News

Tesla rumored to use BYD ‘Blade’ battery days after $25k car speculation swirls

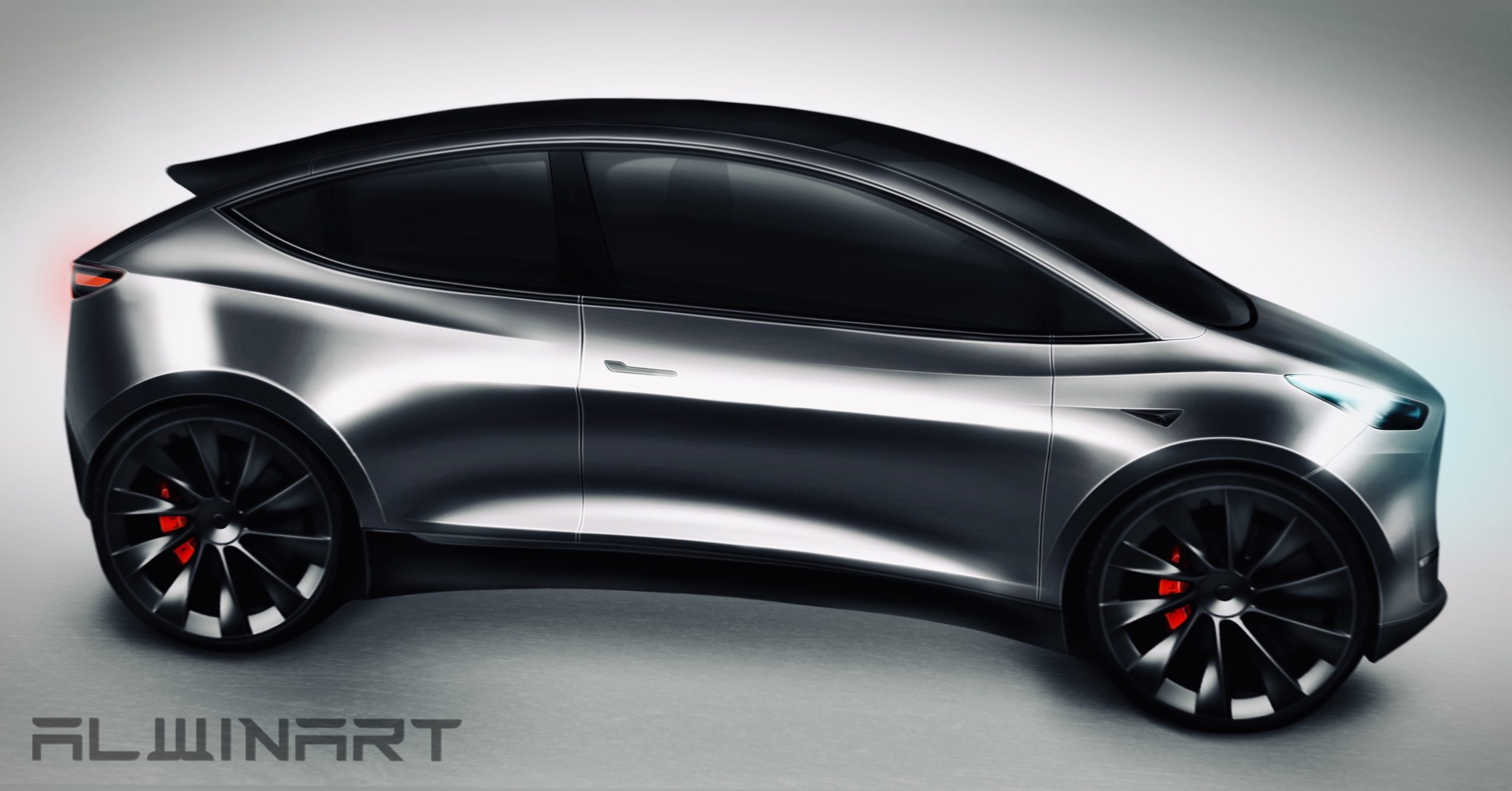

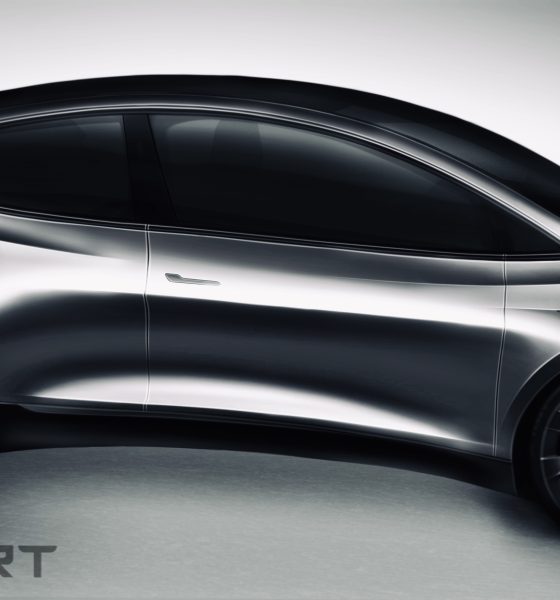

Tesla could use Chinese automotive company BYD’s new, ultra-safe “Blade” battery design in some of its vehicles in 2022. The rumors that associate the Blade battery from BYD being paired with Tesla’s successful electric models in China follow a report from just days ago when Tesla was rumored to have already completed a prototype for its $25,000 EV.

Multiple Chinese media sources, including the Associated Press, have reported that people familiar with BYD’s supply chain and plans for the blade battery have indicated that the company will supply Tesla with the pack design as soon as Q2 2022. According to the initial reports, Tesla is already testing its vehicles with the blade batteries, which could have fueled the speculation from several days ago that an affordable $25k car prototype is in the works at Giga Shanghai, Tesla’s Chinese production facility.

The reports stated that Tesla has already entered the “C-sample test phase” with vehicles with the blade battery installed.

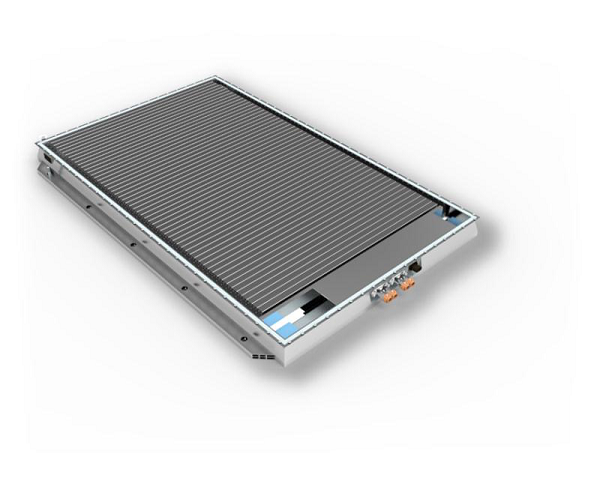

BYD’s Blade battery has been developed for several years, but the automotive entity unveiled the design in March 2020. The company began the development to mitigate concerns about battery safety in EVs, a growing concern as the industry began to take off a few years ago.

The design is different than current battery pack designs. In the Blade battery, singular cells are arranged together in an array, then inserted into a battery pack. It eliminates unnecessary space due to arrangement optimization, and the space within the pack is increased by over 50% compared to block batteries, BYD said.

Credit: BYD

The battery pack underwent extensive testing to ensure safety and efficiency with its design. The Blade pack passed nail penetration tests by not emitting smoke or fire after the pack’s main housing was punctured. Additionally, surface temperatures only reached between 30 and 60 degrees Celsius (86 to 140 Fahrenheit). Traditional pack designs for LFP block batteries did not catch fire, but temperatures reached 200 to 400 degrees Celsius. Additionally, ternary lithium batteries exceeded 500 degrees Celsius and “violently burned,” BYD stated.

Interestingly, several days ago, it was rumored that Tesla might have already completed some prototypes of its $25k sedan that it targets for the Chinese market. The report revealed that Tesla might have already lined up the suppliers for this vehicle. Now that rumors of BYD’s blade battery could be installed in the car to help reach the affordable price point, there is certainly some momentum behind the speculation. Tesla has attempted to develop the $25k car in China for some time, and it will eventually be a global offering from Tesla. However, the company has been ramping production of the Model 3 and Model Y and attempting to keep up with demand in China with those two vehicles.

The $25k Tesla could launch as early as next year. With suppliers beginning to reveal themselves, it is not a long shot to think that Tesla could capture some more of China’s EV market share with a sub-$30,000 vehicle.

What do you think? Let us know in the comments below, or be sure to email me at joey@teslarati.com or on Twitter @KlenderJoey.

News

Tesla begins Grok AI chatbot rollout to Australia and New Zealand fleet

The update follows earlier deployments in the United States and Europe.

Tesla has rolled out its Grok AI assistant to Australia and New Zealand, embedding the conversational chatbot directly into compatible vehicles via an over-the-air update.

The system, developed by Elon Musk’s xAI, is now live on select models, giving drivers access to a voice-based assistant that goes well beyond traditional command-driven controls.

The update follows earlier deployments in the United States and Europe.

Tesla Australia confirmed Grok is available on Model S, Model 3, Model X and Model Y vehicles equipped with an AMD processor and running software version 2025.26 or later.

“Grok is coming to Teslas in Australia and New Zealand. It can answer almost any question using real-time information & also add/edit navigation destinations to become your personal guide. Phased rollout has now begun to eligible vehicles,” Tesla Australia and New Zealand wrote in a post on its official X account.

Drivers can activate Grok using the steering wheel controls once the update is installed. Access requires either a Premium Connectivity subscription or a stable Wi-Fi connection.

Unlike conventional in-car voice assistants that rely on fixed prompts, Grok is designed to respond conversationally. It can adjust navigation mid-trip, locate nearby points of interest, explain dashboard warnings, provide driving guidance and reference the owner’s manual.

Tesla noted that interactions with Grok are processed by xAI and remain anonymous to Tesla, adding that conversations are not linked to a specific driver or vehicle.

Grok has attracted attention overseas for offering multiple interaction modes. In the U.S., users can select personalities such as Assistant, Language Tutor, Therapist, Storyteller and Meditation. Additional optional modes for adult users include settings labeled Unhinged, Motivation, Argumentative, Romantic and even Sexy.

Viral clips shared online have shown Grok adopting sarcastic or playful tones that differ from more neutral digital assistants, with the AI assistant typically catching drivers off-guard with its sharp personality and wit.

News

Ford is charging for a basic EV feature on the Mustang Mach-E

When ordering a new Ford Mustang Mach-E, you’ll now be hit with an additional fee for one basic EV feature: the frunk.

Ford is charging an additional fee for a basic EV feature on its Mustang Mach-E, its most popular electric vehicle offering.

Ford has shuttered its initial Model e program, but is venturing into a more controlled and refined effort, and it is abandoning the F-150 Lightning in favor of a new pickup that is currently under design, but appears to have some favorable features.

However, ordering a new Mustang Mach-E now comes with an additional fee for one basic EV feature: the frunk.

The frunk is the front trunk, and due to the lack of a large engine in the front of an electric vehicle, OEMs are able to offer additional storage space under the hood. There’s one problem, though, and that is that companies appear to be recognizing that they can remove it for free while offering the function for a fee.

Ford is now charging $495 on the Mustang Mach-E frunk (front trunk). What are your thoughts on that? pic.twitter.com/EOzZe3z9ZQ

— Alan of TesCalendar 📆⚡️ (@TesCalendar1) February 24, 2026

Ford is charging $495 for the frunk.

Interestingly, the frunk size varies by vehicle, but the Mustang Mach-E features a 4.7 to 4.8 cubic-foot-sized frunk, which measures approximately 9 inches deep, 26 inches wide, and 14 inches high.

When the vehicle was first released, Ford marketed the frunk as the ultimate tailgating feature, showing it off as a perfect place to store and serve cold shrimp cocktail.

Ford Mach-E frunk is perfect for chowders and chicken wings, and we’re not even joking

It appears the decision to charge for what is a simple advantage of an EV is not going over well, as even Ford loyal customers say the frunk is a “basic expectation” of an EV. Without it, it seems as if fans feel the company is nickel-and-diming its customers.

It will be pretty interesting to see the Mach-E without a frunk, and while it should not be enough to turn people away from potentially buying the vehicle, it seems the decision to add an additional charge to include one will definitely annoy some customers.

News

Tesla to improve one of its best features, coding shows

According to the update, Tesla will work on improving the headlights when coming into contact with highly reflective objects, including road signs, traffic signs, and street lights. Additionally, pixel-level dimming will happen in two stages, whereas it currently performs with just one, meaning on or off.

Tesla is looking to upgrade its Matrix Headlights, a unique and high-tech feature that is available on several of its vehicles. The headlights aim to maximize visibility for Tesla drivers while being considerate of oncoming traffic.

The Matrix Headlights Tesla offers utilize dimming of individual light pixels to ensure that visibility stays high for those behind the wheel, while also being considerate of other cars by decreasing the brightness in areas where other cars are traveling.

Here’s what they look like in action:

- Credit: u/ObjectiveScratch | Reddit

- Credit: u/ObjectiveScratch | Reddit

As you can see, the Matrix headlight system intentionally dims the area where oncoming cars would be impacted by high beams. This keeps visibility at a maximum for everyone on the road, including those who could be hit with bright lights in their eyes.

There are still a handful of complaints from owners, however, but Tesla appears to be looking to resolve these with the coming updates in a Software Version that is currently labeled 2026.2.xxx. The coding was spotted by X user BERKANT:

🚨 Tesla is quietly upgrading Matrix headlights.

Software https://t.co/pXEklQiXSq reveals a hidden feature:

matrix_two_stage_reflection_dip

This is a major step beyond current adaptive high beams.

What it means:

• The car detects highly reflective objects

Road signs,… pic.twitter.com/m5UpQJFA2n— BERKANT (@Tesla_NL_TR) February 24, 2026

According to the update, Tesla will work on improving the headlights when coming into contact with highly reflective objects, including road signs, traffic signs, and street lights. Additionally, pixel-level dimming will happen in two stages, whereas it currently performs with just one, meaning on or off.

Finally, the new system will prevent the high beams from glaring back at the driver. The system is made to dim when it recognizes oncoming cars, but not necessarily objects that could produce glaring issues back at the driver.

Tesla’s revolutionary Matrix headlights are coming to the U.S.

This upgrade is software-focused, so there will not need to be any physical changes or upgrades made to Tesla vehicles that utilize the Matrix headlights currently.