News

ViaSat asks FCC to halt SpaceX Starlink launches because it can’t compete

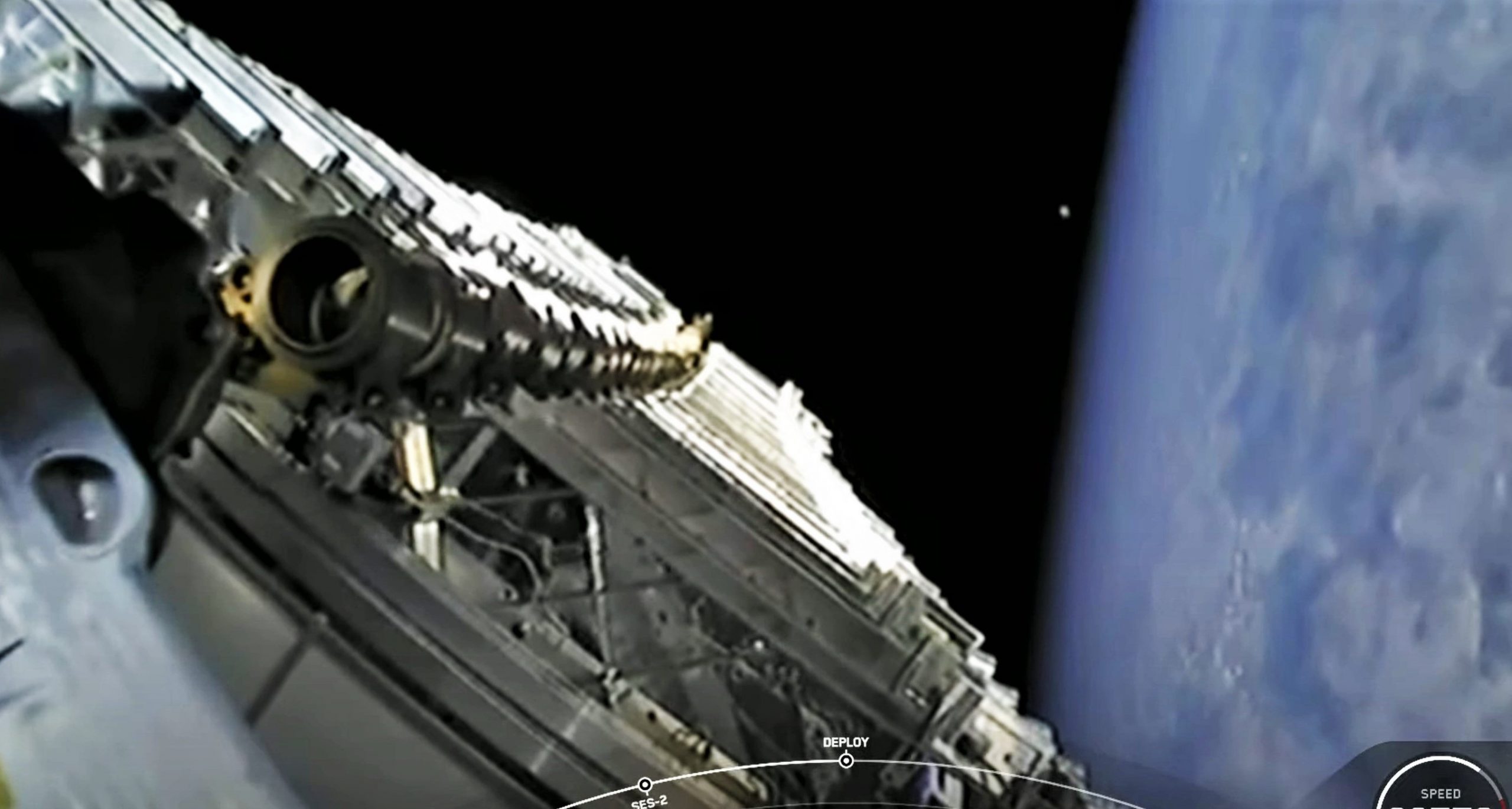

Under the hollow pretense of concern for the environment, Starlink satellite internet competitor ViaSat has asked the Federal Communication Commission (FCC) to force SpaceX to stop Starlink launches and threatened to take the matter to court if it doesn’t get its way.

A long-time satellite internet provider notorious for offering expensive, mediocre service with strict bandwidth restrictions, ViaSat has also been engaged in a years-long attempt to disrupt, slow down, and even kill SpaceX’s Starlink constellation by any means necessary. That includes fabricating nonsensical protests, petitioning the FCC dozens of times, and – most recently – threatening to sue the agency and federal government as the company becomes increasingly desperate.

The reason is simple: even compared to SpaceX’s finicky, often-unreliable Starlink Beta service, ViaSat’s satellite internet is almost insultingly bad. With a focus on serving the underserved and unserved, SpaceX’s Starlink beta users – many of which were already relying on ViaSat or HughesNet internet – have overwhelmingly described the differences as night and day.

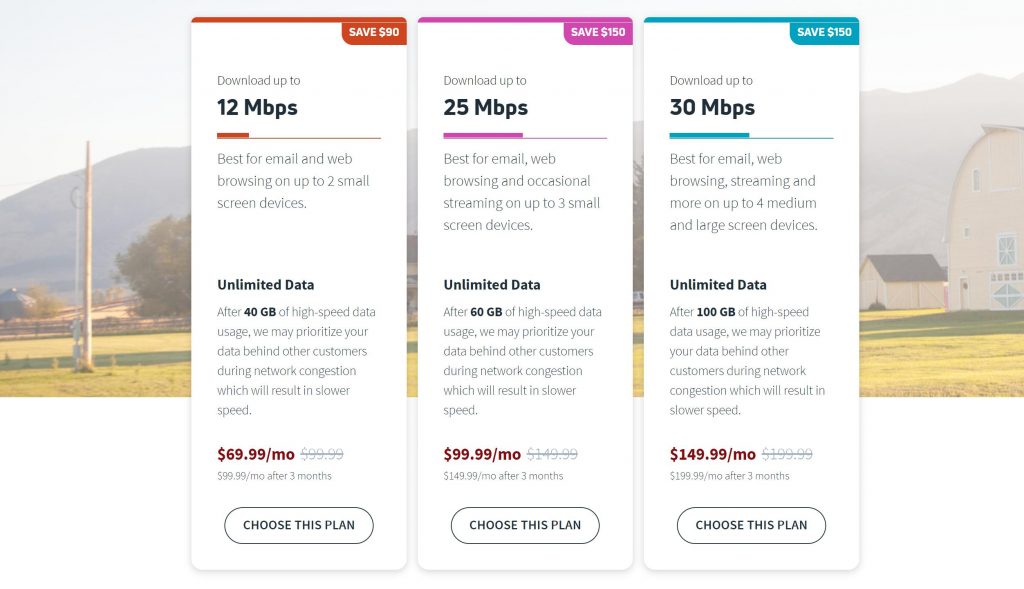

In simple terms, if given the option, it’s extraordinarily unlikely that a single public ViaSat subscriber would choose the company’s internet over SpaceX’s Starlink. While Starlink currently requires subscribers to pay a substantial upfront cost – ~$500 – for the dish used to access the satellite network, ViaSat internet costs at least as much per month. Currently, new subscribers would pay a bare minimum of ~$113 per month for speeds up to 12 Mbps (akin to DSL) and an insultingly small 40GB data cap. For a 60GB cap and 25 Mbps, subscribers will pay more than $160 per month after a three-month promotion.

With a fixed cost of $99 per month, truly unlimited data, and uncapped speeds that vary from 50 to 200+ Mbps, any ViaSat “silver” subscriber would receive far better service by switching to Starlink and save enough money to pay off the $500 dish in less than a year. While Starlink is currently in beta and often unstable and unreliable as a result, users continue to notice major improvements in speeds and uptime as SpaceX works to continuously improve the network.

In the US, ViaSat has less than 600,000 household internet subscribers, all of which are almost certainly liable to switch to better alternatives. Short of local and state governments actually standing up for their citizens and forcing monopolistic ground-based internet service providers (ISPs) to fairly serve rural customers, Starlink is currently the only real hope for rural Americans who are tired of settling for second-class internet service.

ViaSat began its latest push to hamstring a looming competitor with regulation when it asked the FCC to perform an environmental review of Starlink’s impact last December. The FCC unsurprisingly failed to heed the company’s spurious, nakedly self-serving demands. Since then, the FCC approved a long-standing SpaceX request to modify its Starlink constellation by lowering thousands of satellites, thus improving service and drastically decreasing the debris risk posed by satellite failures, which would take a few years to reenter from 550 kilometers instead of decades for spacecraft orbiting at 1000+ kilometers.

To a very small extent, there are some real questions worth asking about the environmental impact of megaconstellations. A few recent studies have begun to do so, though it’s such a new field of inquiry that virtually nothing is known with any confidence. However, ViaSat is transparently disinterested in the actual environmental impact given that its petition for the FCC to immediately halt all Starlink launches focuses on Starlink alone and not competitor OneWeb – also in the process of launching satellites – or prospective constellations being developed by Telesat and Amazon.

What ViaSat actually wants is for the FCC to catastrophically hamstring Starlink, thus saving the profit-focused company from having to actually work to compete with an internet service provider that is all but guaranteed to capture most of its subscribers on an even playing field. Incredibly, ViaSat actually removes its greenwashing mask in the very same FCC request [PDF], stating that it “will suffer competitive injury” if Starlink is allowed to “compete directly with Viasat in the market for satellite broadband services.”

Cybertruck

Tesla Cybertruck’s newest trim will undergo massive change in ten days, Musk says

It appears as if the new All-Wheel-Drive trim of Cybertruck won’t be around for too long, however. Elon Musk revealed this morning that it will be around “only for the next 10 days.”

Tesla’s new Cybertruck trim has already gotten the axe from CEO Elon Musk, who said the All-Wheel-Drive configuration of the all-electric pickup will only be available “for the next ten days.”

Musk could mean the price, which is $59,990, or the availability of the trim altogether.

Last night, Tesla launched the All-Wheel-Drive configuration of the Cybertruck, a pickup that comes in at less than $60,000 and features a competitive range and features that are not far off from the offerings of the premium trim.

Tesla launches new Cybertruck trim with more features than ever for a low price

It was a nice surprise from Tesla, considering that last year, it offered a Rear-Wheel-Drive trim of the Cybertruck that only lasted a few months. It had extremely underwhelming demand because it was only $10,000 cheaper than the next trim level up, and it was missing a significant number of premium features.

Simply put, it was not worth the money. Tesla killed the RWD Cybertruck just a few months after offering it.

With the news that Tesla was offering this All-Wheel-Drive configuration of the Cybertruck, many fans and consumers were encouraged. The Cybertruck has been an underwhelming seller, and this seemed to be a lot of truck for the price when looking at its features:

- Dual Motor AWD w/ est. 325 mi of range

- Powered tonneau cover

- Bed outlets (2x 120V + 1x 240V) & Powershare capability

- Coil springs w/ adaptive damping

- Heated first-row seats w/ textile material that is easy to clean

- Steer-by-wire & Four Wheel Steering

- 6’ x 4’ composite bed

- Towing capacity of up to 7,500 lbs

- Powered frunk

It appears as if this trim of Cybertruck won’t be around for too long, however. Musk revealed this morning that it will be around “only for the next 10 days.”

Only for the next 10 days https://t.co/82JnvZQGh2

— Elon Musk (@elonmusk) February 20, 2026

Musk could mean the price of the truck and not necessarily the ability to order it. However, most are taking it as a cancellation.

If it is, in fact, a short-term availability decision, it is baffling, especially as Tesla fans and analysts claim that metrics like quarterly deliveries are no longer important. This seems like a way to boost sales short-term, and if so many people are encouraged about this offering, why would it be kept around for such a short period of time?

Some are even considering the potential that Tesla axes the Cybertruck program as a whole. Although Musk said during the recent Q4 Earnings Call that Cybertruck would still be produced, the end of the Model S and Model X programs indicates Tesla might be prepared to do away with any low-volume vehicles that do not contribute to the company’s future visions of autonomy.

The decision to axe the car just ten days after making it available seems like a true head-scratcher.

Elon Musk

Elon Musk’s Neuralink sparks BCI race in China

One of the most prominent is NeuroXess, which launched in 2021 and is already testing implants in patients.

Neuralink, founded by Elon Musk, is helping spark a surge of brain-computer interface (BCI) development in China, where startups are moving quickly into human trials with strong state backing.

One of the most prominent is NeuroXess, which launched in 2021 and is already testing implants in patients.

Neuralink’s clinical work and public demonstrations have drawn worldwide attention to invasive brain implants that allow patients to control digital devices using their minds. The company is currently running a global clinical trial and is also busy preparing for its next product, Blindsight, which would restore vision to people with visual impairments.

Neuralink’s visibility has helped accelerate similar efforts in China. Beijing last year classified brain-computer interfaces as a strategic sector and issued a roadmap calling for two or three globally competitive companies by 2030, as per the Financial Times. Since February last year, at least 10 clinical trials for invasive brain chips have launched in the country.

NeuroXess recently reported that a paralyzed patient was able to control a computer cursor within five days of implantation. Founder Tiger Tao credited government support for helping shorten the path from research to trials.

Investment activity has followed the policy push. Industry data show dozens of financing rounds for Chinese BCI startups over the past year, reflecting rising capital interest in the field. Ultimately, while Neuralink remains one of the most closely watched players globally, its momentum has clearly energized competitors abroad.

News

Tesla Supercharger vandalized with frozen cables and anti-Musk imagery amid Sweden union dispute

The incident comes amid Tesla’s ongoing labor dispute with IF Metall.

Tesla’s Supercharger site in Vansbro, Sweden, was vandalized during peak winter travel weeks. Images shared to local media showed frozen charging cables and a banner reading “Go home Elon,” which was complete with a graphic of Musk’s controversial gesture.

The incident comes amid Tesla’s ongoing labor dispute with IF Metall, which has been striking against the company for more than two years over collective bargaining agreements, as noted in a report from Expressen.

Local resident Stefan Jakobsson said he arrived at the Vansbro charging station to find a board criticizing Elon Musk and accusing Tesla of strikebreaking. He also found the charging cables frozen after someone seemingly poured water over them.

“I laughed a little and it was pretty nicely drawn. But it was a bit unnecessary,” Jakobsson said. “They don’t have to do vandalism because they’re angry at Elon Musk.”

The site has seen heavy traffic during Sweden’s winter sports holidays, with travelers heading toward Sälen and other mountain destinations. Jakobsson said long lines formed last weekend, with roughly 50 Teslas and other EVs waiting to charge.

Tesla Superchargers in Sweden are typically open to other electric vehicle brands, making them a reliable option for all EV owners.

Tesla installed a generator at the location after sympathy strikes from other unions disrupted power supply to some stations. The generator itself was reportedly not working on the morning of the incident, though it is unclear whether that was connected to the protest.

The dispute between Tesla and IF Metall centers on the company’s refusal to sign a collective agreement covering Swedish workers. The strike has drawn support from other unions, including Seko, which has taken steps affecting electricity supply to certain Tesla facilities. Tesla Sweden, for its part, has insisted that its workers are already fairly compensated and it does not need a collective agreement,

Jesper Pettersson, press spokesperson for IF Metall, criticized Tesla’s use of generators to keep charging stations running. Still, IF Metall emphasized that it strongly distances itself from the vandalism incident at the Vansbro Supercharger.

“We think it is remarkable that instead of taking the easy route and signing a collective agreement for our members, they are choosing to use every possible means to get around the strike,” Pettersson said.