SpaceX

SpaceX’s April 7th Falcon Heavy launch a step toward new commercial markets

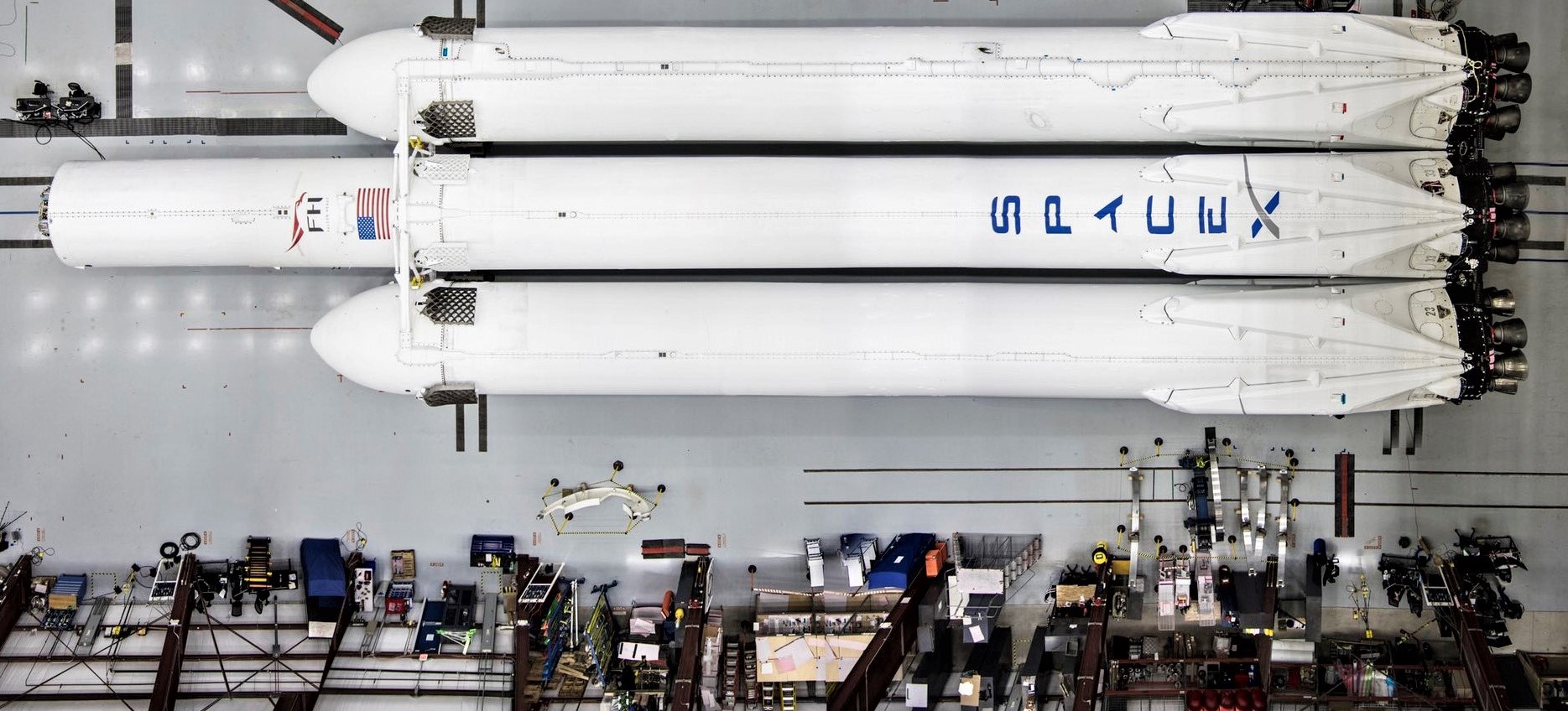

A bit less than 14 months after SpaceX’s Falcon Heavy took to the sky for the first time, the company’s super-heavy-lift rocket – the only such vehicle in the world that is currently operational – has garnered a pending date for its second launch attempt and commercial debut.

While there is some inherent uncertainty surrounding the (once again) fairly new rocket, SpaceX has now officially filed a plan with the Cape Canaveral range authorities that would see Falcon Heavy nominally conduct a critical static fire test as soon as March 31st, followed one week later by a launch target of no earlier than (NET) 6:36 pm EDT (22:36 UTC), April 7th. Set to place the ~6000 kg (13,200 lb) Arabsat 6A communications satellite in a high-energy geostationary orbit, a successful mission that ultimately proves Falcon Heavy’s commercial utility could also raise global launch market interest in the rocket, including potential anchor customers like NASA.

Falcon Heavy enters a different era

While it could be fairly argued that SpaceX has already near-flawlessly demonstrated Falcon Heavy’s performance and basic existence with the rocket’s February 2018 launch debut, that debut is really only half the story when it comes to breaking into commercial markets as a serious contender. Above all else, the fact remains that Falcon Heavy is often seen as infamous for what is perceived as a torturous, delay-ridden period of development, a common partial misunderstanding that has not exactly been combated by the now 14+ months separating the rocket’s first and second launch attempts. In the industries that have the most potential interest in Falcon Heavy, on-time launches are a central selling point of launch vehicles, with affordability effectively being a luxury behind timeliness and overall reliability.

Despite the success of Falcon Heavy’s debut, what SpaceX has not yet demonstrated is the ability to reliably and accurately insert a large customer payload into a specific orbit, for a specific (i.e. contracted) price. Adding another partial hurdle to the path before Falcon Heavy, the rocket’s first launch featured a hardware setup that could be described as a one-off, owing to the fact that Flight 1 utilized a mishmash of flight-proven Block 2 boosters and one unique Block 3-derived center core. By the time that the rocket was ready for its first launch, SpaceX was just three months away from debuting Falcon 9’s Block 5 variation, framed as the family’s ‘final’ version. Featuring an extensive range of major changes to Falcon structures, Merlin engines, avionics, reusability, and manufacturing processes, this ultimately meant that the next Falcon Heavy to fly would be a significantly different rocket compared to its sole predecessor.

While we actually know very little about what the task of re-certifying Falcon Heavy’s Block 5 upgrade for flight entailed, the minimum of 14 months separating flights 1 and 2 offers at least a partial idea of just how extensive the required rework was. With a long-delayed customer’s extremely expensive (likely $150-300M+) satellite on the line, there is a surplus of pressure on SpaceX to both complete this launch flawlessly and do so as soon as possible.

If all goes well with the imminent launch of Arabsat 6A and the USAF’s STP-2 mission shortly thereafter, SpaceX will have done a great deal to assuage many industry doubts about Falcon Heavy, particularly its practical launch availability and the company’s ability to ensure that its launches are at least roughly on-time. As of today, SpaceX has won five firm launch contracts for Falcon Heavy – three in the last year alone – and has the potential to acquire several additional contracts in the coming years, ranging from additional national security satellites from the NRO and USAF to flagship NASA science missions like the Jupiter-bound Europa Clipper. Aside from Blue Origin’s New Glenn (launch debut NET 2021), ULA’s Vulcan (also NET 2021), and ULA’s Delta IV Heavy (likely far too expensive), SpaceX’s Falcon Heavy is also the frontrunner for commercial contracts to launch segments of a proposed lunar space station, with launches potentially beginning as early as the early 2020s.

Further still, NASA administrator Jim Bridenstine announced earlier this month that the space agency was actively considering a stand-in fix for

Either way, the long term prospects of Falcon Heavy rocket could potentially be both lucrative for SpaceX and immensely beneficial for satellite industries and national space agencies alike. If SpaceX can demonstrate that it has inherited Falcon 9’s now thoroughly impressive reliability and moderate to great schedule assurance, the market for Falcon Heavy could end up supporting a major fraction of SpaceX’s sizable launch business.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

Elon Musk

SpaceX to launch Starlink V2 satellites on Starship starting 2027

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls.

SpaceX is looking to start launching its next-generation Starlink V2 satellites in mid-2027 using Starship.

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls during remarks at Mobile World Congress (MWC) in Barcelona, Spain.

“With Starship, we’ll be able to deploy the constellation very quickly,” Nicolls stated. “Our goal is to deploy a constellation capable of providing global and contiguous coverage within six months, and that’s roughly 1,200 satellites.”

Nicolls added that once Starship is operational, it will be capable of launching approximately 50 of the larger, more powerful Starlink satellites at a time, as noted in a Bloomberg News report.

The initial deployment of roughly 1,200 next-generation satellites is intended to establish global and contiguous coverage. After that phase, SpaceX plans to continue expanding the system to reach “truly global coverage, including the polar regions,” Nicolls said.

Currently, all Starlink satellites are launched on SpaceX’s Falcon 9 rocket. The next-generation fleet will rely on Starship, which remains in development following a series of test flights in 2025. SpaceX is targeting its next Starship test flight, featuring an upgraded version of the rocket, as soon as this month.

Starlink is currently the largest satellite network in orbit, with nearly 10,000 satellites deployed. Bloomberg Intelligence estimates the business could generate approximately $9 billion in revenue for SpaceX in 2026.

Nicolls also confirmed that SpaceX is rebranding its direct-to-cell service as Starlink Mobile.

The service currently operates with 650 satellites capable of connecting directly to smartphones and has approximately 10 million monthly active users. SpaceX expects that figure to exceed 25 million monthly active users by the end of 2026.

Elon Musk

Starlink V2 to bring satellite-to-phone service to Deutsche Telekom in Europe

Starlink stated that the system is designed to deliver 5G speeds directly to compatible smartphones in remote areas.

Starlink is partnering with Deutsche Telekom to roll out satellite-to-mobile connectivity across Europe, extending coverage to more than 140 million subscribers across 10 countries.

The service, planned for launch in 2028 in several Telekom markets, including Germany, will use Starlink’s next-generation V2 satellites and Mobile Satellite Service (MSS) spectrum to enable direct-to-device connectivity.

In a post on X, the official Starlink account stated that the agreement will be the first in Europe to deploy its V2 next-generation satellite-to-mobile technology using new MSS spectrum. The company added that the system is designed to deliver 5G speeds directly to compatible smartphones in remote areas.

Abdu Mudesir, Board Member for Product and Technology at Deutsche Telekom, shared his excitement for the partnership in a press release. “We provide our customers with the best mobile network. And we continue to invest heavily in expanding our infrastructure. At the same time, there are regions where expansion is especially complex due to topographical conditions or official constraints,” he said.

“We want to ensure reliable connectivity for our customers in those areas as well. That is why we are strategically complementing our network with satellite-to-mobile connectivity. For us, it is clear: connectivity creates security and trust. And we deliver. Everywhere.”

Under the partnership, compatible smartphones will automatically switch to Starlink’s satellite network when terrestrial coverage is unavailable, enabling access to data, voice, video, and messaging services.

Telekom reports 5G geographic coverage approaching 90% in Germany, with LTE exceeding 92% and voice coverage reaching up to 99%. Starlink’s satellite layer is intended to extend connectivity beyond those terrestrial limits, particularly in topographically challenging or infrastructure-constrained areas.

Stephanie Bednarek, VP of Starlink Sales, also shared her thoughts on the partnership. “We’re so pleased to bring reliable satellite-to-mobile connectivity to millions of people across 10 countries in partnership with Deutsche Telekom. This agreement will be the first-of-its-kind in Europe to launch Starlink’s V2 next-generation technology that will expand on data, voice and messaging by providing broadband directly to mobile phones,” she said.

Starlink’s V2 constellation is designed to expand bandwidth and capacity compared to its predecessor. If implemented as outlined, the 2028 launch would mark one of the first large-scale European deployments of integrated satellite-to-phone connectivity by a major telecom operator.

Elon Musk

SpaceX pursues 5G-level connectivity with Starlink Mobile V2 expansion

SpaceX noted that the upcoming Starlink V2 satellites will deliver up to 100 times the data density of the current first-generation system.

SpaceX has previewed a major upgrade to Starlink Mobile, outlining next-generation satellites that aim to deliver significantly higher capacity and full 5G-level connectivity directly to mobile phones.

The update comes as Starlink rebrands its Direct-to-Cell service to Starlink Mobile, positioning the platform as a scalable satellite-to-mobile solution that’s integrated with global telecom partners.

SpaceX noted that the upcoming Starlink V2 satellites will deliver up to 100 times the data density of the current first-generation system. The company also noted that the new V2 satellites are designed to provide significantly higher throughput capability compared to its current iteration.

“The next generation of Starlink Mobile satellites – V2 – will deliver full cellular coverage to places never thought possible via the highest performing satellite-to-mobile network ever built.

“Driven by custom SpaceX-designed silicon and phased array antennas, the satellites will support thousands of spatial beams and higher bandwidth capability, enabling around 20x the throughput capability as compared to a first-generation satellite,” SpaceX wrote in its official Starlink Mobile page.

Thanks to the higher bandwidth of Starlink Mobile, users should be able to stream, browse the internet, use high-speed apps, and enjoy voice services comparable to terrestrial cellular networks.

In most environments, Starlink says the upgraded system will enable full 5G cellular connectivity with a user experience similar to existing ground-based networks.

The satellites function as “cell towers in space,” using advanced phased-array antennas and laser interlinks to integrate with terrestrial infrastructure in a roaming-like architecture.

“Starlink Mobile works with existing LTE phones wherever you can see the sky. The satellites have an antenna that acts like a cellphone tower in space, the most advanced phased array antennas in the world that connect seamlessly over lasers to any point in the globe, allowing network integration similar to a standard roaming partner,” SpaceX wrote.

Starlink Mobile currently operates with approximately 650 satellites in low-Earth orbit and is active across more than 32 countries, representing over 1.7 billion people through partnerships with mobile network operators. Starlink Mobile’s current partnerships span North America, Europe, Asia, Africa, and Oceania, allowing reciprocal access across participating nations.