Investor's Corner

Tesla ends Q4 2018 with a flourish, passes 190k total Model 3 VIN registrations

Tesla started 2018 as an electric car maker struggling to ramp the production of its most ambitious vehicle. As Q4 2018 comes to a close, it is becoming apparent that Tesla is closing the year as a carmaker that can hold its own against the veterans of the hyper-competitive auto industry. Seemingly as a final flourish to an otherwise historic 2018, Tesla has registered what could very well be its final large batch of Model 3 VINs for the quarter, breaching the 190,000 barrier for filings of the electric sedan.

#Tesla registered 3,569 new #Model3 VINs. ~52% estimated to be dual motor. Highest VIN is 193556. https://t.co/ezA2Bas4Kh

— Model 3 VINs (@Model3VINs) December 30, 2018

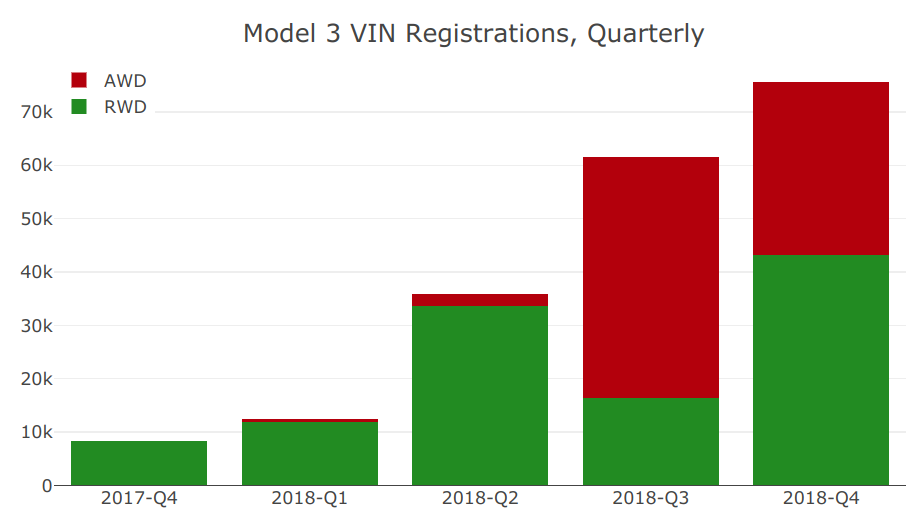

Twitter group @Model3VINs, which tracks registrations for the electric sedan, recently reported that Tesla filed a rather large batch of 3,569 vehicles, comprised of both Dual Motor and RWD units. With this latest batch, Tesla has broken the 190,000 mark in total Model 3 filings to date. Among this number, more than 75,000 were registered in the fourth quarter alone. As noted by this graph provided by the Model 3 VIN tracking group, the Q4 2018 is characterized by a massive influx of RWD filings, possibly as a result of the introduction, production, and deliveries of the Mid Range Model 3.

To keep the company’s Q4 Model 3 VIN registrations in perspective, it should be noted that Tesla was only able to breach the 75,000 mark back in mid-July, roughly a year since starting the production of the vehicle. For a company that encountered hiccups with the Model 3 ramp, being able to register 12 months worth of cars in the past 90 days is impressive.

Tesla’s Model 3 VIN registrations for the fourth quarter comes amidst reports that the company has reached a point where it is capable of producing 1,000 units of the electric sedan every day. As reflected by an alleged leaked email from Elon Musk late last month, as well as by social media posts from Tesla employees in the days and weeks after, it appears that the company’s Model 3 output continues to improve.

https://twitter.com/VickiSalvador/status/1074397006318120960

With Tesla at a point where it is capable of sustained levels of Model 3 production, the company is now starting to lay the foundations for the electric sedan’s international ramp in 2019. In Europe, for one, reports have emerged pointing to Tesla shipping 3,000 Model 3 per week starting in February. Deliveries of the Model 3 in China are also expected to begin within the next few months.

At the core of the Model 3, though, lies the vehicle and its demand. In several key regions such as the United States, after all, the Model 3 competes in a market that widely prefers SUVs and larger vehicles. Nevertheless, as the electric sedan’s sales in the US and Canada have shown so far, the Model 3 is capable of standing out despite being a passenger car in an SUV dominated region.

As the Model 3 prepares to breach the foreign markets, Wall Street analyst Dan Ives from Wedbush Securities noted that demand for the vehicle would likely be strong in 2019. According to the analyst, the demand for the car in regions such as Europe — which still have notable passenger car markets — would likely reduce Tesla’s need to raise capital in the near future.

“Demand for Tesla’s Model 3 mid-size electric sedan looks very strong into 2019 and beyond. While there are worries that some European unit shipments might spill over into Q2 and out of Q1, we believe the Street is well aware of this potential timing dynamic as underlying pent-up demand looks robust on this new European frontier for Musk & Co heading into 2019, with China also a major growth catalyst on the heels of recent price cuts,” the analyst wrote.

As a cherry on top for the already successful vehicle, the Model 3 recently received the 2018 Car of the Year award from The Detroit News, with longtime gearhead Henry Payne stating that the electric sedan is “Apple on wheels.”

Investor's Corner

Tesla Board member and Airbnb co-founder loads up on TSLA ahead of robotaxi launch

Tesla CEO Elon Musk gave a nod of appreciation for the Tesla Board member’s purchase.

Tesla Board member and Airbnb Co-Founder Joe Gebbia has loaded up on TSLA stock (NASDAQ:TSLA). The Board member’s purchase comes just over a month before Tesla is expected to launch an initial robotaxi service in Austin, Texas.

Tesla CEO Elon Musk gave a nod of appreciation for the Tesla Board member in a post on social media.

The TSLA Purchase

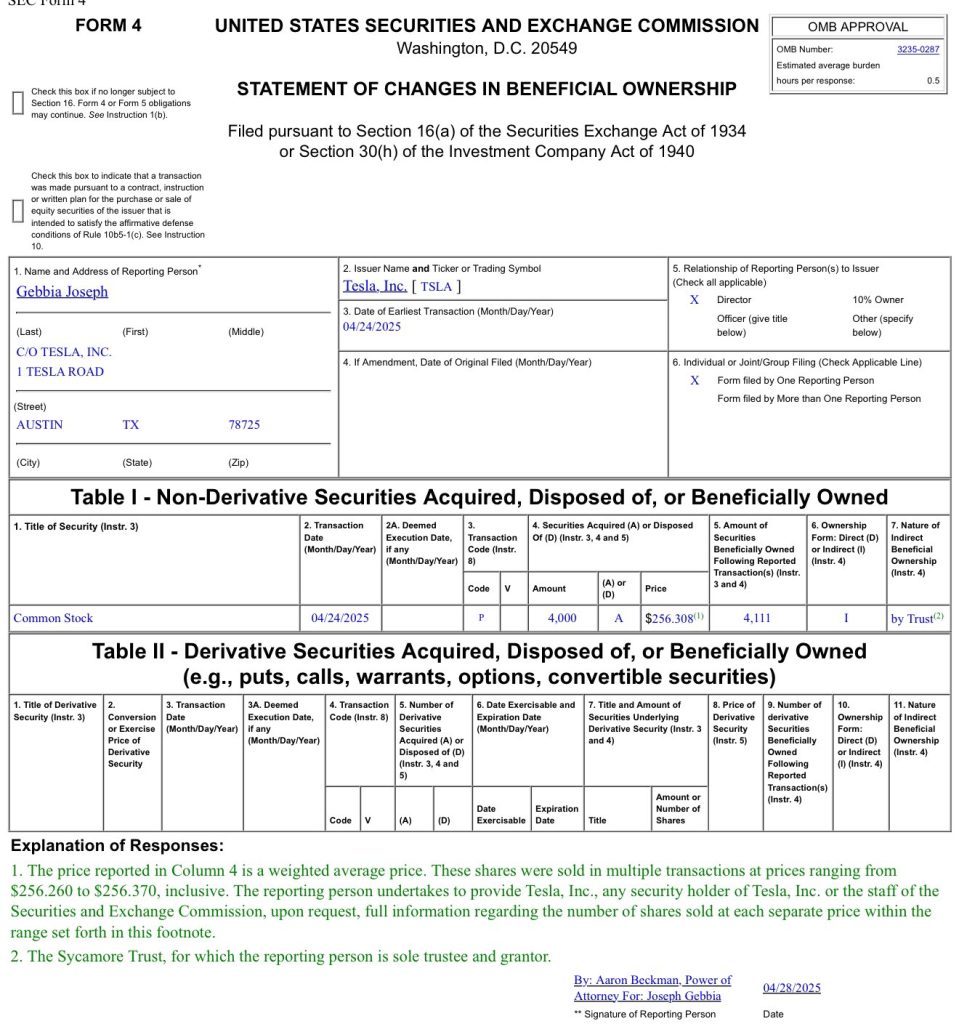

As could be seen in a Form 4 submitted to the United States Securities and Exchange Commission (SEC) on Monday, Gebbia purchased about $1.02 million worth of TSLA stock. This was comprised of 4,000 TSLA shares at an average price of $256.308 per share.

Interestingly enough, Gebbia’s purchase represents the first time an insider has purchased TSLA stock in about five years. CEO Elon Musk, in response to a post on social media platform X about the Tesla Board member’s TSLA purchase, gave a nod of appreciation for Gebbia. “Joe rocks,” Musk wrote in his post on X.

Gebbia has served on Tesla’s Board as an independent director since 2022, and he is also a known friend of Elon Musk. He even joined the Trump Administration’s Department of Government Efficiency (DOGE) to help the government optimize its processes.

Just a Few Weeks Before Robotaxi

The timing of Gebbia’s TSLA stock purchase is quite interesting as the company is expected to launch a dedicated roboatxi service this June in Austin. A recent report from Insider, citing sources reportedly familiar with the matter, claimed that Tesla currently has 300 test operators driving robotaxis around Austin city streets. The publication’s sources also noted that Tesla has an internal deadline of June 1 for the robotaxi service’s rollout, but even a launch near the end of the month would be impressive.

During the Q1 2025 earnings call, Elon Musk explained that the robotaxi service that would be launched in June will feature autonomous rides in Model Y units. He also noted that the robotaxi service would see an expansion to other cities by the end of 2025. “The Teslas that will be fully autonomous in June in Austin are probably Model Ys. So, that is currently on track to be able to do paid rides fully autonomously in Austin in June and then to be in many other cities in the US by the end of this year,” Musk stated.

Investor's Corner

Tesla hints at ‘Model 2’ & next-gen EV designs

Tesla’s Q1 2025 update confirms new models this year, with production tied to existing factory lines. Could it be time for the Model 2 debut?

During its Q1 2025 earnings call, Tesla executives hinted at the much-rumored “Model 2” and other next-gen EV designs.

Tesla slightly addressed whether or not it will be pushing forward with the debut of new models later this year in its latest earnings call. The company’s product development executive, Lars Moravy, shared some details about Tesla’s design process and the upcoming affordable models.

“We’re still planning to release models this year. As with all launches, we’re working through, like, the last minute issues that pop up. We’re knocking them down one by one. At this point, I would say that the ramp might be a little slower than we had hoped initially…But there’s nothing that’s blocking us from starting production within the next, within the timeline laid out in the opening remarks.

“And I will say it’s important to emphasize that, as we’ve said all along, the full utilization of our factories is the primary goal for these new products. And so the flexibility of what we can do within the form factor and, you know, the design of it is really limited to what we can do on our existing lines rather than building new ones. But we’ve been targeting the low cost of ownership. Monthly payment is the biggest differentiator for our vehicles, and that’s why we’re focused on bringing these new models with the, you know, the lowest price, to the market, within the constraints I just highlighted.”

The Model 3 is a hell of a deal, ngl. With the federal tax credit, it'd be silly to get a comparably priced combustion-powered car.

Now for the big question. Is the Model 3 currently the best-looking Tesla? https://t.co/5E37J9OKhU— TESLARATI (@Teslarati) April 24, 2025

In January, Tesla’s Chief Financial Officer Vaibhav Taneja teased several new product introductions for this year. There is at least one product that most Tesla supporters and investors are hoping to see: the company’s affordable vehicles, which have been dubbed by the EV community as the “Model 2” or “Model Q.”

Before Tesla’s Robotaxi event last year, many speculated that the company would also unveil its affordable next-gen vehicle. Gene Munster from Deepwater had expected Tesla to release a stripped-down version of the Model 3 as its affordable vehicle during the Robotaxi event. In the end, Tesla unveiled its Robotaxi vehicle and its Robovan design.

It’s been a while since the Robotaxi event, and Tesla has kept mum about its affordable vehicle. Considering its Q1 2025 performance, TSLA investors look forward to catalysts that could boost the stock.

The “Model 2” has been labeled a potential catalyst for Tesla. As such, TSLA investors and supporters have been itching for news about the new affordable vehicle. The main questions surrounding the “Model 2” revolve around its design and price. Based on Moravy’s statement, the “Model 2’s” design will heavily depend on Tesla’s current assembly lines and supply chain structures.

Elon Musk

Tesla regains Piper Sandler’s confidence with Robotaxi plans & Q1 Results

Piper Sandler says Tesla delivered the best-case scenario for bulls. $TSLA has catalysts ahead to silence the bears.

Tesla gained Piper Sandler analyst Alexander Potter’s confidence following its Q1 2025 earnings call. Piper Sandler reaffirmed its Overweight rating and $400 TSLA price target, signaling optimism for the company’s robotaxi and affordable vehicle launches expected this year. The firm’s stance reflects Tesla’s resilience amid market challenges.

Despite expectations of weak Q1 financials, Tesla’s stock edged up in after-hours trading, defying skepticism. Piper Sandler’s Alexander Potter noted that the results met the hopes of Tesla supporters, particularly as the company held firm on its timelines. Potter emphasized that anticipation for robotaxi details and new vehicle launches should keep critics at bay, supporting the $400 target.

“In our preview last week, we predicted that (at best) Q1 would be a non-event. With the stock trading up slightly in the after-hours session, it appears our best-case scenario has materialized. Considering generally weak Q1 financials, we think this is the best result that TSLA bulls could’ve reasonably hoped for.

“In our view, the most important Q1 takeaway is this: Tesla didn’t hedge expectations re: launching Robotaxis or lower-priced vehicles in 1H25. With <2 months until the end of June, investors can look forward to some interesting catalysts in the weeks ahead. In our view, this alone should be enough to keep the bears at bay, at least until we have a better idea re: the details of Tesla’s new products, as well as the scale/scope of the Robotaxi launch,” wrote Potter.

Wedbush Securities’ Dan Ives, a longtime TSLA bull, echoed Potter’s optimism for Tesla. Ives raised his price target for Tesla stock from $315 to $350 with a BUY rating. His Tesla upgrade came after Elon Musk’s announcement during the Q1 earnings call that he would reduce his involvement with DOGE, signaling a sharper focus on Tesla.

Tesla’s steady Q1 performance and unwavering commitment to its 2025 roadmap, including the Robotaxi launch and lower-priced models, bolster investor confidence. Piper Sandler’s analysis underscores Tesla’s ability to navigate a competitive electric vehicle market while advancing its technological edge. The upcoming Robotaxi launch and affordable vehicle introductions are pivotal, with analysts expecting these initiatives to drive stock value through 2025.

As Tesla prepares for these milestones, its stock movement reflects market trust in Musk’s vision. With Piper Sandler and Wedbush reaffirming bullish outlooks, Tesla’s strategic moves will remain under close scrutiny, positioning the company to capitalize on its innovation pipeline in a dynamic industry landscape.

-

News1 week ago

News1 week agoTesla’s Hollywood Diner is finally getting close to opening

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla doubles down on Robotaxi launch date, putting a big bet on its timeline

-

News6 days ago

News6 days agoTesla is trying to make a statement with its Q2 delivery numbers

-

Investor's Corner1 week ago

Investor's Corner1 week agoLIVE BLOG: Tesla (TSLA) Q1 2025 Company Update and earnings call

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla reportedly suspended Cybercab and Semi parts order amid tariff war: Reuters

-

SpaceX2 weeks ago

SpaceX2 weeks agoSpaceX pitches subscription model for Trump’s Golden Dome

-

News2 weeks ago

News2 weeks agoDriverless Teslas using FSD Unsupervised are starting to look common in Giga Texas

-

News3 days ago

News3 days agoNY Democrats are taking aim at Tesla direct sales licenses in New York