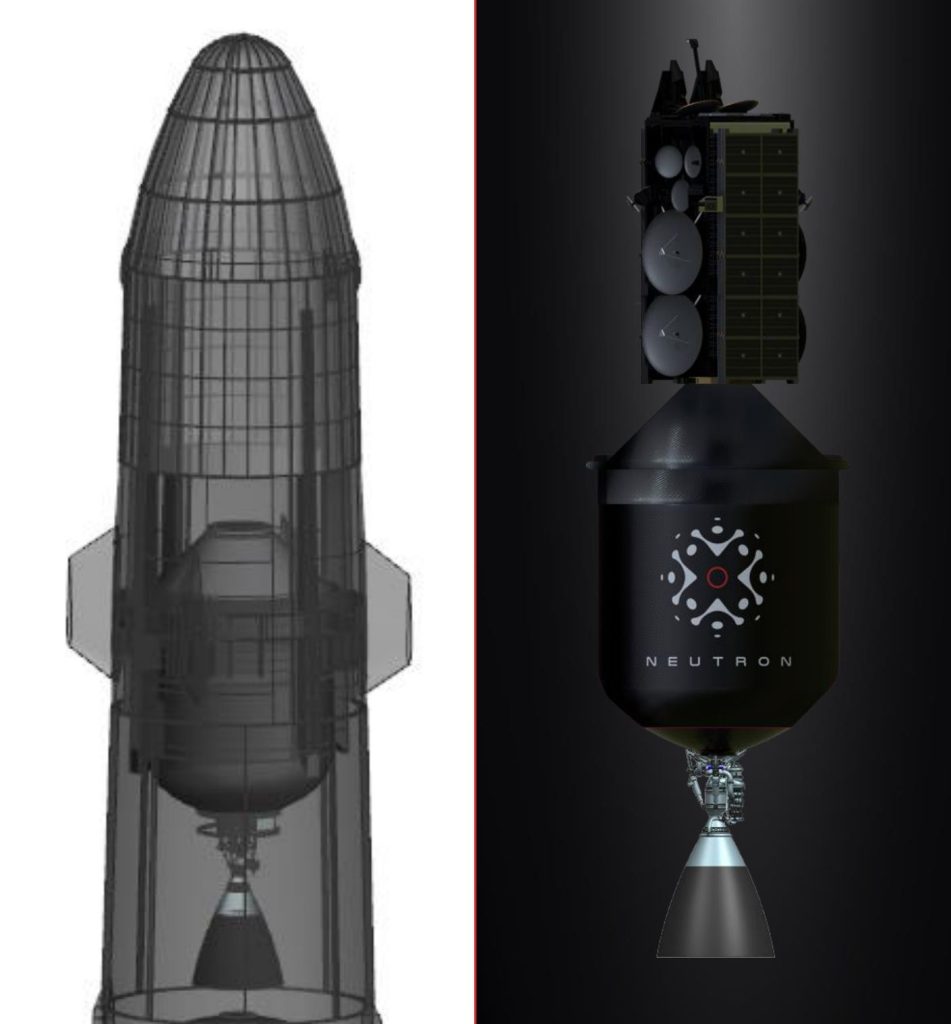

Announced in March 2021 and properly unveiled in December 2021, Neutron is a partially-reusable two-stage rocket designed to launch up to 15 tons to Low Earth Orbit (LEO) using liquid methane and oxygen propellant. Neutron measures 42.8 meters (140.4 ft) tall and up to seven meters (23 ft) wide. Its stout, ballistically-optimized design means that it’s simultaneously 40% shorter and up to 190% wider than SpaceX’s workhorse Falcon 9 rocket.

Design differences aside, Neutron is the first rocket that has been obviously designed as an answer to Falcon 9, which has become one of the most prolific, cost-effective, and routinely reusable rockets in the world over the last five or so years. Depending on how much Rocket Lab can sell Neutron for while still breaking even, Neutron has the potential to give Falcon 9 a serious run for its money – or at least force SpaceX to lower its prices. Like Falcon 9, Neutron will have a reusable booster, a reusable payload fairing, and an expendable upper stage. Its booster will also have nine (Archimedes) engines and the upper stage will be powered by one engine. At liftoff, Neutron will produce up to 674 tons (1.49M lbf) of thrust to Falcon 9’s 770 tons (1.7M lbf).

Unlike Falcon 9, Neutron’s similarly-sized reusable fairing is integral, meaning that it will stay permanently attached to the booster. But despite the added mass of the integral fairing and the rocket’s significantly shorter layout, Rocket Lab says that Neutron will be able to launch up to 13 tons (~28,700 lb) to LEO if the booster lands on a barge downrange. Using the same approach with a deployable fairing, Falcon 9 has launched up to 16.7 tons (~36,800 lb) to LEO. That 23% performance gap may seem significant, but the reality is that only SpaceX’s own Starlink and Dragon missions have ever needed Falcon 9 to launch more than 13 tons to orbit.

If Neutron can consistently launch ~25% less payload than Falcon 9 to all Earth and near-Earth orbits, virtually every commercial launch contract that’s currently a SpaceX shoo-in could be within reach of Rocket Lab within several years. The challenge, of course, is building Neutron and making sure the ambitious rocket and its clean-sheet Archimedes engine work as expected and can be reused as easily as Falcon 9.

The company is attempting to get there with its far smaller Electron vehicle, but Rocket Lab has never reused a rocket. And five and a half years after Electron’s debut, the company has never launched more than nine times in one year. SpaceX is about to reuse a Falcon booster for the 140th time and launched 61 times in 2022 – a lead that may prove almost impossible to close. There’s also the fact that the size gap between Rocket Lab’s rockets is so extreme that Neutron could likely launch a fully-fueled Electron into orbit.

But again, SpaceX serves as a demonstration that what Rocket Lab hopes to achieve is not impossible. SpaceX went directly from Falcon 1 (about twice as large as Electron) to Falcon 9 V1.0 (about 30% smaller than Neutron) after just two successful launches of the smaller rocket. Electron has successfully launched 29 times since May 2017 and Rocket Lab is already learning about reusability through the smaller rocket. The challenges facing Rocket Lab are huge, but Neutron still remains the most promising SpaceX competitor currently in development. Kicking off full-scale Neutron tank testing just 2-3 years after the rocket was revealed would only reiterate its strengths. Stay tuned to see how much Neutron progress Rocket Lab can make in 2023.

Elon Musk

SpaceX to launch Starlink V2 satellites on Starship starting 2027

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls.

SpaceX is looking to start launching its next-generation Starlink V2 satellites in mid-2027 using Starship.

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls during remarks at Mobile World Congress (MWC) in Barcelona, Spain.

“With Starship, we’ll be able to deploy the constellation very quickly,” Nicolls stated. “Our goal is to deploy a constellation capable of providing global and contiguous coverage within six months, and that’s roughly 1,200 satellites.”

Nicolls added that once Starship is operational, it will be capable of launching approximately 50 of the larger, more powerful Starlink satellites at a time, as noted in a Bloomberg News report.

The initial deployment of roughly 1,200 next-generation satellites is intended to establish global and contiguous coverage. After that phase, SpaceX plans to continue expanding the system to reach “truly global coverage, including the polar regions,” Nicolls said.

Currently, all Starlink satellites are launched on SpaceX’s Falcon 9 rocket. The next-generation fleet will rely on Starship, which remains in development following a series of test flights in 2025. SpaceX is targeting its next Starship test flight, featuring an upgraded version of the rocket, as soon as this month.

Starlink is currently the largest satellite network in orbit, with nearly 10,000 satellites deployed. Bloomberg Intelligence estimates the business could generate approximately $9 billion in revenue for SpaceX in 2026.

Nicolls also confirmed that SpaceX is rebranding its direct-to-cell service as Starlink Mobile.

The service currently operates with 650 satellites capable of connecting directly to smartphones and has approximately 10 million monthly active users. SpaceX expects that figure to exceed 25 million monthly active users by the end of 2026.

Elon Musk

Elon Musk’s xAI and X to pay off $17.5B debt in full: report

The update was shared initially in a report from Bloomberg News, which cited people reportedly familiar with the matter.

Elon Musk’s social platform X and artificial intelligence startup xAI are reportedly preparing to repay approximately $17.5 billion in outstanding debt in full.

The update was shared initially in a report from Bloomberg News, which cited people reportedly familiar with the matter.

Morgan Stanley, which arranged the debt financing for both companies, has reportedly informed existing lenders that X and xAI plan to pay back the full amount of the $17.5 billion debt. Bloomberg’s sources did not disclose where the capital for the repayment would be coming from.

X, formerly known as Twitter, assumed roughly $12.5 billion in debt during Musk’s acquisition of the company. xAI separately borrowed about $5 billion through bonds and loans last June. The two firms merged last year under xAI Holdings.

Bloomberg noted that portions of the debt are relatively recent and may carry early repayment penalties. xAI’s $3 billion in high-yield bonds are expected to be redeemed at 117 cents on the dollar, reflecting a premium since the debt was expected to stay outstanding for at least two years.

X has been servicing tens of millions of dollars in monthly debt payments, while xAI has reportedly been burning approximately $1 billion in cash per month as it invests heavily in data centers, chips, and AI talent. That being said, xAI also concluded a funding round in January, where it raised $20 billion of new equity.

The repayment plans come as Musk consolidates several of his businesses. SpaceX recently acquired xAI, making it a subsidiary as the company explores plans for space-based data centers. The combined entity has been valued at approximately $1.25 trillion.

Bloomberg previously reported that SpaceX is targeting a confidential IPO filing as soon as this month, potentially positioning the private space firm for a public listing later this year. Representatives for Morgan Stanley declined to comment, and X and xAI did not immediately respond to requests for comment.

News

Tesla Giga Berlin head calls out Handelsblatt’s claimed 2025 production figures

Andre Thierig, Senior Director of Manufacturing at Giga Berlin, published a detailed post on LinkedIn challenging several points made in the publication’s coverage of the Grünheide facility.

Tesla Gigafactory Berlin’s plant manager has publicly pushed back against recent reporting by German business publication Handelsblatt, which cited reportedly erroneous data about the factory’s production figures and financial performance.

Andre Thierig, Senior Director of Manufacturing at Giga Berlin, published a detailed post on LinkedIn challenging several points made in the publication’s coverage of the Grünheide facility.

In his LinkedIn post, Thierig called out Handelsblatt’s claim that 149,000 Model Y vehicles were produced at Giga Berlin in 2025. He noted that “the article is simply filled from front to back with false information and claims!

“I have to set the record straight here! In the last article about Tesla in Grünheide, the Handelsblatt speaks e.g. of 149,000 Model Ys built in 2025. WRONG!

“In 2025, we again produced over 200,000 vehicles. And this despite the fact that we stopped production in Q1 for the changeover to the new Model Y and then ramped it up again to 5,000 units per week over several weeks,” Thierig wrote.

He added that production increased each quarter in 2025 compared to the prior quarter and stated that more than 700,000 Model Y units have been produced at Grünheide since manufacturing began in 2022. For the first quarter of 2026, he stated that the factory is planning another production increase compared to the fourth quarter of 2025.

Thierig also questioned Handelsblatt’s reported 0.74% profit margin, writing that how the publication calculated the figure “remains reserved for their secret ‘calculation skills.’”

Beyond production data, Thierig highlighted Tesla’s broader footprint in Germany, stating that the company has invested more than €5 billion in Grünheide since 2020 and created nearly 11,000 permanent, above-tariff jobs. He added that Tesla is currently investing nearly €100 million into battery cell production at the site, which is expected to generate several hundred additional positions.

In a follow-up comment, Thierig noted that he did communicate with the publication’s editor-in-chief in an effort to “start fresh,” but he was informed that Handelsblatt’s current approach works just fine.

“Last year, I spoke to a representative of the Handelsblatt editor-in-chief and suggested that we “start anew” again. Handelsblatt turned down this offer on the grounds that their current approach works well for them,” Thierig noted.

Sönke Iwersen, Head of Investigative Research at Handelsblatt, responded to Thierig’s post, stating that the newspaper’s figures were based on Tesla’s own annual financial statements for the Grünheide entity.

He cited reported 2024 revenue of €7.68 billion, operating profit of €156.8 million, and net income after taxes of €55.6 million. Iwersen also referenced prior public comments from Elon Musk about Cybertruck demand, noting the gap between reported pre-orders and subsequent annual sales figures.

He also stated that the works council election eligibility figures Giga Berlin had dropped to 10,703 employees today from 12,415 two years ago.

“As far as production figures are concerned, these are figures from the data service provider Inovev. This is also stated in the article. Please compare this with Elon Musk’s information on demand for the Cybertruck. According to Musk, there were one million pre-orders. In the first year, 39,000 units were sold, in the second year 20,000. How can this be explained? With a million pre-orders?

“You yourself have repeatedly pointed out in recent months that no jobs would be cut in Grünheide because Tesla is different from the competition. Now a new works council is being elected in Grünheide. 10,703 people are eligible to vote. Two years ago, 12,415 people were eligible to vote. So there were exactly 1712 fewer from 2024 to 2026,” Iwersen wrote.