Driverless ride-hailing company Waymo is looking to expand its testing to Los Angeles, but a new bill introduced just weeks ago may threaten the company’s ability to operate in the Southern California city if it’s passed.

Waymo announced its plan to expand driverless testing to Los Angeles just a few weeks ago, beyond the company’s current operations in San Francisco and Phoenix, Arizona. However, Senator Dave Cortese (D-San Jose) introduced a bill around the same time that would allow communities to have the most say in whether autonomous vehicles (AVs) can operate locally, potentially throwing a wrench into the Alphabet-owned company’s plans.

Cortese introduced SB 915, the Autonomous Vehicle Service Deployment and Data Transparency Act, which would effectively let local communities determine the regulations and requirements around where and if driverless vehicles can operate, instead of them only being granted or denied by the California Public Utilities Commission (CPUC) and the Department of Motor Vehicles (DMV).

“City councils and county boards of supervisors adopt ordinances on any given week, nimbly and with local accountability. SB 915 returns control to the local communities who know their streets best,” Senator Cortese said in a statement. “The emergence of autonomous vehicles is an exciting technological development with massive potential upsides for safety and convenience. We must ensure this innovative technology rolls out safely.”

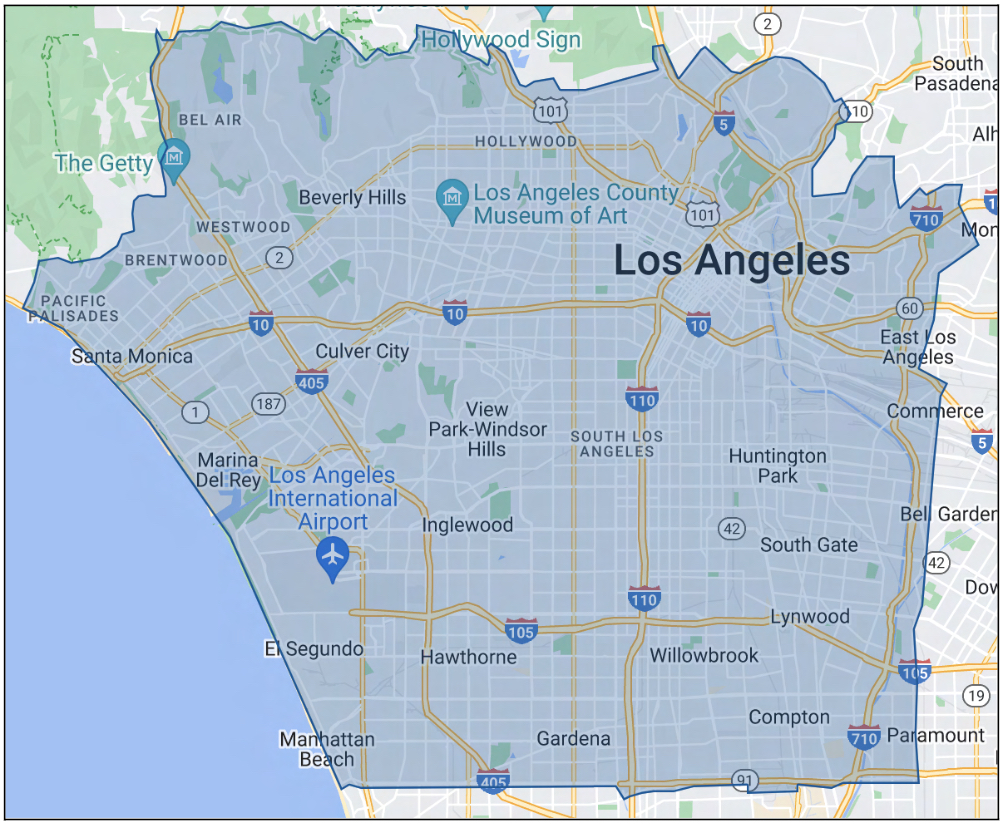

Below you can see the proposed map of Los Angeles operations from Waymo’s advice letter filed with the CPUC:

Credit: Waymo

The introduction of the bill comes after significant scrutiny around driverless vehicles has hit many communities, including San Francisco, where Waymo and General Motors-owned Cruise were approved to begin operating 24 hours a day in August. Critics were quick to voice their concerns, and just months after the approval, Cruise’s permit to operate driverless vehicles was revoked after one of its robotaxis dragged and pinned a pedestrian who had been hit by another car with a human driver.

Authorities in San Francisco have also been vocal about wanting more control over regulations surrounding AVs.

“Right now is the time for Cruise, Waymo and Zoox to say, ‘We welcome sensible regulations,’ rather than do what they’ve done the last half-dozen years,” said Aaron Peskin, San Francisco Board of Supervisors President (via Automotive News).

Others have argued that the bill could slow down innovation, as it would require Waymo and other companies to gain approval from over a dozen municipalities before expanding.

“For all de facto purposes, Waymo is becoming the Standard Oil of autonomous driving,” said Grayson Brulte, head of insights firm Road to Autonomy. “If I want to go visit my mom one town over, and that town doesn’t have the ordinance, then I can’t take a Waymo there. What this bill does is harm California’s innovation economy.”

Discussions on SB 915 are expected to begin in the Senate after Friday, though the body likely won’t vote on the legislation until later this year.

While Waymo’s expansion plans were approved by the California DMV last month, the company is awaiting a response from the CPUC by February 20. The staff can either approve, deny or suspend the application, with the latter option offering the staff up to 120 extra days to review the proposal.

Waymo expanding autonomous driving tests to include freeways

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send your tips to us at tips@teslarati.com.

News

Tesla is making two big upgrades to the Model 3, coding shows

According to coding found in the European and Chinese configurators, Tesla is planning to make two big upgrades: Black Headliner offerings and a new 16-inch QHD display, similar to that on the Model Y Performance.

Tesla is making two big upgrades to the Model 3, one of which is widely requested by owners and fans, and another that it has already started to make on some trim levels of other models within the lineup.

The changes appear to be taking effect in the European and Chinese markets, but these are expected to come to the United States based on what Tesla has done with the Model Y.

According to coding found in the European and Chinese configurators, Tesla is planning to make two big upgrades: Black Headliner offerings and a new 16-inch QHD display, similar to that on the Model Y Performance.

These changes in the coding were spotted by X user BERKANT, who shared the findings on the social media platform this morning:

🚨 Model 3 changes spotted in Tesla backend

• New interior code: IN3PB (Interior 3 Premium Black)

• Linked to Alcantara-style black headliner

• Mapped to 2026 Model 3 Performance and Premium VINs• EPC now shows: “Display_16_QHD”

• Multiple 2026 builds marked with… pic.twitter.com/OkDM5EdbTu— BERKANT (@Tesla_NL_TR) February 23, 2026

It appears these new upgrades will roll out with the Model 3 Performance and Tesla’s Premium trim levels of the all-electric sedan.

The changes are welcome. Tesla fans have been requesting that its Model 3 and Model Y offerings receive a black headliner, as even with the black interior options, the headliner is grey.

Tesla recently upgraded Model Y vehicles to this black headliner option, even in the United States, so it seems as if the Model 3 will get the same treatment as it appears to be getting in the Eastern hemisphere.

Tesla has been basically accentuating the Model 3 and Model Y with small upgrades that owners have been wanting, and it has been a focal point of the company’s future plans as it phases out other vehicles like the Model S and Model X.

Additionally, Tesla offered an excellent 0.99% APR last week on the Model 3, hoping to push more units out the door to support a strong Q1 delivery figure at the beginning of April.

Elon Musk

SpaceX secures FAA approval for 44 annual Starship launches in Florida

The FAA’s environmental review covers up to 44 launches annually, along with 44 Super Heavy booster landings and 44 upper-stage landings.

SpaceX has received environmental approval from the Federal Aviation Administration (FAA) to conduct up to 44 Starship-Super Heavy launches per year from Kennedy Space Center Launch Complex 39A in Florida.

The decision allows the company to proceed with plans tied to its next-generation launch system and future satellite deployments.

The FAA’s environmental review covers up to 44 launches annually, along with 44 Super Heavy booster landings and 44 upper-stage landings. The approval concludes the agency’s public comment period and outlines required mitigation measures related to noise, emissions, wildlife, and airspace management.

Construction of Starship infrastructure at Launch Complex 39A is nearing completion. The site, previously used for Apollo and space shuttle missions, is transitioning to support Starship operations, as noted in a Florida Today report.

If fully deployed across Kennedy Space Center and nearby Cape Canaveral Space Force Station, Starship activity on the Space Coast could exceed 120 launches annually, excluding tests. Separately, the U.S. Air Force has authorized repurposing Space Launch Complex 37 for potential additional Starship activity, pending further FAA airspace analysis.

The approval supports SpaceX’s long-term strategy, which includes deploying a large constellation of satellites intended to power space-based artificial intelligence data infrastructure. The company has previously indicated that expanded Starship capacity will be central to that effort.

The FAA review identified likely impacts from increased noise, nitrogen oxide emissions, and temporary airspace closures. Commercial flights may experience periodic delays during launch windows. The agency, however, determined these effects would be intermittent and manageable through scheduling, public notification, and worker safety protocols.

Wildlife protections are required under the approval, Florida Today noted. These include lighting controls to protect sea turtles, seasonal monitoring of scrub jays and beach mice, and restrictions on offshore landings to avoid coral reefs and right whale critical habitat. Recovery vessels must also carry trained observers to prevent collisions with protected marine species.

Elon Musk

Texas township wants The Boring Company to build it a Loop system

The township’s board unanimously approved an application to The Boring Company’s “Tunnel Vision Challenge.”

The Woodlands Township, Texas, has formally entered The Boring Company’s tunneling sweepstakes.

The township’s board unanimously approved an application to The Boring Company’s “Tunnel Vision Challenge,” which offers up to one mile of tunnel construction at no cost to a selected community.

The Woodlands’ proposal, dubbed “The Current,” features two parallel 12-foot-diameter tunnels beneath the Town Center corridor near The Waterway. Teslas would shuttle passengers between Waterway Square, Cynthia Woods Mitchell Pavilion, Town Green Park and nearby hotels during concerts and large-scale events, as noted in a Chron report.

Township officials framed the tunnel as a solution for the township’s traffic congestion issues. The Pavilion alone hosts more than 60 shows each year and can accommodate crowds of up to 16,500, often straining Lake Robbins Drive and surrounding intersections.

“We know we have traffic impacts and pedestrian movement challenges, especially in the Town Center area,” Chris Nunes, chief operating officer of The Woodlands Township, stated during the meeting.

“The Current” mirrors the Loop system operating beneath the Las Vegas Convention Center, where Tesla vehicles transport passengers through underground tunnels between venues and resorts.

The Boring Company issued its request for proposals (RFP) in mid-January, inviting cities and districts to pitch local uses for its tunneling technology. The Woodlands must submit its application by Feb. 23, though no timeline has been provided for when a winning community will be announced.

Nunes confirmed that the board has authorized a submission for “The Current’s” proposal, though he emphasized that the project is still in its preliminary stages.

“The Woodlands Township Board of Directors has authorized staff to submit an application to The Boring Company, which has issued an RFP for communities interested in leveraging their technology to address community challenges,” he said in a statement.

“The Board believes that an underground tunnel would provide a safe and efficient means to transport people to and from various high-use community amenities in our Town Center.”