News

Tesla bull asks Elon Musk for Full Self-Driving value to be added with vehicle trade-in

Tesla will consider adding monetary value to its Full Self-Driving suite when an owner is attempting to trade-in their vehicle. The company is looking into the possibility following a request to Elon Musk from notable Wall Street analyst and Tesla bull Pierre Ferragu.

Ferragu, an analyst from New Street Research, currently owns a Model 3 equipped with Tesla’s Full Self-Driving suite. After purchasing the self-driving capability in November, Ferragu said he is interested in upgrading from a Model 3 to a Model Y. Still, he isn’t pleased about paying the $10,000 price tag for the semi-autonomous driving feature when he recently shelled out the money for the Model 3.

Tesla’s Full Self-Driving suite is what the company may be most known for outside of its highly-advanced electric vehicle tech, which has made it the undeniable leader in the EV sector. However, the Full Self-Driving suite is not included with the purchase of the vehicle like Basic Autopilot is, and to have the FSD capabilities, the owner must pay $10,000 on top of the price of the car.

“@elonmusk: I paid FSD for my Model 3 in November. I now want to upgrade to model Y and your team tells me you don’t value FSD in your trade-in offer because you can do the software upgrade for free. Want me to pay again full price for FSD again? That’s not fair, change that!” Ferragu tweeted to Musk.

@elonmusk: I paid FSD for my Model 3 in November. I now want to upgrade to model Y and your team tells me you don’t value FSD in your trade-in offer because you can do the software upgrade for free. Want me to pay again full price for FSD again? That’s not fair, change that!

— Pierre Ferragu (@p_ferragu) January 16, 2021

Musk and Tesla are considering adding the transfer or giving some credit toward an FSD-equipped vehicle’s trade-in value. Currently, the issue is that Tesla is not giving any monetary value to the FSD suite when someone wishes to trade in their car toward a new one. This would effectively mean that FSD makes the car no more or less valuable than it would be without the functionality equipped. This is causing a dilemma with some owners who wish to upgrade or change their Tesla vehicle as it would require paying another hefty $10,000 fee.

ALSO READ:

Tesla FSD Beta completes LA to Silicon Valley drive with zero interventions

Musk stated that he would look into the possibility of having FSD add value to a trade-in. The reason Tesla didn’t consider it before, according to Ferragu, is because the company can activate the functionality to any vehicle for free.

Looking into this. No question that FSD should be viewed as reasonably valuable when doing a trade-in.

— Elon Musk (@elonmusk) January 18, 2021

Other owners would be interested in a one-time transfer to a new vehicle, which would be advantageous for multiple scenarios. One would be if a family has two Teslas, but one is driven more than another. If the new car will be driven more frequently, but the current car has FSD, some owners may want to transfer the self-driving capability to the new vehicle. Another situation that would give owners some more leeway would be if they are trading an FSD-equipped vehicle in for a new Tesla. If their FSD purchase was recent and at the same price point as the current $10,000 tag, the feature could be transferred to the new car. If the owner paid less, Tesla could require the owner to pay the difference.

Tesla has been known to listen to real-world owners and use the feedback to improve their cars. Musk will likely update the development as it is figured out. It will be interesting to see how the company values FSD through trade-ins or if it will take the route of a transfer option for recent buyers of the Full Self-Driving suite.

Elon Musk

Tesla Full Self-Driving’s newest behavior is the perfect answer to aggressive cars

According to a recent video, it now appears the suite will automatically pull over if there is a tailgater on your bumper, the most ideal solution for when a driver is riding your bumper.

Tesla Full Self-Driving appears to have a new behavior that is the perfect answer to aggressive drivers.

According to a recent video, it now appears the suite will automatically pull over if there is a tailgater on your bumper, the most ideal solution for when a driver is riding your bumper.

With FSD’s constantly-changing Speed Profiles, it seems as if this solution could help eliminate the need to tinker with driving modes from the person in the driver’s seat. This tends to be one of my biggest complaints from FSD at times.

A video posted on X shows a Tesla on Full Self-Driving pulling over to the shoulder on windy, wet roads after another car seemed to be following it quite aggressively. The car looks to have automatically sensed that the vehicle behind it was in a bit of a hurry, so FSD determined that pulling over and letting it by was the best idea:

Tesla appears to be implementing some sort of feature that will now pull over if someone is tailgating you to let the car by

Really cool feature, definitely get a lot of this from those who think they drive race cars

— TESLARATI (@Teslarati) February 26, 2026

We can see from the clip that there was no human intervention to pull over to the side, as the driver’s hands are stationary and never interfere with the turn signal stalk.

This can be used to override some of the decisions FSD makes, and is a great way to get things back on track if the semi-autonomous functionality tries to do something that is either unneeded or not included in the routing on the in-car Nav.

FSD tends to move over for faster traffic on the interstate when there are multiple lanes. On two-lane highways, it will pass slower cars using the left lane. When faster traffic is behind a Tesla on FSD, the vehicle will move back over to the right lane, the correct behavior in a scenario like this.

Perhaps one of my biggest complaints at times with Full Self-Driving, especially from version to version, is how much tinkering Tesla does with Speed Profiles. One minute, they’re suitable for driving on local roads, the next, they’re either too fast or too slow.

When they are too slow, most of us just shift up into a faster setting, but at times, even that’s not enough, see below:

What has happened to Mad Max?

At one point it was going 32 in a 35. Traffic ahead had pulled away considerably https://t.co/bjKvaMVTNX pic.twitter.com/aaZSWmLu5v

— TESLARATI (@Teslarati) January 24, 2026

There are times when it feels like it would be suitable for the car to just pull over and let the vehicle that is traveling behind pass. This, at least up until this point, it appears, was something that required human intervention.

Now, it looks like Tesla is trying to get FSD to a point where it just knows that it should probably get out of the way.

Elon Musk

Tesla Megapack powers $1.1B AI data center project in Brazil

By integrating Tesla’s Megapack systems, the facility will function not only as a major power consumer but also as a grid-supporting asset.

Tesla’s Megapack battery systems will be deployed as part of a 400MW AI data center campus in Uberlândia, Brazil. The initiative is described as one of Latin America’s largest AI infrastructure projects.

The project is being led by RT-One, which confirmed that the facility will integrate Tesla Megapack battery energy storage systems (BESS) as part of a broader industrial alliance that includes Hitachi Energy, Siemens, ABB, HIMOINSA, and Schneider Electric. The project is backed by more than R$6 billion (approximately $1.1 billion) in private capital.

According to RT-One, the data center is designed to operate on 100% renewable energy while also reinforcing regional grid stability.

“Brazil generates abundant energy, particularly from renewable sources such as solar and wind. However, high renewable penetration can create grid stability challenges,” RT-One President Fernando Palamone noted in a post on LinkedIn. “Managing this imbalance is one of the country’s growing infrastructure priorities.”

By integrating Tesla’s Megapack systems, the facility will function not only as a major power consumer but also as a grid-supporting asset.

“The facility will be capable of absorbing excess electricity when supply is high and providing stabilization services when the grid requires additional support. This approach enhances resilience, improves reliability, and contributes to a more efficient use of renewable generation,” Palamone added.

The model mirrors approaches used in energy-intensive regions such as California and Texas, where large battery systems help manage fluctuations tied to renewable energy generation.

The RT-One President recently visited Tesla’s Megafactory in Lathrop, California, where Megapacks are produced, as part of establishing the partnership. He thanked the Tesla team, including Marcel Dall Pai, Nicholas Reale, and Sean Jones, for supporting the collaboration in his LinkedIn post.

Elon Musk

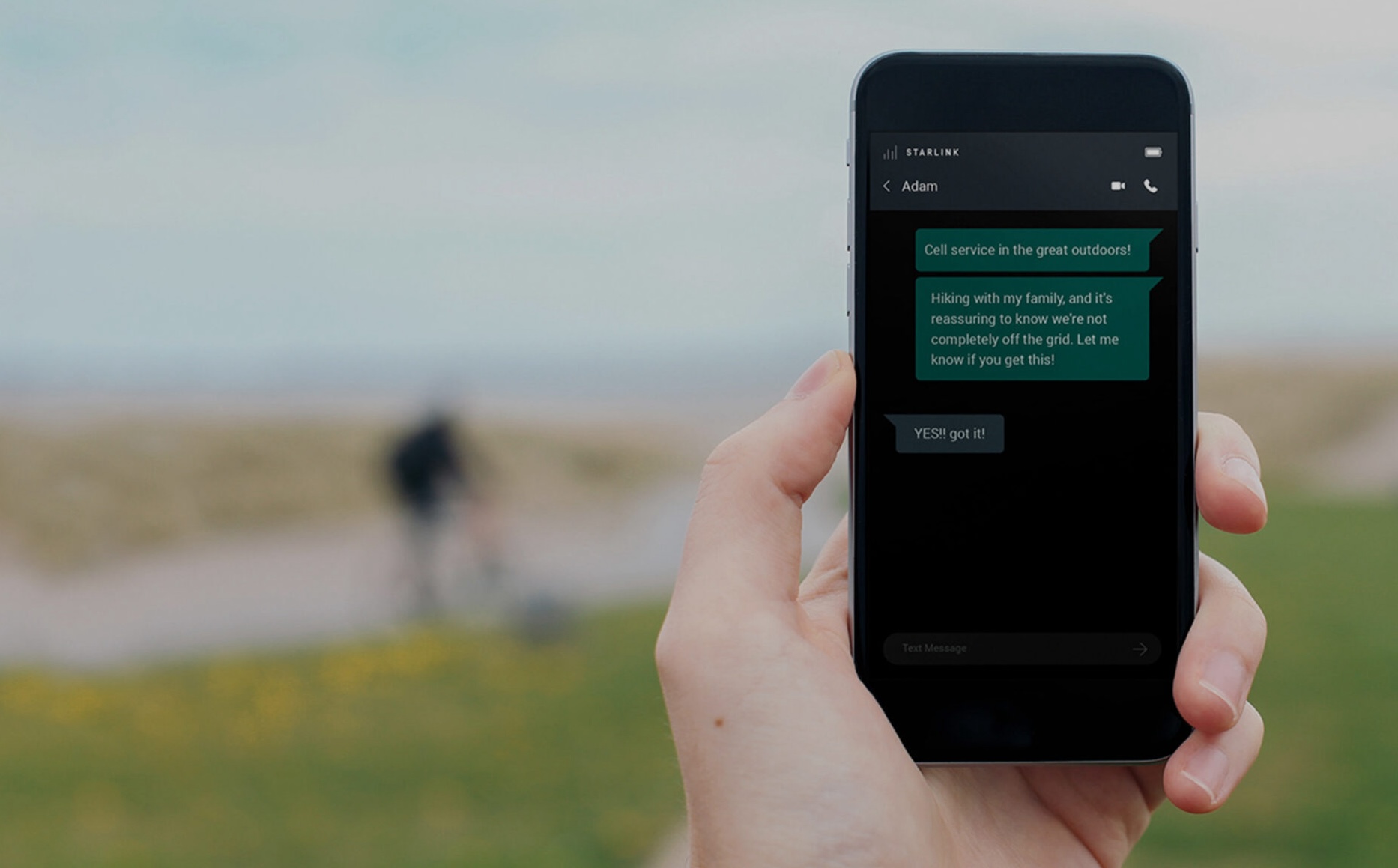

Starlink powers Europe’s first satellite-to-phone service with O2 partnership

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools.

Starlink is now powering Europe’s first commercial satellite-to-smartphone service, as Virgin Media O2 launches a space-based mobile data offering across the UK.

The new O2 Satellite service uses Starlink’s low-Earth orbit network to connect regular smartphones in areas without terrestrial coverage, expanding O2’s reach from 89% to 95% of Britain’s landmass.

Under the rollout, compatible Samsung devices automatically connect to Starlink satellites when users move beyond traditional mobile coverage, according to Reuters.

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools. O2 is pricing the add-on at £3 per month.

By leveraging Starlink’s satellite infrastructure, O2 can deliver connectivity in remote and rural regions without building additional ground towers. The move represents another step in Starlink’s push beyond fixed broadband and into direct-to-device mobile services.

Virgin Media O2 chief executive Lutz Schuler shared his thoughts about the Starlink partnership. “By launching O2 Satellite, we’ve become the first operator in Europe to launch a space-based mobile data service that, overnight, has brought new mobile coverage to an area around two-thirds the size of Wales for the first time,” he said.

Satellite-based mobile connectivity is gaining traction globally. In the U.S., T-Mobile has launched a similar satellite-to-cell offering. Meanwhile, Vodafone has conducted satellite video call tests through its partnership with AST SpaceMobile last year.

For Starlink, the O2 agreement highlights how its network is increasingly being integrated into national telecom systems, enabling standard smartphones to connect directly to satellites without specialized hardware.