Energy

How Tesla’s Big Battery saved South Australia from 3 major blackouts

The Tesla-powered Hornsdale Power Reserve (HPR) in South Australia has saved businesses and local residents from three wide-scale blackouts, proving how big batteries can play a key role in maintaining a region’s power grid.

The Hornsdale Power Reserve, owned by French renewable energy producer Neoen, uses Tesla’s utility-scale Powerpack system. Based on an impact study from consulting firm Aurecon, it appears that the big battery has saved consumers AUD 116 million or roughly $76 million in 2019. The same report detailed how the HPR responded to three separate major events since it went online in 2018. The said events occurred in August 2018, November 2019, and January 2020.

“On each occasion, HPR responded by closely tracking the changing frequency and accurately changing its power dispatch as required,” the Hornsdale Power Reserve Year 2 Technical and Market Impact Case Study read.

The Hornsdale Power Reserve provides Fast Frequency Response using its fast dispatch capability to ensure power is supplied quickly, avoiding major power outages.

During the August 2018 event, the grids in South Australia and Queensland were cut off from the main grid following lighting strikes that resulted in major blackouts in New South Wales and Victoria. NSW shed 724MW of load while Victoria shed 280MW. Victoria and South Australia did not go in the dark. Tesla’s big battery was quickest to respond during the said event and has proven itself as a critical asset where power security is needed.

“The large-scale battery storage in SA was valuable in this event, assisting in containing the initial decline in system frequency, and then rapidly changing output from generation back to load, to limit the over-frequency condition in SA following separation from VIC,” the Australian Energy Market Operator report about the Aug. 2018 event reads.

On November 16, 2019, another event caused the islanding of the grid in South Australia. In the early evening on the said date, the Heywood interconnector, the main link between South Australia and Victoria, tripped. Despite this, the lights in SA did not go dark, thanks to solar, wind, and big batteries. The Tesla Big Battery responded as required and helped return the supply to in a matter of minutes after the islanding event. As it maintained the supply in normal range, other energy producers that charge higher during such events were not able to perform as well.

On January 31, 2020, South Australia was once again separated from the National Electric Market due to a storm that broke a massive transmission line. The cut transmission lines actually meant there was an oversupply in SA and just like in undersupply events, the Hornsdale Power Reserve, together with South Australia’s other big batteries and windfarms, promptly responded to correct the fluttering frequency. SA effectively operated like an “island” until power was resynchronized on February 17.

The three events in South Australia highlight the vital role of how Tesla big battery-supplied Hornsdale Power Reserve can help maintain grid security and ensure that lights are kept on even when the state is “islanded.” These are only the beginning too, especially since Neoen has announced that it will be expanding its Tesla Powerpack Farm by 50%.

Energy

Tesla meets Giga New York’s Buffalo job target amid political pressures

Giga New York reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease.

Tesla has surpassed its job commitments at Giga New York in Buffalo, easing pressure from lawmakers who threatened the company with fines, subsidy clawbacks, and dealership license revocations last year.

The company reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease at the state-built facility.

As per an employment report reviewed by local media, Tesla employed 2,399 full-time workers at Gigafactory New York and 1,060 additional employees across the state at the end of 2025. Part-time roles pushed the total headcount of Tesla’s New York staff above the 3,460-job target.

The gains stemmed in part from a new Long Island service center, a Buffalo warehouse, and additional showrooms in White Plains and Staten Island. Tesla also said it has invested $350 million in supercomputing infrastructure at the site and has begun manufacturing solar panels.

Empire State Development CEO Hope Knight said the agency was “very happy” with Giga New York’s progress, as noted in a WXXI report. The current lease runs through 2029, and negotiations over updated terms have included potential adjustments to job requirements and future rent payments.

Some lawmakers remain skeptical, however. Assemblymember Pat Burke questioned whether the reported job figures have been fully verified. State Sen. Patricia Fahy has also continued to sponsor legislation that would revoke Tesla’s company-owned dealership licenses in New York. John Kaehny of Reinvent Albany has argued that the project has not delivered the manufacturing impact originally promised as well.

Knight, for her part, maintained that Empire State Development has been making the best of a difficult situation.

“(Empire State Development) has tried to make the best of a very difficult situation. There hasn’t been another use that has come forward that would replace this one, and so to the extent that we’re in this place, the fact that 2,000 families at (Giga New York) are being supported through the activity of this employer. It’s the best that we can have happen,” the CEO noted.

Energy

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

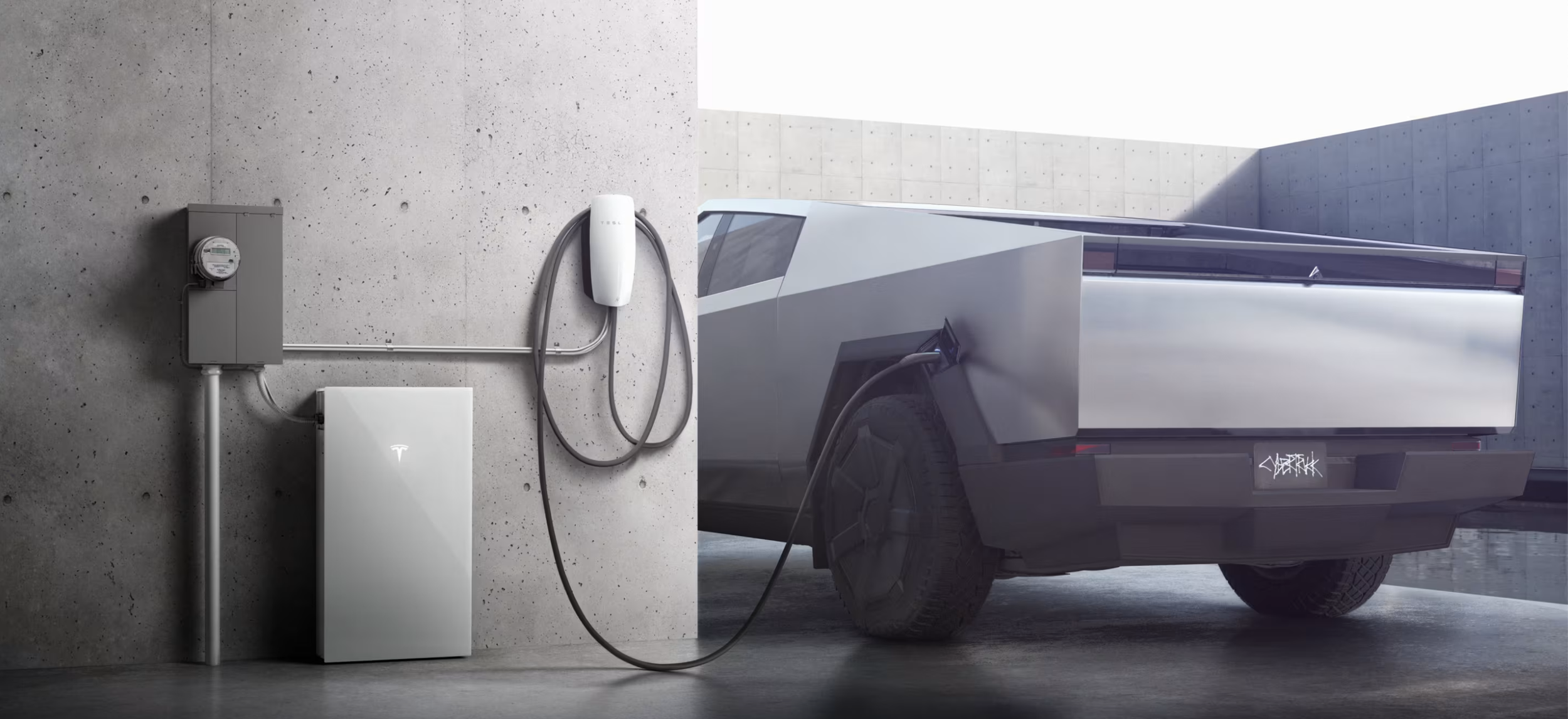

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.

Cybertruck

Tesla updates Cybertruck owners about key Powershare feature

Tesla is updating Cybertruck owners on its timeline of a massive feature that has yet to ship: Powershare with Powerwall.

Powershare is a bidirectional charging feature exclusive to Cybertruck, which allows the vehicle’s battery to act as a portable power source for homes, appliances, tools, other EVs, and more. It was announced in late 2023 as part of Tesla’s push into vehicle-to-everything energy sharing, and acting as a giant portable charger is the main advantage, as it can provide backup power during outages.

Cybertruck’s Powershare system supports both vehicle-to-load (V2L) and vehicle-to-home (V2H), making it flexible and well-rounded for a variety of applications.

However, even though the feature was promised with Cybertruck, it has yet to be shipped to vehicles. Tesla communicated with owners through email recently regarding Powershare with Powerwall, which essentially has the pickup act as an extended battery.

Powerwall discharge would be prioritized before tapping into the truck’s larger pack.

However, Tesla is still working on getting the feature out to owners, an email said:

“We’re writing to let you know that the Powershare with Powerwall feature is still in development and is now scheduled for release in mid-2026.

This new release date gives us additional time to design and test this feature, ensuring its ability to communicate and optimize energy sharing between your vehicle and many configurations and generations of Powerwall. We are also using this time to develop additional Powershare features that will help us continue to accelerate the world’s transition to sustainable energy.”

Owners have expressed some real disappointment in Tesla’s continuous delays in releasing the feature, as it was expected to be released by late 2024, but now has been pushed back several times to mid-2026, according to the email.

Foundation Series Cybertruck buyers paid extra, expecting the feature to be rolled out with their vehicle upon pickup.

Cybertruck’s Lead Engineer, Wes Morrill, even commented on the holdup:

As a Cybertruck owner who also has Powerwall, I empathize with the disappointed comments.

To their credit, the team has delivered powershare functionality to Cybertruck customers who otherwise have no backup with development of the powershare gateway. As well as those with solar…

— Wes (@wmorrill3) December 12, 2025

He said that “it turned out to be much harder than anticipated to make powershare work seamlessly with existing Powerwalls through existing wall connectors. Two grid-forming devices need to negotiate who will form and who will follow, depending on the state of charge of each, and they need to do this without a network and through multiple generations of hardware, and test and validate this process through rigorous certifications to ensure grid safety.”

It’s nice to see the transparency, but it is justified for some Cybertruck owners to feel like they’ve been bait-and-switched.