News

Tesla adjusts Model 3 prices amid lowered $3,750 federal tax credit

To say that the past year has been monumental for Tesla is a gross understatement. By the end of 2018, the electric car maker had established itself as a leader in the premium EV market, and the Model 3, its most ambitious vehicle, continues to perform well. Seemingly as a means to ensure that the electric sedan remains competitive regardless of the phaseout of the $3,750 federal tax credit, Tesla has adjusted the prices of its Model 3 lineup.

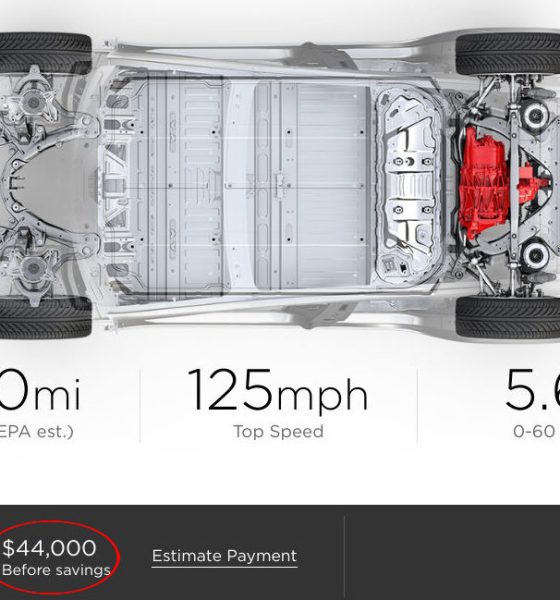

With the recent price adjustments in place, the Mid Range Model 3 RWD — the most affordable version of the vehicle currently available — is now priced at $44,000 before incentives. This is $1,000 less than the vehicle’s introductory price of $45,000 and $2,000 less than the electric sedan’s $46,000 cost, which was in effect until the end of 2018. The most recent price adjustments also lowered the price of the Tesla Model 3 Performance to $62,000 before incentives. The Dual Motor AWD variant, on the other hand, is now priced at $51,000 before gas savings and the remaining $3,750 tax credit.

https://twitter.com/28delayslater/status/1080429285112979456

By adopting this pricing strategy, Tesla is all but ensuring that its customers would not feel the full brunt of the $7,500 federal tax credit’s phaseout. Had Tesla not rolled back its vehicles’ prices, the cost of the entire Model 3 line would increase by $3,750 after 2018 ended. With the current adjustments in place, though, $2,000 of the lost tax credit would practically be covered by Tesla. Thus, for all intents and purposes, it appears that the phaseout of the $7,500 federal tax credit only resulted in Tesla’s vehicles raising their total prices by about $1,750.

Such adjustments could be yet another strategy for Tesla to ensure that demand in the United States remains healthy despite the vehicle’s international rollout. A notable portion of the electric car’s remaining reservation holders in the US, after all, are likely waiting for the Model 3’s $35,000 base variant. So far, Tesla’s website notes that Model 3 equipped with a Standard Battery would be available in 4 to 6 months.

Tesla is yet to release its production and delivery figures for the fourth quarter of 2018, though estimates from the electric car community expect the automaker to deliver around 33,000 vehicles in December, of which about 24,500 were Model 3. Considering that Tesla reportedly hit a production rate of 1,000 Model 3 per day in Q4, and considering that the company was pushing deliveries until the end of the year, there is a good chance that the electric car maker has achieved yet another record-setting quarter.

The next 12 months would likely go down as Tesla’s most historic year yet. Apart from the international rollout of the Model 3, the company is also expected to unveil the Model Y SUV this year. Just like the Model 3, the Model Y is aimed at the mass market, and considering the industry’s preference for SUVs, expectations are high that demand for the Model Y would exceed even that of the electric sedan. This is not all, though, as Elon Musk has teased that the Tesla Truck might be unveiled in 2019, and initial production of its all-electric long hauler — the Semi — could enter its first phases sometime this year as well. Lastly, Tesla’s Energy products such as the Solar Roof, which also has a long line of reservation holders, is expected to ramp production in 2019.

News

Tesla opens Supercharging Network to other EVs in new country

Tesla’s Supercharging infrastructure is the most robust in the world, and it has done a wonderful job of keeping things up and running for the millions of owners out there. As it expanded access to non-Tesla EVs a couple years back, it has still managed to keep things pretty steady, although the need for more charging is apparent.

Tesla has started opening its Supercharging Network, which is the most expansive in the world, to other EVs in a new country for the first time.

After expanding its Supercharging offerings to other car companies in the United States a few years ago, Tesla is still making the move in other markets, as it aims to make EV ownership easier for everyone, regardless of what manufacturer a consumer chose to purchase from.

Tesla’s Supercharging infrastructure is the most robust in the world, and it has done a wonderful job of keeping things up and running for the millions of owners out there. As it expanded access to non-Tesla EVs a couple years back, it has still managed to keep things pretty steady, although the need for more charging is apparent.

Tesla just added a cool new feature for leaving your charger at home or even leaving the Supercharger pic.twitter.com/iw0SDrWuX6

— TESLARATI (@Teslarati) March 10, 2026

Now, Tesla is expanding access to the Supercharger Network to non-Tesla EVs in Malaysia. The automaker just opened up a charging stie at the Pavilion KL Mall in Kuala Lumpur to non-Tesla owners, giving them eight additional Superchargers to utilize with a charging speed of up to 250 kW.

Tesla is also opening up the four-Supercharger site in Shah Alam, a four-Supercharger site at the IOI City Mall, and a six-Supercharger site in Gamuda Cove Township.

Electrive first reported the opening of these Superchargers in Malaysia.

The initiative from Tesla helps make EV ownership much simpler for those who only have access to third-party charging solutions or at-home charging. While at-home charging is the most advantageous, it is not an end-all solution as every driver will eventually need to grab some range on the road.

Tesla has been offering its Superchargers to non-Tesla EVs in the United States since 2024, as Ford became the first company to gain access to the massive network early that year when CEO Elon Musk and Ford frontman Jim Farley announced it together. Since then, Tesla has offered its chargers to nearly every EV maker, as companies like Rivian and Lucid, and even legacy car companies like General Motors have gained access.

It’s best for everyone to have the ability to use Tesla Superchargers, but there are of course some growing pains.

Charging cables are built to cater to Tesla owners, so pull-in Superchargers are most advantageous for non-Tesla EVs currently, but the company’s V4 Superchargers, which are not as plentiful in the U.S. quite yet, do enable easier reach for those vehicles.

News

Tesla Semi expands pilot program to Texas logistics firm: here’s what they said

Mone said the Tesla Semi it put into its fleet for this test recorded 1.64 kWh per mile efficiency, beating Tesla’s official 1.7 kWh per mile target and delivering a massive leap over conventional diesel trucks.

Tesla has expanded its Semi pilot program to a new region, as it has made it to Texas to be tested by logistics from Mone Transport. With the Semi entering production this year, Tesla is getting even more valuable data regarding the vehicle and its efficiency, which will help companies cut expenditures.

Mone Transport operates in Texas and on the Southern border, and it specializes in cross-border U.S.-Mexico freight operations. After completing some rigorous testing, Mone shared public results, which stand out when compared to efficiency metrics offered by diesel vehicles.

“Mone Transport recently had the opportunity to put the Tesla Semi to the test, and we’re thrilled with the results! Over 4,700 miles of operations at 1.64 kWh/mile in our Texas operation. We’re committed to providing zero-emission transportation to our customers!” the company said in a post on X.

🚨 Mone Transport just recorded an extremely impressive Tesla Semi test:

1.64 kWh per mile over 4,700 miles! https://t.co/xwS2dDeomP pic.twitter.com/oLZHoQgXsu

— TESLARATI (@Teslarati) March 10, 2026

Mone said the Tesla Semi it put into its fleet for this test recorded 1.64 kWh per mile efficiency, beating Tesla’s official 1.7 kWh per mile target and delivering a massive leap over conventional diesel trucks.

Comparable Class 8 diesel semis, typically achieving 6-7 miles per gallon, consume roughly 5.5 kWh per mile in energy-equivalent terms, meaning the Semi uses three to four times less energy while also producing zero tailpipe emissions.

Tesla Semi undergoes major redesign as dedicated factory preps for deliveries

The performance of the Tesla Semi in Mone Transport’s testing aligns with data from other participants in the pilot program. ArcBest’s ABF Freight Division logged 4,494 miles over three weeks in 2025, averaging 1.55 kWh per mile across varied routes, including a grueling 7,200-foot Donner Pass climb. The truck “generally matched the performance of its diesel counterparts,” the carrier said.

PepsiCo, which operates the largest known Semi fleet, recorded 1.7 kWh per mile in North American Council for Freight Efficiency testing. Additional pilots showed similar gains: DHL hit 1.72 kWh per mile, and Saia achieved 1.73 kWh per mile.

These metrics underscore the Semi’s ability to slash operating costs through superior efficiency, lower maintenance, and zero-emission operation. As charging infrastructure scales and production ramps toward 2026 targets, participants like Mone Transport are proving electric semis can seamlessly integrate into freight networks, accelerating the industry’s shift to sustainable, high-performance trucking.

Tesla continues to prep for a more widespread presence of the Semi in the coming months as it recently launched the first public Semi Megacharger site in Los Angeles. It is working on building out infrastructure for regional runs on the West Coast initially, with plans to expand this to the other end of the country in the coming years.

Elon Musk

SpaceX weighs Nasdaq listing as company explores early index entry: report

The company is reportedly seeking early inclusion in the Nasdaq-100 index.

Elon Musk’s SpaceX is reportedly leaning toward listing its shares on the Nasdaq for a potential initial public offering (IPO) that could become the largest in history.

As per a recent report, the company is reportedly seeking early inclusion in the Nasdaq-100 index. The update was reported by Reuters, citing people familiar with the matter.

According to the publication, SpaceX is considering Nasdaq as the venue for its eventual IPO, though the New York Stock Exchange is also competing for the listing. Neither exchange has reportedly been informed of a final decision.

Reuters has previously reported that SpaceX could pursue an IPO as early as June, though the company’s plans could still change.

One of the publication’s sources also suggested that SpaceX is targeting a valuation of about $1.75 trillion for its IPO. At that level, the company would rank among the largest publicly traded firms in the United States by market capitalization.

Nasdaq has proposed a rule change that could accelerate the inclusion of newly listed megacap companies into the Nasdaq-100 index.

Under the proposed “Fast Entry” rule, a newly listed company could qualify for the index in less than a month if its market capitalization ranks among the top 40 companies already included in the Nasdaq-100.

If SpaceX is successful in achieving its target valuation of $1.75 trillion, it would become the sixth-largest company by market value in the United States, at least based on recent share prices.

Newly listed companies typically have to wait up to a year before becoming eligible for major indexes such as the Nasdaq-100 or S&P 500.

Inclusion in a major index can significantly broaden a company’s shareholder base because many institutional investors purchase shares through index-tracking funds.

According to Reuters, Nasdaq’s proposed fast-track rule is partly intended to attract highly valued private companies such as SpaceX, OpenAI, and Anthropic to list on the exchange.