News

Tesla Semi competitor Nikola opens new headquarters, public tours to follow

Tesla Semi competitor Nikola Motors has opened its new headquarters in Phoenix, Arizona, according to CEO Trevor Milton. The facility will house the company’s design, research and development teams.

“Nikola HQ is awesome. Just opened last week,” Milton announced via Twitter alongside a photo of what appears to be a lobby inside the building. Most of the company’s product line was pictured, to include the Nikola One and Nikola Tre hydrogen-electric semi trucks, the all-electric Nikola NZT off-road vehicle, and the Nikola WAV sit-down electric watercraft. Only the Nikola Two, the day cab variant of their hydrogen-electric semi truck unveiled in April with the WAV and NZT, was missing from the image. Milton also suggested that tours of the headquarters may be open to the public as soon as August.

Earlier this year, Nikola released details surrounding a deal made with Saint Holdings, LLC for 400 acres in Pinal County, Arizona where the company will build its manufacturing facility. The location is inside Heritage, an 11,438-acre prime development area, within the Inland Port Arizona portion of the site, itself comprising 3,000 acres and dubbed a “manufacturing mega site.” Nikola’s presence in the area is expected to bring an estimated $1 billion in economic stimulus to the region by 2024.

https://twitter.com/nikolatrevor/status/1140751941846237184

Nikola’s latest product unveilings took place in Scottsdale at Nikola World 2019, a two-day event featuring a presentation, breakout sessions, track demos, and vehicle tours. In the weeks since, Milton and his team have continued to promote their products and mission via trade show appearances and interviews. One of the notable topics discussed during that time was Nikola’s commitment to hydrogen as a fuel source while acknowledging the advantages of fully-electric trucking systems for short-haul tasks.

“Around long-haul, you have more advantage on the hydrogen side because it’s lighter. It’s all about freight weight, or how much it costs to move a freight-ton per mile. There’s advantages to both infrastructures, but we’re mainly focused on the hydrogen side. We just offer battery-electric so we can tell people we’ll shoot you straight. There are areas where hydrogen does not make sense,” Milton said during an interview with Trucks.com. “The battery alone in an electric truck is going to cost $200,000. We’re shooting for an internal cost of $150,000 for our entire Nikola truck. Our truck also weighs less than the batteries in an electric truck. Now, electric is going to kick our butt in short-haul because it’s a really good solution, but electric trucks are not one size fits all.”

https://twitter.com/nikolatrevor/status/1140754280116183041

As part of Nikola’s commitment to hydrogen power, the trucking startup also announced a $14 million dollar fuel cell lab investment at the end of March this year, with several hundred dollars planned overall. The laboratory represents a critical component in the company’s plan to provide high-quality, high-efficiency fuel cell technology at a pace quick enough to meet the needs of the trucking industry as it drives towards an alternative-power future. Nikola plans to centralize the development, validation, and testing of its entire fuel cell system in one place, reducing the time required to meet its mission milestones.

Nikola will break ground on its main manufacturing facility later this year in Coolidge. Initial production is estimated to be 35,000 semi trucks annually and grow to an eventual 50,000 built per year. In the interim, Fitzgerald Glider Kits is producing the Class 8 long haulers with full production planned for 2022-2023.

News

Tesla to discuss expansion of Samsung AI6 production plans: report

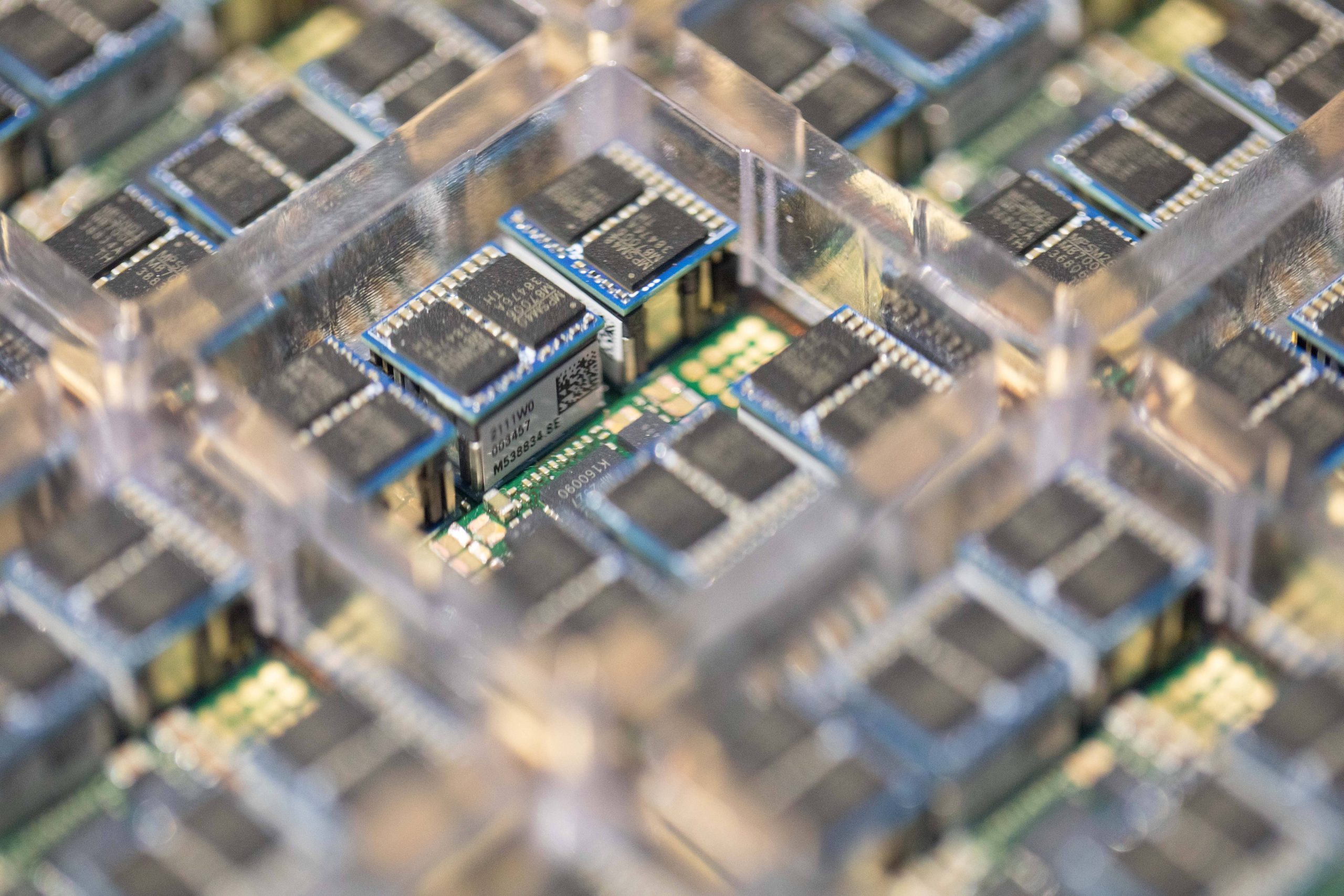

Tesla has reportedly requested an additional 24,000 wafers per month, which would bring total production capacity to around 40,000 wafers if finalized.

Tesla is reportedly discussing an expansion of its next-generation AI chip supply deal with Samsung Electronics.

As per a report from Korean industry outlet The Elec, Tesla purchasing executives are reportedly scheduled to meet Samsung officials this week to negotiate additional production volume for the company’s upcoming AI6 chip.

Industry sources cited in the report stated that Tesla is pushing to increase the production volume of its AI6 chip, which will be manufactured using Samsung’s 2-nanometer process.

Tesla previously signed a long-term foundry agreement with Samsung covering AI6 production through December 31, 2033. The deal was reportedly valued at about 22.8 trillion won (roughly $16–17 billion).

Under the existing agreement, Tesla secured approximately 16,000 wafers per month from the facility. The company has reportedly requested an additional 24,000 wafers per month, which would bring total production capacity to around 40,000 wafers if finalized.

Tesla purchasing executives are expected to discuss detailed supply terms during their visit to Samsung this week.

The AI6 chip is expected to support several Tesla technologies. Industry sources stated that the chip could be used for the company’s Full Self-Driving system, the Optimus humanoid robot, and Tesla’s internal AI data centers.

The report also indicated that AI6 clusters could replace the role previously planned for Tesla’s Dojo AI supercomputer. Instead of a single system, multiple AI6 chips would be combined into server-level clusters.

Tesla’s semiconductor collaboration with Samsung dates back several years. Samsung participated in the design of Tesla’s HW3 (AI3) chip and manufactured it using a 14-nanometer process. The HW4 chip currently used in Tesla vehicles was also produced by Samsung using a 5-nanometer node.

Tesla previously planned to split production of its AI5 chip between Samsung and TSMC. However, the company reportedly chose Samsung as the primary partner for the newer AI6 chip.

Elon Musk

Elon Musk: Tesla could be first to build AGI in humanoid form

Musk’s statement was shared in a post on social media platform X.

Elon Musk predicted that Tesla could become one of the developers of Artificial General Intelligence (AGI) in humanoid form. Musk’s statement was shared in a post on social media platform X.

In his post, Musk stated that “Tesla will be one of the companies to make AGI and probably the first to make it in humanoid/atom-shaping form.”

The comment comes as Tesla expands development of its Optimus humanoid robot.

During Tesla’s Q4 earnings report, Elon Musk stated that production of the Model S and Model X would be phased out at its Fremont, California, facility. The vehicles’ production line will then be converted to a pilot line for Optimus. Tesla is looking to produce 1 million units of the humanoid robots annually to start.

Musk has previously stated that Optimus could eventually function as a von Neumann probe. The concept, proposed by mathematician John von Neumann, describes a machine capable of replicating itself using planetary resources and sending those replicas to other worlds.

Optimus would likely only be able to achieve this potential if it manages to achieve Artificial General Intelligence.

Other leaders in the AI sector have also expressed strong expectations about AGI’s potential. Demis Hassabis, CEO of Google DeepMind, recently spoke about the technology at the India AI Impact Summit 2026, as noted in a Benzinga report.

“It’s going to be something like ten times the impact of the Industrial Revolution, but happening at ten times the speed,” Hassabis said.

Elon Musk’s recent comments about Tesla producing a product with AGI could hint at further collaboration among his companies. So far, Tesla is actively pursuing autonomous driving, but it is xAI that is pursuing AGI with its Grok program.

Considering that Elon Musk mentioned a Tesla humanoid product with AGI, it appears that an Optimus robot running xAI’s AI models could become a reality.

xAI had recently merged with SpaceX, though reports suggest that Elon Musk is also considering an even bigger merger for all his companies, including Tesla.

News

Tesla influencers argue company’s polarizing Full Self-Driving transfer decision

Tesla maintains it will honor transfers for orders with initial delivery windows before the deadline and offers full deposit refunds otherwise, citing longstanding fine print that the program is “subject to change at any time.”

Tesla’s decision to tighten its Full Self-Driving (FSD) transfer promotion has ignited fierce debate among owners and enthusiasts.

The company quietly updated its terms in late February 2026, changing the eligibility from “order by March 31, 2026” to “take delivery by March 31, 2026.”

What began as a flexible incentive to boost sales, allowing buyers to transfer their paid FSD (Supervised) to a new vehicle, now excludes many, particularly Cybertruck owners facing delivery delays into summer or later.

Tesla maintains it will honor transfers for orders with initial delivery windows before the deadline and offers full deposit refunds otherwise, citing longstanding fine print that the program is “subject to change at any time.”

The reversal has polarized the Tesla community, with accusations of a “bait-and-switch” clashing against defenses of corporate pragmatism. Many owners who placed orders under the original wording feel betrayed, especially as production backlogs and new unsupervised FSD rollout complicate timelines.

However, Tesla has allowed them to cancel their orders and receive a refund.

Critics of the decision argue that the change disadvantages loyal customers who helped fund FSD development, calling it poor communication and a revenue grab as Tesla pivots toward subscriptions.

Popular influencers have amplified the divide. Whole Mars Catalog struck a measured but firm tone, acknowledging the original “order by” language but emphasizing Tesla’s right to adjust terms. He has continued to defend Tesla in this particular issue:

Sad to see so many fans trashing Tesla with such extreme language.

LIARS!!! PATHETIC!!! And if you aren’t as furious and angry as they are they are you’re “worshipping” and saying “they can do no wrong”.

Let’s get real here. They’re not liars. They offered FSD transfer to us… https://t.co/3Ay7vGaVR6

— Whole Mars Catalog (@wholemars) March 3, 2026

He criticized extreme backlash as “dramatization” and “spoiled kids,” noting the unsupervised FSD era and broader sales challenges make blanket transfers financially risky. Whole Mars advocated for polite outreach to CEO Elon Musk over the issue.

Rather than “calling them out”, I would simply say “Hey Elon, really hoped to be able to do FSD transfer on my cybertruck but the terms changed. Would really appreciate if Tesla could extend this to everyone who ordered before the terms changes”

that would probably work

— Whole Mars Catalog (@wholemars) March 3, 2026

In a contrasting perspective, Dirty TesLA voiced sharper frustration, posting that blocking transfers feels “crazy” and distancing himself from “people that want to worship a corporation and say they can do no wrong.” His stance resonated with owners who view the policy flip as disrespectful to early adopters.

Popular Tesla influencer Sawyer Merritt captured the frustration felt by thousands. In a widely shared thread viewed over 700,000 times, Merritt detailed how pre-change Cybertruck orders now risk losing FSD eligibility unless their initial delivery window falls before March 31.

It’s not a contradiction, it’s a change in policy that Tesla just made an hour ago. I am trying to check if the change is retroactive to all existing orders, including Cybertruck AWD orders, because if it is, that sucks big time.

— Sawyer Merritt (@SawyerMerritt) February 28, 2026

The controversy underscores deeper tensions—between Tesla’s need for revenue discipline and owners’ expectations of goodwill. As FSD evolves toward unsupervised capability, the community remains split: some see the change as necessary business, others as a broken promise. Whether Tesla reconsiders under pressure or holds firm remains to be seen, but it does not appear they are planning to budge.