Energy

Tesla dumbs down Powerwall 2 offering but it actually comes in two versions

Tesla CEO Elon Musk revealed in October that the second generation of its residential storage battery — the Powerwall 2 — would have double the energy density of the original product and cost $5,000 with a built-in inverter. That’s a significant upgrade over the original, which needed a separate external inverter and was priced at $7,000 not including the price of the separate inverter and installation costs. More energy storage and an inverter for less money?

Yes and no. Green Tech Media has learned the company is quietly offering two versions of the Powerwall 2, one with a built in AC inverter and one that requires a separate external DC inverter. Why the difference? It depends on how a customer intends to use the Powerwall 2.

Ravi Manghani, energy storage director at GTM Research, has the answer. “The AC one maximizes efficiency for self-consumption in real time or export to the grid,” he says. “The DC system maximizes efficiency for customers who are less likely to consume during the daytime when the solar is producing — customers who need time-shifting to evening hours.” Offering the Powerwall 2 with and without an inverter allows the installer to custom design the system to meet the needs of individual customers.

Why is Tesla not touting the two different products? Manghani thinks it may be to avoid confusing customers with too much technical information. Explaining the difference between AC and DC current and then adding in the different efficiency levels of DC versus AC inverters may be too much information for non-professionals to comprehend. Customers are interested in price, not arcane details about how electricity works.

“Tesla is trying to simplify the information that it’s providing to the end customers, whereas other companies will specifically say ‘This is an AC-coupled system or a DC-coupled system,’” Manghini sasys. “It’s probably an information overload in some cases.”

Tesla now suggests that customers should allow an additional $1,500 for “installation and supporting hardware,” bringing the total to $7,000. That is very close to the number Tesla quoted when the original version of the Powerwall was introduced. The difference is the second generation product has twice the capacity of the original.

One other advantage of the Powerwall 2 with built in inverter is that it will interface seamlessly with existing rooftop solar systems. There are already a million such systems in Australia, Germany, and the US that could benefit from having a Powerwall added to the mix.

Both versions are priced at $5,500 even though one comes with a built in inverter and one does not. External inverters usually cost around $2,000 or more. Bear in mind that the installed price of a Powerwall system will vary widely, depending on the complexity of installation in each individual home. Tesla is expected to begin delivering Powerwall 2 in early 2017.

Energy

Tesla Megapack Megafactory in Texas advances with major property sale

Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet.

Tesla’s planned Megapack factory in Brookshire, Texas has taken a significant step forward, as two massive industrial buildings fully leased to the company were sold to an institutional investor.

In a press release, Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet. The properties are 100% leased to Tesla under a long-term agreement and were acquired by BGO on behalf of an institutional investor.

The two facilities, located at 100 Empire Boulevard in Brookshire, Texas, will serve as Tesla’s new Megafactory dedicated to manufacturing Megapack battery systems.

According to local filings previously reported, Tesla plans to invest nearly $200 million into the site. The investment includes approximately $44 million in facility upgrades such as electrical, utility, and HVAC improvements, along with roughly $150 million in manufacturing equipment.

Building 9, spanning roughly 1 million square feet, will function as the primary manufacturing floor where Megapacks are assembled. Building 10, covering approximately 600,000 square feet, will be dedicated to warehousing and logistics operations, supporting storage and distribution of completed battery systems.

Waller County Commissioners have approved a 10-year tax abatement agreement with Tesla, offering up to a 60% property-tax reduction if the company meets hiring and investment targets. Tesla has committed to employing at least 375 people by the end of 2026, increasing to 1,500 by the end of 2028, as noted in an Austin County News Online report.

The Brookshire Megafactory will complement Tesla’s Lathrop Megafactory in California and expand U.S. production capacity for the utility-scale energy storage unit. Megapacks are designed to support grid stabilization and renewable-energy integration, a segment that has become one of Tesla’s fastest-growing businesses.

Energy

Tesla meets Giga New York’s Buffalo job target amid political pressures

Giga New York reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease.

Tesla has surpassed its job commitments at Giga New York in Buffalo, easing pressure from lawmakers who threatened the company with fines, subsidy clawbacks, and dealership license revocations last year.

The company reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease at the state-built facility.

As per an employment report reviewed by local media, Tesla employed 2,399 full-time workers at Gigafactory New York and 1,060 additional employees across the state at the end of 2025. Part-time roles pushed the total headcount of Tesla’s New York staff above the 3,460-job target.

The gains stemmed in part from a new Long Island service center, a Buffalo warehouse, and additional showrooms in White Plains and Staten Island. Tesla also said it has invested $350 million in supercomputing infrastructure at the site and has begun manufacturing solar panels.

Empire State Development CEO Hope Knight said the agency was “very happy” with Giga New York’s progress, as noted in a WXXI report. The current lease runs through 2029, and negotiations over updated terms have included potential adjustments to job requirements and future rent payments.

Some lawmakers remain skeptical, however. Assemblymember Pat Burke questioned whether the reported job figures have been fully verified. State Sen. Patricia Fahy has also continued to sponsor legislation that would revoke Tesla’s company-owned dealership licenses in New York. John Kaehny of Reinvent Albany has argued that the project has not delivered the manufacturing impact originally promised as well.

Knight, for her part, maintained that Empire State Development has been making the best of a difficult situation.

“(Empire State Development) has tried to make the best of a very difficult situation. There hasn’t been another use that has come forward that would replace this one, and so to the extent that we’re in this place, the fact that 2,000 families at (Giga New York) are being supported through the activity of this employer. It’s the best that we can have happen,” the CEO noted.

Energy

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

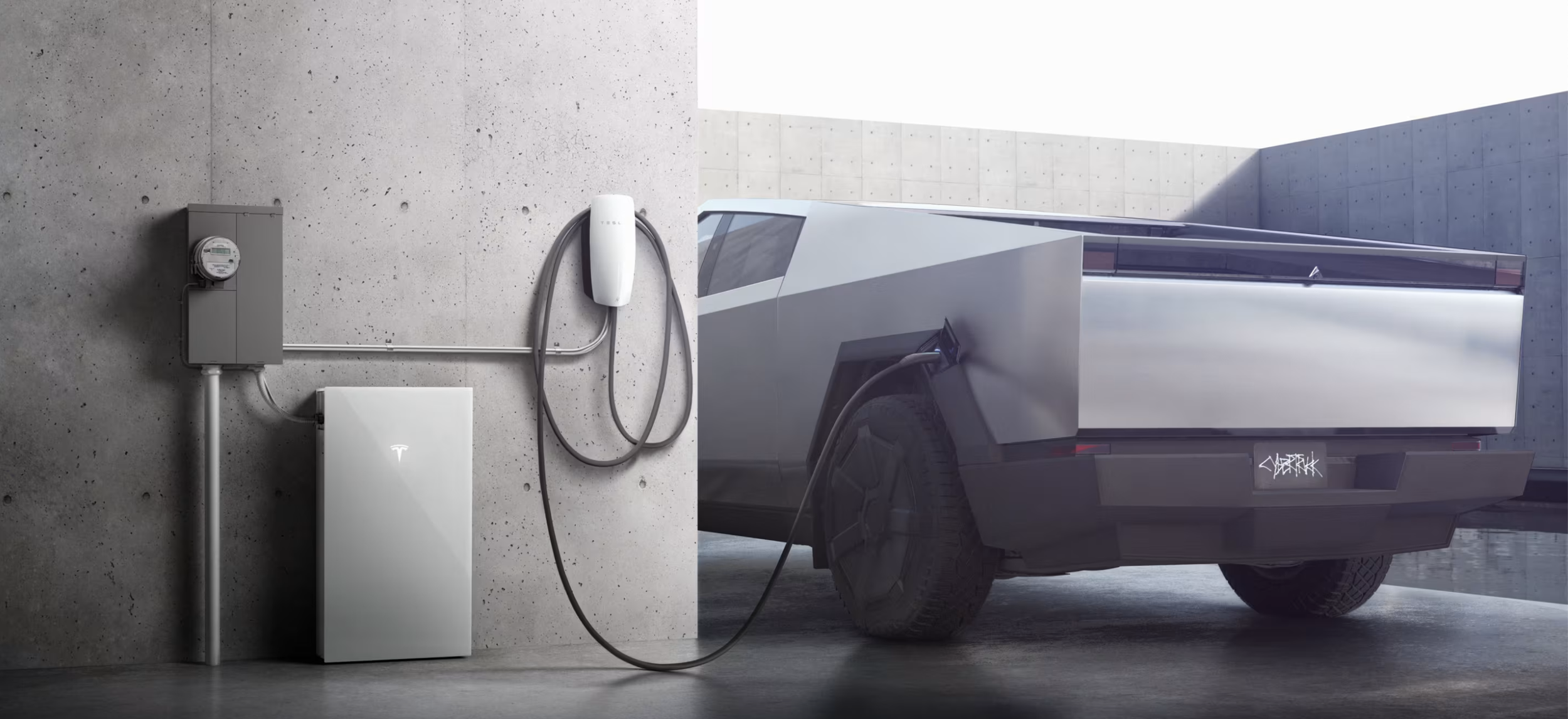

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.