Investor's Corner

Tesla Planning More Superchargers Across Europe In 2016

Tesla is planning an aggressive expansion of its SuperChargers into southern, central, and eastern Europe in 2016.

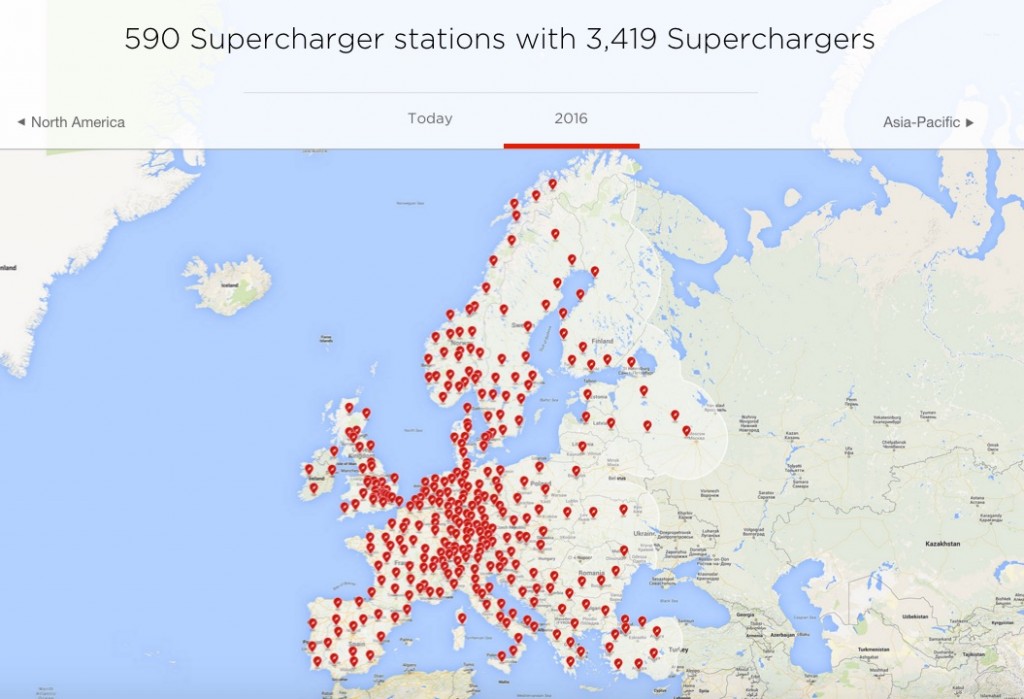

As of January 2016, 590 Tesla Supercharger locations have been installed worldwide with a total of 3,419 physical Superchargers within its network. Much of Italy, Spain, and Portugal remain underserved, along with most of central Europe and Russia, but that will soon change if Tesla is to hold to its 2016 projections.

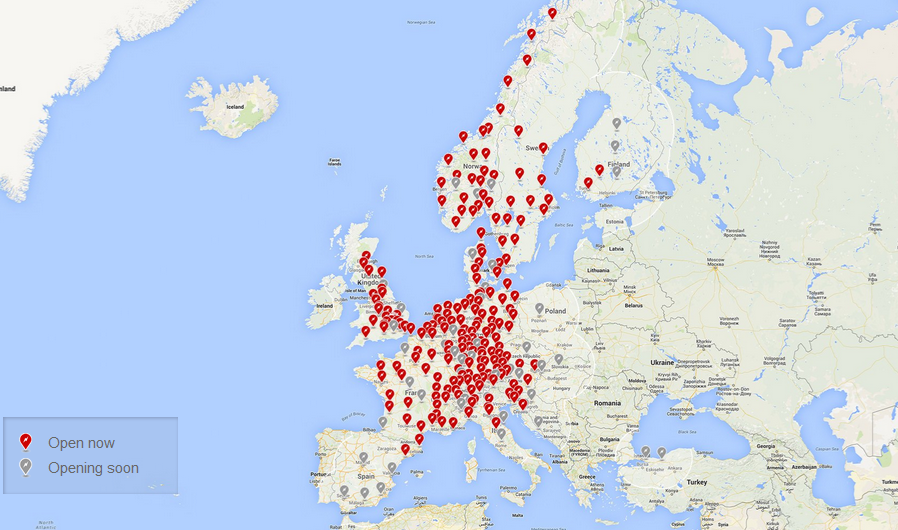

Tesla plans a major expansion of its Supercharger network into southern and eastern Europe in 2016 according to the latest Supercharger map published on the company’s website. New locations in Poland, the Czech Republic and Slovakia have been recently sighted, and by the time 2016 is done, the company plans to further extend its Superchargers to Spain, Portugal, Italy, Turkey, and Russia.

By the end of this year, Tesla owners should be able to travel from Dublin to Moscow and everywhere in between without being out of range of a Tesla Supercharger location. Tesla’s continued focus on serving existing customers and would-be buyers through the expansion of its charging network gives it a significant lead over other manufacturers looking into entering the EV space.

Elon Musk has recently discussed the potential of Teslas being able to perform cross country travel without a human driver on board using its new Summon feature in roughly 2 to 3 years. The vehicles will recharge themselves autonomously along their journeys using a device similar to its automatic charging ‘snake bot’. Earlier in the year, Tesla announced that it was piloting a liquid cooled Supercharger in Mountain View, CA that’s said to be able to charge at the same, if not higher power levels, while increasing the length of the charging cable without overheating.

Arguably, the expansion of Tesla’s charging infrastructure has given it an insurmountable lead in the race to building a viable mass market electric vehicle.

Hat tip: InsideEVs

Investor's Corner

Tesla Earnings Call: Top 5 questions investors are asking

Tesla has scheduled its Earnings Call for Q4 and Full Year 2025 for next Wednesday, January 28, at 5:30 p.m. EST, and investors are already preparing to get some answers from executives regarding a wide variety of topics.

The company accepts several questions from retail investors through the platform Say, which then allows shareholders to vote on the best questions.

Tesla does not answer anything regarding future product releases, but they are willing to shed light on current timelines, progress of certain projects, and other plans.

There are five questions that range over a variety of topics, including SpaceX, Full Self-Driving, Robotaxi, and Optimus, which are currently in the lead to be asked and potentially answered by Elon Musk and other Tesla executives:

- You once said: Loyalty deserves loyalty. Will long-term Tesla shareholders still be prioritized if SpaceX does an IPO?

- Our Take – With a lot of speculation regarding an incoming SpaceX IPO, Tesla investors, especially long-term ones, should be able to benefit from an early opportunity to purchase shares. This has been discussed endlessly over the past year, and we must be getting close to it.

- When is FSD going to be 100% unsupervised?

- Our Take – Musk said today that this is essentially a solved problem, and it could be available in the U.S. by the end of this year.

- What is the current bottleneck to increase Robotaxi deployment & personal use unsupervised FSD? The safety/performance of the most recent models or people to monitor robots, robotaxis, in-car, or remotely? Or something else?

- Our Take – The bottleneck seems to be based on data, which Musk said Tesla needs 10 billion miles of data to achieve unsupervised FSD. Once that happens, regulatory issues will be what hold things up from moving forward.

- Regarding Optimus, could you share the current number of units deployed in Tesla factories and actively performing production tasks? What specific roles or operations are they handling, and how has their integration impacted factory efficiency or output?

- Our Take – Optimus is going to have a larger role in factories moving forward, and later this year, they will have larger responsibilities.

- Can you please tie purchased FSD to our owner accounts vs. locked to the car? This will help us enjoy it in any Tesla we drive/buy and reward us for hanging in so long, some of us since 2017.

- Our Take – This is a good one and should get us some additional information on the FSD transfer plans and Subscription-only model that Tesla will adopt soon.

Tesla will have its Earnings Call on Wednesday, January 28.

Elon Musk

Tesla locks in Elon Musk’s top problem solver as it enters its most ambitious era

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla has granted Senior Vice President of Automotive Tom Zhu more than 520,000 stock options, tying a significant portion of his compensation to the company’s long-term performance.

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla secures top talent

According to a Form 4 filing with the U.S. Securities and Exchange Commission, Tom Zhu received 520,021 stock options with an exercise price of $435.80 per share. Since the award will not fully vest until March 5, 2031, Zhu must remain at Tesla for more than five years to realize the award’s full benefit.

Considering that Tesla shares are currently trading at around the $445 to $450 per share level, Zhu will really only see gains in his equity award if Tesla’s stock price sees a notable rise over the years, as noted in a Sina Finance report.

Still, even at today’s prices, Zhu’s stock award is already worth over $230 million. If Tesla reaches the market cap targets set forth in Elon Musk’s 2025 CEO Performance Award, Zhu would become a billionaire from this equity award alone.

Tesla’s problem solver

Zhu joined Tesla in April 2014 and initially led the company’s Supercharger rollout in China. Later that year, he assumed the leadership of Tesla’s China business, where he played a central role in Tesla’s localization efforts, including expanding retail and service networks, and later, overseeing the development of Gigafactory Shanghai.

Zhu’s efforts helped transform China into one of Tesla’s most important markets and production hubs. In 2023, Tesla promoted Zhu to Senior Vice President of Automotive, placing him among the company’s core global executives and expanding his influence beyond China. He has since garnered a reputation as the company’s problem solver, being tapped by Elon Musk to help ramp Giga Texas’s vehicle production.

With this in mind, Tesla’s recent filing seems to suggest that the company is locking in its top talent as it enters its newest, most ambitious era to date. As could be seen in the targets of Elon Musk’s 2025 pay package, Tesla is now aiming to be the world’s largest company by market cap, and it is aiming to achieve production levels that are unheard of. Zhu’s talents would definitely be of use in this stage of the company’s growth.

Investor's Corner

Tesla analyst teases self-driving dominance in new note: ‘It’s not even close’

Tesla analyst Andrew Percoco of Morgan Stanley teased the company’s dominance in its self-driving initiative, stating that its lead over competitors is “not even close.”

Percoco recently overtook coverage of Tesla stock from Adam Jonas, who had covered the company at Morgan Stanley for years. Percoco is handling Tesla now that Jonas is covering embodied AI stocks and no longer automotive.

His first move after grabbing coverage was to adjust the price target from $410 to $425, as well as the rating from ‘Overweight’ to ‘Equal Weight.’

Percoco’s new note regarding Tesla highlights the company’s extensive lead in self-driving and autonomy projects, something that it has plenty of competition in, but has established its prowess over the past few years.

He writes:

“It’s not even close. Tesla continues to lead in autonomous driving, even as Nvidia rolls out new technology aimed at helping other automakers build driverless systems.”

Percoco’s main point regarding Tesla’s advantage is the company’s ability to collect large amounts of training data through its massive fleet, as millions of cars are driving throughout the world and gathering millions of miles of vehicle behavior on the road.

This is the main point that Percoco makes regarding Tesla’s lead in the entire autonomy sector: data is King, and Tesla has the most of it.

One big story that has hit the news over the past week is that of NVIDIA and its own self-driving suite, called Alpamayo. NVIDIA launched this open-source AI program last week, but it differs from Tesla’s in a significant fashion, especially from a hardware perspective, as it plans to use a combination of LiDAR, Radar, and Vision (Cameras) to operate.

Percoco said that NVIDIA’s announcement does not impact Morgan Stanley’s long-term opinions on Tesla and its strength or prowess in self-driving.

NVIDIA CEO Jensen Huang commends Tesla’s Elon Musk for early belief

And, for what it’s worth, NVIDIA CEO Jensen Huang even said some remarkable things about Tesla following the launch of Alpamayo:

“I think the Tesla stack is the most advanced autonomous vehicle stack in the world. I’m fairly certain they were already using end-to-end AI. Whether their AI did reasoning or not is somewhat secondary to that first part.”

Percoco reiterated both the $425 price target and the ‘Equal Weight’ rating on Tesla shares.