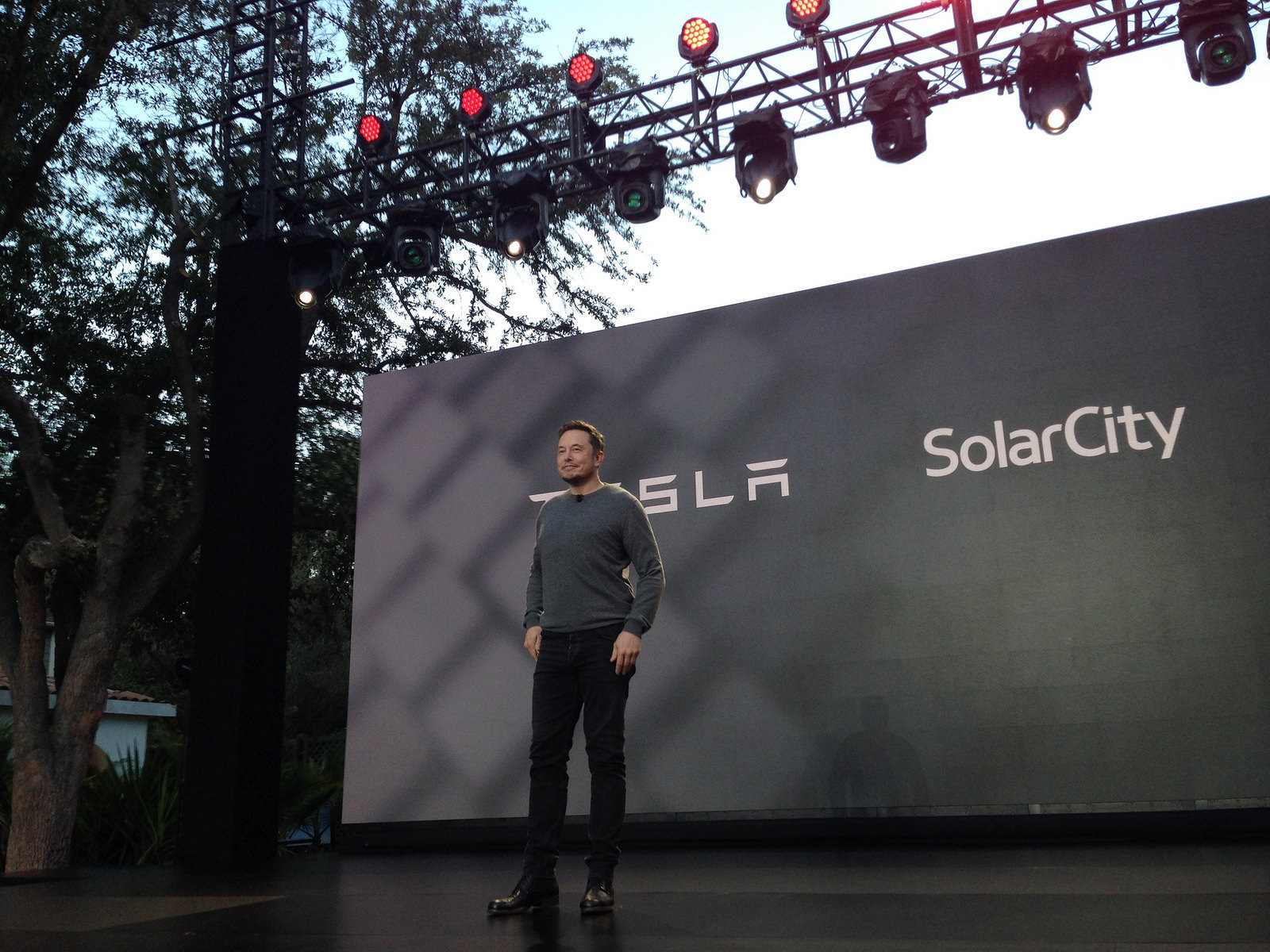

In November, shareholders approved a deal for Tesla to buy SolarCity Corp. in a transaction worth approximately $2.6 billion. Since that time, investors have pushed Tesla CEO Elon Musk to prove that this acquisition is fiscally responsible, with high expectations for the final quarter of 2016 and a positive outlook for 2017.

In the Tesla Q4 and full year 2016 financial results and Q&A webcast on Wednesday, SolarCity was well-celebrated as an essential element of “the world’s only integrated sustainable energy company, from generation to storage to transportation.”

Discussions around the Tesla Q4 financial statement included the results of SolarCity’s operations from the close of the acquisition on November 21 to December 31, 2016. Increases totaling Q4 GAAP operating expenses supported the growing Tesla business spectrum alongside $85 million of solar-related operating expenses since the acquisition of SolarCity. Moreover, Tesla also received $214 million in cash from the acquisition of SolarCity, which helped sweeten the Q4 report.

Tesla reports that it is “on track to generate $500M in cash” in the next two years. As Musk quipped at the beginning of the webcast, “I admire long term planning.” A significant component of that advanced fiscal forecast is the “achieve the cost synergies” that Tesla committed to upon acquiring SolarCity. Tesla outlined three ways that they intend to build the SolarCity.

- Cutting advertising spending: Ad Age commented in the past that “Tesla Motors has no advertising, no ad agency, no CMO, no dealer network. And that’s no problem.” As with today’s investor’s letter and webcast, the company receives positive coverage for posting its quarterly profits and announcing expansion of its product line and service networks. Musk, like many celebrity business people and politicians these days, uses Twitter to introduce company concepts and to generate buzz about everything Tesla— and that will extend more and more to SolarCity in the second half of 2017.

- Selling solar products in Tesla stores: The move to reinvent its retail sales strategy comes as part of Tesla’s long term business plan to promote a 360° sustainable energy lifestyle — complete with electric cars, solar power, and home battery storage. Selling a lifestyle and a way of thinking, Tesla retail store reconfiguration has deepened its already formidable brand, which offers a premium lifestyle experience that complements a high-tech image. SolarCity products, as part of this melange, will become an essential element of the Tesla product catalog at retail locations, with emphasis on markets with the most demand for solar energy products.

- Shifting away from leasing solar systems: At the end of 2016, SolarCity CEO Lyndon Rive had announced that the company expected to reduce the number of leases while loans and cash purchases increase. Now the market is expected to trend steadily toward direct ownership as loan designs become more appealing, system costs continue to fall, and more people see the benefit in a purchase.

Tesla is well-positioned in the alternative energy sector with SolarCity, as solar power installations doubled in 2016 over 2015 as more and more areas of the U.S. began pulling their power from the sun. Indeed, for the first time, solar power installations formed the largest group of electricity generating capacity of any energy source. Nearly 40 percent of new power generation projects added last year were solar, in terms of electrical production capacity. A record 22 states each added more than 100 megawatts.

The trend should continue in the next two years, consistent with the Tesla SolarCity viability plan, according to a report by GTM Research. They say that the community solar segment is on verge of becoming a mainstream driver of U.S. solar market growth. Starting in 2017, community solar is expected to consistently drive 20% – 25% of the annual non-residential PV market and become a half-gigawatt annual market by 2019.